27 June 2025

SOURCE: CPF Board

As you embark on a new and exciting life stage of retirement, you may start to consider how your lifestyle and living arrangements could change. This may include whether your existing home still serves your future needs and priorities. If you are looking for more suitable housing options, consider ‘right-sizing’ your current home.

A major advantage of right-sizing your home is the possibility of cash proceeds, which can boost your retirement income. Beyond monetary benefits, a smaller house means easier and quicker cleaning as it may be increasingly challenging to maintain a large house as you age. If your children have already moved out, staying in a big empty space might also heighten the feeling of loneliness.

Some of the considerations that retirees think about include moving closer to your friends and family for convenience, and to ensure they will always be nearby to offer support and companionship when needed.

Here are some housing options for your retirement if you are looking to right-size your home.

Community Care Apartments (CCA) give you the luxury of your own space while letting you enjoy the perks of being part of a community. Recently launched in 2021, this joint initiative by the Ministry of National Development (MND), Ministry of Health (MOH) and Housing & Development Board (HDB), features senior-friendly housing with care services. This makes it ideal for individuals aged 65 and above who cherish their own independence.

The CCAs have been well received, with a vibrant project in Bukit Batok and Queensway and Bedok on the way. Inspired by the response and the growing need from seniors for such homes, HDB has extended this initiative through its fourth project at Geylang Merpati Alcove.

Video source: HDB

Image source: HDB

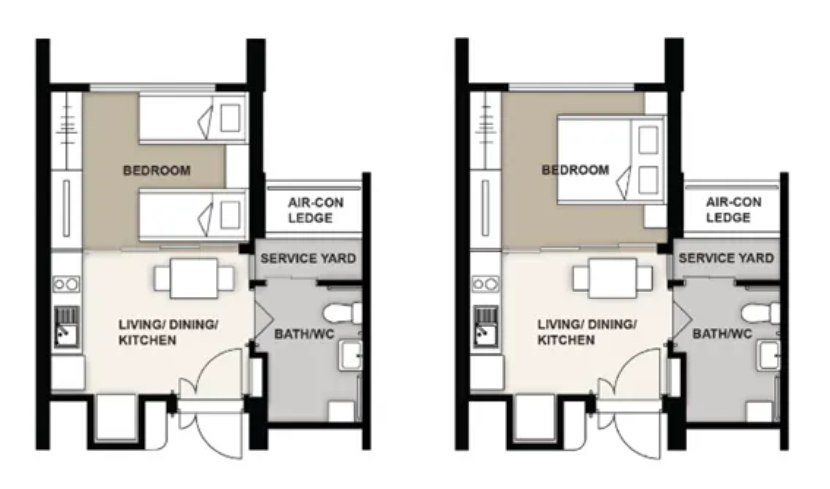

Each CCA unit has an internal floor area of 32 square metres (35 square meters, inclusive of air-con ledge), and comes fully furnished and fitted with elderly-friendly features including:

- Wide and wheelchair-friendly main door with a built-in bench at the side

- Wheel-chair accessible bathroom fitted with grab bars and slip-resistant flooring

- Built-in wardrobe and cabinets

- Furnished kitchen (appliances are not provided)

- Easy-to-slide partitions between rooms for privacy

Each block will have dedicated communal spaces on every floor to encourage residents to forge meaningful friendships with their neighbours and thrive in enriching group activities.

Eligibility conditions

You must be a Singapore Citizen (SC) to apply. If you are applying with your spouse, they must be included either as a core member or core occupier. All buyers and their spouses must be at least 65 years old at the time of application.

If you are applying with your parent(s) or child(ren), only one of them must be an SC or SPR.

The 2-room Flexi flats from HDB provides the flexibility of selecting your preferred lease duration through five-year increments from 15 to 45 years. However, the lease must cover the youngest owner until at least age 95. This will be suitable for those aged 55 and over who prefer a smaller home to upkeep.

If you are planning to buy a 2-room Flexi flat in close proximity (i.e., within 4km) to your married child (HDB flat or private property), you can enjoy priority under the Senior Priority Scheme (SPS), offering you increased chances of securing a flat near your loved ones.

Features

The 2-room Flexi-flats come in two sizes: 36 square metres and 46 square metres.

These senior-friendly short-lease flats are fitted with grab bars. In addition, HDB offers you the option to add on other senior-friendly features in your flat. These include built-in kitchen cabinets with induction hobs and cooker hood, kitchen sink, and a built-in wardrobe.

Unlike CCAs, most of the 2-room Flexi flats are within larger developments which are home to residents of all ages. There are also no compulsory service packages you would have to subscribe to.

Eligibility conditions

Similar to the Community Care Apartments, you must be a Singapore Citizen (SC) to apply. If you are applying with your spouse, they must be included either as a core member or core occupier. All buyers and their spouses must be at least 55 years old at the time of application.

If you are applying with your parent(s) or child(ren), only one of them must be an SC or SPR.

Note: You are not eligible to buy a short lease 2-room Flexi Flat or Community Care Apartment if you or any listed core member(s) had previously enjoyed two or more subsidised housing units and one of which was a Studio Apartment or a short lease 2-room Flexi flat or Community Care Apartment.

The resale market also offers a wide array of flats readily available to you. Resale flats come in diverse sizes, age and locations, each influencing their market value.

When buying a flat, remember to prioritise your retirement needs and set a feasible budget before locking in your decision. Additional costs such as renovation and maintenance will also be incurred so it’s wise to also factor this into your planning.

It truly depends on your priorities, needs, preferences, and financial considerations in your retirement journey.

If you hope for a like-minded community

If you would like to be in closer proximity and engage with friends and a like-minded community, the Community Care Apartments (CCA) would be a viable option.

If you prefer to live close to family

Alternatively, if you prefer staying near to your children, you may opt for the short-lease 2-room Flexi flats with more available units across Singapore. Lastly, if you prefer greater variety in terms of flat sizes and locations, do consider resale flats which best suit your retirement budget and needs.

As you plan your retirement and consider right-sizing your current home, we want to help you make informed financial decisions. The Home Purchase Planner can help assess your current financial position, using the estimated sales proceeds from your current home, to calculate a suitable home purchase budget. Use this handy tool to learn how your new home purchase could impact your retirement plans.

If you prefer to continue living in your existing home and are looking for ways to unlock more retirement funds, do check out these housing monetising options to see which best suit your needs.

Making a housing decision is a significant move as you look towards retirement. Take the time to evaluate what’s most important to you, and consider the options available to make the best decision to support your retirement needs.

The information provided in this article is accurate as of the date of publication.