2 Jun 2025

SOURCE: CPF Board

Making a CPF nomination need not be a complicated affair. With the option to do one from the comfort of your home, you do not need to head down to a CPF service centre to direct what happens to your CPF savings after you pass away.

Here’s all you need to know about making a CPF nomination!

A CPF nomination allows your CPF savings to be distributed according to your personal wishes. This includes allowing you to:

Choose the beneficiaries to receive your CPF savings

Decide the share of the savings you want to give to each chosen beneficiary

If you do not make a CPF nomination, upon your passing, your CPF savings will be transferred to the Public Trustee for distribution in cash to your family member(s) in accordance with the relevant intestacy laws. The Public Trustee will charge a fee for the provision of this service.

The claiming process can take up to six months as the Public Trustee will need to identify the family members who are eligible to receive your CPF savings. Your family members will also need to produce documentary evidence to prove their relationship with you.

Moreover, relying on the intestacy laws to distribute your CPF savings to eligible family members might not align with how you want to distribute your CPF savings. For example, you may want to give more shares of your savings to certain family members who had taken care of you during your lifetime. In comparison, the intestacy laws apportion your CPF savings to each eligible family member without these considerations that are personal to you.

As such, it is always a good idea to make a CPF nomination and decide how you want to distribute your CPF savings.

Check out if you’ve made a CPF nomination on the “Providing for your loved ones dashboard”. This useful feature gives a one-stop look into your CPF nomination and allows you to view your term life insurance coverage for the Dependants' Protection Scheme as well.

Making a CPF nomination is free of charge. The CPF Board also does not deduct any administration fees when your nominee(s) come forward to receive your CPF savings in the event of your death.

However, if you have not made a CPF nomination, the Public Trustee deducts an administration fee based on the amount of CPF savings you have before your eligible beneficiaries can claim your CPF savings.

Having a CPF nomination allows your nominee(s) to receive your CPF savings in a timely manner after your passing. Generally, the CPF Board will reach out to your designated nominee(s) within 10 working days following notification of your passing to arrange for the claiming of your CPF savings.

The nominee(s) will then be able to receive your CPF savings in cash (via bank transfer).

