23 Jan 2026

SOURCE: CPF Board

Your CPF savings can support you in various areas, from your home purchase, to healthcare expenditure, to retirement planning. The monthly payouts from your CPF savings can help to fund your desired retirement lifestyle. Thus, it’s important to give your CPF savings a boost whenever you can. That’s where topping up comes in.

Your CPF savings grow via compound interest, which means any interest accrued on your CPF savings will also gain interest over time. Because of this, the more time your savings have to grow, the more savings you will gain. Any top-ups made to your CPF savings will also accumulate interest, which will be credited to your CPF accounts the year following your top-ups.

Topping up your CPF savings can help you achieve higher payouts in retirement. Does topping up early have an impact though?

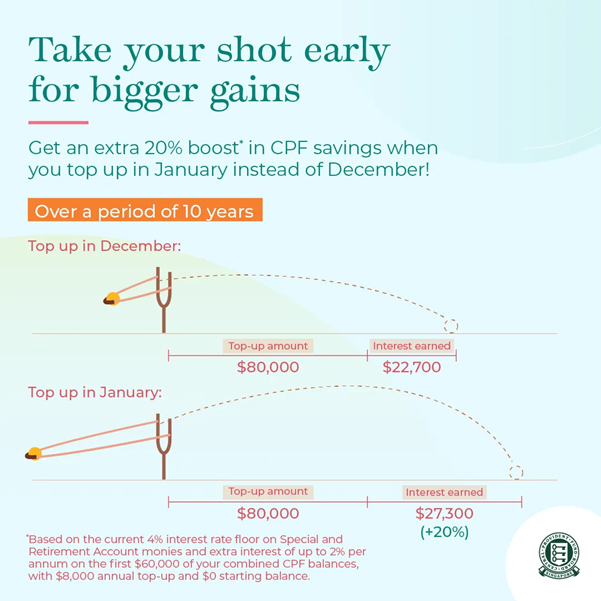

As illustrated above, topping up early makes a difference compared to when you do so at the end of the year. While the interest rates across the year do not change, topping up at the start of the year gives your CPF savings more time to grow, since CPF interest is computed monthly. This is true for top-ups made to your loved ones as well!

What if you are nowhere near retirement, and do not see the value of an early top-up?

As mentioned above, your CPF savings can also be used in a variety of areas, from housing to healthcare to retirement. While top-ups made to your Special Account (SA) or Retirement Account (RA) can’t be used for things like buying a house, it can be a key part of your financial planning strategy, helping you to achieve your retirement goals.

By starting the habit of topping up early, you can make the most of your SA interest rates when you have a longer runway, via the power of compound interest.

Speaking of saving, another benefit of topping up is tax relief. Cash top-ups made to your CPF savings allow you to enjoy tax relief each calendar year, up to a total of $16,000. This is broken down into:

$8,000 when you or your employer tops up your own SA or RA

$8,000 when you top up your loved ones' SA/RA

Tax relief will not be granted for top-ups beyond the current year’s Full Retirement Sum (FRS), and the same applies when making top-ups to others. In addition, the tax relief cap on cash top-ups to your own SA/RA is shared with cash top-ups to your MediSave Account (MA) as well as the overall tax relief income cap of $80,000 a year. Cash top-ups are also irreversible, so it’s advisable to do so only after you are sure you have considered your current financial situation and have the leeway to do so.

A new year is the perfect time for some changes. Starting the year strong with some top-ups not only gives your savings a boost, with ample time to grow even more, but also helps check one item off your to-do list for the year. Now that you know the benefits of topping up, you can approach the year ahead with confidence knowing that you’re getting a head start on growing your retirement savings.

The information provided in this article is accurate as of the date of publication.

.jpg)