6 Feb 2026

SOURCE: CPF Board

Caring for your loved ones does not always mean giving them more. Sometimes, it is about giving them support to help them better protect themselves.

In recent years, scam tactics have become more sophisticated. A second opinion from someone you trust can be invaluable when it comes to flagging something suspicious.

That’s why we should also play our part and alert our parents to the latest anti-scam measures and developments, to keep their CPF accounts safe.

Here are three ways to do so:

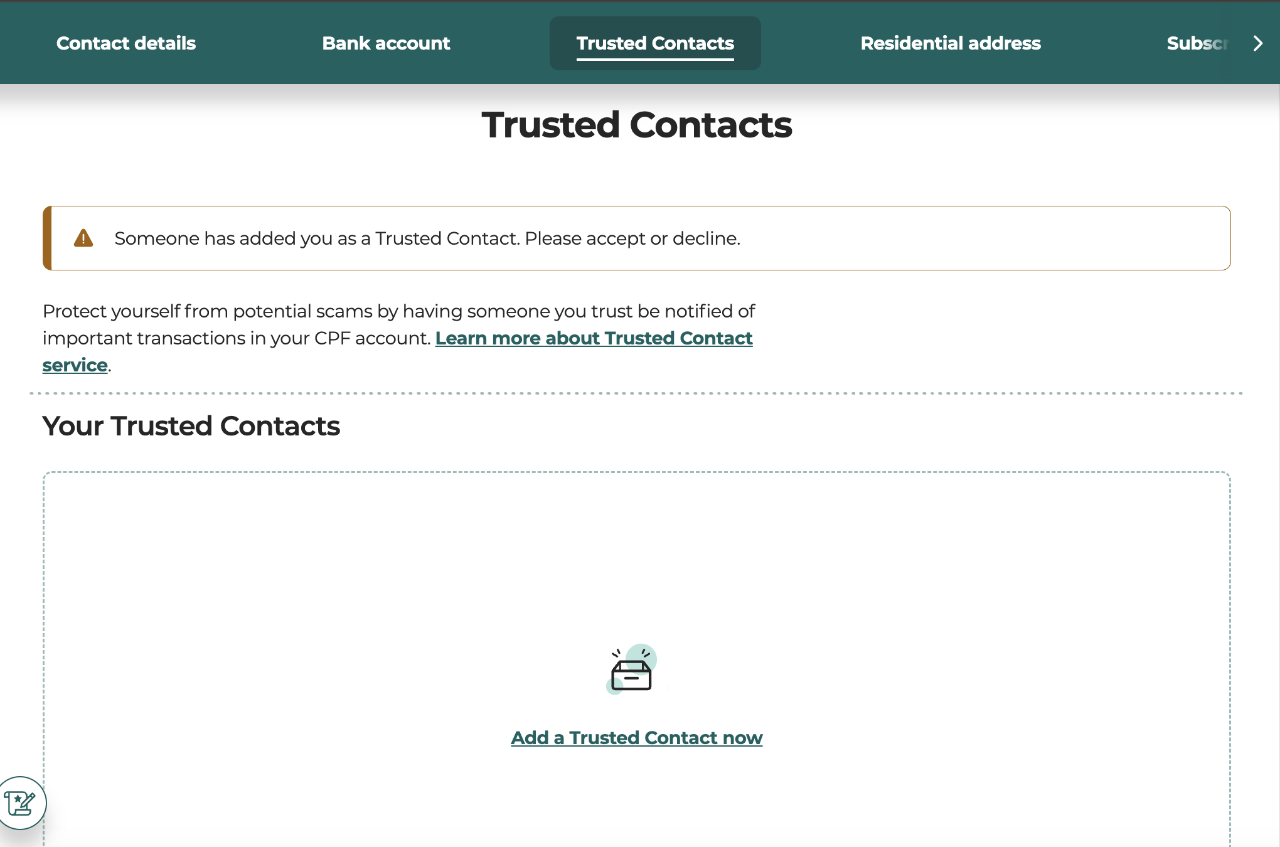

The Trusted Contact notification service allows a CPF member to appoint someone they trust, such as a close loved one, to receive a copy of their notifications whenever important CPF transactions and updates occur. This provides the member with an additional safeguard, by enabling the Trusted Contact to help them spot suspicious transactions and to get alerted quickly.

