18 August 2023

SOURCE: CPF Board

Buying your first home is undeniably an exciting journey. While there are plenty of steps to take in your house hunt, it is recommended that you start by reviewing your finances and determining your budget.

If you are considering a Build-To-Order (BTO) flat, here are some useful budgeting tips to help with your financial planning!

1. Deciding between cash or CPF to pay for your home

A common question that new homeowners often ask is whether to use their CPF savings from their Ordinary Account (OA) or opt for cash when paying for their flat.

While there is no one-size-fits-all approach, consider using a combination of both cash and your CPF savings to maximise the benefits of both options. Keep in mind that you should consider your immediate and mid-term needs before deciding on the right approach.

Benefits of using your CPF savings

i) Tapping into your accumulated CPF savings

Your CPF savings start to accumulate in your OA from the moment you begin working, benefiting from compound interest along the way.

These accumulated savings will be useful when it comes to funding your flat's downpayment and reducing your mortgage. Without your CPF savings, you would need to come up with cash for the downpayment and this might be quite a substantial amount.

ii) Free up your finances

Using your CPF savings also means that you would have more available cash for other expenses.

This includes big-ticket items such as your renovation or wedding – which can only be paid with cash. Don’t forget that electronic appliances and furniture can significantly add to the overall cost of your home as well!

Check out our guide on the other housing expenses such as utility bills and property tax.

Benefits of using cash

i) Allows your CPF savings to grow at risk-free interest rates

Leaving a portion of your CPF untouched means that you have room for it to grow. With your CPF savings steadily growing at an interest rate of 2.5% p.a., you will be able to secure more for your retirement needs.

ii) Lesser CPF savings to refund when selling your property

Your CPF savings are meant for your retirement needs. This means that any CPF funds used to purchase a property (along with its accrued interest and any housing grant received) will have to be refunded to your CPF account after selling your property. The refunded amount can then be used to finance your next home or for retirement.

iii) Reduces your mortgage

You can also use additional cash to reduce your housing debt. This decreases your housing loan, which means that you pay less interest over time.

2. Understand your loan quantum and grant eligibility

Your loan quantum, which is the amount of money that you can borrow from HDB or a bank, plays a significant role in determining your budget for your flat. Essentially, you should aim for a loan quantum that is manageable in the long run.

Grants offered by CPF can make a substantial difference in your overall housing costs, so remember to incorporate them in your decision-making process as well.

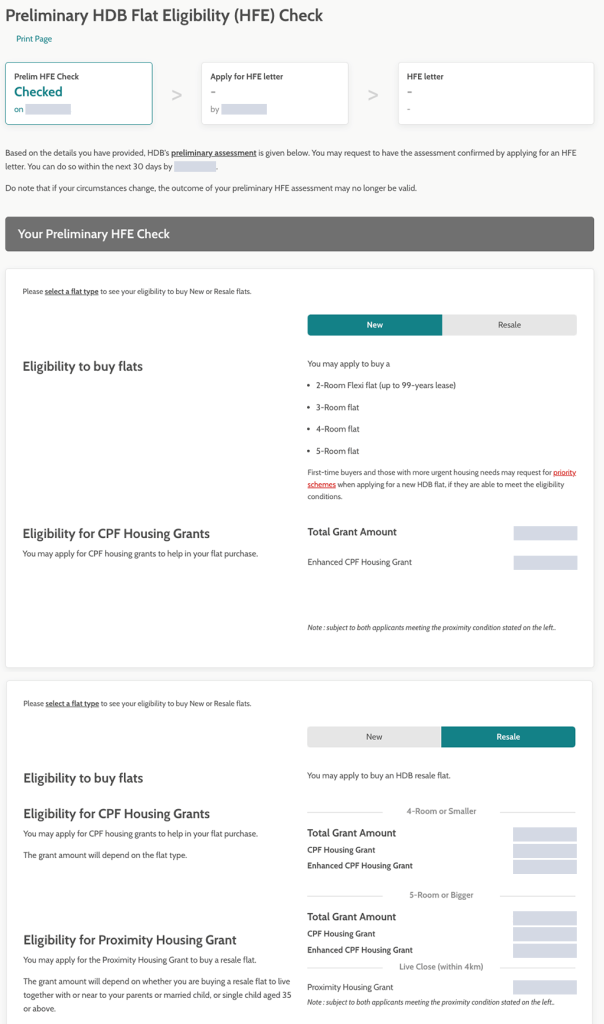

The HDB Flat Eligibility (HFE) Letter is a great resource for planning your flat budget. It provides a snapshot of your eligible grants and is a mandatory step in the process of applying for a BTO flat.

For second-time homeowners, the HFE letter also includes information about the resale levy/premium you must pay when purchasing another subsidised flat from HDB.

3. Purchase prudently

The BTO flats that are offered each cycle vary in size and location, catering to a wide range of budgets.

Prudence involves being realistic about your finances and not overextending yourself by counting on a future income that has yet to be secured.

Stick to these three useful rules when reviewing your housing budget:

i) Keep your Mortgage Servicing Ratio to 25%

The Mortgage Servicing Ratio (MSR) is the percentage of your gross monthly income used to repay your property loan.

To avoid excessive debt, keep your MSR within 25% of your gross monthly income. This leaves room for other financial commitments and enable you to save more for the future.

ii) Ensure that your monthly instalments are less than your monthly OA contributions

A sensible and sustainable approach to financial planning would mean that your monthly housing instalments should be lesser than your monthly Ordinary Account (OA) contributions. This helps to ensure that you will have a positive net balance in your OA, which will enhance your retirement savings.

Keep in mind that your monthly OA contributions begin to decrease at the age of 35, with a bigger proportion being redirected to your MediSave Account (MA) and Special Account (SA) for your retirement needs.

iii) Choose a flat that costs less than five times your combined annual income

Buying a home has substantial financial implications, making it one of your most significant purchases. Choosing a costlier flat could strain your finances and may not be a sensible decision in the long run.

A useful rule of thumb to follow is to buy a flat that costs less than five times your combined annual income. While there may be opportunities in the future to increase your annual income, it’s important to use a realistic forecast to ensure that your finances are not overly stretched.

Budgeting tips for buying your first home

Setting a realistic budget for your first home can give you the freedom to pursue other financial goals without being weighed down by huge housing loans. You can always upgrade to a bigger and better home down the road, when you earn more and are in a better financial situation.

Keep these handy budgeting tips in mind when planning your finances for your BTO flat and take the right first step towards home ownership!

The information provided in this article is accurate as of the date of publication.