3 July 2023

SOURCE: CPF Board

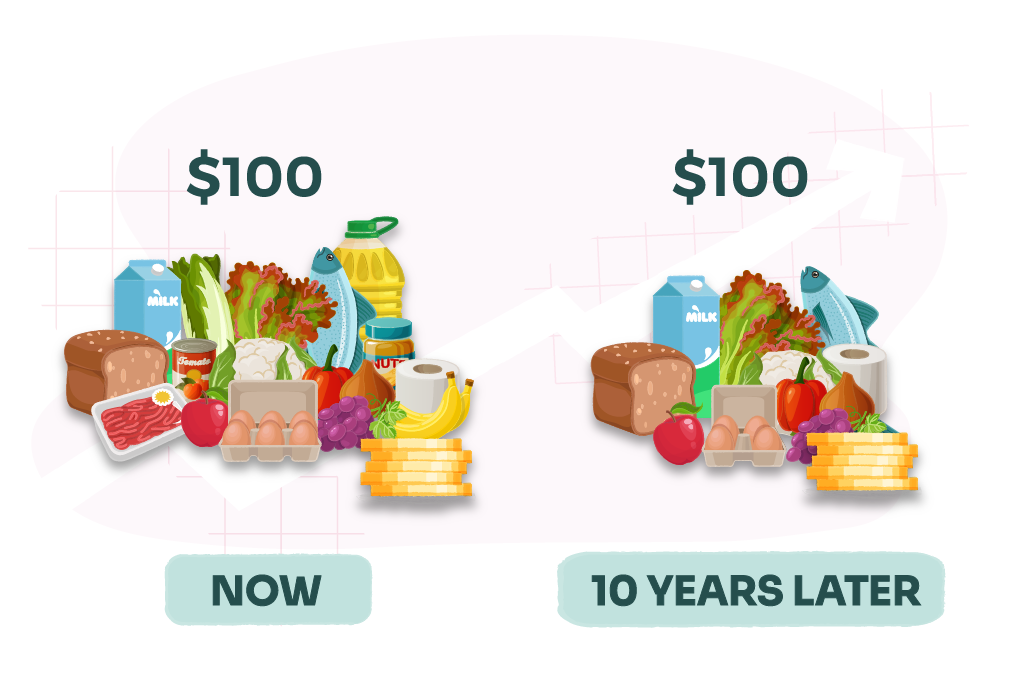

If you leave your money idle, its value will gradually erode overtime due to inflation.

Consider this: spending $100 at the supermarket will get you fewer groceries a decade from now. What you need for your retirement today might not be the same for the future. That’s why it’s important to grow your money and make it work harder for you.

Investing is one way to gradually expand your wealth. Generally, it is recommended to invest at least 10% of your income (after deducting CPF contributions) for retirement and other financial goals. If you feel intimidated by investing because it involves analysing complex charts and graphs, don't worry! There are many ways to invest according to the amount of time and effort that you want to put into it.

In the last instalment of our three-part series on basic financial literacy, we share more about how investments work, the different types of investment options available, and how you can kick-start your investment journey. Get ready to level up your investing game!

At its core, investing involves purchasing assets with the expectation that their value will increase or can generate income over time. These assets can vary from financial instruments like stocks and bonds to tangible items such as real estate.

While art, wine, and luxury watches have gained popularity as alternative investment options, this article will cover the more common investments that are easily accessible to all individuals.

Before we get started with investments, it’s essential to keep several investment fundamentals in mind. These apply to all types of investments, so keep them handy when reviewing any investment opportunity.

Just like the age-old saying of not putting all your eggs in one basket, diversifying helps to protect your investments.

It’s important to understand the relationship between different investment products to diversify successfully. Assets that increase or decreasing in value in tandem are considered correlated. For instance, stocks, regardless of their sector, generally decline in price during market crashes.

To diversify your investment portfolio, include stable assets that are not heavily influenced by market trends.

All investments come with risks. Before you invest, understand that there is a real possibility that you might lose some or all your investment outlay.

A handy rule to follow is to invest with money that you can afford to lose. This is because there is always a risk that your investments can decrease in value.

Investments grow with time. If an investment promises high returns within a short period, it is likely that there’s an equally high chance of losing your original investment.

When it comes to investing, there is no one-size-fits-all number. The amount you invest depends on a variety of factors, including your income, age, risk tolerance, and investment goals.

For short-term goals like budgeting for a vacation, it is better to keep that money in a safe and easily accessible bank savings account instead.

From bonds that guarantee steady returns to riskier investing alternatives such as stocks, here are some popular investment options to get started on your investment journey.

Note that the CPF Board does not endorse any investment providers or products.

