18 July 2022

SOURCE: DollarsAndSense

When we think of CPF, the first thing that comes to mind is retirement. After all, CPF is usually seen as a key pillar of Singapore’s social security system. The funds set aside in our CPF accounts are meant to set the foundation for our retirement.

Yet, even as we save and grow our savings for our golden years, our CPF can also be used to protect and plan for our family’s financial stability today.

CPF can act as emergency savings to protect our home

When we purchase a property in Singapore, savings in our Ordinary Account (OA) can be used to pay for the downpayment and other related costs. Many of us may also use the monthly contributions we receive in our OA to service our home mortgage repayments.

Besides just using it for downpayment or regular mortgage payment, a third way to “use” our OA savings is simply to do nothing with it.

By leaving a part of our OA savings untouched, we enjoy two key benefits. The first is that our OA savings continue to earn us a base interest rate of 2.5% per annum. If we have $100,000 in our OA savings, this means earning a risk-free interest rate of about $2,700 a year (an additional 1% per annum is accrued on the first $20,000). When left untouched, our OA savings will grow over time because of compound interest.

The second advantage from building up our OA savings is that it can serve as a form of emergency funds for our mortgage repayment. If at any point in time we suffer a loss of regular income (e.g., retrenchment, pay cuts, gap between jobs), our OA savings can be utilised to service our mortgage repayment.

Suppose our monthly mortgage repayment is $1,000 and we have savings of $40,000 in our OA. In this case, our OA can service our monthly mortgage repayment for a period of 40 months, giving our family the assurance that our mortgage payments will still be covered for more than three years despite the loss of income.

CPF can help with cash flow when we are between homes

Buying a property can be stressful. The complexity of the transaction and the level of stress that comes with it increases when we are not only purchasing a property, but also handling the sale of our existing home.

When we sell our existing home before purchasing a new place, we run the risk of being unable to find a suitable home in time, leaving us with no other option than to seek alternative accommodation for our families. On the other hand, if we purchase a new property before selling our existing home, we risk being unable to sell it in time, or having to settle for less than our ideal asking price.

In both scenarios, we may face short-term cash flow problems. For example, even after we have found a buyer who has exercised their option-to-purchase our HDB flat, we need to wait about two to three months before the sales transaction is complete to receive the sales proceeds. If we have already purchased another property during this period, we may have to stretch ourselves to cover costs such as the stamp duty, legal fees and even the downpayment for our new place.

Savings in our OA can be useful to help us complete the property transactions before our sales proceeds come in.

CPF can be used for insurance premiums

CPF savings can be used to pay the premiums of some essential insurance policies that protect our families and us.

One such insurance policy is the Dependants’ Protection Scheme (DPS), a term life insurance scheme intended to protect CPF members and their families in the event of untimely death, terminal illness or total permanent disability. The DPS provides a coverage of $70,000, up till the age of 65. Funds in either our OA or Special Account (SA) can be used to pay for the premiums.

Another insurance policy is the Home Protection Scheme (HPS), a mortgage-reducing insurance that helps pay for our outstanding mortgage amount until the age of 65, or until our housing loans are fully paid up, whichever is earlier. We can pay the premiums for the HPS using our OA savings.

While having both the DPS and HPS doesn’t mean we don’t need any other private insurance policies, they provide our families and us with a basic level of financial protection to safeguard our home and our family if we pass on.

CPF can cover our healthcare needs, and that of our loved ones

Besides our OA savings, the other CPF account that we are most likely to use both in our work and retirement years is MediSave.

As we progress through the various stages of our lives, we want to ensure access to necessary healthcare treatments.

