26 Jan 2024

SOURCE: CPF Board

As a parent, you want to give your child the best possible start in life. While there are many ways to do so, the simplest one is to leverage the stable interests offered by CPF to build up their CPF savings.

Start growing your child's savings early

Even small contributions made early on in your child's life can grow significantly over time thanks to the power of compounding. If you start setting aside $100 a month for your child at age 1, with an average annual return of 4% per annum, their money will grow to over $36,000 by the time they turn 21.

If you’re looking for a good place to park your child’s extra monies received during the festive season, consider making a cash top-up to their CPF Accounts. You can choose to top up:

directly to their Special Account (SA) via the Retirement Sum Topping-Up Scheme (RSTU)

directly to their MediSave Account (MA)

Do note that no tax relief is given for top-ups to your child’s CPF accounts.

For CPF members below age 55:

Ordinary Account (OA):

OA savings grow steadily at a risk-free interest rate of 2.5% per annum, providing a solid financial foundation.

When your child wants to purchase a home, the accumulated OA savings can play a significant role in financing their dream home.

Special Account (SA):

SA savings grows at 4% per annum, boosting your child’s future retirement income.

MediSave Account (MA):

MA savings grows at 4% per annum, providing a safety net for your child’s healthcare needs. It can be used to pay for medical expenses, including premiums for MediShield Life or approved private Integrated Shield Plans (IPs), hospitalisations, approved outpatient treatments, day surgeries, and recommended vaccinations.

On top of that, there’s 1% extra interest to be earned on the first S$60,000 of combined balances (capped at S$20,000 for the OA). The extra interest earned will go into the SA.

How to make a cash top-up to your child's CPF account

You can make a cash top up to your child's SA at your own convenience on the CPF website or CPF Mobile.

