6 Mar 2026

SOURCE: CPF Board

When it comes to buying a home in Singapore, Build-To-Order (BTO) flats are often a popular choice due to their affordability and wide selection. With multiple sales exercises each year, BTO flats give buyers the flexibility to choose one that best aligns with their preferences.

Before you start looking for a suitable home, review your finances and determine a budget. This important financial planning step helps you narrow down your housing options to those that you can comfortably afford.

If you are planning to buy a BTO flat, here are some useful budgeting tips to guide you through this exciting journey!

1. Decide on using cash, CPF savings, or a combination of both

How do you decide whether to use your CPF savings, cash, or a combination of both when paying for your flat?

There is no universal approach (everyone’s circumstances are different!), but it is a good idea to use a mix of cash and CPF Ordinary Account (OA) savings to maximise the benefits of both options.

The pros of using your CPF savings

i) Taps into your accumulated CPF savings

Your CPF savings start to accumulate in your OA from your first pay cheque, growing further thanks to the power of compound interest.

These accumulated savings in your OA are useful for funding your flat’s downpayment and reducing your mortgage, so you won’t have to fork out as much cash upfront. However, do note that using your OA savings for housing means tapping into money meant for retirement, which may leave you with less for your golden years.

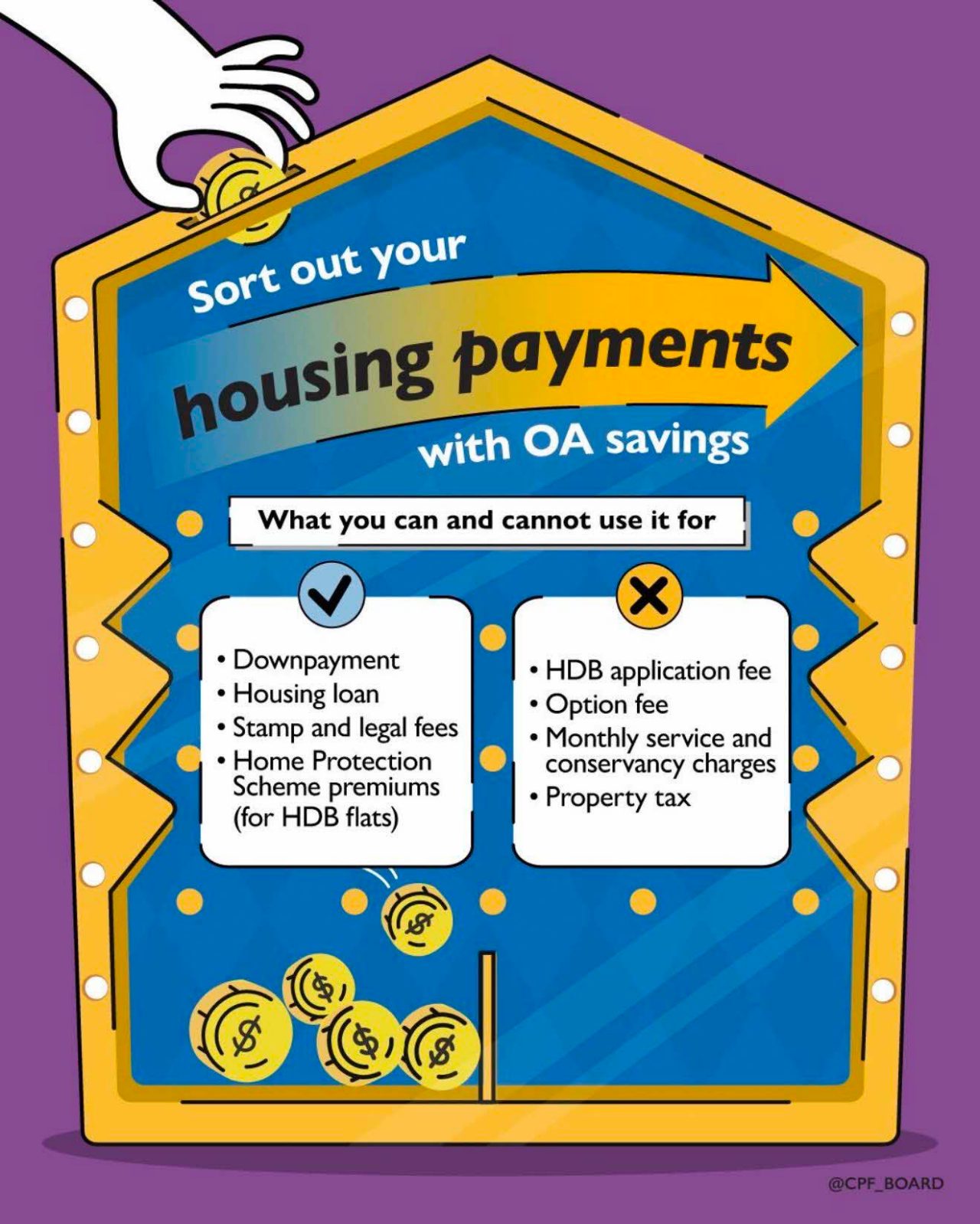

Take a look at the housing-related expenses that you can use your OA savings for:

ii) Frees up your cash outlay

When you use your CPF savings to pay for your flat, you free up more cash for other expenses.

This additional cash on hand is useful for covering upcoming bills, such as wedding or home renovation costs. It can also go towards setting up your new home with furniture and electronic appliances!

The pros of using cash

i) Allows your CPF savings to grow at risk-free interest rates

Depending on the interest rate environment, opting to pay cash instead of using your CPF savings allows you to earn the 2.5% per annum interest – which may help you to build more savings overall for retirement.

ii) Less CPF savings to refund when selling your property

When you sell your property, any CPF funds used for the purchase (principal amount), along with the accrued interest and any housing grant received, must be refunded to your CPF account. Thereafter, you can use the refunded amount to finance your next home or keep it for retirement. The more cash you use for your property, the less you’ll have to refund to your CPF account.

iii) Reduces your mortgage

If you have extra cash to spare, using it to pay for your flat can reduce your housing debt. With a smaller loan amount, you pay less interest over time.

2. Know your loan amount and maximise grants

Before you can apply for a BTO flat, you need a valid HDB Flat Eligibility (HFE) Letter. This mandatory step informs you of your flat buying eligibility, housing grant, and loan amount.

