11 August 2023

SOURCE: CPF Board

What do the Great Wall of China, the Taj Mahal, and compound interest have in common?

According to Albert Einstein, compound interest is "the eighth wonder of the world." He explained that: “he who understands it, earns it; he who doesn't, pays it." But what did he mean by that?

The Great Wall of China, the Taj Mahal, and compound interest share a common trait: they are all long-term projects. Just as the wonders of the world required years of construction, if you start now and let your money compound, your savings can be standing as tall as these historic monuments as well.

What is compound interest?

You earn interest when you deposit money in an interest-earning account. Over time, this interest accumulates and enables you to earn additional interest from it as well. This is known as compound interest.

The longer you leave your money in the account, the more time it can compound. This means the sooner you begin saving, the larger the sum of money you will accumulate by

a specific target age.

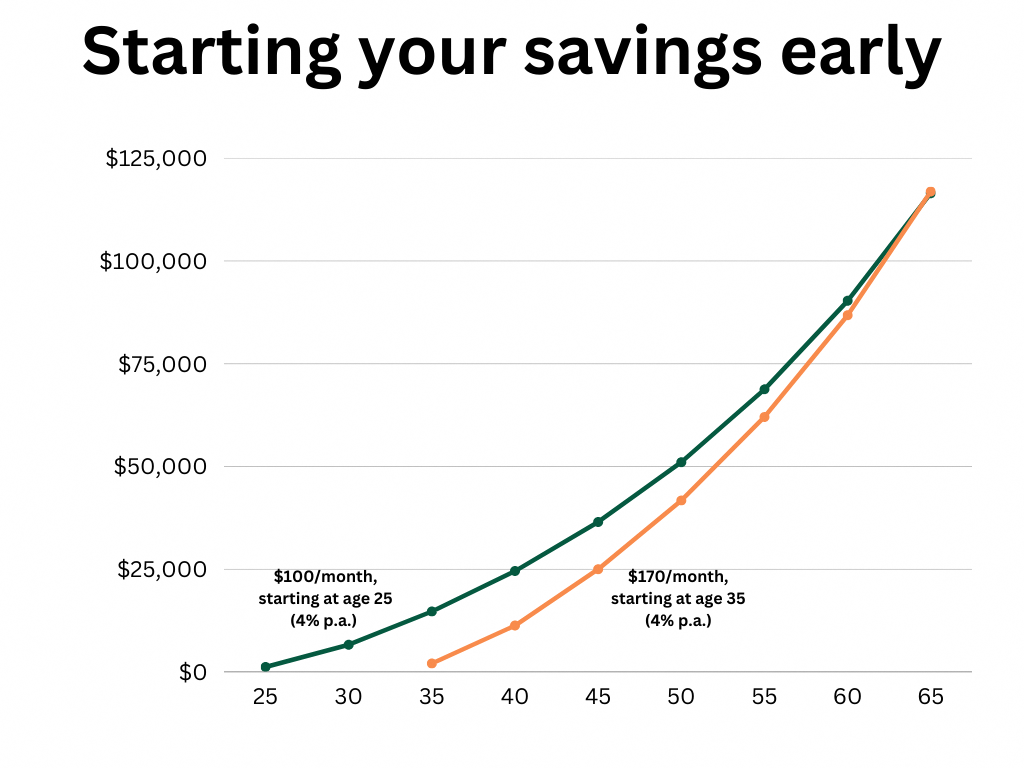

If you begin setting aside $100 per month at the age of 25, and your savings earn an average annual return of 4% p.a., your money will grow to over $116,000 by the time you retire at age 65.

But by waiting a decade later at age 35 to start saving, you will need to save $170 per month to achieve the same amount at age 65.

That's the “power” of compound interest. It's a useful tool that can multiply your wealth over time, but only if you give it enough time to work its magic.

How compound interest can expand your wealth

Another way of looking at compound interest is how fast it can grow your money once it has taken full momentum.