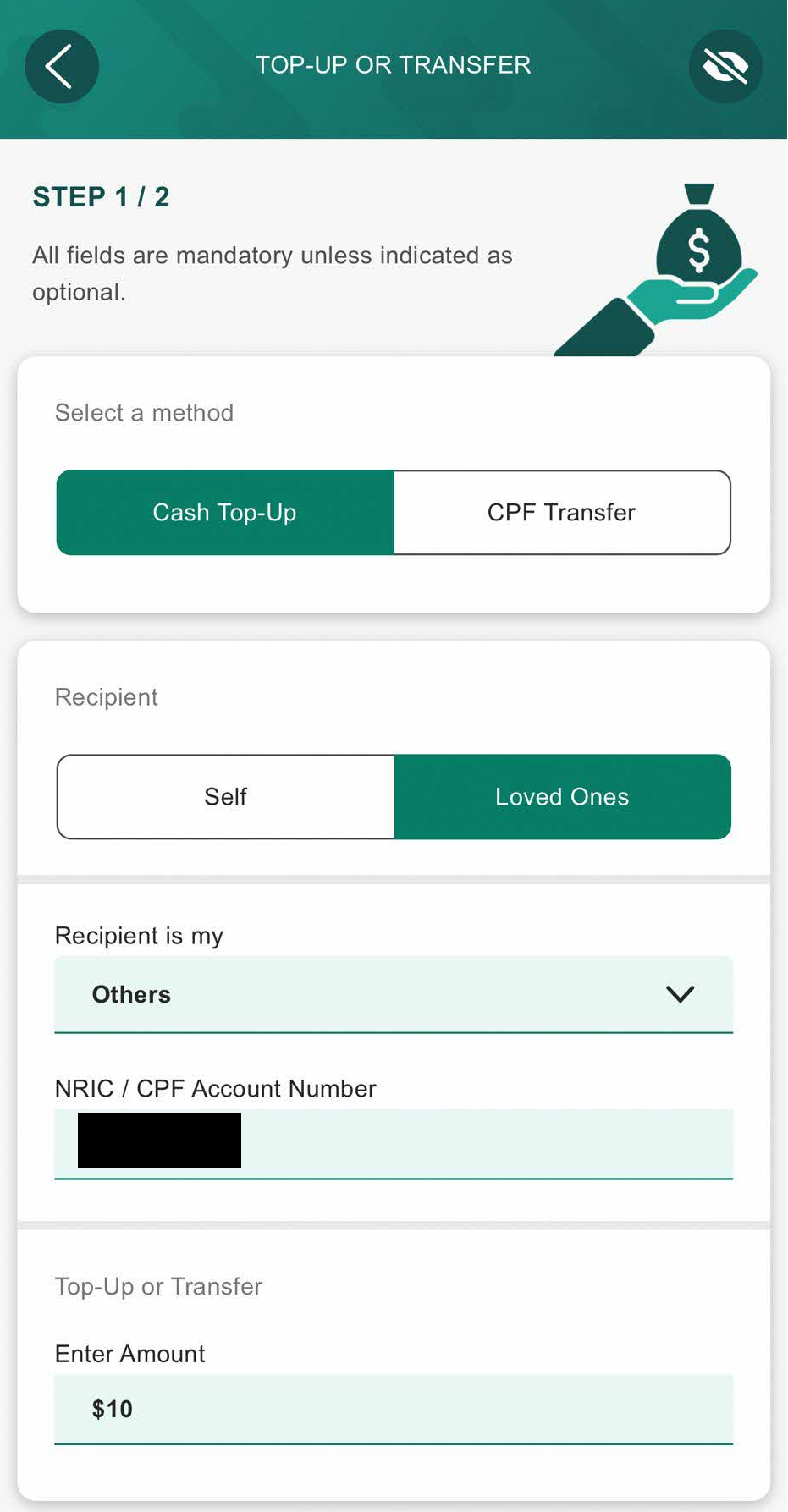

Step-by-step guide on CPF Mobile:

1) Log-in via your Singpass, select “Services” and “Cash Top-up and CPF Transfers”.

2) Fill in the mandatory fields:

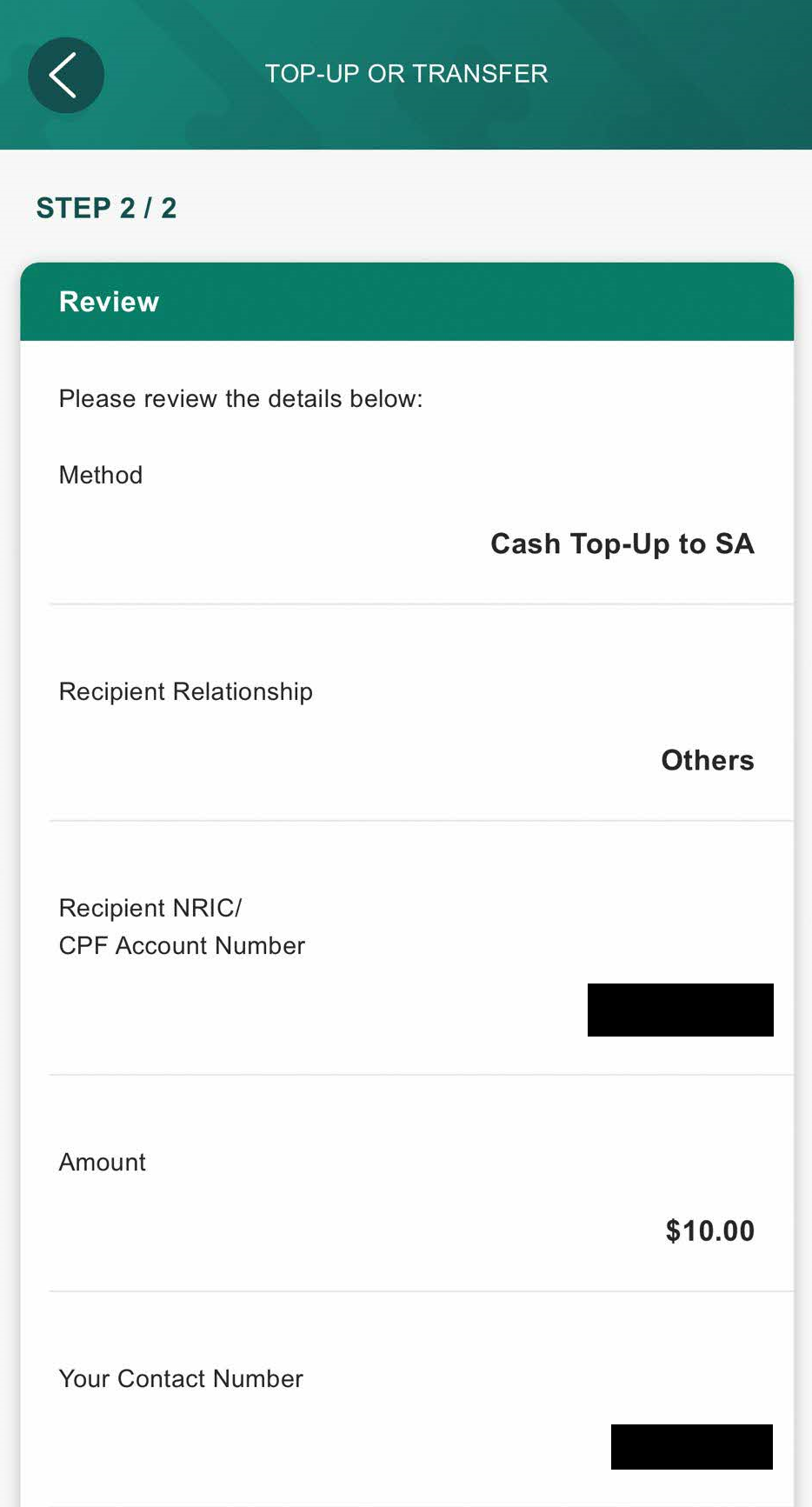

3) Review the details before confirming the submission and making payment:

To make a top-up to your child’s MA, use the form under Healthcare Financing - Top Up to My/My Loved One's MediSave Account for Healthcare Insurance Premium Payment.

Input your own NRIC/CPF Account Number to indicate yourself as the Giver.

You will be prompted to key in your Recipient's NRIC/CPF Account Number subsequently, along with other mandatory fields before making payment.

