7 July 2022

SOURCE: CPF Board

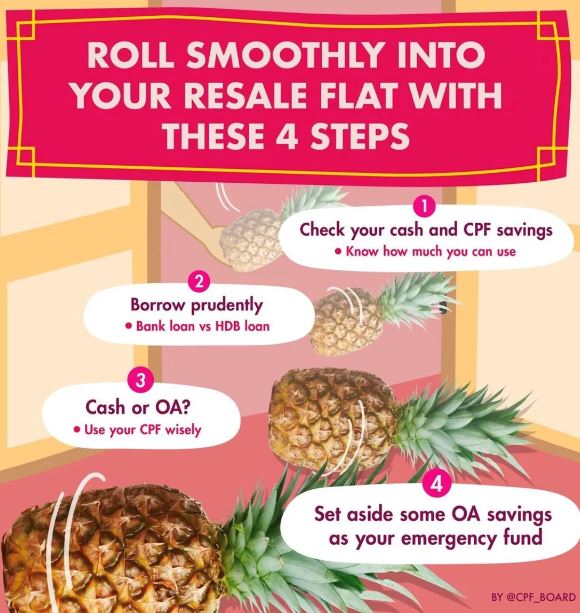

Have you heart set on a nice resale flat but unsure if you can comfortably afford it? A house is, after all, a costly expenditure—one that requires planning and some sense of how your home purchase will impact your future plans. How then, can you make the process of buying a resale flat, simpler? Let us guide you through the four steps that can help you with your planning.

1: Check your cash and CPF savings

Whenever you want to buy something, the first thing you do is to check how much money it costs and how much you have in your wallet. The same applies when you’re buying a resale flat! The difference here, however, is that you have two “wallets” to consider: your cash, and your CPF savings.

As with all things, this might require some balance on your end. It’s not ideal to spend most if not all your cash savings on the flat, since that leaves you with little to use in the case of an emergency or unexpected expenditure. Similarly, it’s not wise to deplete your CPF savings either. While your CPF Ordinary Account (OA) savings can be used for your housing purchase, it is also meant for your retirement. Thus, it’s always best to plan with an idea of what you would be comfortable with when it comes to your housing budget.

You can get an estimate of the price of the flat you can afford, using the First Home Calculator, and also find out how much of your OA savings you can use for your property with the CPF Housing usage calculator.

2: Borrow prudently

There are two types of loans you can choose from when buying a home: a HDB loan and a bank loan. Both are valid options, so which one you go with depends on which best fits your needs.

Here’s a quick breakdown on some key differences between the two:

| |

HDB loan | Bank loan |

| Maximum loan | Up to 85% | Up to 75% |

| Interest rates | Pegged at 0.1% above OA interest rate | Generally lower but may fluctuate with market conditions |

| Lock-in period | No | Yes |

Where loans are concerned, neither is strictly better than the other. However, something to note is that if you decide to take a bank loan, you will not be able to switch to a HDB loan thereafter. Of course, the most important factor to consider would be how prudent your choice of resale flat is, as flats across different locations may have a larger difference in price.

3: Cash or OA?

As mentioned in the first point, it’s recommended to use a mixture of cash and OA savings to purchase your home. Another consideration is that your cash and OA have further uses in the future after you purchase your flat.

Cash savings can be used to repay loans and service your debt. To be prudent, we would advise keeping your total debt servicing ratio and monthly housing instalment within 55% and 25% of your gross monthly income respectively. This helps you have sufficient cash savings for other forms of expenditure, such as your short-term needs (food, transport and clothing).

But that doesn’t mean you should just spend all your OA savings to preserve your cash savings. Unused savings in your OA can earn up to 3.5% risk-free interest and will eventually form part of your retirement savings to support your desired retirement lifestyle as well. Therefore, if it’s possible, refrain from depleting it in one go so as to allow it grow overtime.

With a good idea of what combination of cash and OA savings you can use, it becomes easier to balance your spending between the two, so that you don’t deplete too much of either! This way, you can purchase your desired resale flat while not compromising on your other immediate financial concerns, or the security of your desired retirement lifestyle.

4: Set aside some OA savings as your emergency fund

Planning for one’s retirement isn’t a short-term checkpoint; it is a long-term goal approached steadily. While on this journey to prepare for your retirement, you can use your OA for housing payments. As a tip, you can also choose to set aside up to $20,000 in your OA when taking up a HDB loan, before the rest is used for housing payments. This sum can act as an emergency fund during unforeseen times and can earn risk-free interest.

Besides housing, your OA savings can also be used for insurance (such as the Dependants' Protection Scheme), investment and education. All of these are equally important expenditures, and you may not always have the cash on hand to pay for them. That’s where your OA savings can come in handy! Also, as mentioned above, your OA savings are ultimately meant to help you prepare for your retirement, so it’s always a good idea to not deplete it in one go!

Planning for a house, even if it is your next home, is one of life’s important milestones, and while it’s certainly exciting to look forward to, it’s also something to consider carefully. Do note a recently purchased resale flat cannot be sold again so soon due to the Minimum occupation period (MOP), which requires home buyers to physically occupy their flats for at least 5 years (or 10 for Prime Location Public Housing (PLH) flats) before they can sell it on the open market.

Thus, it certainly pays to approach it with caution, and knowing what you can do is a big first step! With the right knowledge of what you have at your disposal to make things easier, you can make decisions about your future housing journey confidence and take things in stride if the unexpected happens.

Information accurate as of the date of publication.