This year, the Central Provident Fund (CPF) Board commemorates its 70th anniversary since its establishment on 1 July 1955. On this milestone, the CPF Board has enhanced its digital offerings with ‘PLAN (Plan Life Ahead, Now!) with CPF’, a one-stop financial guidance platform that brings together relevant planners and resources to help CPF members make informed financial decisions about their CPF savings. A commemorative book chronicling the history and evolution of CPF was also launched by Senior Minister Mr Lee Hsien Loong, who attended CPF Board’s 70th anniversary and outreach event at Our Tampines Hub on 5 July 2025.

Empowering members to ‘PLAN with CPF’ through life’s moments

As an organisation that touches the lives of Singaporeans across life stages, CPF Board developed ‘PLAN with CPF’ to reflect its commitment to journey with CPF members through life’s moments, by making financial planning more accessible. ‘PLAN with CPF’ empowers CPF members to take charge of their financial health across different milestones – from young adults starting their careers and building savings, to planning for their first home and starting a family, to reviewing their healthcare insurance needs, or preparing for retirement. This platform supports CPF members in their overall financial planning journey by helping them to make informed decisions about how to grow, optimise and use their CPF savings to meet their financial goals.

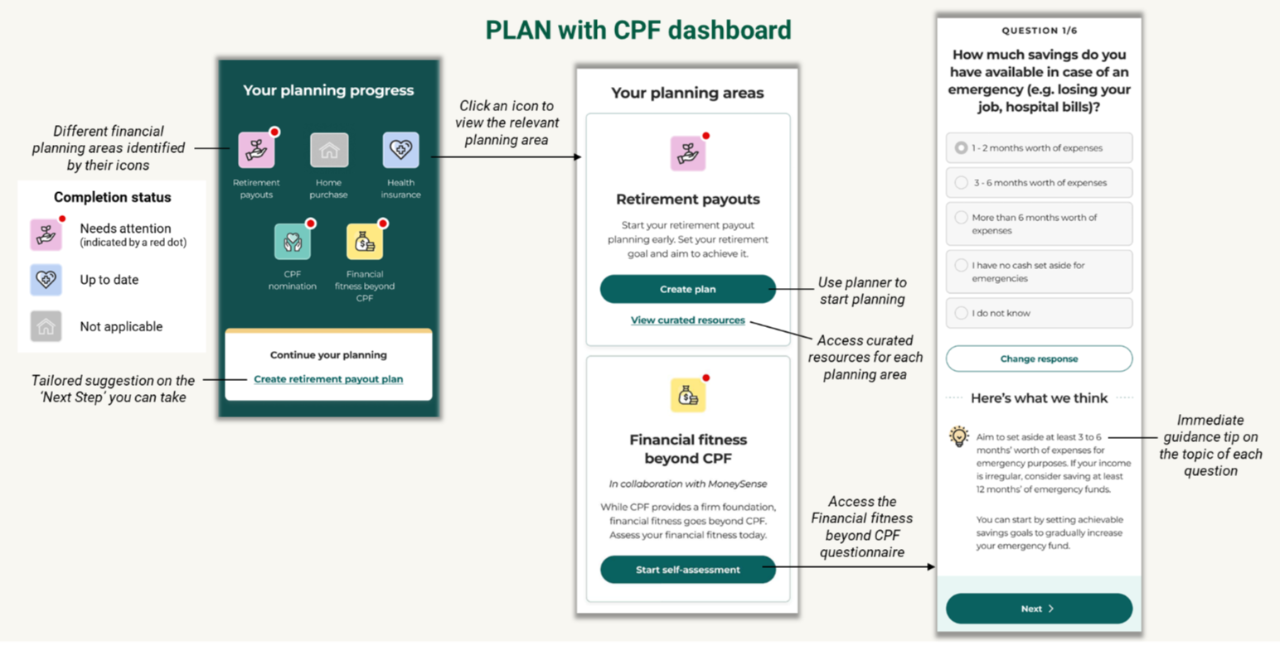

CPF members can access their personalised ‘PLAN with CPF’ dashboard (refer to Figure 1 below) via Singpass login. The dashboard is designed to guide CPF members on their financial planning journey, track their planning progress and identify next steps. CPF members can use the dashboard for quick access to the following suite of planning tools and resources:

a. CPF planners and tools to guide them in making informed decisions across different planning areas, such as:

- Retirement Payout Planner: Helps CPF members set their retirement payout goal, project their retirement savings and payout, and explore ways to leverage CPF to achieve their goal;

- Home Purchase Planner: CPF members can explore their home purchase budget, loan options, and how their housing decisions can impact their retirement payouts; and

- Health Insurance Planner: Helps CPF members assess the long-term affordability of health insurance premiums, compare premiums and key features across different Integrated Shield Plans and make informed decisions about their healthcare coverage.

b. Curated educational resources to help CPF members deepen their understanding of various financial planning areas that may be relevant at different life stages; and

c. A financial fitness questionnaire to allow CPF members to do a quick self-assessment on their financial health beyond CPF. This was developed in collaboration with MoneySense, based on the Basic Financial Planning Guide1.

“As we mark our 70th anniversary, we want to build on the CPF Board’s legacy of service and innovation, and strengthen our commitment to support members through life’s milestones. We are taking another step towards empowering Singaporeans to take charge of their financial health with ‘PLAN with CPF’, which aims to make financial planning more accessible and actionable for everyone,” said Ms Melissa Khoo, Chief Executive Officer of CPF Board. “While CPF Board has been providing financial planning tools and information across different touchpoints, ‘PLAN with CPF’ makes these resources more accessible by bringing them together in one place. This would help members better understand and optimise their CPF savings as part of their broader financial planning journey.”

CPF Board welcomes feedback from CPF members as we continue to enhance ‘PLAN with CPF’ to ensure it remains relevant and effective in empowering members to make confident financial decisions throughout their lives. For more information on ‘PLAN with CPF’, please refer to Annex A2 or visit cpf.gov.sg/planwithcpf.

‘Save & Sound: 70 Years of CPF’ commemorative book

To commemorate its 70th anniversary, CPF Board also unveiled ‘Save & Sound: 70 Years of CPF’, a commemorative book chronicling the organisation’s transformative journey over the past seven decades. The book captures candid behind-the-scenes perspectives from current and former Ministers, as well as past and present leadership and staff of CPF Board, alongside personal stories from CPF members on how the CPF system has impacted their lives. Through archival photographs and first-hand accounts, it documents how CPF schemes and policies have evolved to respond to Singapore's changing social and economic landscape, and how the CPF system will continue to meet the needs of future generations of Singaporeans. Please refer to Annex B for a summary of the key highlights of the book. The book is not for sale, and a digital copy of the book can be accessed or downloaded at cpf.gov.sg/cpf70.

Visit the CPF70 and Life’s Supermart exhibitions at Our Tampines Hub until 10 July

We invite visitors to explore CPF’s rich 70-year history at Our Tampines Hub from 4 to 10 July 2025. Through commemorative displays and carefully curated historical artefacts, visitors can learn more about the social security system that shaped our nation, browse through hardcopies of the commemorative book at the exhibition space, and redeem exclusive premiums.

The Life’s Supermart exhibition, which is also held during the same period at Our Tampines Hub, welcomes visitors to participate in an interactive supermart experience where they can gather practical financial planning resources and try out 'PLAN with CPF'. They can also register for the CPF Talk series, which features four insightful sessions on housing, healthcare, and retirement to gain practical knowledge for their CPF journey. For more information, please refer to Annex C.

1 MAS and MoneySense, in collaboration with CPF Board and finance industry associations, have developed a Basic Financial Planning Guide to help Singaporeans take simple steps to enhance their financial well-being.

2 Please refer to Annex A - Factsheet on key features of 'PLAN with CPF' here.