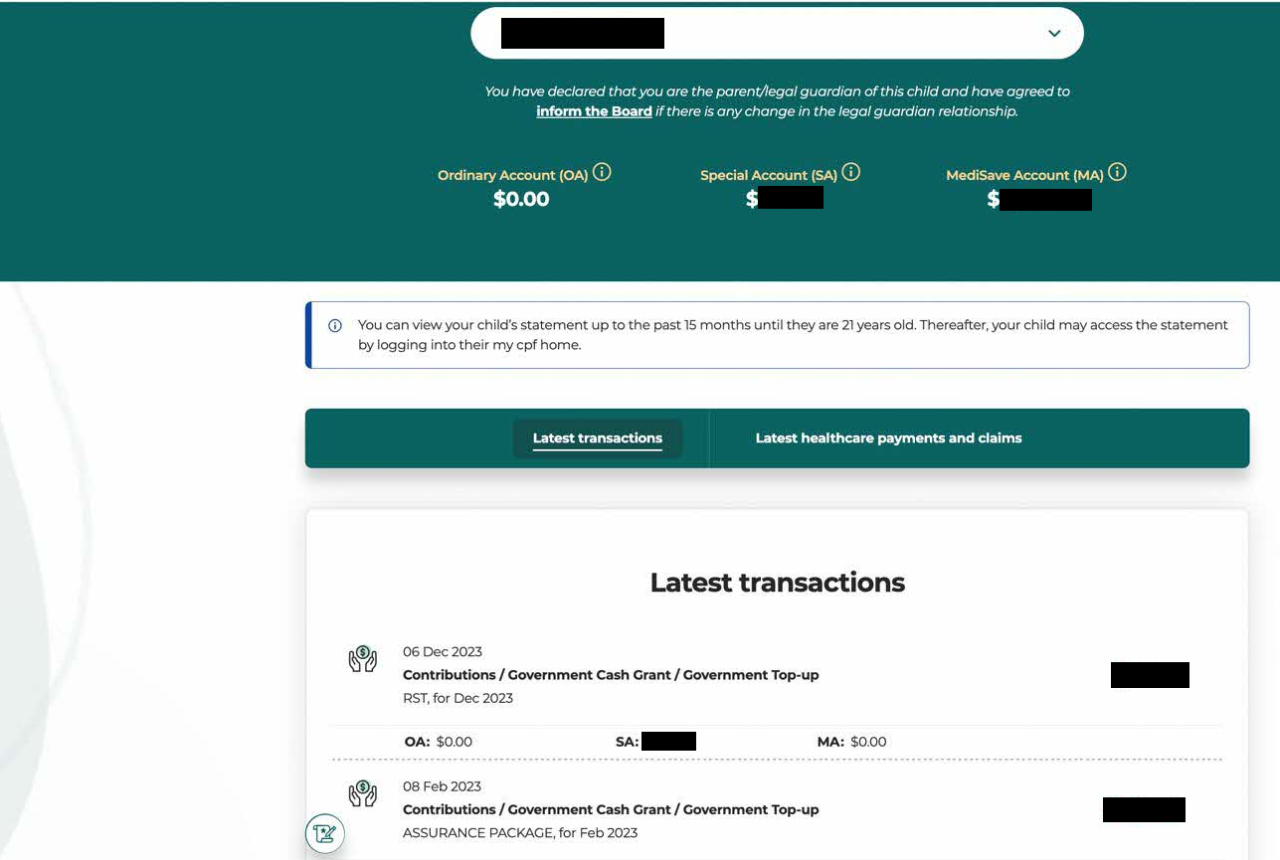

How to check and manage your child's CPF accounts

You can log in to the CPF website to view your child’s CPF transaction history, as well as healthcare payments and claims. Here is a step-by-step guide on how to check your child’s CPF account.

