19 Dec 2025

SOURCE: CPF Board

Use this 2026 CPF retirement planning checklist to make sure you’re up to date on the important details, especially changes to CPF in 2026. Test yourself to see how much you know!

1) Planning ahead with the right CPF resources

Retirement planning requires making projections into the future. The right resources can help you plan with clarity, eliminating much of the guesswork.

Did you know – annual increases to the Full Retirement Sum (FRS) and Enhanced Retirement Sum (ERS) can affect how much tax relief you enjoy from voluntary top-ups, as well as how you can maximise your payouts!

So, are you ready to start planning ahead?

Please choose the option that applies to you.

You’ll need the proper tools to help you do so. If you’re not sure where to start, Plan Life Ahead, Now! (PLAN) with CPF is a one-stop financial guidance platform that helps you make informed financial decisions as you navigate through life. It provides easy access to planners for your financial planning needs, including:

- The Retirement Payout Planner to set retirement payout goals and plan how to reach those goals

- The Home Purchase Planner for your home budgeting needs, including loans and projecting impact on your retirement goals

- The Health Insurance Planner to help align your health insurance with your needs

PLAN with CPF also provides recommended resources you can read to boost your retirement planning knowledge, no matter which stage of life you’re currently at. You can also track your progress via the PLAN with CPF dashboard, allowing you to pause and continue your planning whenever you want. It even has a short questionnaire to give tips on how to strengthen your financial fitness!

Let’s start smaller. The first step is to understand what CPF is, and why it’s important. When you have a better idea of how CPF works, you will have a clearer direction for your retirement planning.

The right tools can help to guide you. Plan Life Ahead, Now! (PLAN) with CPF is a one-stop financial guidance platform that helps you make informed financial decisions as you navigate through life. It has planners to help you with retirement, healthcare and housing planning, which helps you take an active first step towards planning for your future.

In addition, PLAN with CPF also features a short questionnaire that gives tips on how you can strengthen your financial fitness. The questionnaire helps you understand your current level of financial knowledge, and provides tips on how to improve. PLAN with CPF also provides curated educational resources to help boost your planning knowledge, in case you want to improve your understanding of CPF’s various schemes and features. Give it a try!

Remember to stay up to date on the latest changes and you’ll be better informed to plan ahead for your retirement.

2) Planning for senior workers

Even if you’re not a senior worker yourself, this can help you assist your parents who may still be working. But here’s the big question: are you aware of the changes to contribution rates for senior workers?

Please choose the option that applies to you.

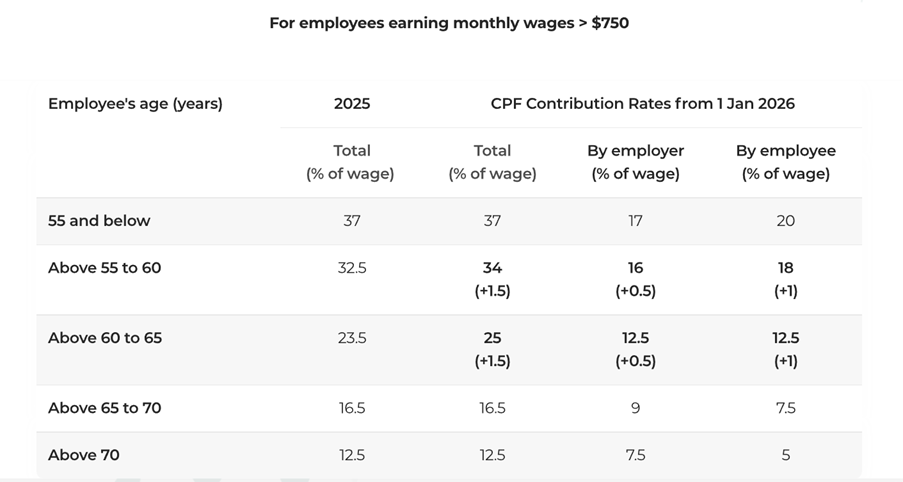

Great! Knowing the updated contribution rates helps you better understand how your savings will grow. This allows you to better calculate how close you are to your retirement goals. These changes will take place from 1 January 2026.

The 1.5% increase in the total CPF contributions for employees aged above 55 to 65 will be fully allocated to the Retirement Account (RA), up to the Full Retirement Sum (FRS), to help senior workers save more for retirement. If employees have set aside the FRS in their RA, these contributions will be channeled to their Ordinary Account.

In addition to the contribution rate changes, the CPF Transition Offset equivalent to half of the 2026 increase in employer CPF contributions will be provided automatically to employers to cushion the impact on business cost.

From 1 January 2026, the contribution rates for senior workers aged above 55 to 65 will be increased by 1.5%. This means your retirement savings will grow at a faster rate.

You can read more about the increase in contribution rates alongside other changes coming your way as announced in Budget 2025 here. Understanding and keeping up to date with the latest changes allows you to better plan your finances, and for your retirement.

3) Making the most of matching grants when you top up

Topping up your CPF savings helps them grow faster. You can also top up the CPF savings of your loved ones to secure their future. The Matched Retirement Savings Scheme (MRSS) helps senior Singapore Citizens with lower retirement savings save more, by matching dollar for dollar the cash top-ups made to their Retirement Accounts (RA).

The MRSS will also be undergoing changes in 2026. So the third question of this checklist is:

Do you know what are the changes to MRSS in 2026?

Please choose the option that applies to you.

That’s great! As of 2025, the age cap for MRSS has also been removed and more eligible senior members can benefit from the matching grant, alongside an increase in matching grant cap from $600 per year to $2,000 a year, with a $20,000 cap over an eligible member’s lifetime.

In addition, from 2026, the expansion of MRSS’s coverage will include eligible members with disabilities of all ages. This allows more members to benefit and to get a boost to their retirement planning.

If this is applicable to you or your loved ones, you can consider making a top-up today to help with your or your loved ones’ retirement planning.

Learn more about MRSS so you don’t miss out! The MRSS - What you need to know article provides a quick and easy rundown of the important aspects of MRSS, as well as the changes that have taken place in 2025.

MRSS’s coverage will also be expanded in 2026, to include eligible members with disabilities of all ages. This allows a wider range of members to benefit and to get a boost to their retirement planning.

But that’s not all! The Matched MediSave Scheme (MMSS) will be implemented in 2026, and piloted for five years. The scheme helps Singapore Citizens aged 55 to 70 (inclusive) with lower MediSave savings to boost their healthcare savings, by matching voluntary cash top-ups made to their MediSave Account (MA), up to an annual cap of $1,000. The increase in MediSave savings will help eligible members pay for insurance premiums, as well as approved medical treatments. Planning well for long-term healthcare costs is a key part of retirement planning too!

Retirement planning takes time, and is an ongoing journey. This checklist helps you make sure you’re on the right track, so that you’re well-equipped to plan ahead.

The information provided in this article is accurate as of the date of publication.

.jpg)

.jpg)