21 Apr 2023

SOURCE: CPF Board

It’s common to do some homework before spending your hard-earned money. If you plan to try that new Korean BBQ restaurant in town, you'll likely search for reviews online. Similarly, if you are looking for the best TV to stream your favourite movies, you can watch review videos online to make an informed choice.

However, it appears that many people overlook the importance of researching on their health insurance. A survey of Singaporean millennials revealed that although 68 percent of the respondents had plans to purchase insurance policies, only 44 percent considered themselves knowledgeable about the insurance market. Often, individuals are not sure on what they are buying and the coverage of their insurance plans. They mainly rely on word of mouth or the advice of insurance companies.

If you're not familiar with health insurance, there's no need to worry. Everyone starts somewhere and we're here to help. The most important thing is to stay informed and do your own research before buying an insurance plan! This way, you can be sure of what you are buying and the insurance coverage that you are entitled to.

In this first instalment of Money Matters, a three-part series on basic financial literacy, we'll walk you through the fundamentals of insurance in Singapore and offer guidance on how to select the best plan for your needs.

Insurance coverage is like buying an umbrella. Just as you would buy one to protect yourself from the rain, you buy insurance to protect yourself from unexpected events such as accidents or illnesses.

When you buy an umbrella, you look for one that is large enough to protect you from the wind and rain. Similarly, it's important to ensure that the right amount of coverage is obtained when buying insurance. There’s little value in spending an unsustainable amount of money for a big umbrella that does not suit your needs.

Just like how holding an umbrella might not prevent you from getting wet in the rain, having insurance won't prevent accidents or mishaps from occurring either. Instead, insurance can provide financial protection and peace of mind to you and your loved ones when unexpected events happen.

| Medical Insurance | Helps you tide through costly medical expenses. |

| Life Insurance | Provides financial payouts if your ability to earn your usual income is affected. |

| Critical Illness Insurance | Reduces financial burden if you are diagnosed with a critical illness, such as cancer or heart attack. |

| Personal Accident Insurance | Pays out a lump sum of money if you are injured or disabled due to an accident. |

| Disability Insurance | Protects your income if you are disabled. |

Medical insurance helps you with costly medical expenses. Without medical insurance, you will have to make out-of-pocket payments that can exert a significant strain on your finances.

The good thing is that since 2015, all Singaporeans have basic medical insurance in the form of MediShield Life. This scheme provides Singaporean citizens and Permanent Residents with lifelong protection against large hospital bills and selected outpatient costs for life. Regardless of your age or health condition, you will always be covered for life.

MediShield Life is designed to cover subsidised bills incurred in Class B2/C wards and subsidised outpatient treatments/day surgery at public hospitals. If you choose to use Class A/B1 or private hospitals, MediShield Life will cover a smaller portion of your bill.

Use the MediSave and MediShield Life claims calculator to get an estimate on how much you can claim from MediShield Life and withdraw from your MediSave for your medical treatment.

