10 Oct 2025

SOURCE: CPF Board

Purchasing a home is a huge financial commitment, and like all big decisions, proper planning helps.

Whether you're a first-time buyer or an experienced homeowner, understanding your financial position and determining a realistic budget can help you secure a sustainable long-term mortgage.

More than a house loan calculator, the Home Purchase Planner is a tool by the CPF Board that takes a holistic assessment of your current financial and housing situation and helps you estimate the home purchase budget that you can likely afford. Here’s what you can get out of it.

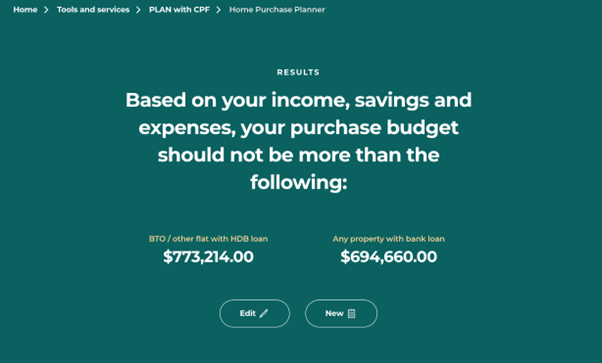

1. It gives you a personalised budget for your next home

The Home Purchase Planner helps you take the first step in creating a home budget by providing an useful overview of your finances, taking into account your income, expenses, and savings (cash and CPF savings) to customise a budget for your exact needs.

If you have an existing home to sell, the Home Purchase Planner can also factor the sales proceeds into the budget for your next home.

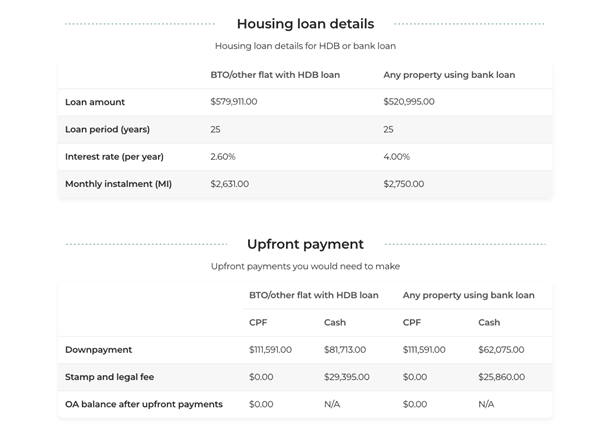

2. It provides key financial details, such as the housing loan and upfront payments you have to make

Besides providing a comprehensive housing budget, the Home Purchase Planner lets you view the estimated monthly instalment and loan period based on your loan amount, and calculates upfront payments such as downpayment, stamp duty and legal fees.

It also shows a preview of your Ordinary Account (OA) balance after all upfront payments are made.

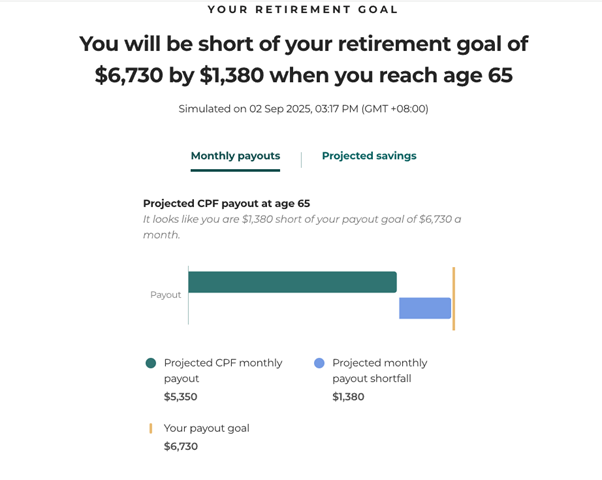

3. It visualises how a home purchase can impact your retirement

Retirement might seem a long way off if you’re a first-time homeowner, but a prudent home purchase goes a long way in ensuring that you have enough when you finally decide to retire.

The Home Purchase Planner helps you do just that by quantifying the impact of the home purchase budget on your retirement. Simply indicate your desired amount of retirement payouts, and the planner will determine if your projected retirement savings will be able to meet your retirement goal.

Start planning for your home purchase with the Home Purchase Planner

Completing the Home Purchase Planner takes no more than 10 minutes and can be finished in one sitting. It is recommended that you log in to your CPF account to obtain a more accurate estimate of your home purchase budget and to view the impact on your retirement savings.

If you’ve enjoyed reading this article, be sure to check out these handy resources for housing planning and also on how much CPF savings you can use for a home purchase!

The information provided in this article is accurate as of the date of publication.