5 Aug 2025

SOURCE: CPF Board

Many turn to social media when they’re researching something, and health insurance is no exception. Scroll through Reddit threads or Telegram chats, and you’ll likely spot the same questions: “Am I overpaying for my coverage?” or “Am I over-insured?” While social media can offer quick opinions, the sheer volume of conflicting advice often makes it hard to know what to trust.

The answers vary wildly. But beneath the anecdotes and opinions lie a shared uncertainty: most people don’t really know if they’ve struck the right balance between assurance and affordability.

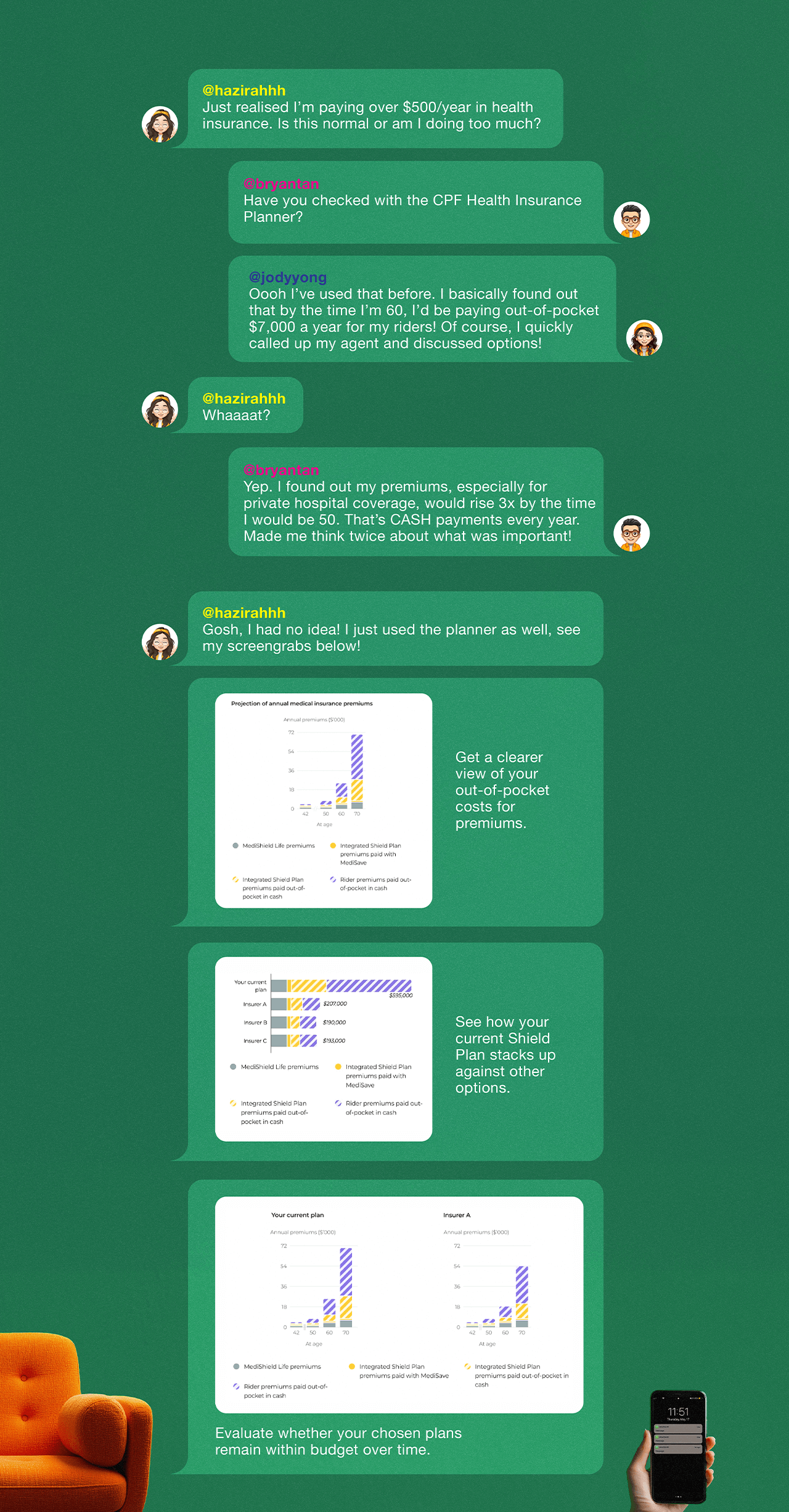

That’s where CPF Board’s Health Insurance Planner comes in. The tool helps you review your existing coverage, compare your coverage with other Integrated Shield Plans (IP), and project your long-term medical insurance premiums, all in one place. It takes the guesswork out of protecting yourself and your loved ones, and replaces it with clear, actionable insight.

In this article, we’ll unpack how health insurance decisions can go off course, what it could be costing you, and how to use the Health Insurance Planner to make smarter, more confident choices going forward.

Protection or Pitfall?

