Check out useful tips and resources, get inspired by others, and make an appointment with a trainer from the Institute for Financial Literacy (IFL), to help you make better decisions for your financial goals.

19 Jan 2024

SOURCE: CPF Board

Imagine driving through life with no map, no destination, hoping for the best, only to end up in places you didn't expect. But what if you could chart a course and a roadmap to a life that's truly fulfilling? That's where financial goals come in.

Working towards your financial goals isn't about becoming a budgeting guru or eating grass1. It's about taking control of your present, deciding what matters most, and creating a future that excites you. Financial goals are the fuel that propels you towards those dreams, and the good news is, getting there is not as difficult as you think.

It's about progress, not perfection, and it's a journey you can take at your own pace, with a little help from this guide.

1 Being in a situation of having no money for daily expenses (i.e. broke)

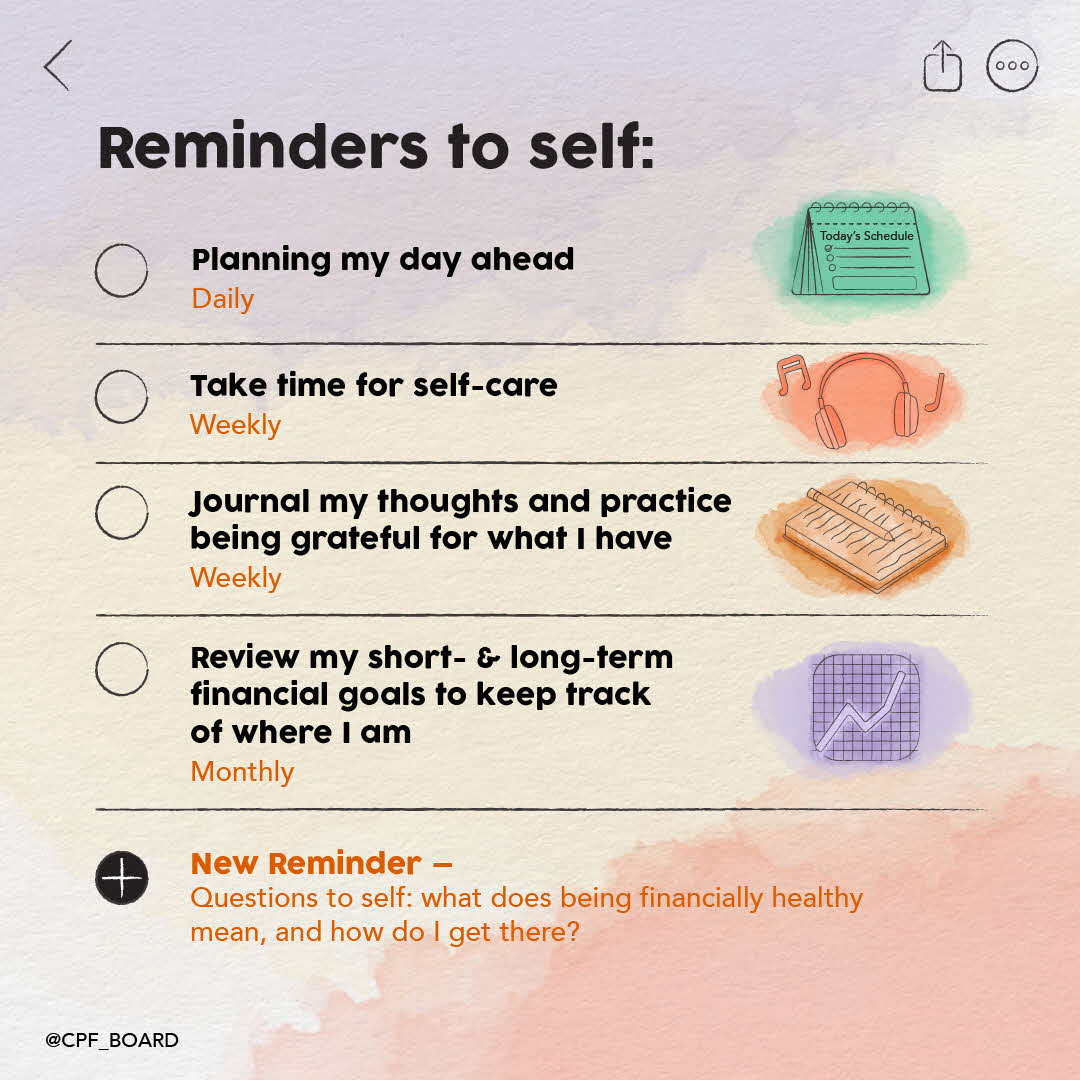

Surprise - the first step isn’t about budgeting or growing your money. While these are essential, your goals are built on a less discussed but equally important foundation: your personal wellness. Just like how a sturdy house needs a strong base, your financial journey needs a foundation that is “well” enough to thrive. Here's how working on yourself can help:

Plan your day ahead: whether it is creative pursuits or spending time with loved ones, invest in things that bring you joy.

