7 Sep 2022

SOURCE: CPF Board

Wondering how you can maximise the benefits of CPF to buff up your financial plan? Then you’ve come to the right place, because in this article, we’ll be sharing some advanced financial tips.

Get FinFit with Me is a series that incorporates physical workouts with financial tips to guide you in taking small, actionable steps to level up your financial (and physical) fitness. For more tips on pushing your savings further, check out our FinFit video playlist.

Get your safety cushion ready before investing

Investing may be one way to grow your monies, but it's important to know that all investments are subject to risk and there’s a possibility of losing part or even all the monies you’ve put in. Before you start, make sure you have a safety net in place and you’ve set aside an emergency fund of at least six months’ worth of expenses.

When investing, a general rule of thumb is to diversify your investments, instead of putting all your eggs in one basket. Diversification can help you weather the ups and downs of the market. If one investment loses money, the other investments may provide some gains.

You should also find out your risk tolerance level before you start investing. Basically, think about the amount of risk you are comfortable to take and how much money you can afford to lose. It’s important to also keep in mind that higher returns come with greater risks.

Next, you should consider how long your investment horizon is, or the amount of time available between when you invest and when you need to cash out. Generally, the longer your investment horizon, the higher the risk you are able to take since you can ride out the volatility in the market. If you find yourself to be risk-averse, there’re plenty of safer options to grow your money as well.

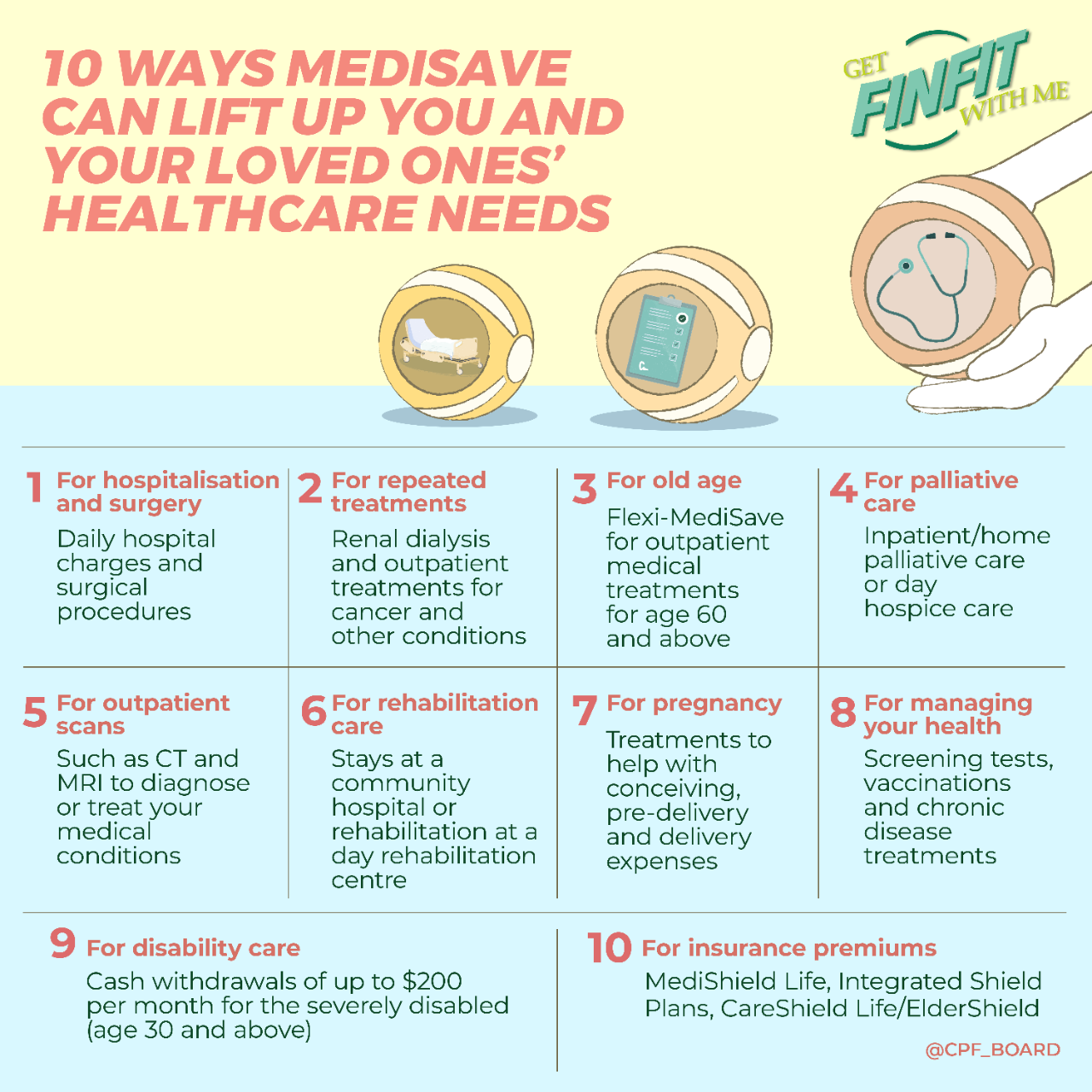

Give your healthcare savings a push with your MediSave

Did you know that aside from topping up your Special Account (SA), you can do so for your MediSave as well? Similar to topping up your SA, you’ll also get to enjoy tax relief of up to $8,000 when you make a cash top-up to your MediSave, which provides up to 5%* interest per annum. You may top up your MediSave, up to the Basic Healthcare Sum.

If you’re self-employed, do remember to make mandatory contributions to your MediSave. You can also contribute to all three CPF accounts to build a safety net for your housing, healthcare and retirement needs. In addition, you get to enjoy tax relief on your mandatory and voluntary contributions, based on your annual Net Trade Income (NTI) — either 37% of assessable income or the CPF Annual Limit of $37,740, whichever is lower. However, there is no tax relief for your mandatory or voluntary CPF contributions if your assessed NTI for the year is zero or negative.

Lift your retirement savings with Voluntary Housing Refunds

If you’ve already reached your top-up limits in your SA and MA, and still wish to put more into your CPF, you can consider making a voluntary housing refund of the amount of CPF savings you have used for your property.

You can do so if you’ve used your Ordinary Account (OA) savings for your property. Check out the amount that you can refund through your Home Ownership dashboard after logging in to your CPF dashboard.

By making a refund as early as possible, you can take advantage of the interest rates of up to 3.5%* p.a. in your OA, which can boost your savings for your next home purchase or for your retirement. It also means you’ll get more cash proceeds as you need to refund less to your CPF should you decide to sell your property in future.

Ultimately, much like exercising or going to the gym, consistency is key and as long as you keep practising good financial fitness, you’ll be able to grow your savings faster for the future.

Watch our accompanying Get FinFit with Me (Advanced) video for a high intensity rundown on buffing up your financial plan.

Make sure to check out our other FinFit articles to build a solid financial foundation!

[Beginner] Get FinFit with Me: Time to kick-start your financial fitness journey

[Intermediate] Get FinFit with Me: Taking your financial fitness up a notch

*Includes extra interest. Terms and conditions apply.

Information in this article is accurate as of date of publication.