3 Feb 2024

SOURCE: CPF Board

MediSave helps you with the healthcare expenses that you or your loved ones may incur in the future.

There are numerous uses for your MediSave. The ones shared in this article are just some of them. Refer to the full list of what you can use with MediSave from the Ministry of Health’s page.

MediSave is a national medical savings scheme that sets aside part of your income to pay for the healthcare expenses of yours and your family members (spouse, children, parents, grandparents*, and siblings*).

MediSave can be used to pay for hospitalisation, day surgery, and long-term healthcare needs. It can also be used to pay for certain costly outpatient treatments like dialysis, cancer drugs and radiotherapy, as well as for treatment of specific chronic diseases like diabetes and hypertension.

*Applicable only if grandparents and siblings are Singapore citizens or Permanent Residents.

Each month, a portion of your monthly salary, ranging from 8% to 10.5%*, is contributed to your MediSave Account. The exact percentage depends on your age group. These contributions are designed to build a financial cushion that covers your basic healthcare expenses throughout your lifetime, particularly in retirement when you no longer have a regular income.

Additionally, your MediSave savings earn interest over time, benefitting from the power of compound interest, even if you don't use them.

*MediSave contribution differs for self-employed persons. Refer to the Self-employed MediSave contribution calculator for more information on how MediSave contribution is calculated for self-employed persons.

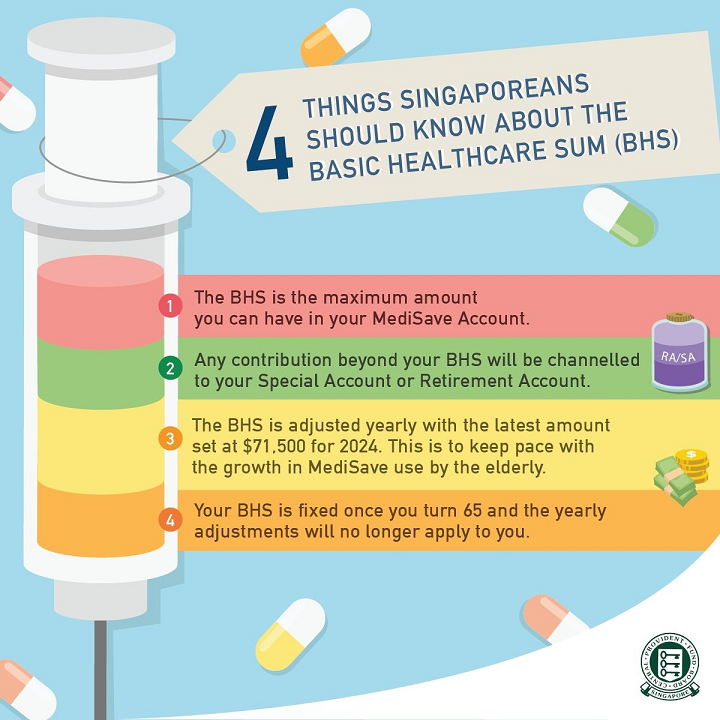

The BHS is the estimated amount of savings you need in your MediSave Account for basic subsidised healthcare expenses in old age. It is the maximum amount you can have in your MediSave Account and any contribution beyond your BHS will be channelled to your Special Account or Retirement Account.

For CPF members below age 65, the BHS is adjusted annually to keep pace with the expected growth in MediSave used. Upon hitting age 65, your BHS is fixed and the yearly adjustments will no longer be applicable to you. The 2024 BHS is $71,500.

MediSave can be used to pay for the health insurance premiums of yours and your immediate family members. These include the premiums for basic insurance plans such as MediShield Life and CareShield Life, and supplement plans such as Integrated Shield Plan and CareShield Life Supplements, up to the Additional Withdrawal Limits.

Remember to assess your healthcare needs and the long-term affordability of the insurance premiums when purchasing additional healthcare and long-term care coverage.

Vaccinations are important in boosting your immune system by teaching it how to fight against harmful diseases.

You have the option to use your MediSave savings for both you and your child’s vaccination under the National Adult Immunisation Schedule and National Childhood Immunisation Schedule respectively.