Take time for self-care: practices like exercise and sleep nourish your well-being, leading to calmer and more mindful financial decisions.

Journal your thoughts and practice being grateful for what you have: remind yourself of the “why” behind your financial goals. Appreciating how your efforts have improved your life gives you the motivation to keep pushing forward. This positive outlook can reduce scarcity thinking and impulsive spending.

In essence, self-care and gratitude journaling are not just feel-good exercises, but powerful tools for cultivating a healthy mindset and approaching financial decisions with clarity and confidence.

Next, paint a clear picture of your current financial situation. This includes:

Check if you’re financially healthy: Subtract your total liabilities (e.g. home mortgage, credit card debt) from your total assets. This will give you a snapshot of your overall financial health.

Track your income and expenses: Understand where your money is going – from essential expenses like food and transportation to your wants like entertainment and shopping. This will help you allocate your money more effectively.

Manage your debts: List all your outstanding debts, including the payment terms and interest rates of each. This will help you develop a plan for repayment.

Remember, reviewing your finances isn't a one-time activity but an ongoing process of self-monitoring and adaptation. By making it a regular habit, you can ensure your finances support your evolving needs and goals.

Think about what you want to achieve financially in the short and long term. Do you want to save for a downpayment on a house, plan a dream vacation, or secure your retirement? Be specific and realistic about your goals and set achievable deadlines.

Goals often fall through because they are:

1) Vague: “I want to earn a lot of money”

Think of this as throwing a dart at a blank wall. It might stick, but it's more likely to land flat on the ground. "A lot" is subjective. Is it $1,000 extra a month? Or $1 million a year? Without specifics like “paying off my home loan by age 40”, you won’t know where to focus or what steps to take.

2) Unrealistic: “I want to be a millionaire in five years"

This is like trying to leap from your living room to the moon. It might sound exciting, but it's setting yourself up for disappointment (and maybe a broken leg). Huge leaps are great, but they need smaller, achievable steps in between.

When it comes to financial goals, every little step matters. For example, if your long-term goal is to sustain your current lifestyle in retirement, break them down into small steps in that direction:

Review your healthcare insurances to see if they are sufficient and affordable, as premium increase with your age

It can even be micro-goals like "top up $50 to my CPF Special Account (SA) this week" or "give my fancy coffee a miss."

Celebrate each small win, even if it's just a mental high five. Small wins build momentum and make the journey more fun.

Once you have defined your goals, figure out what it will take to reach them. This may involve:

Calculating the gap: Estimate the difference between your current financial state and where you need to be to achieve your goals.

Cutting expenses: If you are currently spending a large portion of your income on “wants” like shopping and entertainment, allocate them to your savings/investments instead.

Identifying additional income sources: Explore ways to increase your income, such as taking on a side hustle or investing in yourself through professional development.

Researching financial products and services: There are reliable information sources like the CPF’s educational resources to explore various financial options, such as CPF top-ups and other types of investments, that can help you bridge the gap and achieve your goals.

You can give your retirement plan a boost with these five tips:

Wherever your heart is, there you will find your treasure. You’ve got to find the treasure, so that everything you have learned along the way can make sense.

Paulo Coelho’s best-selling book “The Alchemist” reminds us: true focus comes not from rigid concentration, but from mindful engagement with life. By appreciating the present moments and its wonders, you can naturally achieve your goals without obsessing over them.

So, find your passion and let it fuel your financial aspirations.

To help you stay motivated:

Find your “partner-in-crime”: Team up with someone who's got your back (and a good head for numbers). Check in with each other, share tips, and celebrate each other's successes.

Reward yourself strategically: Instead of splurging on fleeting pleasures, reward yourself with experiences or things that align with your goals. Treat yourself to a weekend getaway or a creative workshop to recharge your motivation.

Financial planning doesn’t have to be a chore. By focusing on the big picture, setting clear goals with the right tools and resources, you can turn achieving your financial goals into a surprising (and maybe even fun) adventure.

Remember, progress, not perfection, is key. Take small, consistent steps, and celebrate your progress along the way. It's time to chart your course to a life that's truly yours, one fulfilling step at a time.

Information in this article is accurate as at the date of publication.

.jpg)