11 Sep 2023

SOURCE: CPF Board

So you just ended your 9 to 5 and made a detour to run errands for your parents, before finally dashing to the childcare centre to pick up the little ones. Rinse and repeat 24/7. 365 days of the year. Ad infinitum.

Sounds familiar? Then you may belong to the sandwich generation, where juggling the dual responsibilities of taking care of your young children and ageing parents is the norm. While family is important, be sure not to neglect your own financial goals and well-being.

When it comes to financial goals, every little step matters. Here are some tips on how you can achieve your goals one small win at a time.

Ever spent hours scrolling online and shortlisting ideas for your dream home? While the thought of owning your own house can be exhilarating, you may find yourself being stretched unless you plan your finances carefully. Here are some tips on how to not compromise on your future savings, while building your happy home.

A good rule of thumb is to keep your Mortgage Servicing Ratio (MSR) within 25% of your gross monthly income to give you some breathing room for other financial commitments. That way, you have more savings to spend on the things you love in life, such as your family, hobbies, or even that holiday you have been dreaming of.

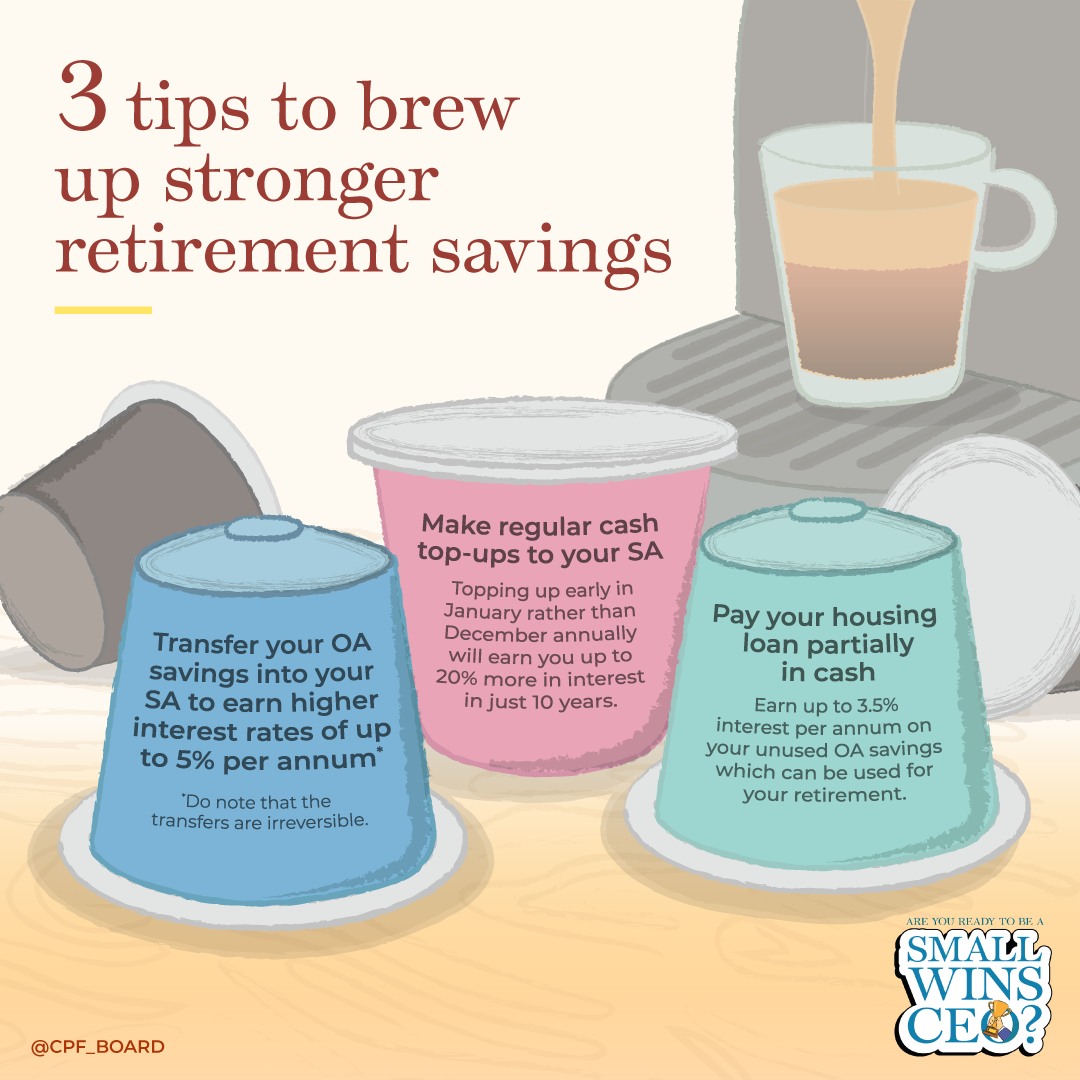

Consider setting aside $20,000 in your OA as a safety net to pay off your housing loan during unforeseen circumstances such as a temporary loss of income. In addition, your OA savings earn up to 3.5% interest per annum. This allows you to grow your OA savings for future housing and retirement needs.

For your monthly housing loan, you can consider using a mix of cash and CPF, so that you can continue earning interest on your CPF savings while relieving any strain on your cash flow.

While giving your dream home a facelift may seem tempting, the price tag of renovation can be rather intimidating. To save money, consider other options such as refurbishing your old furniture, or hunting for cheaper alternatives online and even at a warehouse sale.

Whatever your dream retirement may be, here are a few tips to get you one step closer to your retirement goal.

It goes without saying that to reach your desired goal, having a roadmap is essential. Having a monthly budget is a good starting point, where you get to portion out your income and accumulate some savings early on.

To take the guesswork out of your retirement planning, use the Retirement Payout Planner to see how near (or far) you are from your retirement goal and what you can do to reach it faster.

If you have budgeted enough of your OA savings for housing, consider transferring the excess monies into your Special Account (SA) to earn a higher interest rate of up to 5% per annum for your retirement fund.

