22 Aug 2022

SOURCE: CPF Board

Have you started your financial journey? If you’re looking to further stretch those savings, here are some tips to help you!

Get FinFit with Me is a series that incorporates physical workouts with financial tips to guide you in taking small, actionable steps to level up your financial (and physical) fitness. For more tips on pushing your savings further, check out our FinFit video playlist.

Upping the pace of your savings with CPF top-ups

The beauty of CPF is that your savings are growing steadily at an interest rate of up to 5% per annum , without you having to do anything at all. But if you want to up your game, you can easily do so by making CPF top-ups!

These savings will allow you to enjoy higher monthly payouts when you retire. On top of that, you can also enjoy up to $8,000 in tax relief when you make cash top-ups to your Special Account (SA).

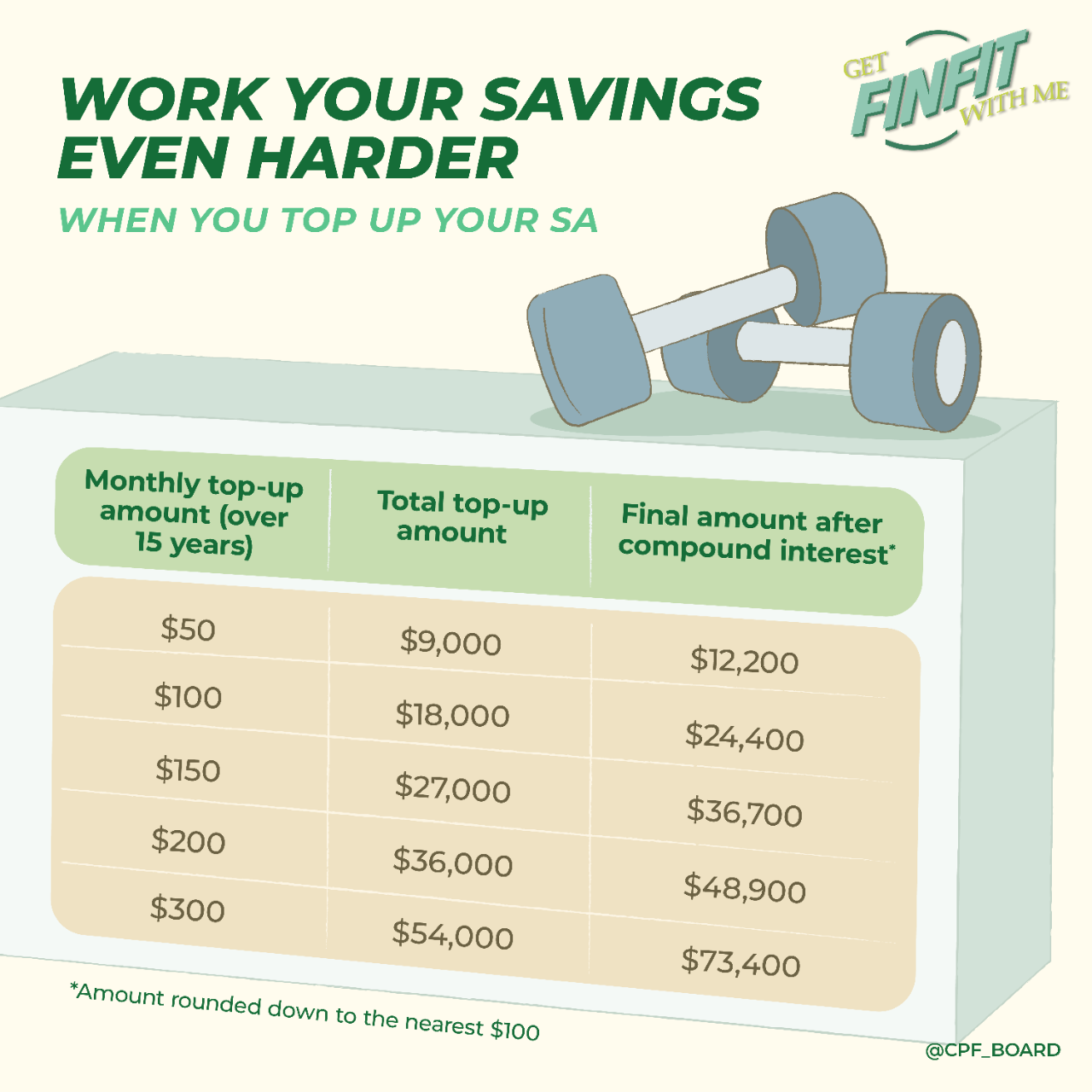

Here’s a handy table to help you visualise how much your top-ups can grow:

For example, if you save $100 a month for 15 years on your own, you can save a total of $18,000. On the other hand, if you top up $100 a month to your SA for 15 years, you can save more than $24,000*. Continue to top up for another 10 years and the amount would grow further to over $50,000*, with the help of compound interest!

Making top-ups is easy – you can make lump-sum cash top-ups to your SA through the CPF Mobile app and CPF website, or you can use GIRO to make small and regular top-ups.

Buying a home that fits you best

Buying a home is a heavy responsibility and a long-term financial commitment. Therefore, it is important that you buy one within your means.

But you might be wondering—what does it mean to “buy within your means”?

First, you should ensure that you’re not overspending by keeping your housing instalment within 30 per cent of your gross monthly income, or 25 per cent, to be more prudent.

Second, take note that your total debt repayments should not exceed 55 per cent of your gross monthly income.

Third, set aside a sum of emergency savings for your housing instalments. In the event that you are in between jobs or have to take a break from work due to unforeseen circumstances, you can tap on this fund. This should be on top of what you set aside for necessary expenses.

One easy way to do so is to keep $20,000 in your Ordinary Account (OA) instead of wiping it all out when you purchase your home. These savings will continue to grow at an interest rate of up to 3.5% per annum and can be used for emergency housing repayments, or for your retirement needs.

Remember, when it comes to buying a home, it’s important to factor what you can afford and not overexert yourself!

Transfer your savings to pump it up

Perhaps you’ve already budgeted how much OA savings you’ll need for your home and would like to pay more attention to your retirement fund. This is where you can consider transferring your OA monies into your SA, which can earn interest rate of up to 5% per annum.

Here’s a quick snapshot of how much additional interest you’ll earn if you transfer your OA savings to SA:

^Projected based on the assumption you have $20,000 in your OA and $30,000 in your SA.

Amount rounded down to the nearest $100.

Watch our accompanying Get FinFit With Me (Intermediate) video for an action-packed summary on staying financially fit!

Make sure to check out our other FinFit articles to take your knowledge to the next level!

[Beginner] Get FinFit with Me: Time to kick-start your financial fitness journey

[Advanced] Get FinFit with Me: Round up your financial journey with these pro tips

*Computed using the base interest of 4% per annum on your Special Account. Terms and conditions apply.

Information in this article is accurate as of date of publication.