Housing loans

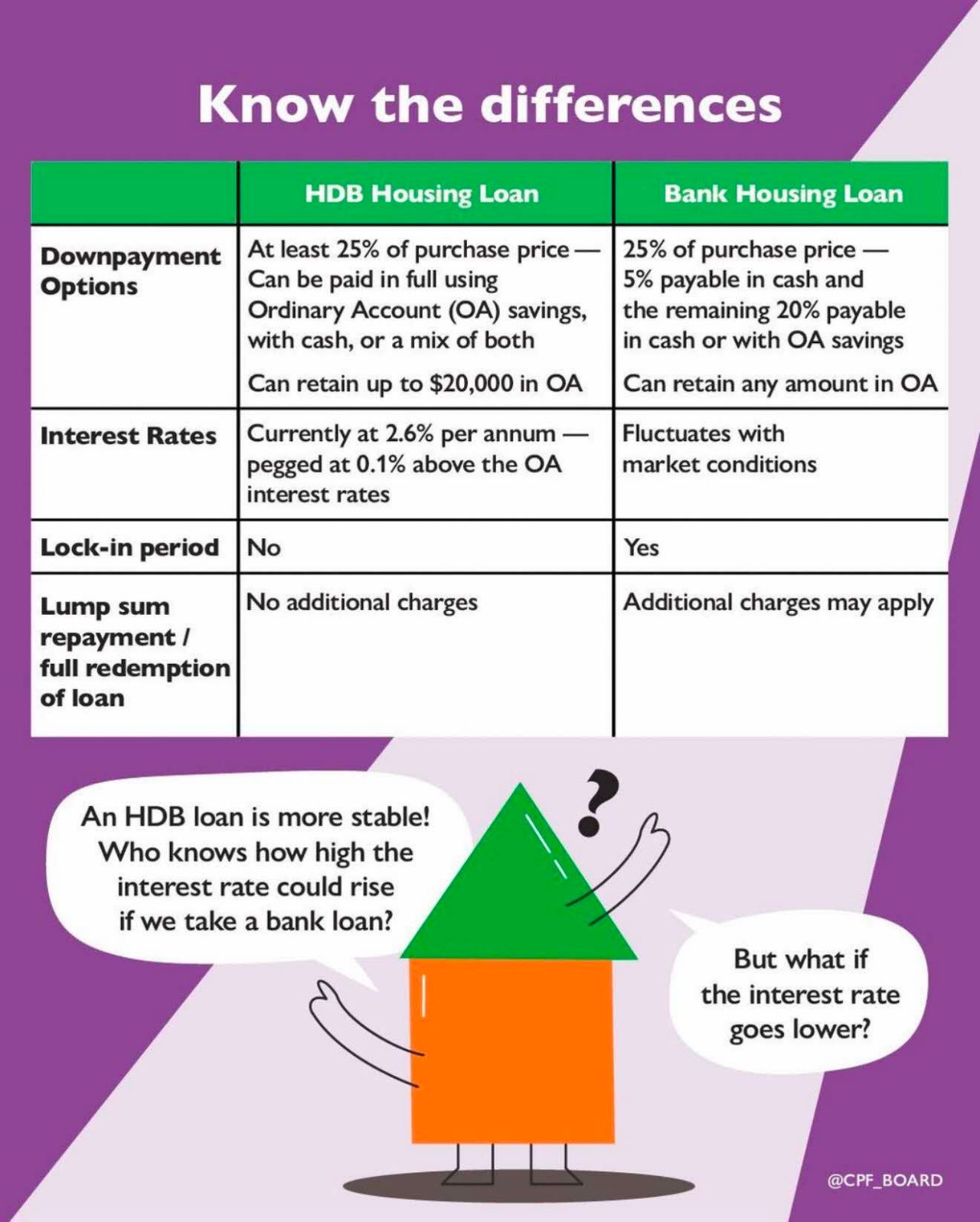

You can finance your home purchase with a housing loan from either HDB or a financial institution (FI). The maximum amount of money that you can borrow is your loan quantum, which is a key consideration when deciding on your flat budget.

Ideally, you should aim for a loan quantum that is financially manageable in the long run.

If you are wondering how an HDB loan differs from a bank (FI) loan, here’s a quick summary:

Housing grants

For eligible first-time buyers, the Enhanced CPF Housing Grant (EHG) helps offset part of the purchase price of a new BTO flat. This reduces the amount you need to finance, thus making homes more affordable.

- Receive an EHG of up to $120,000, depending on your monthly household income.

- Monthly household income ceiling: $9,000 for first-timer households, or $4,500 for first-timer and second-timer applicants.

Find out more about the Enhanced CPF Housing Grant (Families).

- Receive an EHG of up to $60,000, depending on your monthly household income. If you are buying with other first-timer single(s), a maximum of two singles can each receive an EHG, for a total of up to $120,000.

- Monthly household income ceiling: $4,500 if you are applying on your own, or $9,000 if applying with other singles.

For more information on the Enhanced CPF Housing Grant (Singles).

Be sure to review your HFE letter in detail as you may be eligible for other housing grants, which can significantly reduce the cost of your flat.

3. Purchase prudently

With the myriad of Standard, Plus, and Prime housing projects offered in each sales exercise, you may find yourself leaning towards certain locations and flat types.

But the key question is: are you able to afford it in the long run? Remember that a housing mortgage can stretch up to 25 years. It is important to be prudent and shortlist BTO flats that truly fit your needs and budget.