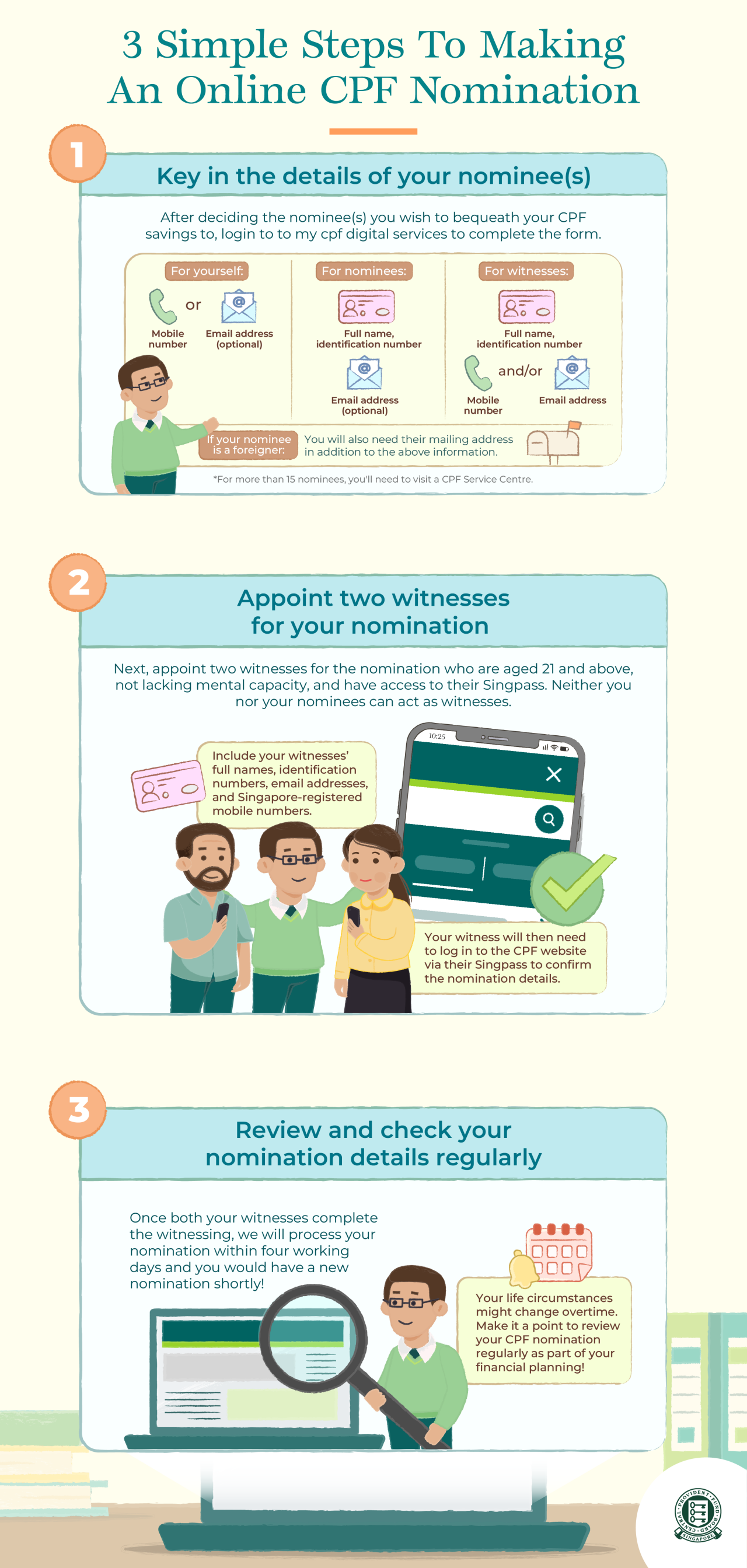

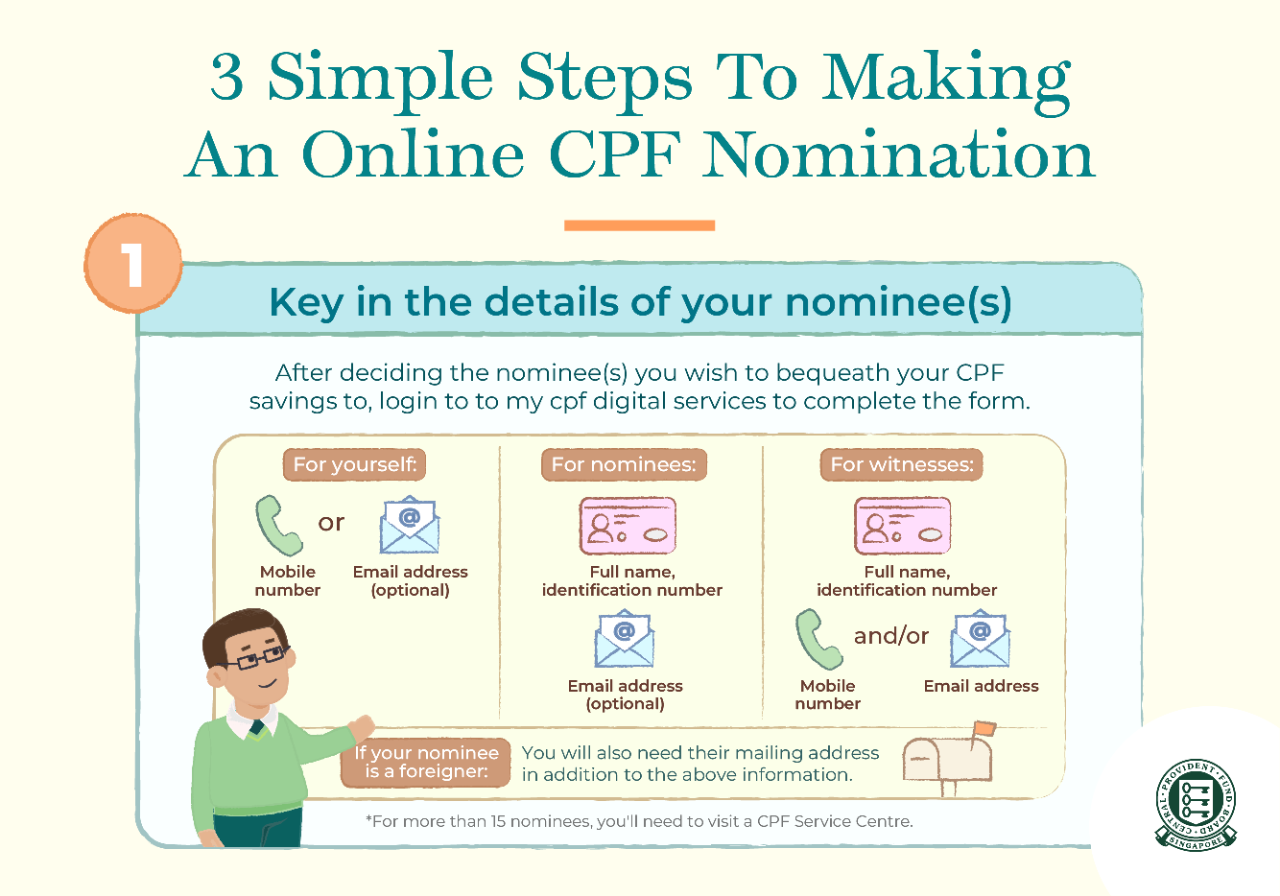

Visit the “Make a CPF Nomination” page to get started. As part of CPF Board's ongoing efforts to enhance security across CPF digital devices, you'll now need to use your biometrics as a form of enhanced authentication. Next, decide the nominee(s) you'd like to appoint. If you're thinking of appointing more than 15 nominees, you'll need to visit a CPF service centre.

You will also need to prepare the full names and identification numbers of your nominees.

Once you have keyed in the details of your nominee(s), you will need to include two witnesses for the nomination process. These witnesses should be age 21 and above, must not lack mental capacity, and have access to their Singpass. Neither you nor your nominees can act as witnesses.

You must also inform your witnesses either face-to-face, via text message, a phone call or email that you are officially appointing them as witnesses. This will allow them to carry out their duties to confirm your intention to make a CPF nomination when they login to CPF website to witness your nomination. Remind your witnesses to complete the witnessing within 7 days from the day you submit your nomination.

Be sure to include your witnesses’ full names and identification numbers. You will also need their email addresses or mobile numbers. This will allow them to receive the link and login with their Singpass to CPF website and complete the witnessing.

Your witnesses will only be required to confirm your intention to make a nomination, and they will not be able to see who you have nominated.

Once both your witnesses complete the witnessing, we will process your nomination within four working days and you would have a new nomination shortly!

With a CPF nomination, you can have additional peace of mind knowing that your CPF savings will be distributed according to your wishes after your passing.

If you’ve ever wondered how to make a CPF nomination, these three simple steps will help guide you in making one effortlessly.

Be sure to check out our other articles on why CPF nomination is an important part of your financial planning and what happens to your CPF savings after your death.

Information in this article is accurate as at the date of publication.

.jpg)

.jpg)