3 Aug 2022

SOURCE: CPF Board

You've recently graduated into the working world and begun earning your own keep. While you're thrilled with this newfound freedom, you soon realise that it also comes with new responsibilities like paying bills, repaying your study loan, saving for big ticket items and making your own financial decisions…

Before you get overwhelmed, remember that everything starts small. Exercising good, everyday habits is key to becoming financially fit. Here are some simple moves you can make to jump-start your financial journey!

Get FinFit with Me is a series that incorporates physical workouts with financial tips to guide you in taking small, actionable steps to level up your financial (and physical) fitness. For more tips on pushing your savings further, check out our FinFit video playlist.

Punch away bad financial habits

Being able to decide on the use of your money comes with the responsibility to spend wisely. Don't overlook small (and bad) habits such as impulsive shopping or paying your credit card bill late — these little costs can easily snowball and eat into your savings for the future.

Here are some tips to punch out unnecessary spends:

1) If you’re going overboard with online shopping, try unsubscribing from the mailing lists of these stores, and if you need an additional helping hand, use extensions on your browser to block their websites.

2) Before spending on a 'want', allow yourself to wait three days to decide if you really need it. This helps you to avoid impulsive buys you might regret later on!

3) If you can’t stop yourself from cabbing everywhere, delete all your ride hailing apps except one and only pay with cash. This way, you’ll remove the convenience of using these apps, and encourage yourself to not only save money, but also keep active by walking to the bus stop or train station.

4) And what better way to nourish your body after a workout than with a healthy home cooked meal? Food deliveries are easy and tempting but the cost of delivery can easily add up if you’re one to make orders twice a day. Preparing and knowing what goes into your food is not only a good habit to have, but also encourages you to be more intentional about your consumption.

Jump-start your savings with compound interest

Start saving as early as possible, as it gives you a longer runway to reach your financial goals and benefit from the power of compound interest.

Not sure what that is? Simply put, compound interest is “interest on interest”.

Consider an initial amount of $30,000 in your CPF Special Account, which earns an interest of up to 5%* per annum. With compound interest, this amount will grow to over $60,000 (without you doing anything) in twenty years! And as time goes by, your savings will snowball as the base amount becomes larger^