You can also make regular cash top-ups to your CPF. This will allow you to enjoy higher monthly payouts when you retire, as well as tax relief of up to $8,000 per year for cash top-ups made to your SA.

Every little bit counts when it comes to building your retirement nest egg, so start taking charge today!

Watching your parents enjoy their retirement after years of hard work is a gratifying feeling, and ensuring that their retirement needs are well taken care of also relieves the financial pressure on you.

If your parents don’t require financial support from you currently, consider topping up their Retirement Account (RA) instead of giving them a monthly allowance. The monies can grow at returns of up to 6% per annum in their RA and will increase their CPF LIFE monthly payouts. CPF LIFE addresses the uncertainty of them outliving their savings by providing them with monthly payouts no matter how long they live.

Another way to help your parents boost their retirement income is to consider monetising their flat through options such as the Silver Housing Bonus and Lease Buyback Scheme.

Being smart with your dollar goes a long way, especially when multiple things require your financial attention. Here are some ways to help you manage your money better.

For big ticket items such as your child’s education, set financial goals to work towards. Estimate how much you will need and how long you have to achieve these goals. This will help to determine the amount you need to save each month.

Of course, saving up for a long-term goal like retirement is different from saving up for a short-term goal like a home renovation. Therefore, it is important to plan and prioritise the different financial goals you may have.

We all know the basic principle of separating your needs from your wants. That’s a good first step towards spending below your means. Other good habits to cultivate include switching to house brands which are cheaper and of comparable quality to branded items, comparing prices across different shops, and making use of credit card promotions or membership programmes that give special deals or loyalty discounts. The list goes on, so start experimenting with different tips and hacks to stretch your dollar.

Saving up for a rainy day is a wise move, but how much do you need exactly? The rule of thumb is to set aside at least 6 to 12 months' worth of expenses. This allows you to have peace of mind knowing that you’re financially prepared for unexpected circumstances such as retrenchments or accidents.

When the going gets tough, the tough get going. Living day-to-day with multiple responsibilities to handle can be overwhelming at first. But if you slow down and appreciate all the smaller wins that you can and have achieved, then you’re one “promotion” closer to being your own Small Wins CEO.

The information provided in this article is accurate as of the date of publication.