Notifications of the following services are copied to a Trusted Contact:

- CPF lump sum withdrawals for immediate retirement needs

- Contact details update

- Bank account update

- Daily Withdrawal Limit update

A Trusted Contact must be:

- A CPF member aged 21 and above;

- A Singapore Citizen or Singapore Permanent Resident (with Singpass account); and

- Have both a Singapore-registered mobile number and email address registered with the CPF Board

Do note that to appoint a Trusted Contact, you will also need to fulfill the conditions above.

This service is optional, and members can add or remove their Trusted Contacts at any time.

Enhanced authentication using biometrics would also be required for the appointment to prevent unauthorised appointments.

Members can appoint up to two Trusted Contacts at any point in time.

If you often find yourself at the receiving end of text messages from your parents asking if a link they saw or if an experience they had was a scam, it never hurts to be proactive rather than to be reactive, especially when time is of essence in such cases. Being their Trusted Contact is one way you can help to monitor their CPF transactions and look out for any unusual or unexpected activities.

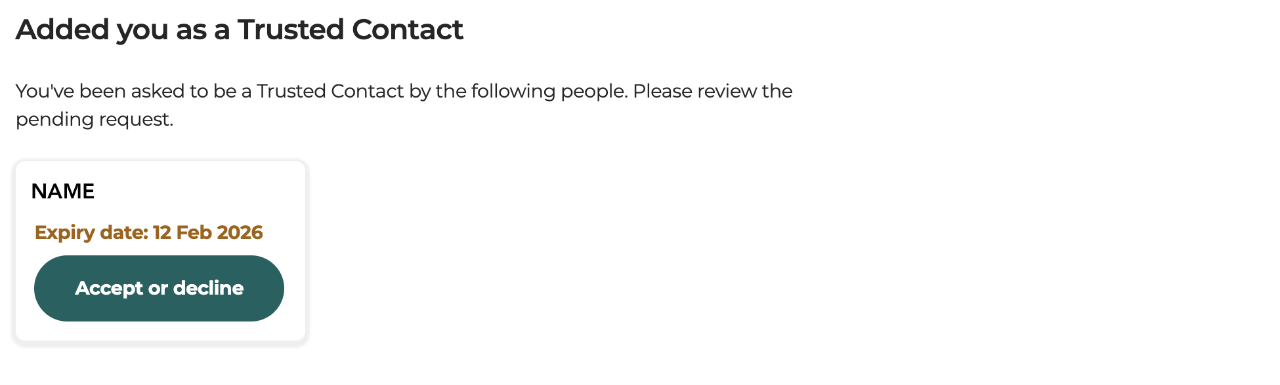

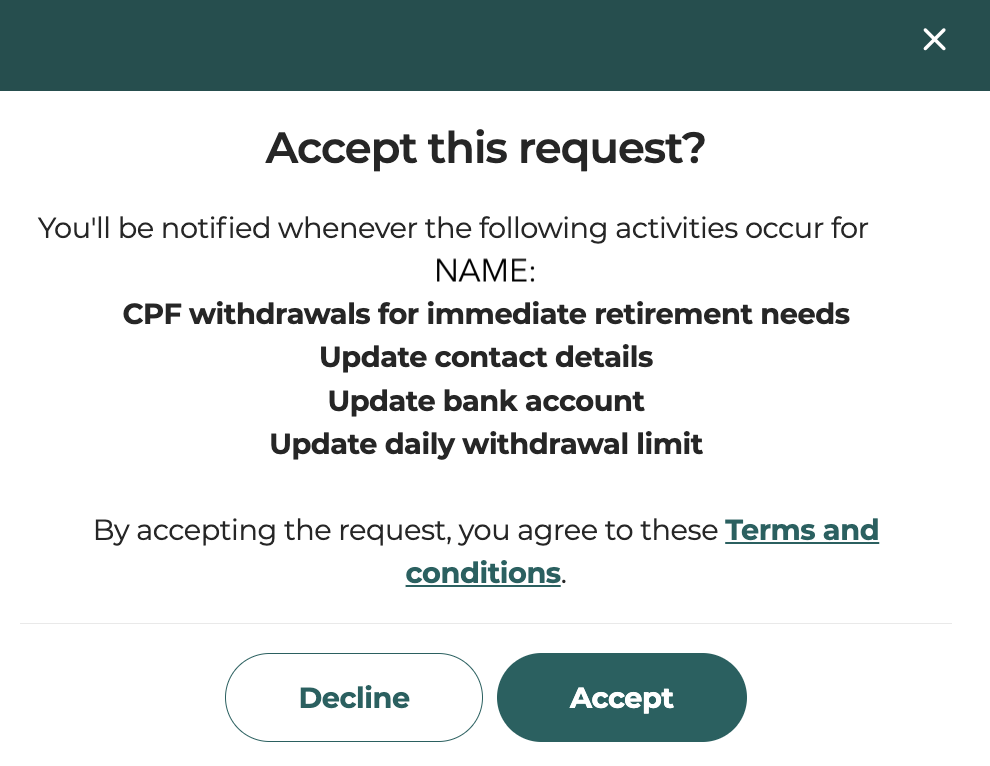

What happens when you are appointed as a Trusted Contact?

Money matters can be sensitive topics for some, which is why it’s crucial to have upfront conversations to align expectations from both sides if you do receive an appointment request from your parents. Have a chat with them to understand their expectations and evaluate if you are ready to take on this role.

Your parents might also be worried about their own privacy and oversharing their CPF details. However, it is important to note that as a Trusted Contact, you cannot view your appointer’s CPF account details beyond the brief information included in the notifications or make transactions on the appointer’s behalf as your appointer (in this case, your parent) has sole control of their CPF transactions.

Once appointed, it is also good for you to be familiar with your role as a Trusted Contact. This includes checking with your parent (as the appointer) to confirm that they made the transaction whenever you receive their CPF notifications, and sharing with your parents the steps to take if there is a suspected scam, such as alerting the bank to freeze any affected bank accounts or informing CPF Board. You have no legal obligations or liabilities as a Trusted Contact, as your appointer retains full control over their CPF accounts.

Before accepting the role of a Trusted Contact, do review the Terms and Conditions of the “Trusted Contact” notification service.