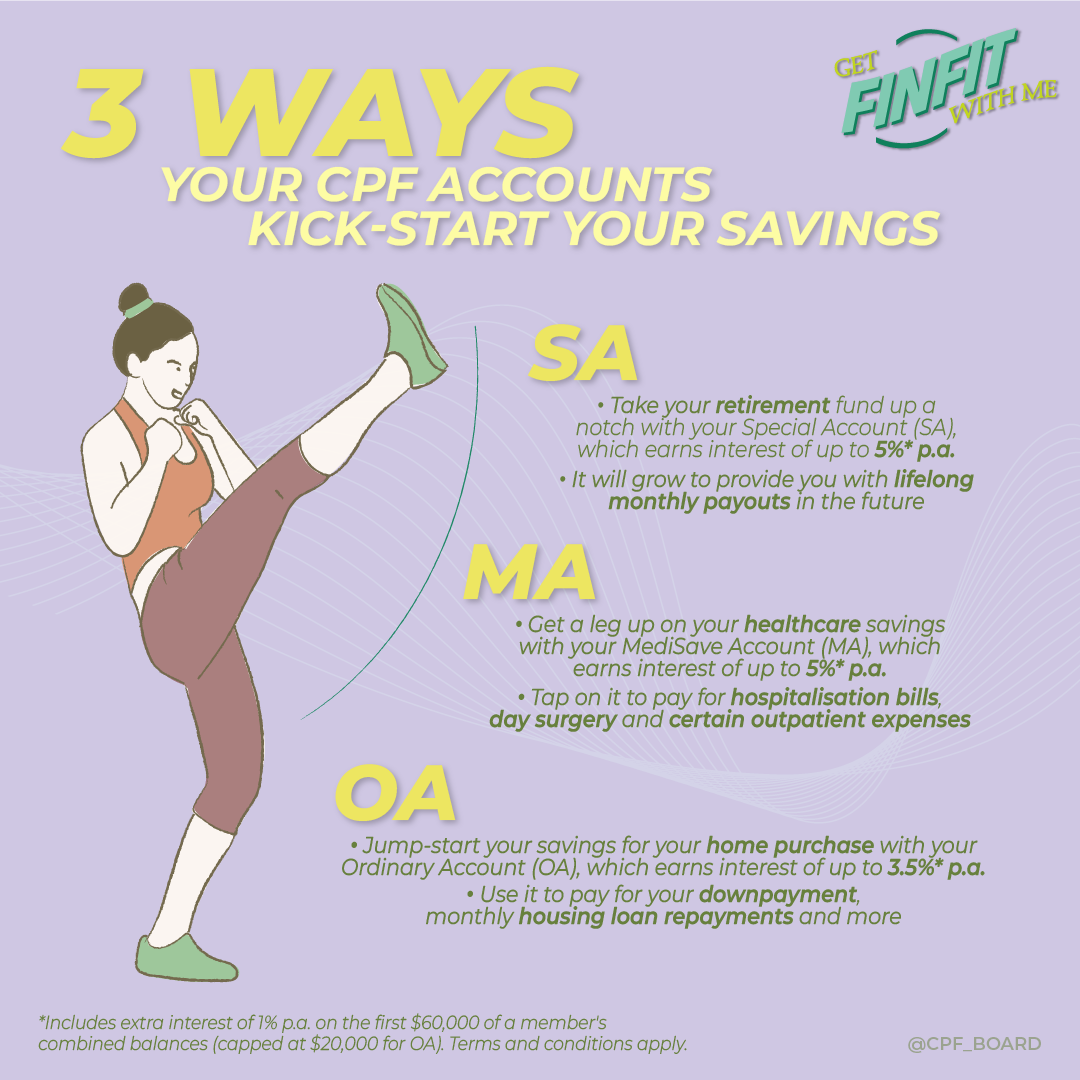

Not sure where to start? The good thing is, you’ve already started saving via your monthly CPF contributions! 20 per cent of your salary goes into your CPF account, and your employer contributes another 17 per cent! These contributions grow with attractive interest rates to help with your different needs.

*Terms and conditions apply

^Computed using a base interest rate of 4% p.a. in the SA.

Take a steady climb towards your goals

Ready to achieve your adulting goals? Ensure you stay on course by equipping yourself with a budget and a plan. Start by making a list for all your current expenses, while highlighting the necessary ones, and the big-ticket items you plan to finance in the future.

It’s integral that you list your goals as specifically as possible. That way it would be easier to navigate your high priority goals (such as buying a house) and cut down on your wants.

For long-term goals, work out how much you need to save on a regular basis. For example, if you and your partner are considering a wedding budget of $30,000 in three years' time, that works out to saving an extra $5,000 a year and $417 a month per person. Consider if that is feasible with your financial situation. If not, you should adjust your wedding budget, or cut back on other expenses.

Don’t forget to set aside some of your income to repay your study loans or other debts too. The sooner you get that out of the way, the earlier you can start saving for your wants with fewer liabilities. For most of us, study loans from banks are paid through automatic monthly GIRO deductions — figure out a comfortable amount to pay and apply for that to be deducted every month.

Remember, good financial management starts with exercising small steps. Watch our accompanying Get FinFit with Me (Beginner) video for an adrenaline-fuelled recap to kick off your financial fitness journey.

Make sure to check out our other FinFit articles to take your knowledge to the next level!

[Intermediate] Get FinFit with Me: Taking your financial fitness up a notch

[Advanced] Get FinFit with Me: Round up your financial journey with these pro tips

Information in this article is accurate as of date of publication.