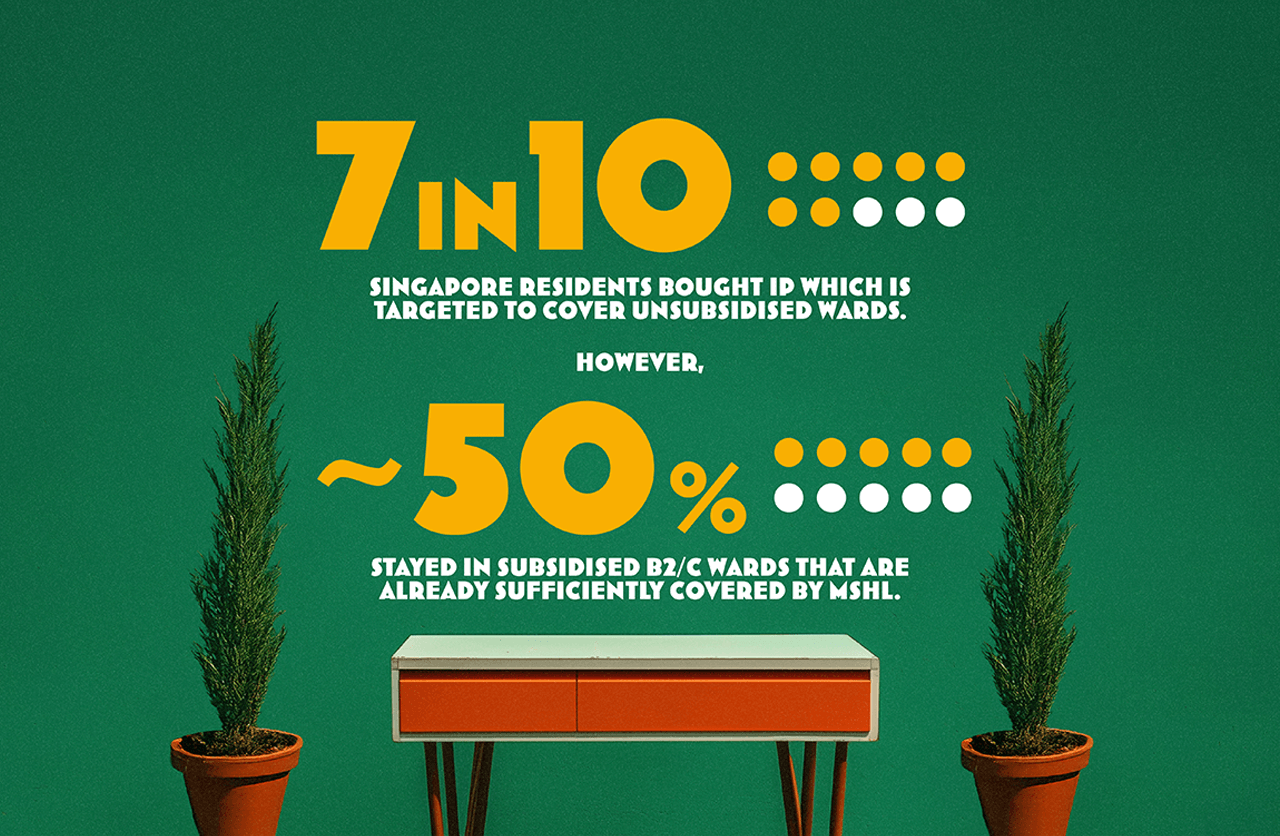

You don’t set out to over-insure yourself but it happens more easily than you think. A surge of fear after reading about rising healthcare costs. Or simply a desire to “do the responsible thing,” even without fully understanding what’s already covered. But over-insurance isn’t just about paying too much; it’s also about not making full use of what you’re paying for. Many who buy additional insurance plans and riders actually don’t end up fully using the extra benefits. In fact, even though 7 in 10 Singaporeans have IPs, about half of IP policyholders chose to stay in subsidised Class B2/C wards that are already sufficiently covered by MSHL.

Without a clear sense of how your insurance plans complement one another, the costs can add up to substantial expenses over time. For example, when you’re 30, you could be paying $1,000 annually out-of-pocket for your IP and rider premiums. When you’re 40, this could rise to $3,100.

And if you’re in your 40s or 50s, the wake-up call might have already arrived. Premiums begin to rise sharply, sometimes even doubling. Your private medical insurance premiums could be up to five times of your MSHL premiums when you are in your 70s or 80s. What once felt like manageable protection now feels like a financial strain, forcing tough decisions about whether to scale back or keep paying more, just to maintain the same sense of security.

What balanced coverage really looks like

Adequate healthcare protection doesn’t necessarily mean having the most expensive policy. It means the right coverage for current and future needs, without overextending yourself financially.

Balanced coverage is:

- Aligned to lifestyle and care preferences

- Affordable now and sustainable later

- Reviewed and updated when life circumstances change

For those considering IPs or riders, or even upgrading your current plans, it’s important to assess the full picture. Ask yourself: What kind of care would you prefer, public or private? Can the premiums be sustained not just now, but 20 years from now? And does your existing coverage already sufficiently meet your needs? Remember that MediShield Life (MSHL) and MediSave cover 9 in 10 subsidised hospitalisation bills.

Any decision to change plans or add coverage should be weighed across all these factors, not just one. Focusing solely on long-term costs, for instance, without considering care preferences or overlaps in coverage, may solve one issue but create another. Balanced coverage means ensuring plans complement one another, offering protection that’s both adequate and sustainable over time.

Is it time to reassess?

So how can you tell if you’ve taken on too much coverage?

Start with a simple exercise: list out all current health insurance policies and riders. What does each one cover? What are the monthly costs? More importantly, do they still match your current needs and future preferences?

If you're unsure, the CPF Health Insurance Planner can help you make sense of it all to help you understand future costs and make informed decisions on your health insurance coverage.

The bottom line

Health insurance is one of the most important financial safeguards you can have. But like all protective measures, it needs to be used with intention.

If you’re unsure of where you stand, the next best step is gaining perspective with the right tool. The CPF Health Insurance Planner is designed to help with exactly this:

- Project how your expenses change with health insurance.

- Compare your coverage with other IPs.

- Compare the projected medical insurance premiums of your current and selected plans.

Because the best coverage isn’t just about what looks good on paper. It’s about what works for you today, tomorrow, and when you need it most.

Information in this article is accurate as at the date of publication.