6 Jun 2025

SOURCE: CPF Board

As the healthcare landscape evolves and costs continue to rise, CPF healthcare schemes will be enhanced to better meet the needs of Singaporeans. Here’s what you need to know.

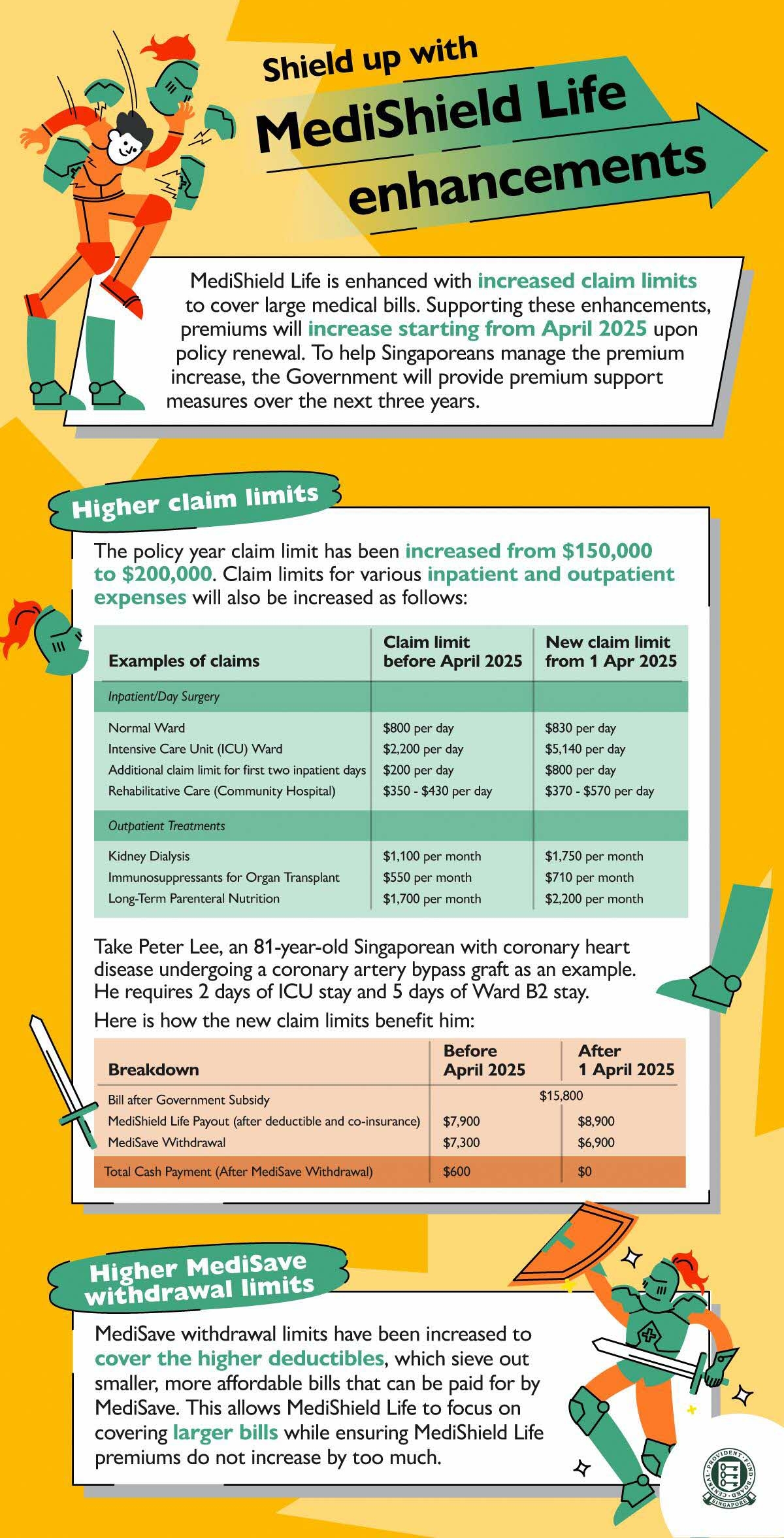

From April 2025, MediShield Life has been enhanced to include expanded coverage and higher claim limits — helping ensure that the scheme remains relevant and continues to provide members with protection against large hospital bills.