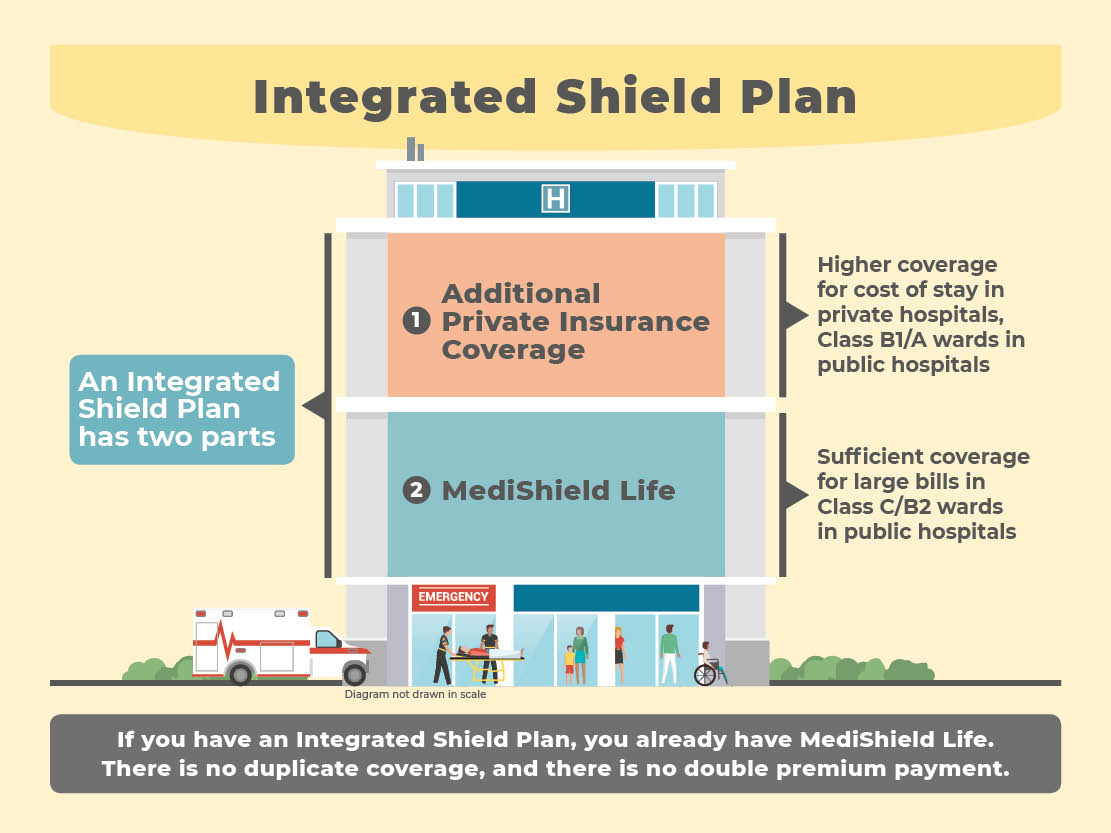

Integrated Shield Plan (IP) is an optional health insurance offered by private insurers in Singapore. These plans provide additional benefits on top of MediShield Life, such as higher coverage for stays in private hospitals or Class B1/A wards in public hospitals.

However, this additional coverage comes at a price – you will need to pay higher premiums using your MediSave savings or cash. These premiums increase with age, so make sure you consider this before buying an Integrated Shield Plan.

Life insurance provides a lump sum of money if your ability to earn your usual income is affected. This can be due to reasons such as disability or death.

If you have dependents such as children or elderly parents, life insurance can ensure that their financial needs are taken care in your absence.

Even if you’re single, life insurance is still worth considering. This is because unexpected tragedies can happen to anyone, regardless of their age, health, or marital status.

Life insurance is commonly sold in two forms: term and whole life.

Think of term insurance as a kind of annual subscription plan. Your subscription is only valid for the stipulated period and you pay a given sum to enjoy the insurance coverage. Term life insurance is usually only sold to individuals below 75 years old.

One advantage of term plans is its affordability. This allows you to enjoy a high degree of coverage at a low premium. Another thing to note is that the premium for term life insurance typically does not increase over time. This makes it easier to plan your budget accordingly.

Unlike term insurance, which covers only a specific period, whole life insurance provides coverage for the entire lifetime of the insured person. Even if you live until the age of 99, your whole life insurance will still provide coverage for you until your death.

Although whole life insurance is costlier than term insurance, it offers a "cash value" component that grows over time at a fixed rate of interest determined by the insurance company.

The cash value increases the longer the policy is held. When needed, it can be surrendered to the insurance company and you will get a lump sum that can be used for significant expenses such as for your retirement or a round-the-world trip.

Cancer is the leading cause of death in Singapore, accounting for 26.4 percent of deaths in 2021. To provide financial support during such tough times, critical illness insurance can become useful. It pays out a lump sum of money when one is diagnosed with a critical illness, such as cancer or heart attack. Some policies also allow multiple claims, which can be helpful when dealing with more than one critical illness at once.

Why sign up for a critical illness insurance if you already have a hospital plan to cover your medical expenses then? Unlike a medical insurance that just covers the bill, critical illness provides a lump sum payout that gives you the flexibility to do whatever you want with it. You can use it to pay for your care expenses or even use it to tick things off your bucket list.

The premiums are calculated based on the “Sum Assured”, which is the lump sum payout you get in the event of a critical illness. If you would like a higher sum assured, you will have to pay a higher annual premium.

When deciding on a critical illness plan, look for a coverage of at least four times your annual income. That is if you are earning $80,000 a year, you should ideally have a CI plan that provides a payout of at least $320,000 upon a diagnosis of a critical illness.

From dengue fever to sports injuries, unexpected accidents can happen anytime. Personal accident insurance pays out a lump sum of money if you are injured or disabled due to an accident. This can be used to cover your medical expenses, rehabilitation costs, and loss of income due to an inability to work.

Personal accident insurance comes with lower premium as compared to life and critical illness insurance. However, it's important to keep in mind that you can only make a claim in the event of an accident.

A lower personal accident coverage plan can be adequate for your needs if you work in a desk-bound job and lead a low-risk lifestyle such as not riding a motorcycle. This is because the probability of an accident is naturally lower in such cases.

