16 Jan 2026

SOURCE: CPF Board

Buying a home is often your biggest expense, but it doesn’t have to drain all your savings. Understanding your options can help you balance housing costs today while still preparing for what’s ahead. Here’s how.

When it comes to using your CPF Ordinary Account (OA) for housing, you may have heard differing opinions. While it's true that using your OA savings for your home helps to reduce your immediate cash outlay, it also means you're reducing your ability to grow those savings for retirement. Therefore, it's important to consider the bigger picture.

A combination of cash and OA savings for your home purchase allows you to:

- Preserve your CPF savings for long-term goals such as retirement.

- Still meet your immediate housing needs, while giving you the flexibility to finance your home without affecting your future retirement payouts.

The recommendation is to keep at least $20,000 in your CPF OA. This buffer ensures that you have enough to cover personal decisions such as taking a career break or facing unforeseen circumstances (like job loss or health concerns). This means that your home payments won’t be disrupted, giving you more financial flexibility.

The CPF OA is also meant for your retirement needs. It offers a risk-free interest rate of 2.5% per annum1. Compared to other investment options, such as fixed deposits (which as of December 2025, ranged from 0.8% to 1.6% per annum) or the 6-month T-bill yield (1.41% as of 4 December 2025), or the 1-year T-bill (1.35% as of the last Auction on 15 October 2025), the OA provides a reliable and steady way to grow your CPF savings.

Source: https://www.mas.gov.sg/bonds-and-bills/treasury-bills-statistics

1Members will earn an extra interest of 1% per annum on the first $60,000 of combined CPF balances (capped at $20,000 for OA). Extra interest earned from OA balances will go into your SA.

Therefore, if you leave $20,000 in your OA instead of using it to pay for your home, in 20 years, it will grow to around $39,700 – almost doubling your savings!

Use the CPF housing usage calculator to calculate the exact amount of OA you can use.

To take a step further, if you have plans to sell this home in the long term, take note that when you use CPF for your home, the amount withdrawn plus the accrued interest must be restored to your CPF when you sell the property. If not planned properly, you might risk a "negative cash sale" scenario, where proceeds fall short of the outstanding loan and CPF refund, causing issues if you’re planning to upgrade or need cash for other purposes.

Beyond that, CPF housing grants — such as the Enhanced CPF Housing Grant and the Proximity Housing Grant (PHG) — can help finance your home. These grants not only ease your upfront costs, but the PHG can also support families who choose to live closer together.

- The Enhanced CPF Housing Grant (EHG) is available to first-time applicants who are either applying for a new Build-To-Order (BTO) flat or buying a resale flat on the open market.

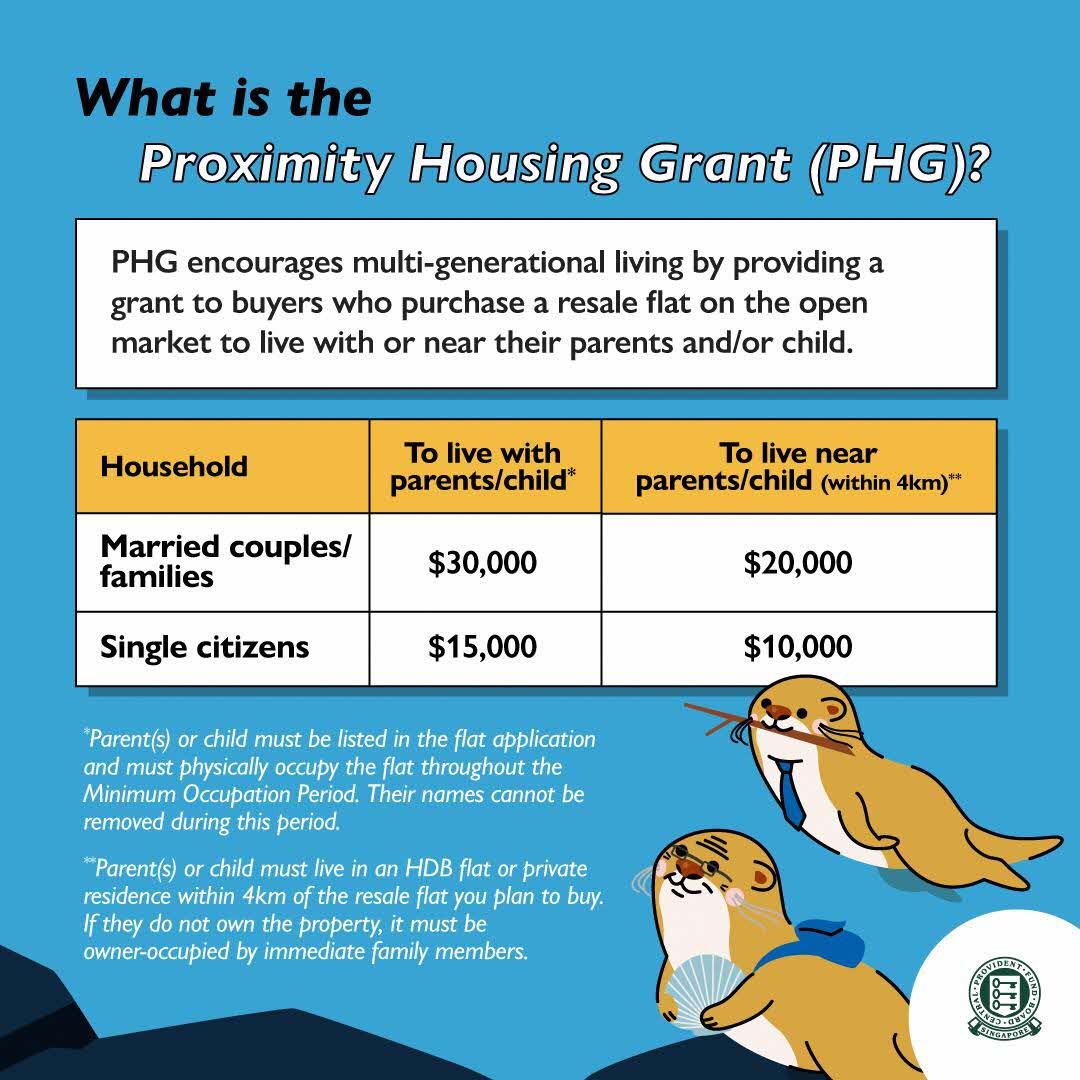

- The Proximity Housing Grant (PHG) supports buyers purchasing a resale flat on the open market to live with or near their parents and/or married children.