Some examples of these vaccinations include:

- Influenza (INF)

- Pneumococcal vaccinations

- Hepatitis B

- Measles, Mumps and Rubella (MMR)

- Tuberculosis (BCG)

- Diphtheria, Pertussis & Tetanus (DTaP/Tdap)

Learn more about the nationally recommended vaccines and how often you should take them.

You can also tap on your MediSave savings for mammogram screenings (for women aged 50 and above) and for selected newborn screening tests.

Your MediSave can also be used for other forms of screenings such as a colonoscopy. Check with your healthcare provider for the approved list of screenings!

In the event that you are hospitalised, you can withdraw up to $550 per day from your MediSave Account for the first two days of your stay in the hospital, and up to $400 per day thereafter. You can also withdraw additional savings from your MediSave Account for surgical expenses, up to the surgical limits. The surgical limits also apply for day surgeries.

Other than surgical expenses, day surgeries include a limit of up to $300 per day which you can withdraw from your MediSave Account for hospital charges such as daily ward charges, daily treatment fees, investigations, and medications.

It’s important to understand that a person is classified as being hospitalised if they have been admitted for a minimum of eight hours. However, this requirement is not applicable to day surgeries.

Your MediSave savings can assist you in covering medical expenses when welcoming your newborn. Under the MediSave Maternity Package, you can tap on your MediSave Account for pre-delivery medical expenses of up to $900, and $3,950 for your delivery procedure. You can also use up to $550 per day for the first two days and up to $400 per day for subsequent days of your stay in hospital.

For assisted conception procedures, you can use up to $6,000 for your first treatment cycle, $5,000 for your second cycle, and $4,000 for your third and subsequent cycles, within a lifetime limit of $15,000 per patient.

Learn more about the Baby Bonus benefits and support for new parents.

MediSave comes in handy not only when you're unwell, but also for treating chronic conditions that can lead to serious diseases.

You can use up to $500 (for non-complex chronic conditions) or $700 (for complex chronic conditions) per year on outpatient treatments of 23 approved chronic conditions under the Chronic Disease Management Programme (CDMP).

This programme is available at public hospital Specialist Outpatient Clinics (SOCs), polyclinics, and more than 1,250 GP clinics and private specialist clinics throughout Singapore.

Your MediSave savings can be tapped for cancer drug treatments on the Cancer Drug List subject to a limit of $600 or $1,200 per month per patient, depending on the cancer drug treatment you are receiving. If you are receiving treatment for multiple primary cancers, you may claim up to the highest cancer drug treatment limit amongst the claimable treatments received for each primary cancer per month.

You can also use MediSave for cancer drug services and other cancer scans which is capped at $600 per year per patient for patients receiving treatment for one primary cancer or $1,200 per year per patient for patients receiving treatment for multiple primary cancers.

Should you require inpatient palliative care, you may use up to $250 (general) or $350 (specialised) per day from your MediSave Account for approved inpatient hospice palliative care services (IHPCS).

There will be no lifetime MediSave withdrawal limit for home palliative care and day hospice for all terminally ill patients if they are paying from their own MediSave account. However, patients will be subjected to a limit of $2,500 per patient per lifetime if they tap on their family member's MediSave.

If you need to stay in a community hospital or undergo rehabilitation to recuperate, you can use up to $250 per day for hospitalisation charges at community hospitals (up to a maximum of $5,000 per year), and up to $25 per day per rehabilitation service at approved day rehabilitation centres (up to a maximum of $1,500 a year).

As you age, there is more flexibility in using your MediSave to reduce out-of-pocket payments for outpatient treatments.

Under the Flexi-MediSave scheme, individuals aged 60 and above can use up to $300 per patient per year from their own or their spouse’s MediSave Account for treatments at polyclinics, public Specialist Outpatient Clinics, and Community Health Assist Scheme (CHAS) GP Clinics.

A portion of your monthly income goes into your MediSave Account to help save for your future medical expenses. Understanding more about the uses of your MediSave Account is useful in ensuring that you can fully benefit from it.

Alongside insurance premiums and vaccinations, there are also plenty of uses of MediSave such as long-term care, and both inpatient and outpatient treatments that can reduce your out-of-pocket payments.

The key to staying healthy is also to live and eat healthily. Check out these pointers for affordable healthy living in Singapore!

The information provided in this article is accurate as of the date of publication.

.jpg)