17 June 2022

SOURCE: CPF Board

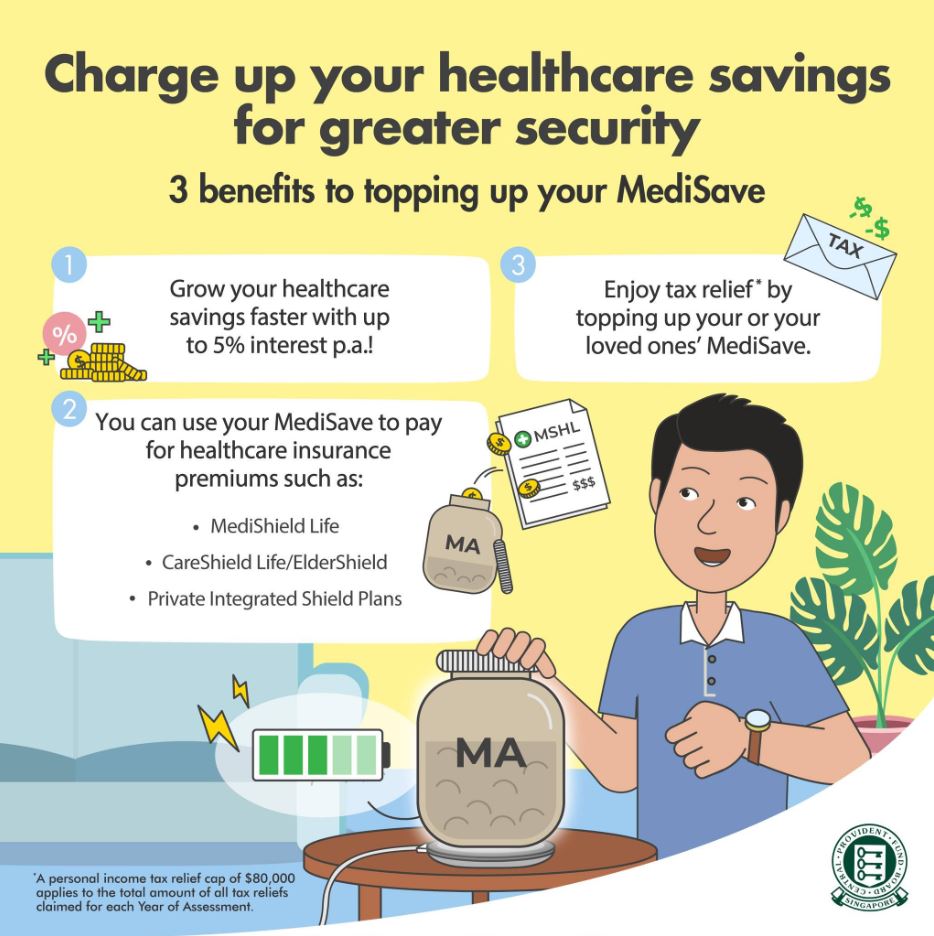

Your healthcare savings are an investment for your well-being and for when unexpected rainy days happen. While there’s no way to predict such days, the uncertainty during those moments can be reduced if you’re well prepared for what happens. Making a top-up to your MediSave Account (MA) can help do just that!

First off, what is MediSave? MediSave is a national medical savings scheme that helps individuals save for future medical expenses. If you are an employee, part of your monthly salary is automatically deducted for the purpose of building up your MA, and your employer will also contribute to your MA every month.

If you’re already growing it automatically, then you might be wondering, what are the benefits of topping up your MA? Let us tell you!

1) Attractive interest rate

Your MA savings will grow with a compound interest rate of up to 5% per annum, which helps act as your safety net. Regular top-ups to your MA allow your savings to grow at a faster rate, thereby ensuring you’re covered when the rainy day does come.

2) Paying for healthcare insurance premiums

You might be familiar with MediShield Life, CareShield Life, Integrated Shield Plan (IP), and so on. These are all healthcare insurance plans to cover you in cases of hospitalisation, certain medical treatments and so on. The premiums for these insurance plans are paid from your MA, which leaves your regular savings untouched. Topping up your MA will allow you to pay these premiums without depleting your MA , allowing the aforementioned attractive interest rates to grow your MA.

To find out more about these plans and MediSave, check out our handy article to help you level up your healthcare knowledge.

3) Tax relief

Topping up your MA also offers you annual tax relief. The cap for tax relief was previously $7,000, but this has been increased to $8,000 from 1 January 2022, for when you top up to your own Special/Retirement Account and/or MA. You also get an additional up to $8,000 of tax relief when you top up your loved ones’ accounts as well.

When it comes to healthcare, you can never be too careful with planning. By topping up today, you can accelerate the growth of your healthcare savings, so you’re never caught off-guard by the rainy days!

Information accurate as of the date of publication.