Staying close to and caring for your parents isn’t only about fulfilling your filial responsibilities. It can also benefit you in practical ways.

Here’s how these options can support your housing plans.

Even if you choose to maximise your use of OA savings for housing, there are other options to help you grow your CPF savings in tandem, such as making top-ups to your Special Account (SA), making a voluntary housing refund, or investing through the CPF Investment Scheme if you are prepared to take some risk.

If you’re willing to take on higher risk for higher expected returns on your CPF savings, you can tap on the CPF Investment Scheme (CPFIS) to invest part of your CPF savings in a variety of investment products with different risk and return profiles. These include Singapore Government Securities (SGS) Bonds, as well as options such as T-bills and fixed deposits.

As a general guide, you should consider investing your CPF savings only if you:

- Can accept the risks that come with investments

- Can afford to set aside the amount you plan to invest

- Monitor your investments consistently

- Feel confident of earning more than the CPF interest rate

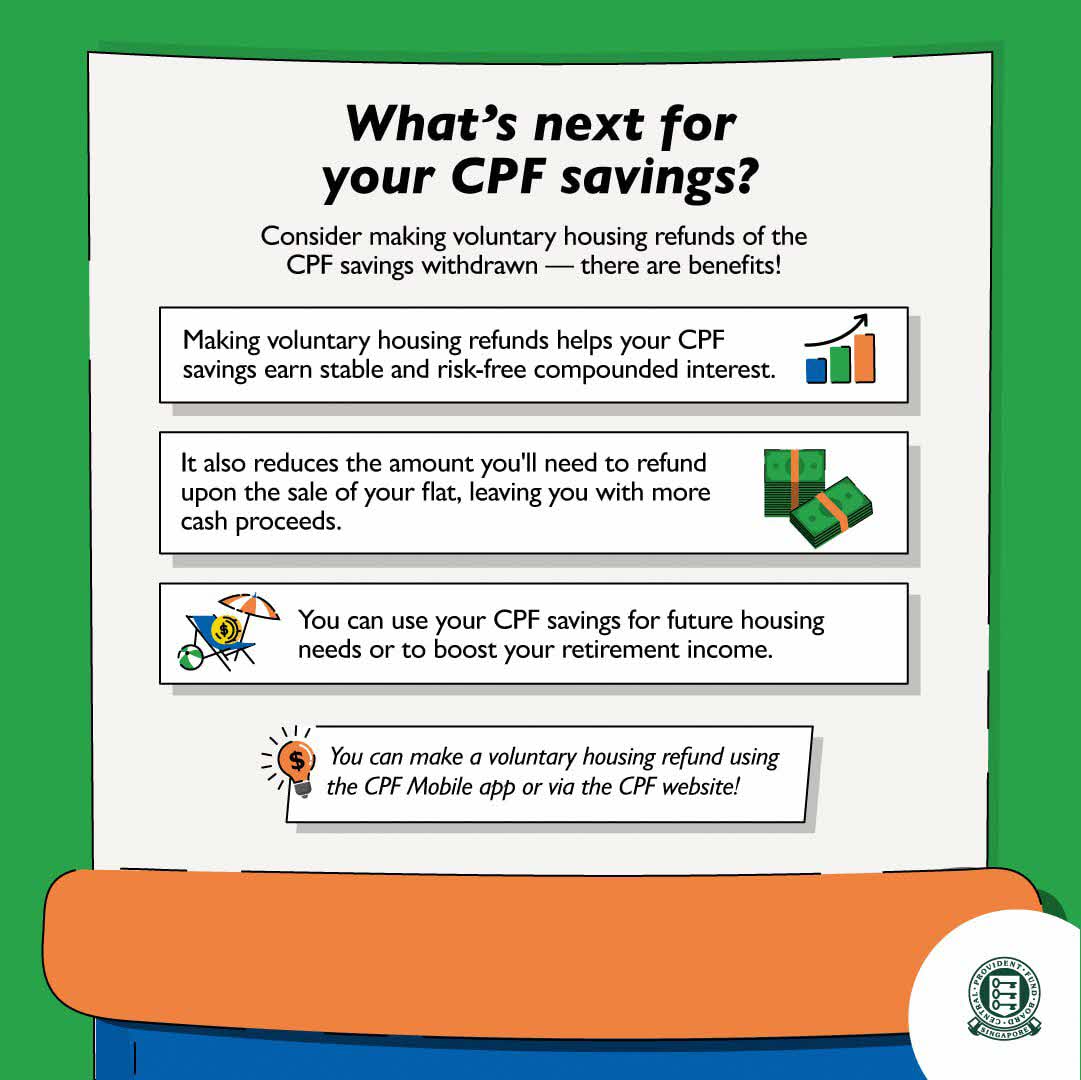

Once you’ve purchased your home (congratulations!), you can also consider making voluntary housing refunds to your CPF accounts over time to grow your retirement savings and strengthen your financial future.

Information in this article is accurate as at the date of publication.

.jpg)