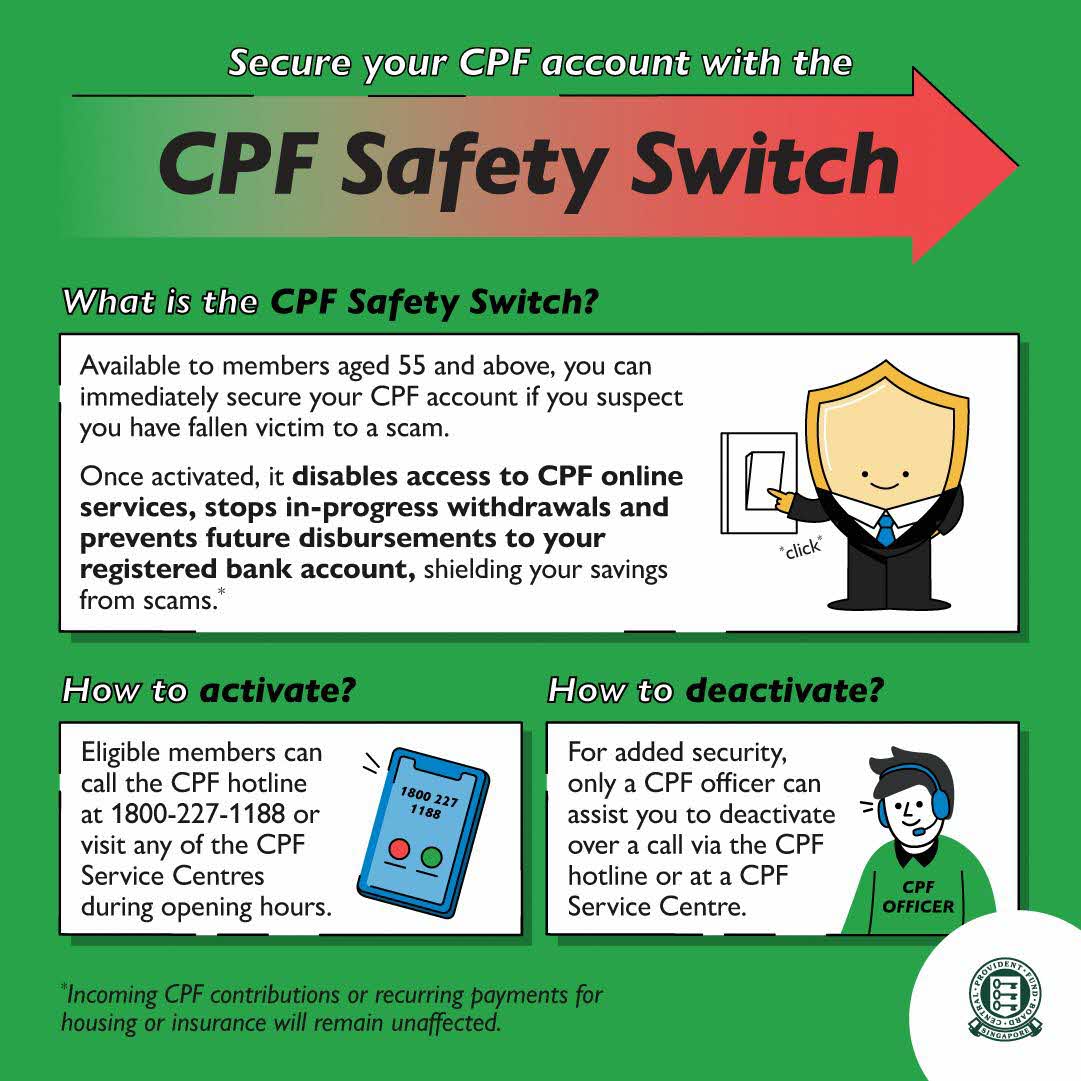

If your parents suspect that they have fallen victim to a scam, the CPF Safety Switch allows members aged 55 and above to immediately secure their CPF account.

Once activated, your parents will not be able to log in to their CPF account through the CPF website and mobile app, preventing scammers from accessing important personal information. The CPF Safety Switch will also stop in-progress withdrawals and all future disbursements to their registered bank account. All incoming CPF contributions or recurring payments to organisations for housing or insurance will remain unaffected. This helps ensure your parents’ CPF accounts stay protected while minimising disruptions to their daily lives.

To activate it, they can call the CPF hotline at 1800-227-1188 or visit any of the CPF Service Centres during operating hours.

While the CPF Board continually enhances our anti-scam measures to better partner members in safeguarding their CPF accounts, we can also help each other out. Your role in reminding your parents to stay vigilant is just as important. Scam tactics evolve, and recent cases include calls and WhatsApp messages impersonating the CPF Board.

Let your parents know that calls from the CPF Board are only made from 6227 1188. The CPF Board will never use automated voice recording systems or any messaging apps such as WhatsApp. WhatsApp messages to members will be sent from “CPF Board Text Us” or “CPF Board”, with the blue verified tick. If they receive a call or message claiming to be from CPF, they should pause and verify its legitimacy before taking any action.

Both you and your parents should also keep your contact details up to date. This will allow you to receive notifications whenever transactions are made and enables the CPF Board to reach you promptly if additional checks are needed for security.

Update your contact details here.

There are also other CPF anti-scam measures that your parents can explore, such as the CPF Withdrawal Lock and Daily Withdrawal Limit.

By being aware of these measures, you can help your loved ones better safeguard their CPF accounts and retirement savings.

Information in this article is accurate as at the date of publication.

.jpg)

.jpg)