Find out if you are eligible via your Retirement Dashboard. We will also be notifying eligible members via email or post between January to February. If you are eligible and would like to make your cash top-up(s), please proceed using this form.

There is no need to apply for the Matched Retirement Savings Scheme (MRSS). Your eligibility is automatically assessed every year.

We will notify eligible members via email or post at the beginning of the year. Find out if you are eligible via your Retirement Dashboard.

You will be eligible for MRSS for the year if you are a Singapore Citizen only, reside in Singapore and meet the following criteria(2).

(2)Previous year’s data is utilised to assess your eligibility as these are the latest data available.

(3)RA savings refers to the RA balances (excluding amounts such as interest earned), plus retirement withdrawals and CPF LIFE premium deducted. If you are below 55 in the assessment year and your RA has not been created at the time we assess your eligibility, your total Special Account and Ordinary Account savings will be used for the eligibility assessment instead.

(4)Basic Retirement Sum for 2026.

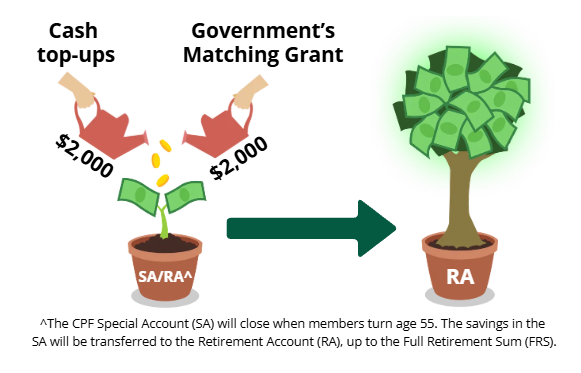

If you are eligible for MRSS and have received cash top-ups in your Retirement or Special Account, you will receive the matching grant. Simply ensure that your one-time top-up via PayNow is submitted by 31st December or your recurring top-up via GIRO is submitted by 31st October in the year of eligibility. You must be a Singapore Citizen only at the point of grant crediting. Please note that cash top-ups which attract the matching grant of up to $2,000 a year will not be eligible for tax relief.

Cash top-ups can be made via the following methods.

The matching grant will be automatically credited into your Retirement or Special Account at the beginning of the following year and you will be notified via email or post. You can also check your matching grant information via your Transaction History.

As a caregiver of a person with disability, you can check your loved one's MRSS eligibility(6) and top up to their Retirement or Special Account (RA/SA) on their behalf. The matching grant will be automatically credited to their RA/SA at the beginning of the following year. You may view their MRSS eligibility and top-ups via their Retirement Dashboard.

Check out this video (available in four languages) on how eligible Singapore Citizens can benefit from the Matched Retirement Savings Scheme.