13 Feb 2024

SOURCE: MoneySense

With so many tips on financial planning out there, it can be hard to ascertain if you are on the right track, especially if you do not have a financial adviser.

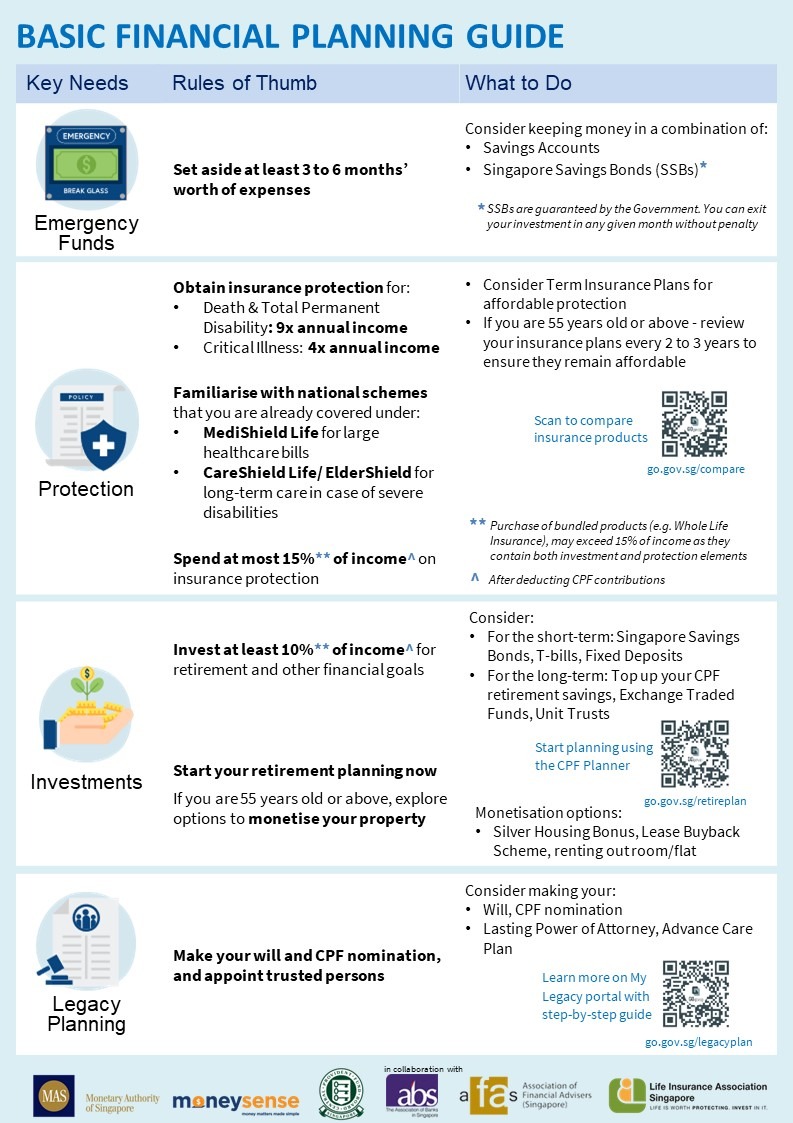

To help Singaporeans proactively identify and plug gaps in their financial planning, MAS, together with the Association of Banks in Singapore, Association of Financial Advisers (Singapore) and Life Insurance Association, have developed a Basic Financial Planning Guide with rules of thumb to support those looking to take proactive steps to address their savings, insurance, and investment needs.

Scroll down to view the specially customised financial planning guide for your life stage!

- Fresh entrants to the workforce (19-29 years old)

- Working adults looking to start a family (25-34 years old)

- Working adults supporting aged parents (35-59 years old)

- Working adults with children and supporting aged parents (35-59 years old)

- Pre-retirees (55-64 years old)

- Golden years (65 years old and above)

Check out the guides below for customised financial planning advice based on the different stages that you might be facing in your life.

This article was first published on MoneySense.

The information provided in this article is accurate as of the date of publication.