9 May 2025

SOURCE: CPF Board

Whether you're in your prime working years or approaching retirement, housing grants can support your home purchase. Here’s how the Enhanced CPF Housing Grant (EHG) and Proximity Housing Grant (PHG) can help couples, families, singles, and seniors.

The Enhanced CPF Housing Grant (EHG) supports first-time Singapore Citizen (SC) and Singapore Permanent Resident (SPR) flat buyers applying for a new BTO or purchasing a resale flat, making homes more affordable for Singaporeans.

Eligible for up to $120,000 in EHG, depending on household income

Monthly household income ceiling: $9,000*

Can be used for both new and resale flats

The buyer or his/her spouse must be employed continuously for 12 months before flat application and remain employed at point of flat application

* Applicable to families with at least two first-timer applicants. If applying as a first-timer with a second-timer, the income ceiling is halved — the average gross monthly household income (including all applicants and occupiers) over the past 12 months must not exceed $4,500.

Find out more about the Enhanced CPF Housing Grant (Families).

If you are a first-timer applicant buying a flat on your own, you may be eligible for an Enhanced CPF Housing Grant (EHG) (Singles) to help with your new or resale flat purchase.

Eligible for up to $60,000 in EHG, depending on household income. If you are applying with other first-timer single(s), up to 2 of you may be eligible for up to $120,000.

Monthly income ceiling: $4,500, or $9,000 if buying with other singles or purchasing a resale flat with your parents.

Must be employed continuously for 12 months before flat application

If you are 55 years old and above, you can still qualify for the EHG as long as you meet the income and employment requirements.

However, the flat you purchase must have a remaining lease that covers the youngest buyer up to age 95. Otherwise, you will receive a pro-rated EHG amount.

The Proximity Housing Grant (PHG) is a CPF housing grant designed to encourage families to live closer together and supports multi-generational living.

Whether you are a single child looking to live closer to your parents, a married couple hoping your children can bond with their grandparents, or a senior planning to right-size and enjoy your golden years near family — the PHG supports your goal of staying connected and strengthening your family support network.

Here's how different groups can benefit:

Household

|

To live with parents/ child1

|

To live near parents/ child (within 4km) 2

|

Married couples/ families

|

$30,000

|

$20,000

|

Single citizens

|

$15,000

|

$10,000

|

1 Your parent(s) or child will live with you in the resale flat you are purchasing. They must be listed in the flat application and must physically occupy the flat throughout the Minimum Occupation Period (MOP). Their names cannot be removed during this period.

2 Your parent(s) or child live in an HDB flat or private residential property within 4km of the resale flat you plan to buy. If they do not own the property, it must be owner-occupied by immediate family members — such as a child or adopted child, parent(s) or in-laws, and/or siblings. Do note that your parent(s) or child must observe the proximity rule during the MOP after purchase.

What type of flat can I buy to be eligible for the PHG?

Household

|

Flat Type

|

Married couples and/or parent(s) with child

|

Any resale flat

|

Single citizens living near parents

|

2 to 5-room resale flat

|

Singles citizens living with parents/child or applicants buying with their non-resident spouse

|

Any resale flat

|

Housing grants make homeownership more affordable for Singaporeans across different life stages. Whether you're starting a family, moving closer to your parents, or right-sizing for retirement, these grants can achieve your housing goals while strengthening family bonds.

But no matter your goal, it’s important to remember: your home purchase will impact your retirement planning. Buying a home is one of the biggest financial decisions you’ll make—so aligning your housing plans with your long-term financial goals, quality of life, and retirement security is key.

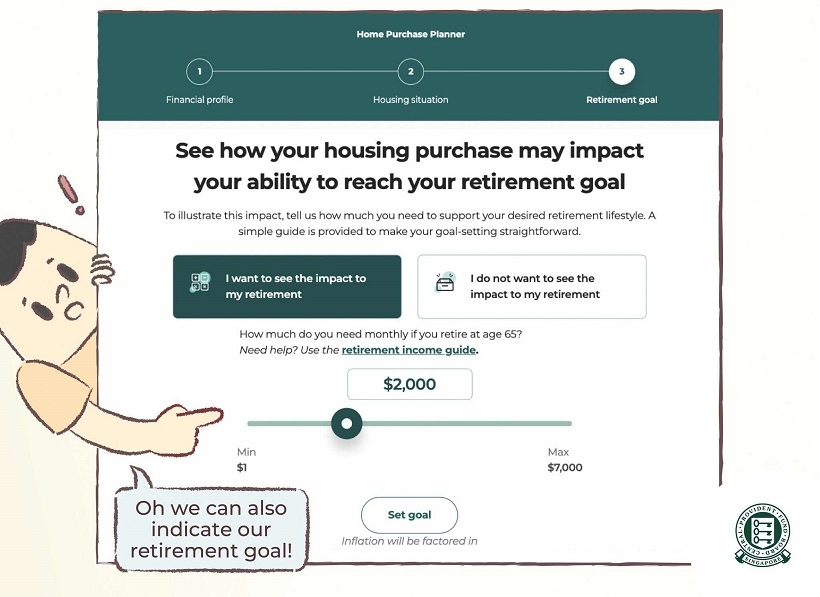

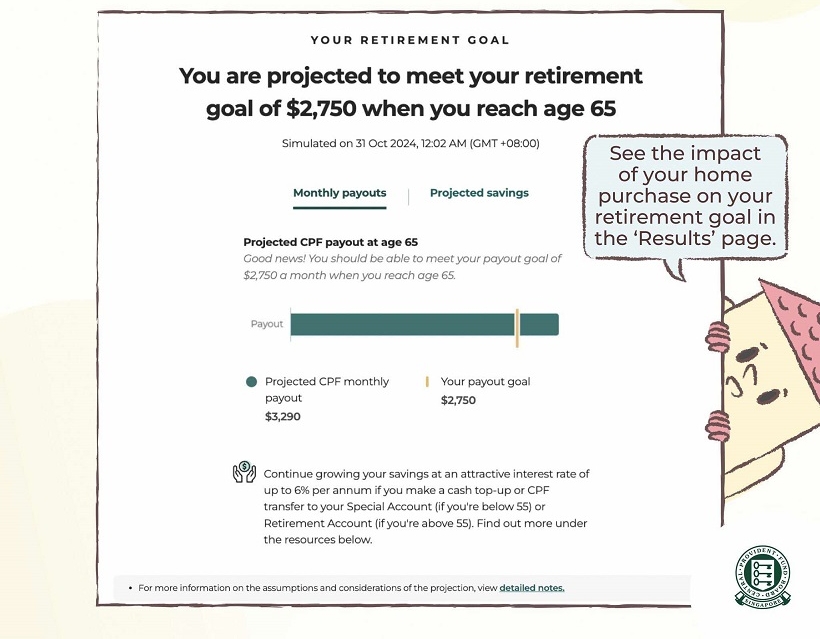

Before making this important decision, use the CPF Home Purchase Planner. It helps you plan for your home purchase with your retirement in mind by estimating your budget based on your current financial and housing situation.

Use the CPF Home Purchase Planner today!

Information in this article is accurate as at the date of publication.