13 Jun 2025

SOURCE: CPF Board

Life's journey has its ups and downs, and the major events around us, such as rising tariffs globally, can impact our long-term financial well-being. Having some form of stability, especially in uncertain times, can help. Let us unpack how your CPF savings can play a role in securing your financial future.

Tariffs are a form of tax levied on goods and services imported from other countries. They can serve as a means to protect domestic businesses from excessive foreign competition, or as a source of revenue for the government. While tariffs are paid by the importer, these costs are likely passed down to the wholesalers, retailers and ultimately consumers.

Given the fluctuations and unpredictability that markets and economies are exposed to, what does this mean for you and your finances? It becomes even more important to have a stable financial foundation, such as your CPF savings, which offers steady growth and interest regardless of global market conditions.

But how do your CPF savings provide this stability? Let’s look at 3 points of security:

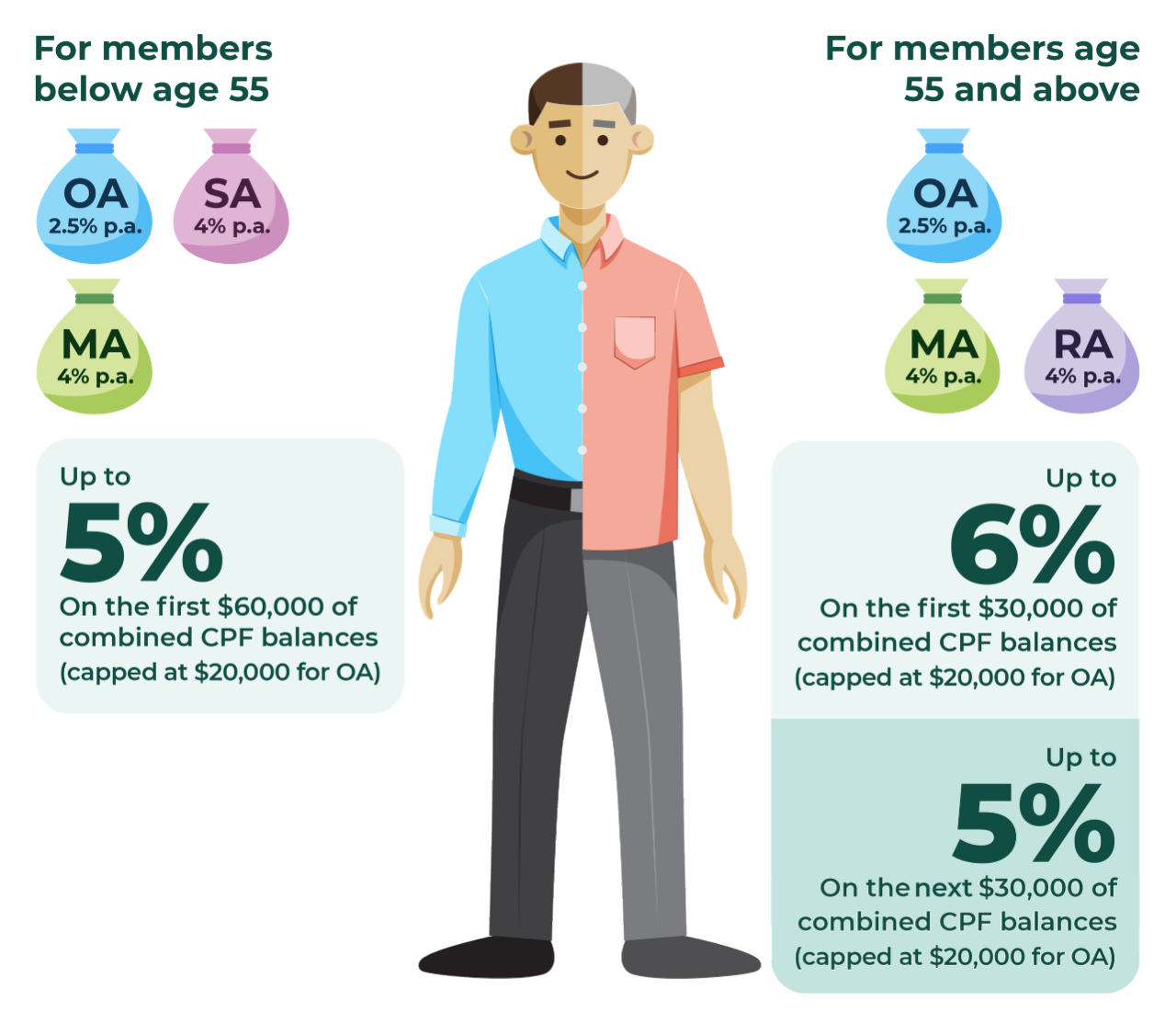

Your CPF savings grow at a steady interest rate, which are risk-free. The interest rates earned depend on the account your savings are in, as well as your age:

But how are these rates determined? Well, it depends on the account in question:

This rate is reviewed quarterly, and is computed based on the 3-month average of major local banks’ interest rates (subject to the legislated minimum interest of 2.5% per annum).

This rate is also reviewed quarterly, but is computed based on the 12-month average yield of 10-year Singapore Government Securities (10YSGS) plus 1% (subject to the current floor interest rate of 4% per annum).

To help members grow their savings, the Government has further extended the 4% floor rate for interest earned on savings in these three accounts until 31 December 2025.

Your savings are invested in Special Singapore Government Securities (SSGS), which are non-tradable bonds issued specifically to the CPF Board for the investment of CPF savings. These bonds are guaranteed by the Government, ensuring that the Board will always be able to pay its members all their monies when due, alongside the interest that has been committed.

This means that regardless of the financial market conditions, your CPF savings will always be safe, ensuring consistent returns via the steady interest rates. If you feel that investments may not yield better returns after considering your investment horizon and risk appetite, you can also choose to make cash top ups to your CPF accounts to capitalise on the stable, risk-free interest rates, with a long-term view of saving for retirement.