Here are the enhancements to MediShield Life benefits and coverage:

- Increase in inpatient and day surgery claim limits

- Increase in outpatient claim limits and expansion of outpatient coverage

- Expansion of coverage to new high-cost treatments that are clinically effective and cost-effective

With the higher claim limits and expansion of coverage, premiums have been increased to ensure the scheme remains sustainable. Total premium increase will be capped at 35%, and phased in evenly over 3 years, from April 2025 to March 2028.

Premiums (applicable for policy start/renewal date on or after 1 April 2025):

Age next birthday |

Annual premiums* (inclusive of 9% GST) |

Age next birthday |

Annual premiums* (inclusive of 9% GST) |

1-20 |

$200 |

74-75 |

$1,816 |

21-30 |

$295 |

76-78 |

$2,027 |

31-40 |

$503 |

79-80 |

$2,187 |

41-50 |

$637 |

81-83 |

$2,303 |

51-60 |

$903 |

84-85 |

$2,616 |

61-65 |

$1,131 |

86-88 |

$2,785 |

66-70 |

$1,326 |

89-90 |

$2,785 |

71-73 |

$1,643 |

> 90 |

$2,826 |

*Before Government subsidies and support

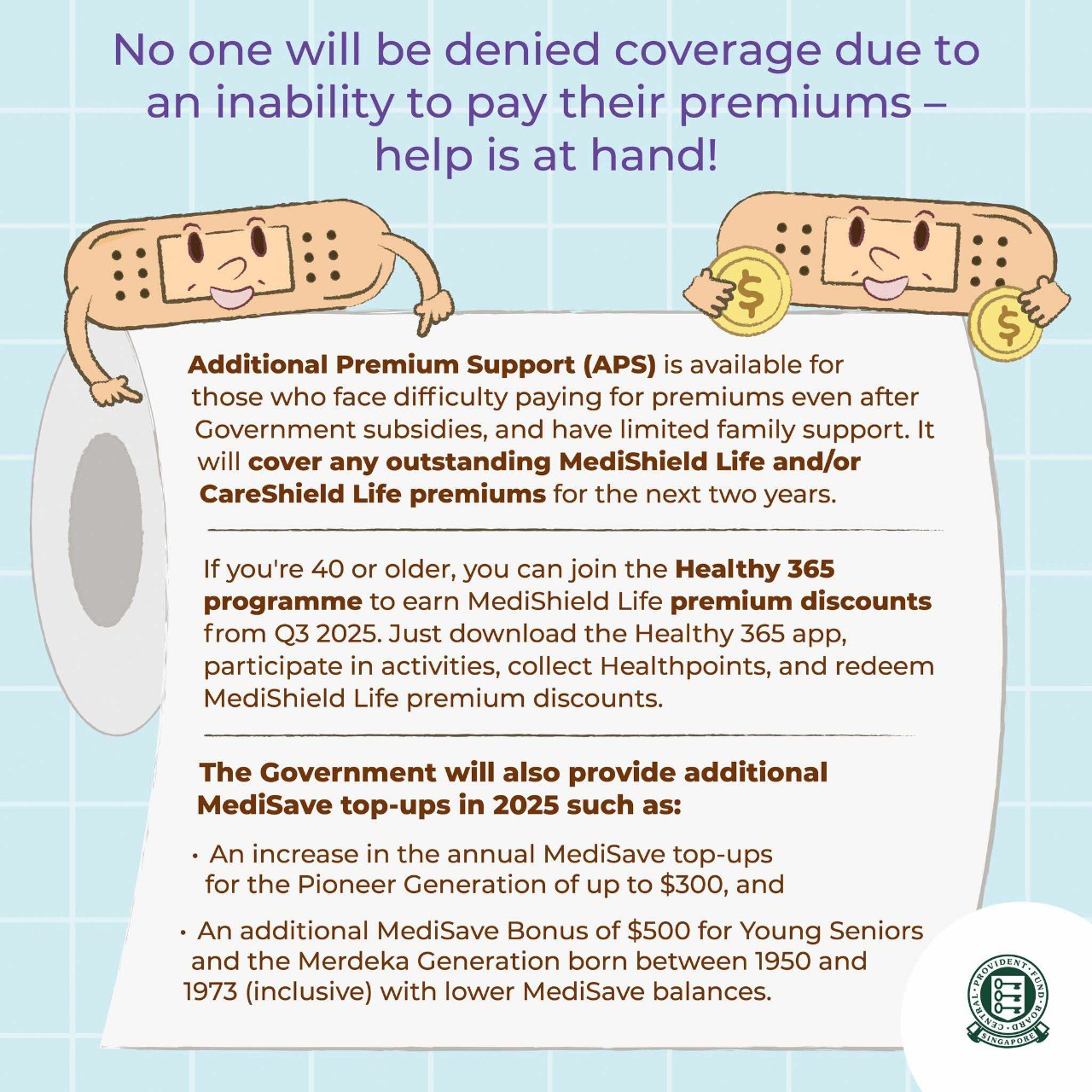

No one will be denied coverage due to an inability to pay their premiums.

The Government will provide an additional $4.1 billion in support measures to aid the transition, comprising $3.4 billion in MediSave top-ups and $0.7 billion in premium subsidies for the next three years.

For more than nine in ten Singaporeans, the support measures will more than offset the premium increases over the next three years.

Announced during Budget 2025, a five-year Matched MediSave Scheme (MMSS) will be introduced from 2026 to 2030 to boost the healthcare adequacy of senior Singaporeans with lower MediSave balances.

Under the MMSS, the Government will match every dollar of cash top-ups to the MediSave Account (MA) of eligible CPF members, up to an annual cap of $1,000.

Who is eligible?

Age |

Between 55 and 70 |

MediSave |

Less than 50% of the |

Average Monthly |

Not more than $4,000 |

Annual Value of |

Not more than $21,000 |

Property |

Own not more than one |

Eligibility will be automatically assessed every year, and CPF Board will notify eligible members at the beginning of each year, from January 2026. The matching grant by the Government will be disbursed to eligible members in the following year.

Anyone, including eligible members themselves, their families, employers, and the community, can make the top-ups* to the eligible member’s MA.

*Cash top-ups that attract government matching grant will not qualify for tax relief.