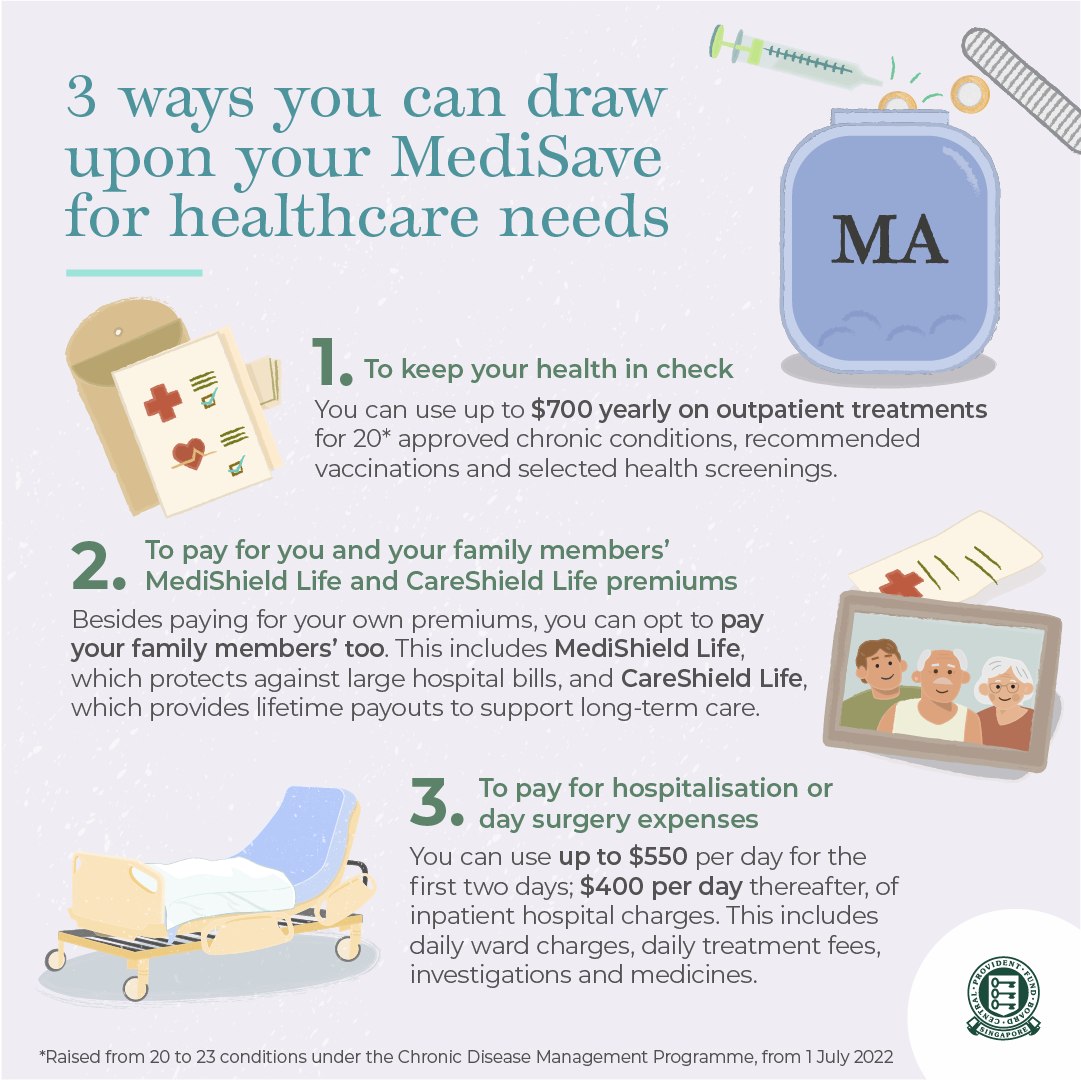

Our MA savings can be used to pay for eligible outpatient treatments, selected hospital treatments and other medical-related expenses such as the delivery of a baby. Severely disabled Singaporeans aged 30 and above can also withdraw up to $200 a month through MediSave Care.

We can also tap on our MA savings for the premiums of insurance such as MediShield Life, CareShield Life or private Integrated Shield Plans.

Finally, it is worth noting that our MA monies aren’t just meant for our own healthcare, but also to cover the healthcare-related costs of the people around us. It can be used to pay for the healthcare insurance premiums, treatments and long-term care costs of our loved ones too.

Read Also: Does It Make Financial Sense To Max Out Your MediSave Account To The Basic Healthcare Sum?

CPF savings as a safe base for our investment portfolio

Between the OA, MediSave Account (MA) and SA, the SA typically gets the least attention among CPF members, and understandably so. Compared to our OA and MA, usage of our SA funds are much more limited since it can’t be used for housing or healthcare-related matters.

That said, it’s important as an account to protect our financial future, particularly our retirement.

Firstly, savings in our SA earn us a base interest rate of 4% per annum. This risk-free return is stable regardless of market conditions, enabling us to grow our savings consistently and in a predictable manner despite any financial turbulence in the market.

If I am 35 this year and have $50,000 in my CPF SA today, this amount will grow to be about $109,556 by the time I am 55, based on the interest rate of 4% per annum, even if I don’t contribute a single dollar to my SA from this day onwards.

Having this predictability from our CPF SA savings can serve as a safety net for us in our investment portfolio. When we have sufficient savings in our SA, we can better withstand the volatility in the financial markets. Regardless of what happens to our investment portfolio, our CPF savings assures us of a secure retirement. This can help us make better long-term investment decisions.

Financial stability via CPF

Even as we strive towards building our retirement nest egg through our CPF, let’s not overlook its potential in financially securing our family’s future today.

Whether it’s to help us with mortgage repayments when we suffer a loss of income, pay for vital insurance policies or even to pay for the healthcare treatments of our loved ones, the financial stability that our CPF savings can offer our families and us goes beyond just our retirement.

This article was written in collaboration with the CPF Board. All views expressed in this article are the independent opinion of DollarsAndSense.sg based on our research. DollarsAndSense.sg is not liable for any financial losses that may arise from any transactions and readers are encouraged to do their own due diligence. You can view our full editorial policy here.

Disclaimer: All calculation in this article is derived by DollarsAndSense using a simple compound interest calculator. Results from this calculator may not necessarily be similar to CPF calculation.

Information is accurate as of the date of publication.