28 Jan 2022

SOURCE: CPF Board

The beginning of a new year is often a good time to kickstart your financial plans for the year and beyond.

A good first step to boost your CPF savings is to make a CPF top up in January.

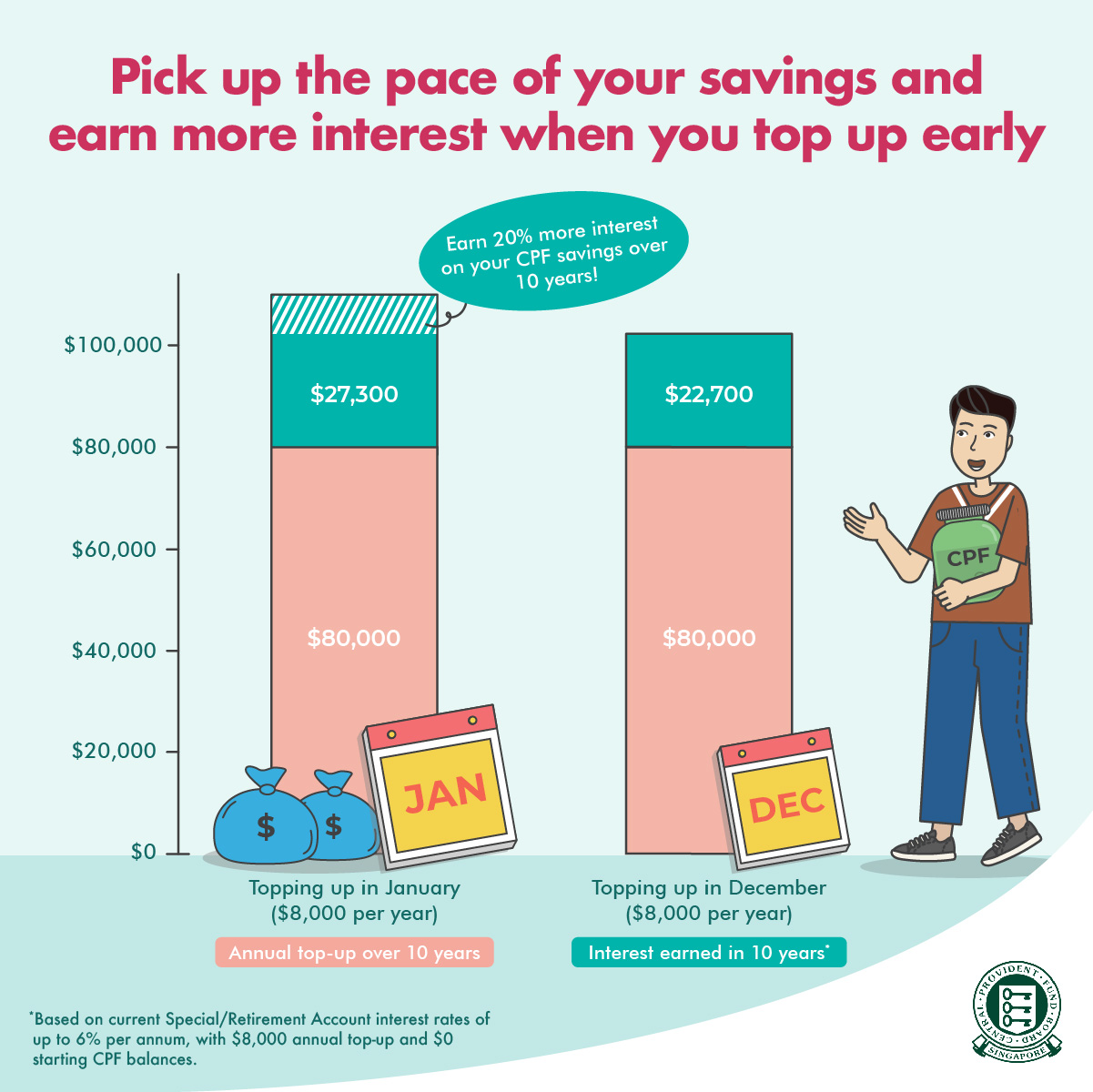

Did you know that you can earn up to 20% more interest on your CPF savings in 10 years, just by making cash top-ups in January instead of later in the year?

If you top up early in the year, you can earn more interest on your top-ups through the power of compound interest.

So make your top up sooner, rather than later!

What are the benefits of topping up your CPF?