When the time comes to choose your BTO flat, stick to these three guidelines to work out your housing budget:

i) Keep your Mortgage Servicing Ratio to 25%

The Mortgage Servicing Ratio (MSR) refers to the percentage of your gross monthly income that is used to repay your property loan.

As a rule of thumb, keep your MSR within 25% of your gross monthly income. This prevents you from taking on excessive debt, while giving you more flexibility for other financial commitments and future savings.

ii) Ensure that your monthly instalments are less than your monthly OA contributions

To stay financially sustainable, your monthly housing instalments should not exceed your monthly OA contributions. This helps you maintain a positive net balance in your OA, which will safeguard your retirement savings.

Keep in mind that the ratio of contribution for OA starts to decrease from age 35, with a larger share allocated to your Special Account (SA) and MediSave Account (MA) for your retirement needs.

iii) Choose a flat priced under five times your combined annual income

To avoid overstretching your finances, choose a flat that costs less than five times your combined annual income. While your income might rise over time, it is prudent to not rely on future increments and bonuses when planning your budget. Focus on making sensible decisions and realistic forecasts so your home purchase stays within your means.

Budgeting tips for buying your first home

Your first home doesn’t have to be perfect – what matters is setting a realistic budget for your home purchase. This way, your housing loan stays manageable, so you can live comfortably with the means to pursue your goals and other priorities.

Plus, upgrading to a bigger and better home down the road is possible, when your finances are stronger in the future.

Don’t forget to follow these useful budgeting tips as you plan your finances for your BTO flat and get ready to own your first home!

Information in this article is accurate as at the date of publication.

.jpg)