26 Aug 2025

SOURCE: CPF Board

Like many things in life, good health shouldn't be taken for granted. This is why getting protected with health insurance is important. However, most people also take their insurance premiums for granted.

With insurance premiums being tied to your age and other external factors such as rising healthcare and manpower costs, what you're paying today will be vastly different a decade from now. This makes it important to review your health insurance policies regularly.

Breaking down your health insurance policy

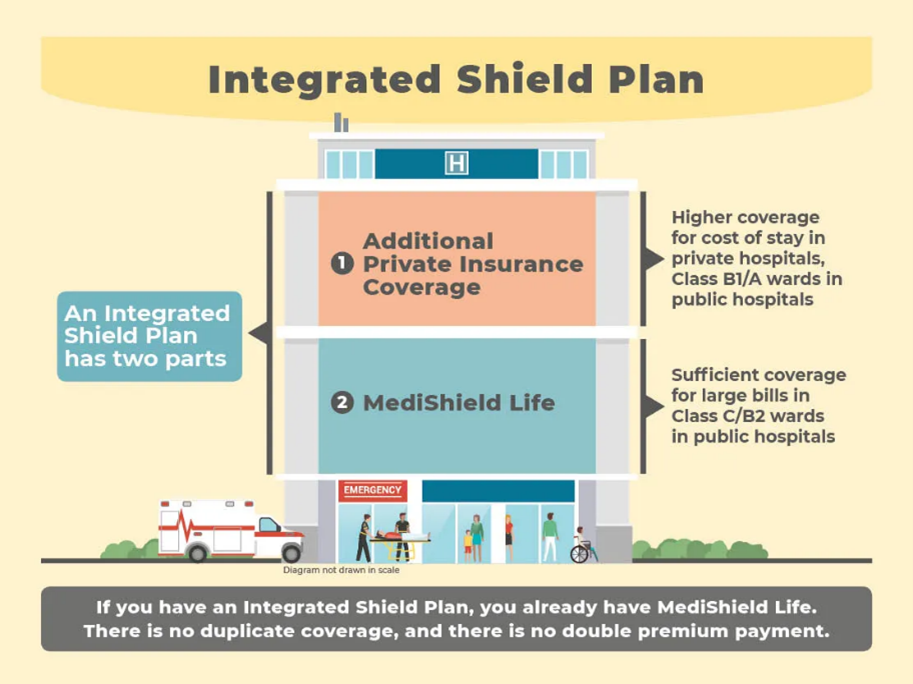

All Singaporeans are automatically covered by MediShield Life, a health insurance that helps you pay for large hospital bills and selected outpatient treatment costs. This is largely sufficient for large bills in Class C/B2 wards in public hospitals.

MediShield Life can be supplemented with an Integrated Shield Plan (IP), which includes additional private insurance coverage for the cost of stay in private hospitals and Class B1/A wards in public hospitals.

Additionally, private insurance companies also offer Riders that are optional add-ons to your policy. They provide additional benefits such as reducing the co-payment amount or dispensing a daily allowance while you are hospitalised.

An important thing to note is that the premiums for MediShield Life can be fully paid by your MediSave savings. However, the premiums for the additional private insurance component that is offered by private insurers are subject to the Additional Withdrawal Limit (AWL) and you will have to pay the portion of your private insurance component premium that exceeds the AWL in cash.

Key life stages to review your insurance policy

While it is always important to review your insurance policy regularly, these three life stages deserve extra attention.

1. Ages 22-26: Starting out at your first job

Getting your first job out of school is something worth celebrating. As you begin to experience financial independence, you might want to take over some of the insurance policies that your parents previously bought for you. Alternatively, you might be considering expanding your insurance coverage now that you have your own income.

Keep these important considerations in mind:

Long-term cost implications: While premiums might seem affordable now, they will accumulate over time as you age.

Matching coverage to usage: IPs and riders help ensure that your out-of-pocket expenses are kept low. However, about half of patients with IPs end up using subsidised public healthcare when hospitalised or receiving day surgery. This means that they are effectively paying for private coverage they do not use.

When reviewing your insurance coverage, make sure to consider how your insurance aligns with your healthcare preferences and needs.

2. Ages 41-51: Large spike in premiums

As you enter your 40s (specifically the 41-51 age bracket), you might face a rude shock when you receive your insurance premium bill and see that the cost has spiked dramatically. This is because the probability of requiring medical care increases with age.

This sudden increase in premiums often leads to tough decisions about insurance coverage, with many Singaporeans choosing to downgrade or drop their IPs and riders entirely.

Before making any hasty decisions, consider these important points:

Use premium spikes as review opportunities: Rather than making reactive decisions and cancelling your insurance policy when costs suddenly increase, take the time to conduct a thorough insurance review.

Keep an eye on the long term: Look at your coverage needs, including family health history and balance this against long-term affordability. This will help assess whether you can afford to hold on to your policies or downgrade or drop your private plan or riders to better manage the long-term costs.

Balance the insurance needs of your family: At this stage of life, you might find yourself managing not just your own insurance needs, but also those of your elderly parents and child. When you're juggling multiple insurance policies, careful financial planning becomes more important to ensure that everyone stays protected within budget.

3. Approaching 55: The pre-retirement review

Reaching age 55 is another important milestone with the opening of your Retirement Account (RA). Your CPF savings in the Special Account and Ordinary Account will be transferred to your RA, up to the Full Retirement Sum and you can withdraw your CPF savings in excess of the FRS

Take this time to review your insurance policy as part of your retirement planning. After all, you’ll still have to continue paying for your insurance premiums when you retire and stop receiving a regular income.

Here are some important considerations for this life stage:

Planning for insurance in retirement: With retirement on the horizon, evaluate whether your current premium payments will remain manageable on a retirement income. Consider how these costs will fit into your retirement budget alongside other essential expenses.

Review coverage needs: Your insurance needs may be different now compared to your younger years. You might have fewer dependents to protect, but potentially higher healthcare needs. Take time to assess whether your current coverage still aligns with your priorities.

Review your insurance policy with the Health Insurance Planner

The Health Insurance Planner is a completely personalised tool that supports you in making informed decisions about your health insurance coverage.

With it, you can compare your existing plan against other options and determine its long-term affordability. You can also project your MediSave savings and future healthcare expenses to understand how much you need to support your desired health insurance coverage.

If you find that you might be paying too much for your insurance premium, consider rightsizing your plans. This can come in the form of reviewing your current plans, going for a different ward class of your IP and rider, or dropping the rider entirely but retaining the ward class catered for under IP.

Take note of these key life stages to review your insurance policy

Private health insurance premiums are rising and they would cost more as you age. If you own riders alongside your IP, you've likely noticed their premiums increasing even more sharply.

Make it a point to understand your insurance policy and the coverage you would need. Before purchasing additional riders, carefully consider if the extra protection matches the long-term premium commitment you’ll be paying.

Check out this article on the latest healthcare updates in Singapore. Be sure to also read more about these popular healthcare-related questions too!

The information provided in this article is accurate as of the date of publication.