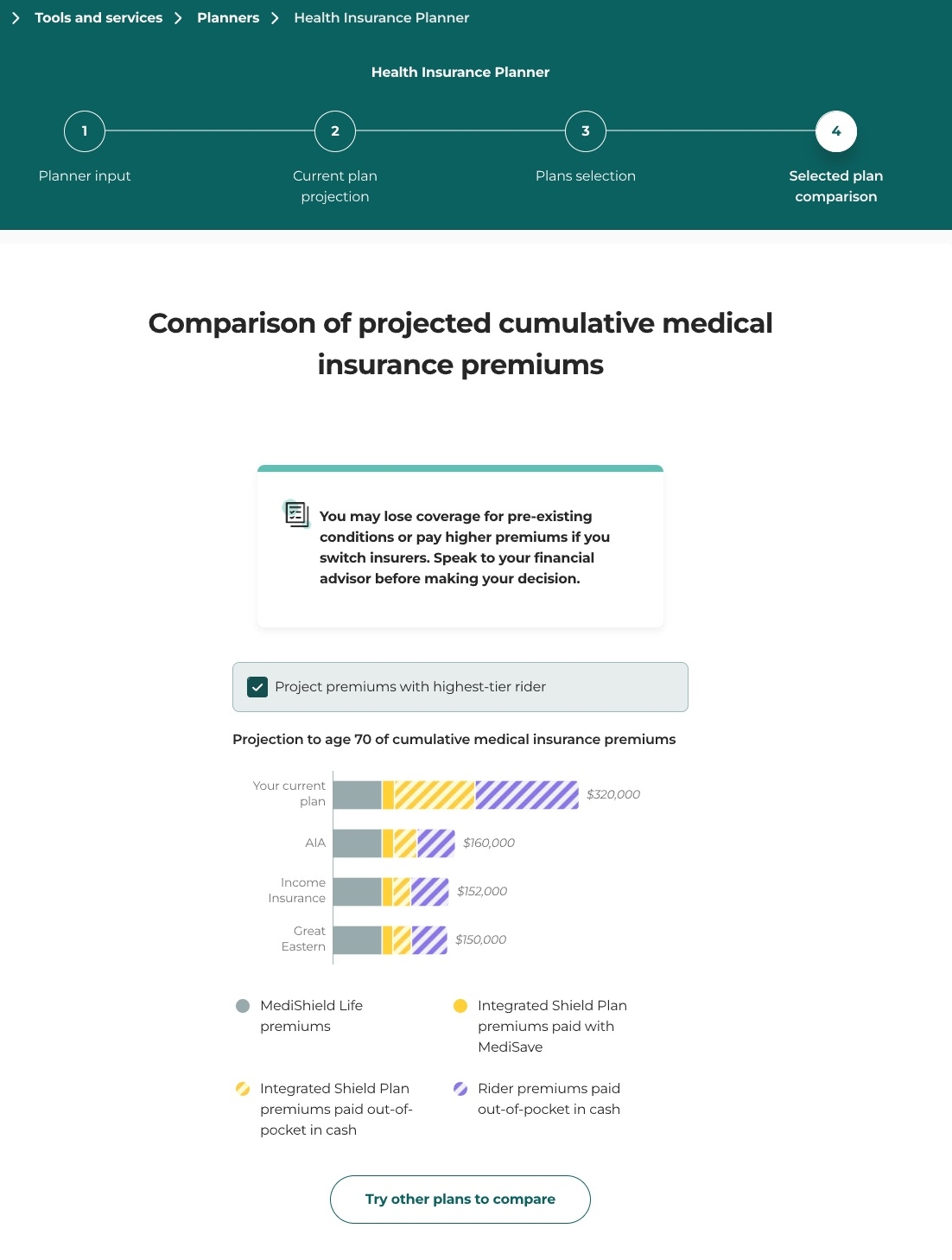

To help you evaluate long-term affordability and make informed decisions about your health insurance, CPF Board and the Ministry of Health launched the Health Insurance Planner (HIP), an interactive and personalised tool. In just four steps, the HIP allows you to:

- Have personalised projections of your long-term MediSave savings and health insurance premiums

- Compare benefits, features and premiums across Integrated Shield Plans (IPs) for your preferred ward type

- Project the long-term premiums for your selected IP and rider

These features provide you with a consolidated view to better review and plan your healthcare coverage. Before you start using the planner, make sure you have the following information:

- The names of your IP and rider (if any)

- The number of years left for you to pay for your CareShield Life and ElderShield Supplements

- Your monthly income and additional income (such as bonus) before CPF deduction.

This will allow you to easily view all your projections and comparisons in just 4 steps – all in about 15 minutes!