1. Attractive interest rates

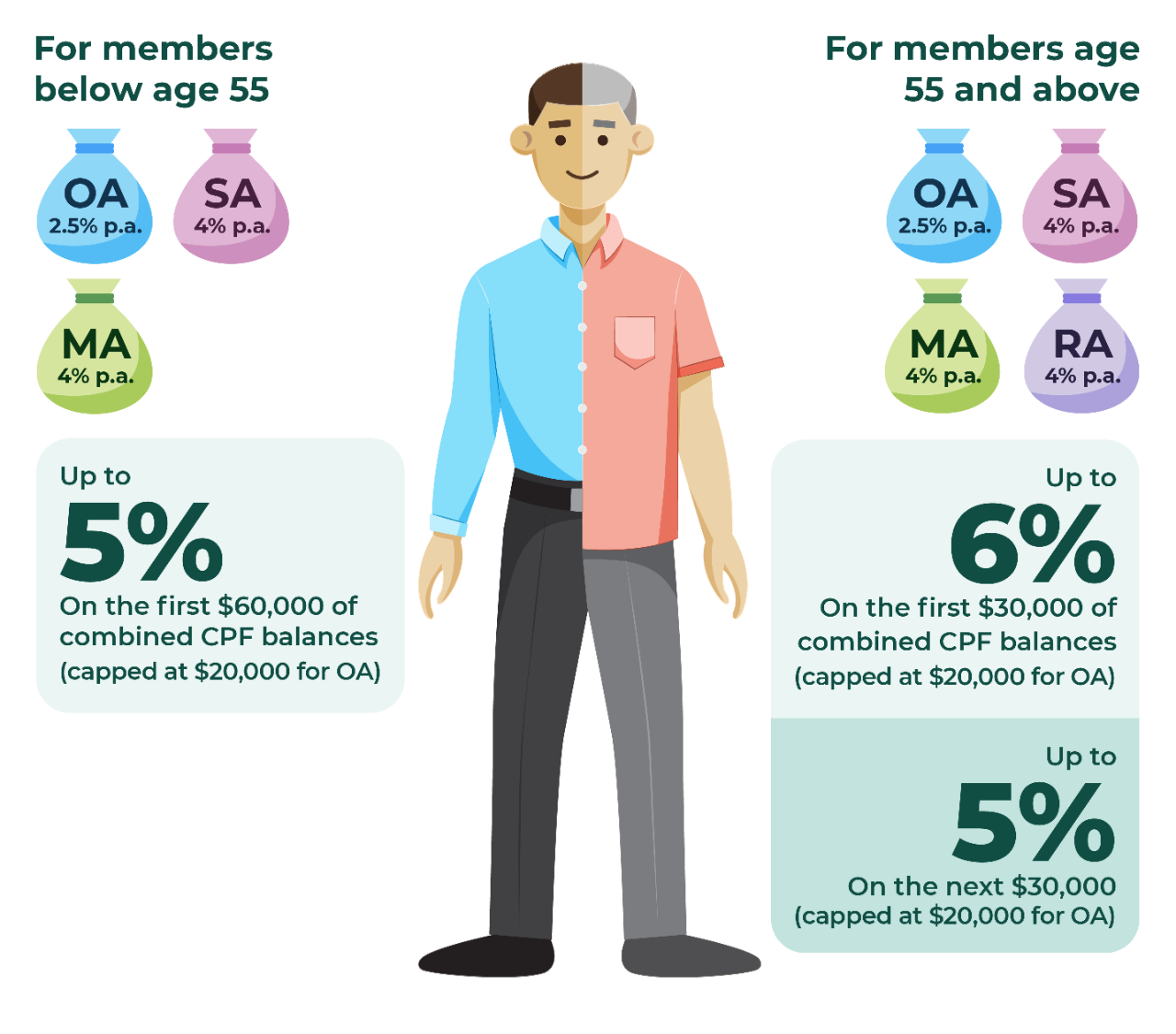

To boost your retirement savings, the Government will pay extra interest on the first $60,000* of your combined balances.

The extra interest earned on your Ordinary Account (OA) savings will go to your Special Account (SA) or Retirement Account (RA) to boost your retirement savings.

You will still earn the extra interest on your combined CPF balances, including savings used for CPF LIFE, if you're participating in the CPF LIFE scheme.

*Capped at $20,000 for OA.

These are the interest rates your savings could earn across your CPF accounts.

2. Higher monthly payouts

Topping up your Special or Retirement accounts grows your retirement savings with attractive CPF interest rates. Reap the benefits from compound interest and enjoy higher monthly payouts when you retire.

3. Tax relief of up to $16,000

From 1 Jan 2022, you can enjoy tax relief of:

- up to $8,000 per calendar year if you make a top-up to yourself

- an additional $8,000 per calendar year if you make a cash top-up to your loved ones

Only cash top-ups within the current Full Retirement Sum (FRS) are eligible for tax-relief.

Information updated as of 28/01/2022