19 May 2022

SOURCE: CPF Board

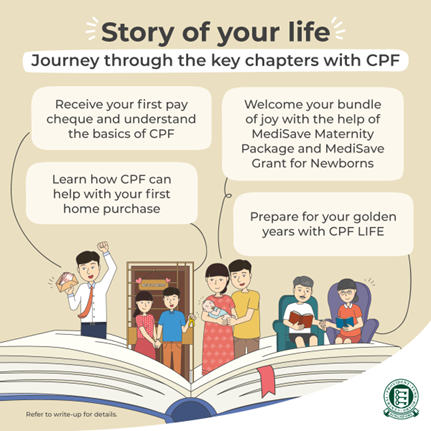

Everyone’s life unfolds differently, but one thing remains constant — CPF is instrumental for your housing and healthcare needs and provides a good foundation for retirement.

Receive your first pay cheque and understand the basics of CPF

Nailing that job interview and finally earning your own income herald the first step of adulthood! But before you get too carried away with your newfound financial independence, take some time to get familiar with your CPF.

Your CPF consists of three accounts: Ordinary Account (OA), Special Account (SA), and MediSave Account (MA) to meet your housing, retirement, and healthcare needs respectively.

Each month, you and your employer will contribute to these three accounts. As a newcomer to the workforce, your monthly CPF contribution will be computed based on a total CPF contribution rate* of 37%, with 20% from you and 17% from your employer.

You can make use of the CPF Contribution Calculator to calculate your CPF contributions.

Learn how CPF can help with your first home purchase

Have you set your sights on a home to call your own? Buying a new home may be your biggest financial decision thus far, but rest easy — your CPF savings can help.

You can pay for housing-related payments such as the downpayment, housing loan, stamp duties, and legal fees with your OA savings. In addition, if you’re buying an HDB flat, there are several CPF Housing Grants available to lighten the load.

Keep in mind that there may be limits to how much CPF savings you can use. These are in place to ensure that you’ll have sufficient CPF savings set aside for your retirement needs!

Check out our CPF website to find out what to consider when using your CPF to buy property and estimate how much Ordinary Account savings you can use for a property purchase with this calculator.

Welcome your bundle of joy with the help of MediSave Maternity Package and MediSave Grant for Newborns

Planning to bring a bundle of joy into the world? Mapping out your finances ahead of time and understanding the various schemes and grants available let you focus on welcoming your new baby with peace of mind.

With the MediSave Maternity Package, you can use your MA savings to pay for pre-delivery and delivery expenses. Withdraw up to $900 from your MA for pre-delivery expenses, such as consultations and ultrasound scans. For the delivery, you can withdraw up to $450 for each day in the hospital, plus an additional surgical withdrawal limit between $750 and $3,950 depending on the type of delivery procedure.

Upon birth registration, an MA will also be created for your baby, with $4,000 credited under the MediSave Grant^ for Newborns. This can be used to pay for your child’s MediShield Life premiums, recommended childhood vaccinations on the National Childhood Immunisation Schedule, as well as other unexpected medical costs.

In addition, the Baby Bonus Scheme is here to help with child-raising expenses. You’ll receive the Baby Bonus Cash Gift of $8,000 for your first and second child, and $10,000 for your third and subsequent children.

Read more about the various schemes and grants you can tap on.

Prepare for your golden years with CPF LIFE

After years of prudent financial planning, you’re probably looking forward to your retirement where you can relax and have more time for your loved ones and hobbies. However, achieving your desired retirement lifestyle starts decades before your golden years!

When you reach age 55, a Retirement Account (RA) would be created for you. Your SA and OA savings, up to your applicable Full Retirement Sum, would be transferred to your RA to make up your retirement sum. Your retirement sum will then be used to join CPF LIFE from age 65, which will provide you with monthly payouts for as long as you live.

There are 3 CPF LIFE plans to choose from, and each plan will differ in the amount of monthly payout you can receive.

Learn more about CPF LIFE and how to pick the CPF LIFE plan that best suits your needs and desired lifestyle.

Each chapter of our lives comes with new experiences and challenges. By understanding how CPF can help support you, you can navigate it with a lighter load!

*Based on CPF contribution rate for employees 35 years old and below (for monthly salary ≥ $750). CPF contributions are payable for your monthly salary of up to $6,000.

^MediSave Grant is for all Singapore Citizen newborns on or after 1 Jan 2015.

Information is accurate as of the date of publication.