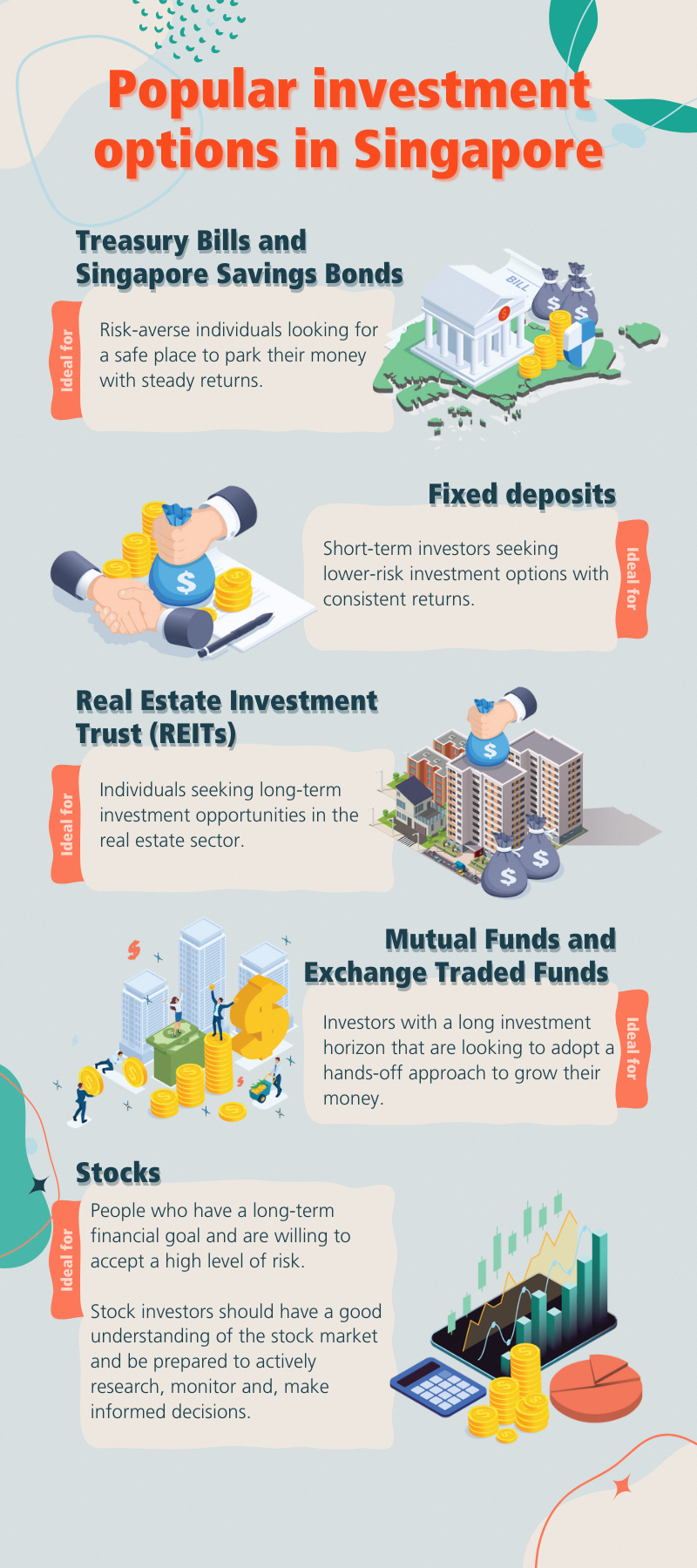

Treasury bills (T-bills) and Singapore Savings Bonds (SSBs) are lower-risk investment products that are issued by the Singapore Government.

T-bills are sold at a discount to their face value. When they reach their maturity date, which can be in either 6 months or 1 year, you can sell them back for their full-face value.

Compared to T-bills that only have a 6-month or 1-year investment horizon, SSBs allow you to hold your investment for up to ten years and let you redeem the principal amount and any accrued interest every month with no penalty.

T-bills and SSBs T-bills are guaranteed by the Singapore Government and carry a AAA credit rating (the highest level possible). This makes them one of the safest investment options available.

Ideal for: Risk-averse individuals looking for a safe place to park their money and generate steady returns.

Fixed deposits, also known as term deposits or time deposits, are a type of deposit where a specific amount of money is placed with a bank or financial institution for a predetermined period.

The bank or financial institution guarantees a fixed interest rate on the deposit for a specified duration. At the end of the term, you receive both the original deposit amount and the interest earned. There are conditions to meet (or even penalties to pay) if you withdraw your deposits before they are due, so make sure to cater sufficient funds for your other daily expenses.

Fixed deposits are seen as lower-risk investments as they are guaranteed by banks or financial institutions. There is a possibility that you may not receive your deposit amount if these institutions become bankrupt, but note that all bank deposits in Singapore are insured up to $75,000 by the Singapore Deposit Insurance Corporation Limited (SDIC).

Ideal for: Short-term investors seeking lower-risk investment options with steady returns.

Real Estate Investment Trust (REITs) allow you to invest in real estate assets such as office buildings and shopping malls without physically owning them.

REITs work by pooling funds from investors to acquire properties. These assets are leased out to generate steady rental income. As an investor in REITs, you receive a portion of this income in the form of dividends which are usually distributed on a quarterly or semi-annual basis.

REITs are typically held for a longer period as it has the potential to generate constant dividends. However, note that the dividends are not guaranteed and may not be distributed in during an economic downturn.