Even individuals who are considered to be in good health may experience disabilities. This can result in significant financial costs due to the high cost of medical treatment and potential loss of income.

Disability insurance can provide a safety net to cover these costs and ensure financial support during the recovery period.

CareShield Life is a long-term care disability insurance scheme that provides monthly payouts starting at $600 per month. This amount increases over time and provides support to Singaporeans who require long-term care for severe disabilities or chronic illness.

All Singaporeans born in 1980 or later are automatically covered by CareShield Life when they turn 30. This is regardless of any pre-existing medical conditions or disability they might have.

If you were born in 1979 or earlier, you have the option to participate in CareShield Life if you do not have a pre-existing disability.

Like MediShield Life and IPs, many insurance providers also offer CareShield Life supplement plans for additional protection against disabilities. These plans complement your basic CareShield Life plan by offering additional benefits such as higher monthly payout amounts that can help enhance your coverage. However, you will also have to pay a higher premium for these supplementary plans.

Choosing the right insurance plan can be confusing. But don’t worry! Just remember two things: coverage and affordability. That way you can pick the right policies for you and your wallet.

Employee medical benefits

Your employer may offer medical benefits as part of your compensation package. These can include health, dental, and disability insurance.

Make it a point to review the benefits of your employee insurance before signing up for additional private insurance plans. This can help you avoid duplicating your insurance coverage. For more information, speak with your Human Resource team to understand the health insurance benefits available.

Note that your medical benefits will no longer be valid once you leave the company. Therefore, it is useful to have some form of insurance coverage to remain protected.

Level of income protection

If you become ill or disabled, you may need income protection to help cover expenses and maintain your lifestyle. Income protection gives you a fixed amount of money even in the event that you are unable to work. This can be extremely beneficial if you have dependents or monthly expenses such as a mortgage.

The recommended level of coverage for insurance protection are:

Death & Total Permanent Disability: 9 x of annual income

Critical illness: 4 x of annual income

Dependents

It's important to think about your loved ones in case of an unexpected event. Your dependents could be parents, spouse, children, or anyone else who relies on you for support. Consider their financial needs and the support they require if you were unable to provide it.

Coverage over time

Your insurance needs can change as you age. For instance, you may need more coverage to help with additional healthcare expenses as you get older. Consider the kind of insurance you would need after 40, 50, 65, and beyond. Think about the amount you would feel comfortable with and adjust your policy accordingly.

Make it a point to regularly review your insurance policy every three to five years to account for changes in your life status, such as a career or lifestyle change, and to ensure that you have adequate coverage.

Pre-existing conditions

A large number of insurance policies do not cover pre-existing conditions such as diabetes, high blood pressure, and high cholesterol. It's essential to carefully review the policy and understand its coverage limitations related to pre-existing conditions before committing to it.

MediShield Life offers universal coverage for all Singaporeans, regardless of their healthcare conditions. No one will lose MediShield Life coverage, no matter what happens.

Buying multiple insurance plans can be expensive and add up to your expenses. Before selecting one, it’s beneficial to assess your needs and financial situation to ensure that you can comfortably afford it.

As a rule of thumb, you should spend at most 15% of your income on insurance protection. Note that purchase of bundled products such as whole life insurance may exceed 15% of your income as they contain both investment and protection elements.

Here are two pointers to consider when making your decision:

- Hospital/ward class preference

Different insurance plans provide differing levels of coverage. The higher your ward class, the more expensive your insurance plan will be.

MediShield Life covers a smaller portion of your bill if you’re seeking treatment at a Class A/B1 ward in a public hospital or at private hospitals. Hence, you could opt for an IP if you prefer to seek treatment at a private hospital or choose your own doctor.

- Paying premiums in the long term

The cost of your premiums can increase in the long term. Similarly, your ability to pay for them might also change over time as well. For example, IP premiums can increase significantly when you reach your 70s and 80s and can be up to four times higher than MediShield Life premiums.

This makes it vital to consider whether you will be able to afford the premiums over an extended period and plan accordingly.

Healthcare can be costly, and without insurance, you might face a significant impact on their financial stability. While healthcare insurance is not related to growing your wealth, it plays an important role in protecting your financial well-being.

This makes it important to familiarise yourself with the available insurance options and protect your finances in the event of unexpected circumstances. You can also compare the many different insurance policies available on CompareFIRST, an insurance comparison tool by the Consumer Association of Singapore (CASE), the Monetary Association of Singapore (MAS), the Life Insurance Association Singapore (LIA), and MoneySENSE.

After all, as the saying goes, good health is the ultimate wealth. Stay healthy!

Information in this article is accurate as at the date of publication.