10 Apr 2023

SOURCE: CPF Board

Are you looking back at the past year and regretting missing out on opportunities to maximise your tax relief? Let’s do it right this year. One of the easiest ways to earn tax relief is by topping up your CPF savings via the Retirement Sum Topping-Up Scheme (RSTU).

By making regular cash top-ups to your CPF savings, you can enjoy tax relief of up to $8,000 a year, and at the same time grow the savings that will be used to fund your dream retirement! What’s more, if you make a cash top-up to your loved ones, you’ll also get additional tax relief of $8,000 a year!

Tax relief is one of the many benefits that RSTU offers. Here are some of the other benefits and why you should start planning early:

Setting aside a large sum of money for retirement can seem very challenging. It doesn’t have to be as daunting as many think, however, if one astutely harnesses the power of compound interest, which Albert Einstein once quipped as the “eighth wonder of the world” (with good reason).

With interest rates up to 5-6% per annum1, it’s possible to accumulate savings in your CPF accounts substantially by saving just a small amount on a regular basis. For example, a monthly top-up of $50 to your Special Account (SA) or Retirement Account (RA) can grow to more than $7,000* in 10 years, and more than $12,000* in 15 years!

1 Inclusive of an extra 1% interest paid on the first $60,000 of a member’s combined balances, capped at $20,000 from the Ordinary Account (OA). Members aged 55 and above will also receive an additional 1% extra interest on the first $30,000 of their combined balances, capped at $20,000 from the OA.

*Computed using base interest of 4% p.a.

The earlier you start to top up your CPF savings, the more time your money has to grow. The power of compounding means that even small amounts can grow into a substantial amount over time. By waiting, you’re effectively missing out on the opportunity to maximise the growth potential of your retirement savings.

The prices of goods and services will also increase over time, which in turn decreases your purchasing power. This means that the amount that may seem enough today may not be enough to cover your expenses in the future. By topping up your CPF savings early (and regularly), you’re ensuring that your retirement savings keep up with the pace of inflation.

Whether you are planning to build your own retirement nest egg or to help your loved ones grow their retirement funds, here’s a guide on making top-ups to help you get started on boosting your retirement funds with compound interest!

Cash top-ups can be made to yourself, your family, friends and on behalf of your employees (if you are an employer). Cash top-ups not only help build up the retirement savings of your loved ones, but you can also claim tax relief from these top-ups.

While there is no threshold for topping up to your parents or grandparents (or parents-in-law/grandparents-in-law), do take note of the conditions for tax relief eligibility for cash top-ups made to your spouse or siblings. To qualify, your spouse or sibling must not have an annual income of more than $4,000 in the year preceding the year of top-up or is handicapped.

Overall, do note the overall personal income tax relief cap of $80,000 also applies for cash top-ups to CPF accounts.

For eligible members under the Matched Retirement Savings Scheme (MRSS), the Government will match every dollar of cash top-ups made to the Retirement Account, up to $600 per year.

Note that both cash top-ups and CPF transfers are irreversible. Also, if you choose to make a transfer of your CPF savings from one account to another, you will not enjoy tax benefits. If you want to enjoy tax relief, you should consider making a cash top-up instead.