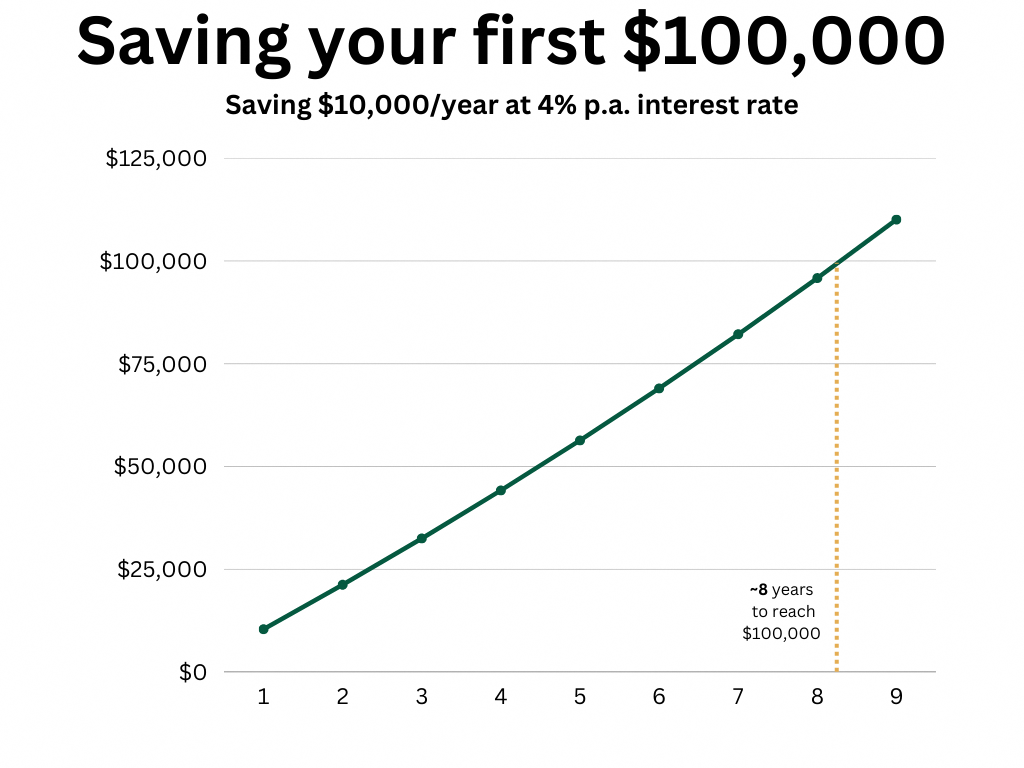

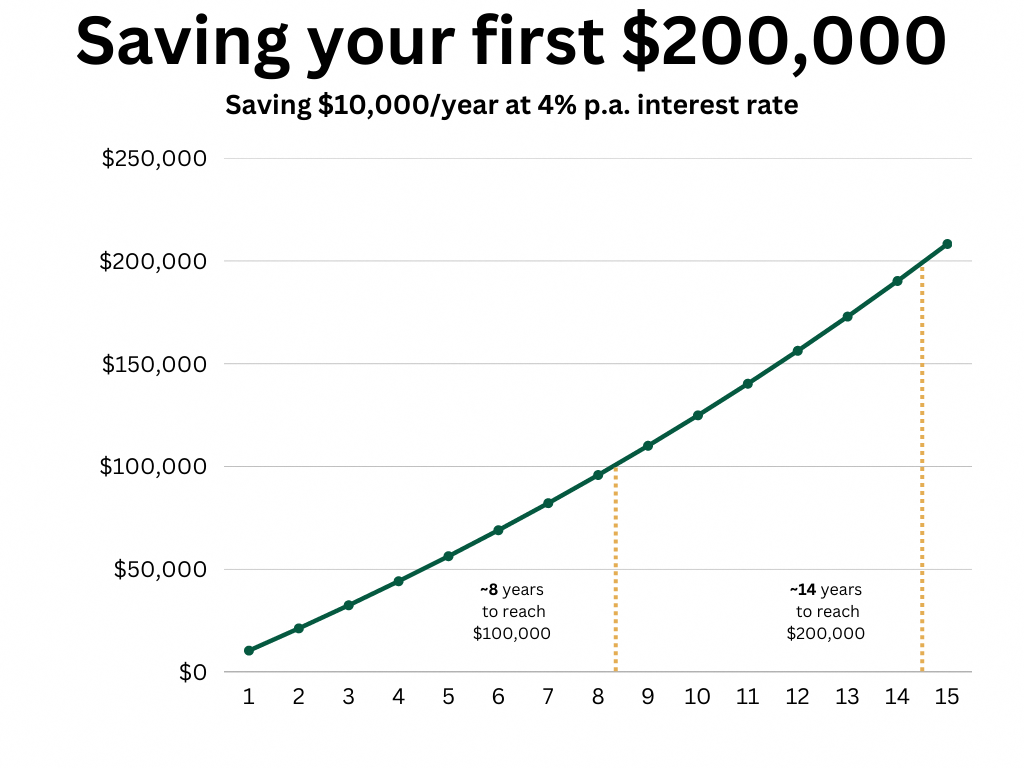

For example, if you place $10,000 a year in a savings account that gives you an interest rate of 4% p.a., it will take you approximately 8 years to reach $100,000.

But if you carry on with your saving habit and continue to save $10,000 per year at the same interest rate, you will be able to save your next $100,000 in approximately 6 years. That’s a difference of over two years!

The magic happens when the extra $100,000 you saved earlier starts working behind the scenes, generating additional interest. This process makes it much easier for you to accumulate the next $100,000.

CPF and compound interest

Your CPF savings also lets you enjoy the power of compound interest. By earning up to 6% p.a. ( if you are above age 55) or 5% p.a. (if you are below age 55)*, your CPF savings can multiply over time and provide support for your housing, healthcare, and retirement requirements.

This also means that the longer you leave your money with CPF, the longer compound interest can work its magic and grow your CPF savings over time!

Ways to maximise your CPF interest

Now that you have a better understanding of compound interest, use it to maximise the interest earned from your CPF savings! Here are two simple ways to do so.

1. Make cash top-ups to the Retirement Sum Top-Up Scheme (RSTU)

Making cash top-ups to your Special Account (SA) helps to boost your interest earned and capitalises on the power of compound interest. Even a monthly contribution of $50 can go far when contributing towards your retirement dreams.

You can also claim tax relief of up to $8,000 per calendar year for cash top-ups made to yourself. An additional $8,000 in tax relief per calendar year is also applicable for cash top-ups made to your spouse, parents, parents-in-law, grandparents, grandparents-in-law, and siblings. Note that the tax relief benefit is capped at the FRS level, terms and conditions apply.

2. Transfer your Ordinary Account savings to your Special Account

Your Ordinary Account (OA) earns an annual interest rate of 2.5% p.a.. If you have already budgeted for your home and have excess OA savings, consider transferring it to your SA which earns a higher interest rate of 4%*.

Take note that this step is irreversible, so it’s important to assess your housing financing situation before you make any transfer.

Compound interest helps to grow your savings

Compound interest is a powerful tool that can help your savings grow over time. Remember to save diligently and compound interest will weave its magic. With time, your savings will work hard and reward you for your patience!

The information provided in this article is accurate as of the date of publication.

*Up to 5%/6% is based on the floor rate of 4% and the SMA rate for Q3 2023 is 4.01%.