18 Feb 2025

SOURCE: CPF Board

Becoming a parent is an exciting and life-changing experience, but it’s also essential to be financially prepared to provide for your growing family. Whether you’re a first-time parent adjusting to new responsibilities or welcoming another child into your home, managing these changes can be challenging.

With support from the Government, including additional parental leave, financial assistance for childcare and even cash benefits, it can help you ease into the transition. By taking advantage of these resources, you can ensure that you and your child get a head start, thus allowing you to focus on the joys of parenthood.

Here are a few tips to help you get started!

Under the enhanced Baby Bonus Scheme, you can receive $11,000 in cash (up from $8,000) for your first and second child, and $13,000 (up from $10,000) for your third and subsequent children. This helps to lighten the financial outlay when it comes to raising your child. Parents will receive up to $9,000 over the first 18 months, followed by $400 every six months until your child turns 6-and-a-half years old.

Children who are Singapore citizens and whose parents are lawfully married will be eligible. They must also be born after 14 Feb 2023 to qualify.

Aside from the Cash Gift, the Baby Bonus Scheme also comprises a special savings account - the CDA. All eligible Singaporean children will receive a First Step Grant (FSG) of $5,000 in the CDA. Under the Large Families Scheme, child of 3rd or higher birth order will receive an additional FSG of $5,000.

You can also double the savings deposited into your child’s CDA by leveraging the Government’s dollar-for-dollar matching, up to the Government co-matching cap. For example, if you top up $4,000 in your child’s CDA, the Government will match it with another $4,000.

This is capped at:

- $4,000 for your first child

- $7,000 for your second child

- $9,000 for your third and fourth child

- $15,000 for your fifth and subsequent child

Funds in the CDA can be used for childcare or healthcare expenses. This includes childcare centres, kindergartens, optical shops and clinics that are Baby Bonus Approved Institutions.

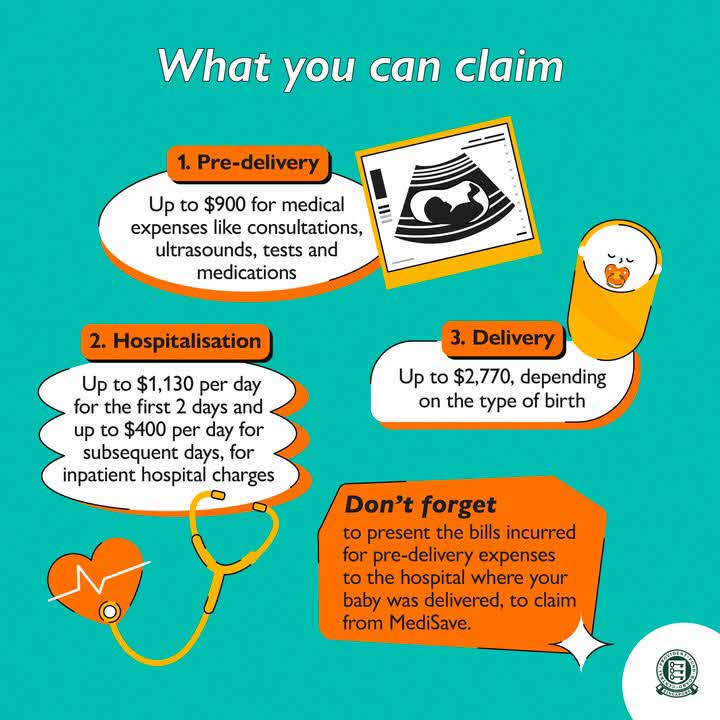

Once you register your child’s birth, a MediSave Account will be created and $5,000 will be credited automatically. This can be used to pay for MediShield Life premiums, recommended childhood vaccinations, hospitalisation and approved outpatient treatments. All Singapore Citizen newborns are eligible for this grant.

If you are a working father of Singaporean children born on or after 1 April 2025, you can enjoy four weeks of mandatory Government-paid paternity leave (GPPL).

You may also take shared parental leave:

- From 1 April 2025: 6 weeks

- From 1 April 2026: 10 weeks

Find out more about the enhancements to parental leave for parents with newborns.

Working parents will receive 12 days of unpaid infant care leave per year for the first two years of their child’s life – an increase from six days currently.

This will be eligible for all parents of Singaporean children who have worked with their current employer for a continuous period of at least three months.

The Large Families Scheme is a Government Scheme administered by the Ministry of Social and Family Development to strengthen support for Singaporeans who have three or more children. It builds on the Government commitment to provide greater support for couples who aspire to have more children, and to create a family-friendly Singapore.

Families with a third or subsequent eligible Singapore Citizen child born on or after 18 February 2025 will receive :

- a Large Family MediSave Grant,

- an increased Child Development Account First Step Grant, and

- enjoy privileges at partnered merchants.

Families may also receive Large Family LifeSG Credits annually (up to when the child is six years old) if they meet the eligibility criteria.

For more information, please visit the Large Families Scheme website (go.gov.sg/LFS).

The number of full-day preschool places have doubled, from about 100,000 in 2013 to over 200,000 today. The Government aims to ensure that 80% of preschoolers will have a place in Government-supported preschools by 2025.

All Singapore Citizen children attending an Early Childhood Development Agency (ECDA) – endorsed childcare and infant care centre will receive a Basic Subsidy. Dual-income families with a gross monthly household income of $12,000 or below are also eligible for the Additional Subsidy. Lower-income families will receive higher subsidies.

Find out more about the Infant and Childcare Subsidy Scheme.

Fee caps will also be further reduced in 2025 and 2026 to allow for lower full-day childcare fees at those preschools.

Did you know you can also claim tax relief as a working mother under the Working Mothers’ Child Relief (WMCR) scheme? With effect from the Year of Assessment 2025, the WMCR has been changed to a fixed dollar relief instead of a percentage of the mother’s earned income:

|

Singaporean children born or adopted on or after 1 January 2024 |

1st child |

$8,000 |

2nd child |

$10,000 |

3rd and subsequent child |

$12,000 |

Find out what are the eligibility conditions to qualify for this tax relief.

If you need to engage a migrant domestic worker for your household needs like taking care of your young children, you can qualify for a concessionary levy rate of $60 per month.

While your current focus is on taking care of your little one, there will come a time when you start wondering if you are able to be self-sufficient as you age, to avoid burdening your children. Your CPF is here to support you and help you build your retirement nest egg, letting your savings growing safely and with minimal effort.

Welcoming a new member into the family is a major milestone for parents, which is why it’s crucial to plan ahead and equip yourself with financial knowledge and take advantage of the different grants available for you and your child. Don’t forget to take care of yourself even as you take on a new role as a parent too!

Information accurate as of date of publication.