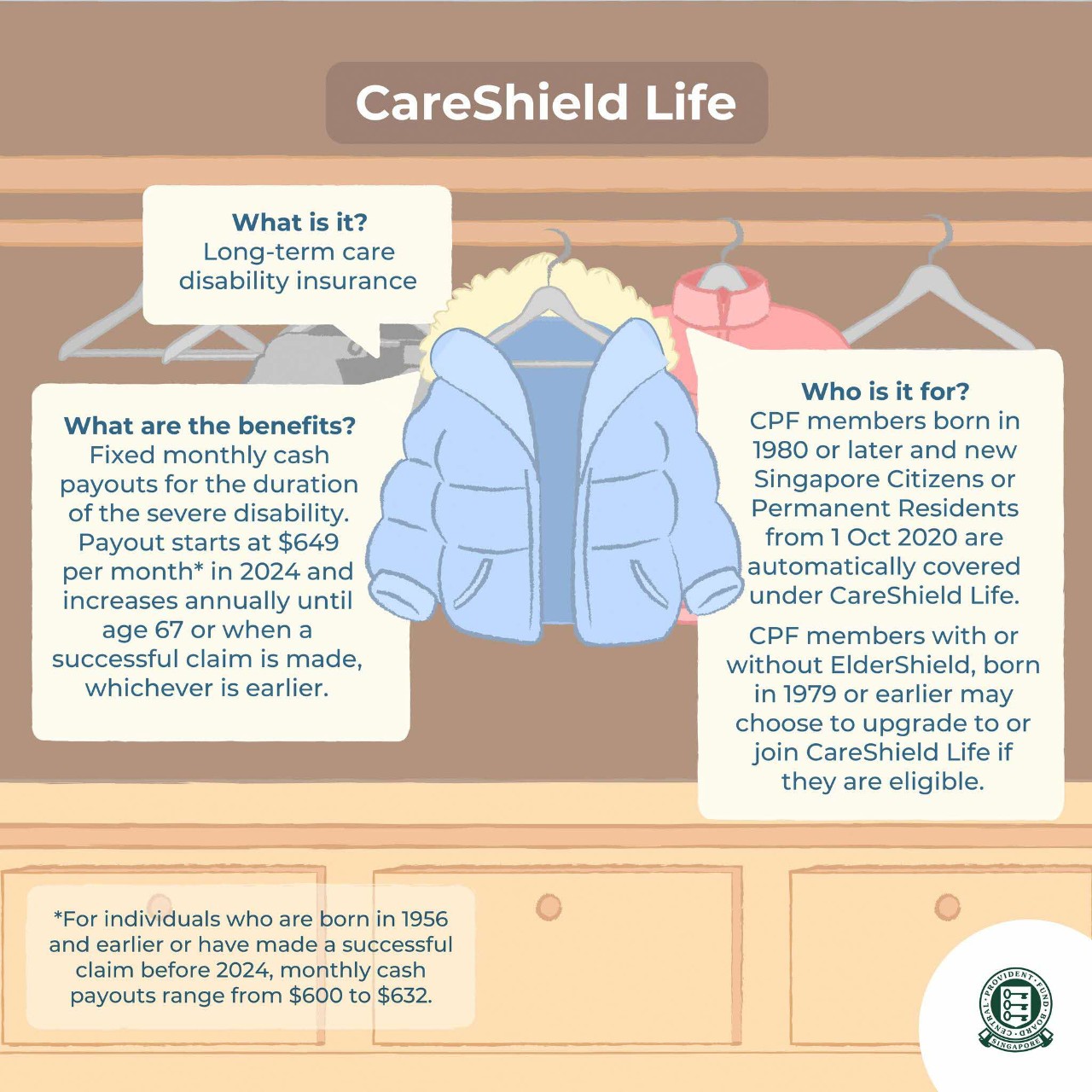

Launched in 2020, CareShield Life is a national long-term care insurance scheme that provides monthly cash payouts to support individuals with severe disabilities. It’s mandatory for Singapore Citizens and Permanent Residents born in 1980 or later, while those born earlier can choose to opt in.

Under the scheme, policyholders who are unable to perform at least three out of six Activities of Daily Living (ADLs) — such as washing, dressing, or feeding — will qualify for payouts.

1 in 2 Singapore Residents are expected to develop severe disability in their lifetime, therefore long-term care planning is becoming increasingly essential.

CareShield Life is undergoing its first review, with recommendations expected in the second half of 2025. Over time, it will play a growing role in helping Singaporeans afford long-term care as the population ages and more individuals are covered.

Information in this article is accurate as at the date of publication.