REIT investors can also potentially earn returns through capital appreciation. This occurs when the value of the properties held by the REIT increases over time, allowing investors to sell their shares at a higher price.

Lastly, it's important to understand that REITs focus solely on real estate. As a result, the level of diversification within a REIT is limited.

Ideal for: Individuals seeking long-term investment opportunities in the real estate sector.

Mutual funds and Exchange-Traded Funds (ETFs) are professionally managed investment products that provide diversification with a mix of assets.

Mutual funds and ETFs can offer higher returns compared to fixed deposits or bonds, but they also carry greater risks. As these products are analysed and managed by a fund manager, they also come with management fees that can reduce your overall returns.

When it comes to investments with higher risk levels, there is a genuine possibility of experiencing losses. Your returns are not guaranteed. Therefore, it is crucial to thoroughly understand the product and its associated risks before committing your hard-earned money.

One important aspect to understand about mutual funds and ETFs is that you may not have direct control over how your money is invested. There might be instances where your money is allocated to certain types of investments that may not align with your interests or preferences. This makes it important to conduct thorough research on the investment product before making any commitments.

Ideal for: Investors with a long investment horizon that are looking to grow their money at a higher rate as compared to fixed deposits and bonds.

Mutual funds are also useful for those who want to adopt a hands-off approach to investing by enlisting the help of a professional firm to directly manage their investments.

Investment Linked Insurance Policies (ILPs) combine both insurance and investments. Think of it as a "two-in-one" product that mixes life insurance coverage with the opportunity to invest in a diverse selection of professionally managed investment-linked funds.

Here are some important pointers to determine if ILPs are suitable for you:

Additional cost

ILPs allocate a portion of your insurance premium to an investment fund. Such funds are managed by third-party money managers, which may entail higher fees. Additionally, ILPs also incur additional policy and administrative fees - resulting in higher costs as compared to directly purchasing the investment fund alone.

Increasing insurance coverage costs

The other portion of your premium in an ILP is used to provide insurance coverage. The coverage varies according to the premium amount and can range from life insurance to critical illnesses.

A crucial point to note is that the cost of insurance coverage increases as you age. This is due to a higher risk of falling ill as you get older. For you to keep up with the same level of coverage without increasing your premium, your investments might have to be sold. This can reduce the amount of money you receive when your policy matures.

Ideal for: Individuals who value convenience and consolidation by combining insurance coverage and investment growth in a single product.

A publicly listed company is divided into many equal parts known as shares. When you buy stocks, you are investing in shares of a company with the hope that it will perform well and experience growth. For instance, if you bought a share that is worth $10, it could be worth $20 or even more in the future. Some listed companies also pay dividends when they make profits.

Keep in mind that the value of shares fluctuates daily due to a variety of factors. This means that you are not guaranteed of your original investment amount and can even lose all of them if the company folds.

A useful tip is to only buy stocks that you believe in. Do your research by reading the company’s annual reports to understand the company’s financials and plans. It’s also a good idea to stay updated on market trends.

Just as it is important to diversify your portfolio with a range of assets, it is equally advisable to diversify your information sources by gathering insights from various outlets instead of relying solely on one.

Ideal for: People who have a long-term financial goal and are willing to accept a high level of risk. Stock investors should have a good understanding of the stock market and be prepared to actively research, monitor, and make informed decisions.

Regardless of your risk appetite, it is always prudent to anchor your portfolio with a secure component.

Whether you are looking at savings, insurance or even investing, CPF plays an important part of your personal financial planning thanks to its ability to grow your CPF savings consistently from the day you started work. It is essentially the foundation for your retirement.

Beyond helping you save for your basic housing, healthcare, and retirement needs, you can also do more with your CPF by making a cash top-up to your CPF savings or investing it.

The CPF Investment Scheme (CPFIS) lets you invest your Ordinary Account (OA) and Special Account (SA) savings to increase your retirement savings. However, not all your savings from your Ordinary Account (OA) and Savings Account (SA) can be used for investments. This is because the money in your CPF accounts is primarily meant for your retirement needs.

When investing with your CPF savings, it’s important to understand that the interest earned from your OA or SA savings will be affected when you make an investment using your CPF monies.

As such, you will need to make sure that you select investment options with a high enough return (which might come with greater risks) to compensate for the difference in interest earned by your OA or SA savings.

Be sure to also consider how much risk you can afford to take before making the decision to invest with your CPF, and to also keep a look out on any additional transaction fees. If you intend to use your OA savings for your housing needs, make sure to plan ahead to ensure you have sufficient savings.

Visit the CPF Investment Scheme page to learn more about the products available for investing!

Investing allows you to grow your wealth with potentially higher returns and there are plenty of ways to invest according to your risk appetite and preferences. Like everything in life, the key is to adopt a balanced approach.

Having a firm understanding of your net worth such as your assets and liabilities is a great way to get started on investing for your goals. Try the MoneySense Net Worth Calculator to help you take stock of your financial situation. Happy investing!

This article on investing is part of our three-part series on basic financial literacy. Check out our other guides on savings and insurance.

Information in this article is accurate as at the date of publication.