4 May 2022

SOURCE: CPF Board

One of the most significant milestones of adulthood is to have a place to call our own. As one of the biggest purchases of our lives, buying a home is a long-term commitment that requires financial planning.

How do we plan our finances to ensure that we stay within our means?

One of the ways to do so is through the use of housing ratios. A housing ratio shows us how much of our income is spent on housing. Understanding this figure provides us with a clearer idea of what we can afford for our housing needs.

Here are two useful ratios you can use to keep your housing budget in check:

Mortgage Servicing Ratio (MSR)

The Mortgage Servicing Ratio (MSR) refers to the portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for.

Under this rule, a maximum of 30% of your gross monthly income can be used for your monthly loan repayment.

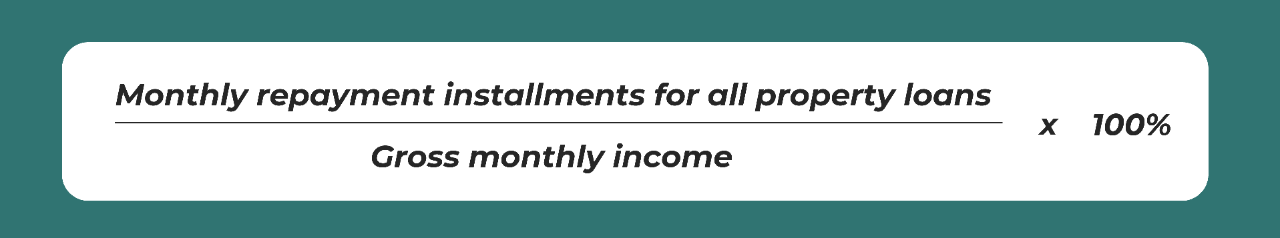

To calculate the MSR, use the following formula:

Do note that the MSR applies only to housing loans for a HDB flat, or an executive condominium (EC) where the minimum occupation period (MOP) of the EC has not expired.

To ensure that you’re not taking up too much debt, a good rule of thumb is to keep this ratio within 25% to 30% of your gross monthly income instead. By using less of your savings (be it cash or CPF) on property, this will also give you more leeway for other financial commitments and allow you to save more for the future.

Total Debt Servicing Ratio (TDSR)

The Total Debt Servicing Ratio (TDSR) refers to the maximum proportion of an individual’s gross monthly income that can go towards repaying all monthly debt obligations. This ensures that you avoid overtaxing yourself in managing your debt obligations.

Examples of debt obligations include:

- Property-related loans, including the loan being applied for

- Car loans

- Student loans

- Renovation loans

- Credit card loans

- Any other secured or unsecured loans, including revolving loans

The TDSR is currently set at a maximum of 55% of one’s gross monthly income (with effect from 16 Dec 2021) and this applies to property loans offered by financial institutions. Loans from HDB are not subject to the TDSR rules.

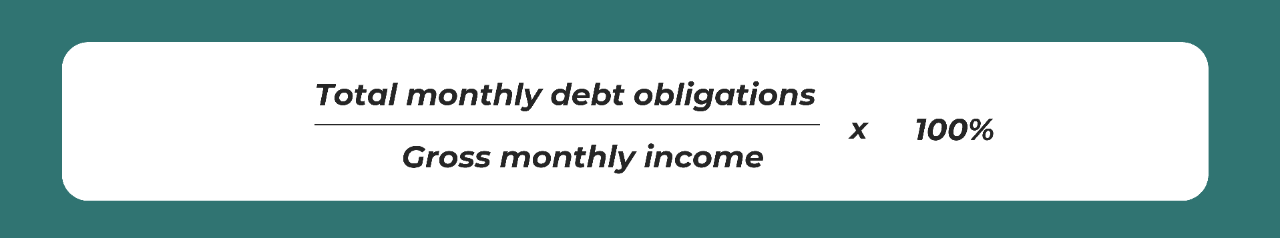

To calculate the TDSR, use the following formula:

Unlike the MSR which only applies to loans taken for HDB flats or ECs, the TDSR applies to loans taken for all types of properties. If you are applying for a loan from a financial institution to buy a HDB flat or EC, both the MSR and the TDSR would be considered.

Even if you are able to meet the MSR and TDSR, do consider against taking up a bigger loan or a longer loan tenure than you need to. By taking on a smaller or shorter tenure loan, you can limit the interest costs that you will incur and better ensure that you are buying a home that you can afford in the long run.

You will also be in a better position to pay for ongoing expenses (such as property taxes and mortgage insurance), cope with potential interest rate increases, as well as weather any other unexpected events (e.g. income reductions).

Information accurate as of the date of publication.