When it comes to retirement planning, one key concern is whether you will outlive your savings.

CPF Lifelong Income For the Elderly (CPF LIFE) is a national longevity insurance annuity scheme that addresses this. It provides members with monthly payouts no matter how long they live, and the assurance of lifelong payouts mean that you have something to fall back on even if prices fluctuate. There are three plans you can choose based on the type of retirement lifestyle you prefer:

Starts off with lower monthly payouts, but the payouts grow by 2% a year for life. This plan helps maintain your desired retirement lifestyle even as the prices of items increase.

Offers a steady monthly payout that does not grow over time, and thus does not protect you against inflation. With this plan, you have to lower your spending over time as things get more expensive.

Monthly payouts dip when your CPF balances go below $60,000. This plan is more suited for members who can lower their spending even more over time.

If you’re unsure about how much savings you need and what sort of retirement goals to set with the respective plans, you can plan ahead with the Retirement Payout Planner. It’s a tool that illustrates how your CPF savings can support and help you meet your retirement goals, by projecting what your retirement payouts will be like and showing you how much savings you need to achieve these goals.

The Matched Retirement Savings Scheme (MRSS) is a scheme that helps Singapore Citizens aged 55 and above with lower retirement savings to save more for their retirement by matching cash top-ups made to their RA. From 1 January 2025, the matching grant cap has been increased from $600 to $2,000 per year, with a $20,000 cap over an eligible member’s lifetime.

If you are supporting your elderly or retired parents with lower RA balances, you can tap on the MRSS to grow their retirement savings, or to help boost their monthly payouts in retirement. This can go a long way in stretching your dollar, and in building financial security for your family, especially with uncertain economic conditions.

During unpredictable and uncertain times, leveraging the CPF system to build a stable financial foundation can provide you with confidence and peace of mind.

Information in this article is accurate as at the date of publication.

.jpg)