28 July 2023

SOURCE: CPF Board

Introduced in 2015, MediShield Life is a health insurance scheme designed to help Singaporeans cope with large hospital bills and selected costly outpatient treatments. It aims to make healthcare more affordable and accessible to all, regardless of age or health conditions, covering all Singaporeans and Permanent Residents (PRs).

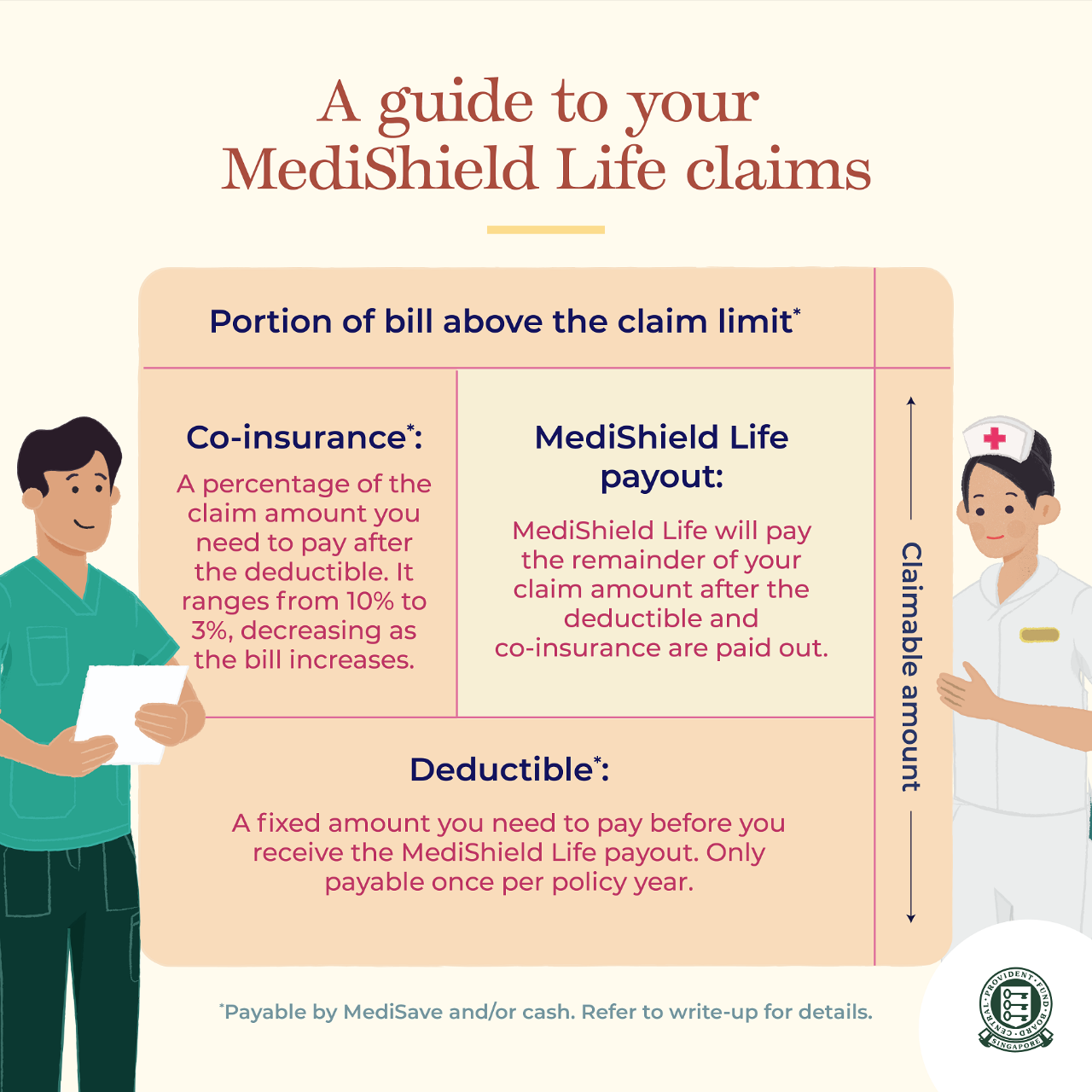

Do you know the components of a hospital bill and what you can claim under MediShield Life?

Here’s a breakdown for a better understanding:

^For Integrated Shield Plan (IP) claims, refer to write-up below.

MediShield Life does not cover the entirety of the bill. The claimable amount for a bill is determined by adjusting the bill based on the pro-ration factor and applying the claim limits. As MediShield Life benefits are designed to provide coverage for subsidised bills incurred by Singaporeans at Class B2/C wards and subsidised outpatient treatments/day surgery at public hospitals, bills that have smaller or no subsidy (e.g. those at Class B1 and above) are pro-rated. Claim limits are then applied to the pro-rated bill.