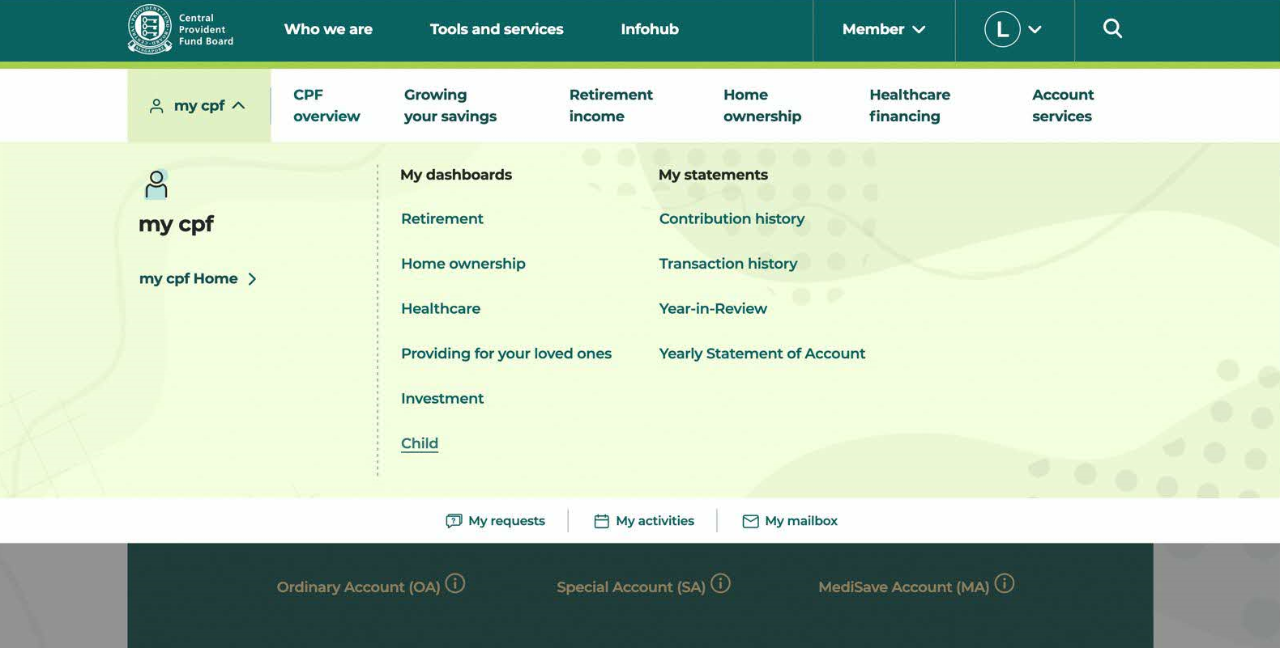

1) Log in with your Singpass. Once you're logged in, navigate to "my cpf" and click on "Child" under the "My dashboards" section:

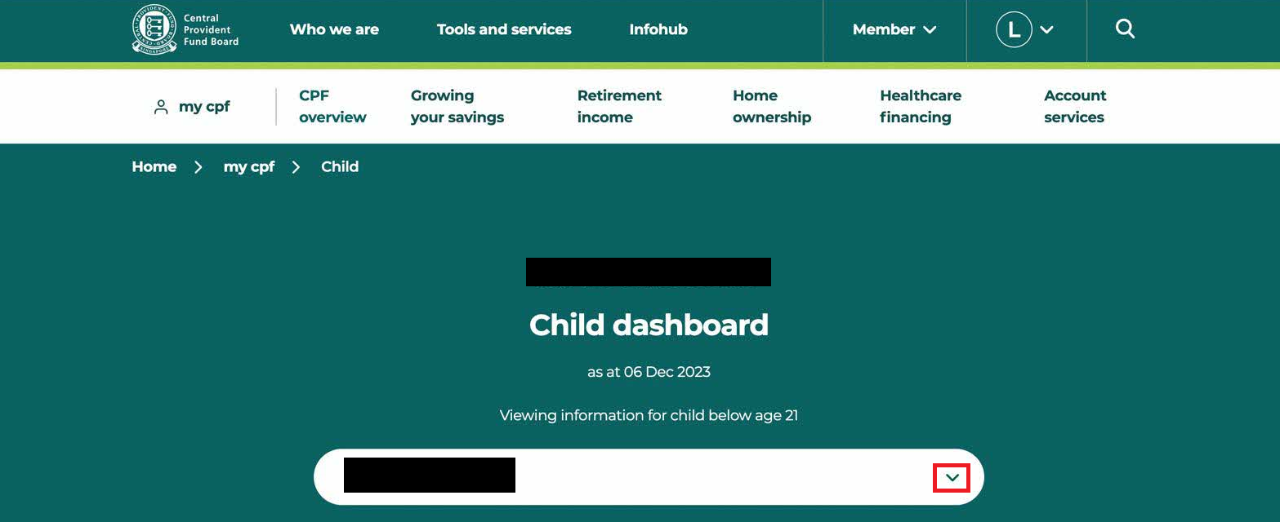

2) Select your child’s name from the drop-down box:

3) You will be prompted to make a declaration:

4) Once you've completed the declaration, you'll see your child's current CPF balances. You can also view the latest transactions, healthcare payments, and claims made in the last 15 months, as shown below:

Managing your child's CPF accounts has never been easier. The intuitive CPF website and user-friendly CPF Mobile allow you to conveniently make top-ups, track account balances, and oversee your child's financial well-being with just a few clicks or taps.

By making contributions to their CPF accounts, you can set them on a path towards a secure future. Start today!

Information in this article is accurate as at the date of publication.