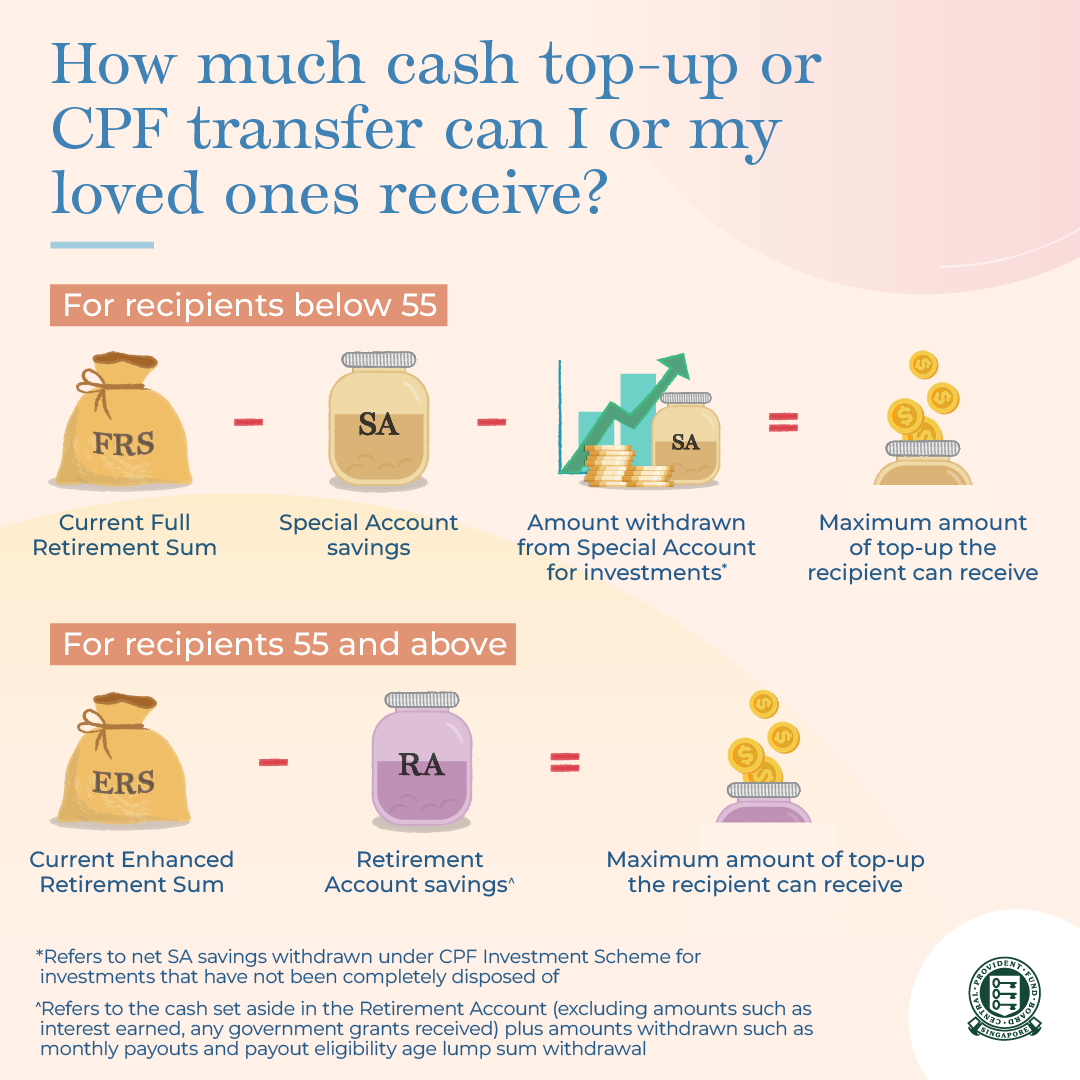

You can receive cash top-ups or CPF transfers up to the Full Retirement Sum (FRS) in your SA if you are below 55, and up to the Enhanced Retirement Sum (ERS) in your RA if you are 55 and above.

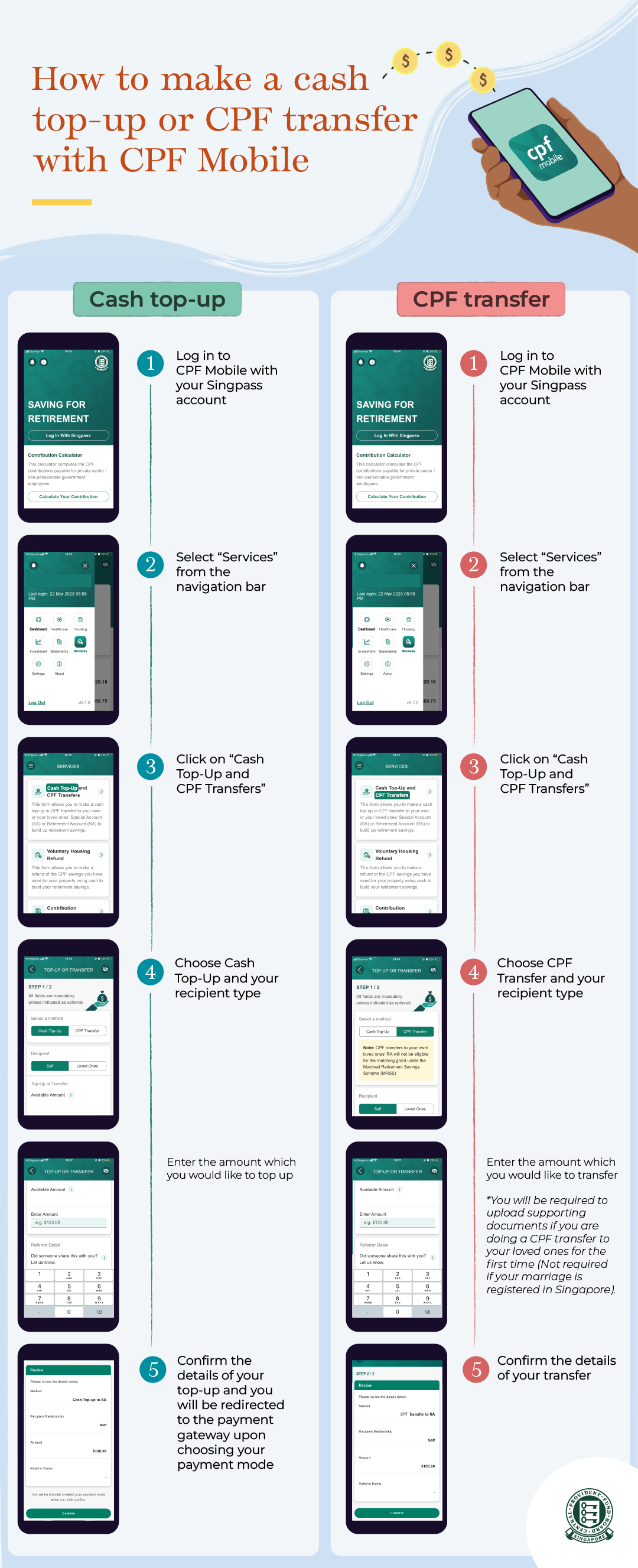

You can now make a cash top-up or CPF transfer easily on the go via the CPF Mobile app (available for Android or iOS):

You can also make a cash top-up or CPF transfer via my cpf Online Services or make regular top-ups with GIRO.

By starting early and contributing regularly, you can grow and make the most of your CPF savings. So don’t wait for next year just for the tax relief benefit – start topping up your CPF savings today!

Information accurate as of date of publication.

.jpg)