How much you can claim depends on the type of treatment you receive, and the length of your hospital stay. The maximum claim limit per policy year is $150,000 with no lifetime limit on the amount you can claim from MediShield Life. You will have to pay the portion the bill that is above the claim limit.

Find out the MediShield Life claim limits for the different categories of benefits.

This is the fixed amount you have to pay before your MediShield Life payout kicks in. The deductible ranges from $1,500 to $3,000, depending on your age and choice of ward class. You only have to pay this once in any year you are hospitalised, and this can be paid using your MediSave savings and/or cash.

Deductible (based on age at next birthday at the start of the policy year) |

||

Ward Class/Treatment |

80 and below |

81 and above |

Class C1 |

$1,500 |

$2,000 |

Class B2 and above1 (including stay in private hospitals) |

$2,000 |

$3,000 |

Day surgery |

$1,500 |

$2,000 |

Outpatient treatments |

Not applicable |

|

1Subsidised patients will follow the deductible for Class C and non-subsidised patients will follow the deductible for Class B2 for Community Hospital, Inpatient Palliative Care Service, Short Stay Wards and Continuation of Autologous Bone Marrow Transplant for Multiple Myeloma.

This is a percentage of the claimable amount that you have to pay after the deductible. The co-insurance ranges from 10% to 3%, decreasing as the bill increases.

Inpatient/Day surgery Claimable amount accumulated within a policy year |

|

First $5,0001 |

10% |

Next $5,000 |

5% |

Above $10,000 |

3% |

Outpatient treatment |

10% |

1Inclusive of deductible |

|

Source: MediShield Life for the newly insured

Like the deductible, the co-insurance can also be paid using your MediSave savings and/or cash.

MediShield Life will cover a portion of your medical bill, but you would need to pay the deductible and co-insurance.

If your intention is to stay in B2/C wards in public hospitals which are heavily subsidised, you do not require an Integrated Shield Plan (IP). MediShield Life will provide sufficient coverage for your large class B2/C bills.

However, if you opt for non-subsidised treatments in Class A/B1/B2+ wards in public hospitals or seek treatment at private hospitals, the costs can be significantly higher. In such cases, MediShield Life will cover a smaller portion of the bill. If you strongly prefer this option, you can consider getting an IP that matches your ward preference.

To better understand how MediShield Life claims work, let’s take a look at Pamela, a 48-year-old Singapore Citizen who had a uterus operation and was hospitalised in a normal C ward for five days. Her total bill came up to $17,600.

In this instance, Pamela’s bill payable is $4,000, after government subsidy. As she is a Singapore Citizen who stayed in C ward, the MediShield Life claim is not pro-rated.

Here’s a breakdown of Pamela’s claim from the bill payable.

|

Hospital Bill Payable |

MediShield Life Claim Computation |

Daily ward and treatment charges (Five days in a normal ward) |

$2,400 |

$2,400 |

Uterus operation under |

$1,600 |

$1,600 |

Total claimable amount |

$4,000 |

|

As Pamela is under 80 years old, there will be a deductible of $1,500 for her stay in a C ward in a public hospital. A co-insurance component also applies.

|

MediShield Life Claim Computation |

Total claimable amount |

$4,000 |

Deductible |

($1,500) |

Claimable (less deductible) |

$2,500 |

Co-insurance (10%) |

($250) |

MediShield Life payout |

$2,250 |

Here’s an overview of Pamela’s bill, subsidies received, and her MediShield Life payout:

Total bill (before subsidy) |

$17,600 |

Government subsidy |

($13,600) |

Total bill (after subsidy) |

$4,000 |

MediShield Life payout |

($2,250) |

Patient co-payment |

$1,750 (can be paid by MediSave and/or cash) |

To utilise MediShield Life or an IP to pay for your medical expenses, you can inform the staff responsible for your admission or outpatient treatment. They will handle the claim submission on your behalf. CPF Board or the private insurer (if you have an IP) will process your claim and directly settle the payment with the medical institution.

Find out more on how to apply to use your healthcare plans.

Part of the changes to your CPF that were announced in Budget 2023 includes the increased usage of MediSave savings and coverage for cancer medication under MediShield Life – helping to alleviate concerns about managing healthcare costs. Find out more about these changes, including more forms of Government support to help caregivers.

To effectively manage healthcare expenses and ensure financial well-being, it is crucial to possess accurate information about CPF healthcare schemes. Learning about your MediShield Life coverage is a good start. Take the opportunity to debunk myths about these healthcare schemes and empower yourself with the knowledge today. This way, you can better strike a balance between healthcare costs and your other financial needs.

The information provided in this article is accurate as of the date of publication.