04 Mar 2022

SOURCE: CPF Board

Buying a home is one of the biggest decisions you will make in your life.

While it may seem like a decision for the now, the choices you make will also play an important part in your future. How much you spend now will inevitably trickle down and impact the savings for your future retirement.

So, when you are weighing up the options to purchase your dream home, remember to also keep saving for your future at the forefront of your mind. Use your CPF savings wisely so that you can have your cake and eat it too – buying your home and saving for your future at the same time.

Here’s how to make a holistic and prudent plan for your housing and future needs.

1. Plan your budget

For first-time home buyers, it is important to find a home that you can afford. That means working out a budget based on your current income and cashflow needs.

As a rule of thumb, it is prudent to make sure that your monthly home mortgage repayment does not exceed 25% of your gross monthly income. This will give you some space to cover your current expenses and financial commitments, while also enabling you to save more for the future.

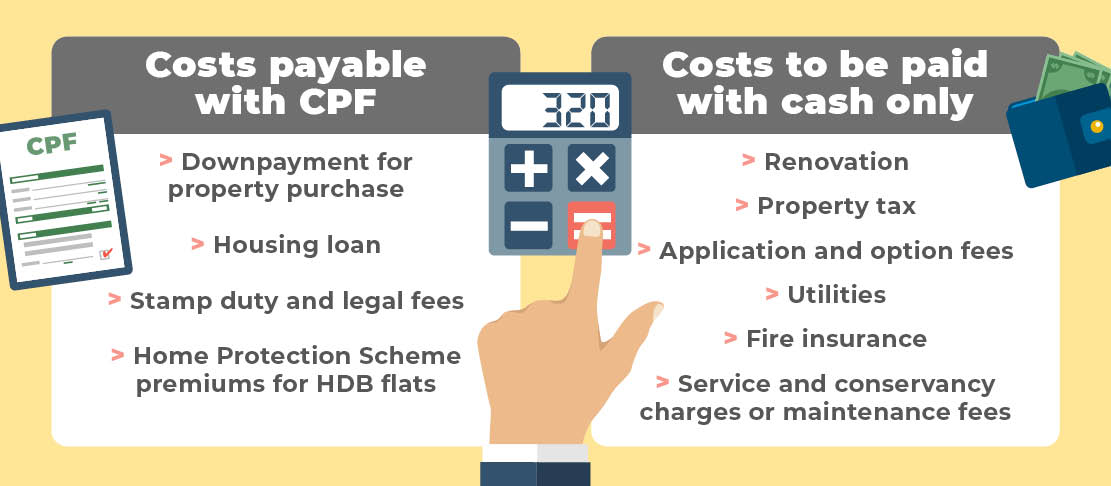

Do keep in mind other housing expenses, such as administrative fees, property tax, and renovation expenses.

While it is tempting to go all out and splurge on your dream home, remember that the more you spend, the less savings you will have for your future needs.

2. Calculate housing limits

Check how much of your Ordinary Account (OA) savings you can use to finance your home purchase. This will be dependent on factors such as the type of property, type of housing loan and whether your home can last you till age 95.

3. Decide on your housing loan

At this point, you probably would have a clear idea of what your housing budget looks like. The next step would be to pick your home loan. There are many factors to consider – fixed or floating interest rates, subsidies, lock-in periods amongst others. Should you choose an HDB loan or bank loan? There isn’t a “best” home loan per se, it depends on your specifics needs and preferences.

Here are the key differences between the two types of housing loans.

4 key differences between an HDB loan and bank loan:

|

HDB Loan |

Bank Loan |

Maximum loan |

Up to 80% |

Up to 75% |

Interest rates |

Pegged at 0.1% above OA interest rate (2.6%) |

Generally lower but may fluctuate with market conditions |

Use of CPF savings |

- May retain up to $20,000 in CPF Ordinary Account (OA)

|

May use or retain any amount in CPF OA (usage up applicable limits) |

Lock-in period |

No, there will be no penalty if you wish to pay off your loans early |

Yes, typically two or three years. You will incur a penalty if you wish to pay off your loans early or refinance your loan with another bank |

4. Find a good balance between using cash and OA monies

Most people view the monies in their OA savings as the main source to finance their home purchase. While it is true that your CPF is an essential cog when it comes to home-financing for most Singaporeans, it is important to recognise that savings in your OA are not just for your current housing needs. Your OA savings go towards building your retirement nest egg as well.

You should hence strike a good balance between using your OA for your housing needs and saving for the future.

It would be more prudent to use a mix of cash and OA savings for your mortgage payments, instead of wiping the latter out entirely for your home purchase. This can provide you with a safety net to continue paying your monthly instalments when unexpected events (such as job loss) occur.

If you take a HDB loan and set aside up to $20,000 in your OA at the point of purchasing your home, your savings can continue to grow, thanks to the attractive risk-free CPF interest rate. The interest rate of your OA and Special Account (SA) is at least 2.5% and 4% respectively and is higher compared to what you get from banks.

Your OA savings can also earn you an additional 1% interest*. The extra interest earned on your OA savings will go into your SA or Retirement Account (RA) which results in you retiring with more.

*Additional 1% is paid on the first $60,000 across all CPF accounts, which is capped at $20,000 for the OA.

If you’ve followed the tips above and have taken the plunge, congratulations! At this stage, you are an owner of a beautiful place to call home.

Here’s more good news — you can still take advantage of CPF’s attractive interest rates after purchasing a home.

5. Make a voluntary housing refund

You can make a voluntary housing refund even without selling your property, especially if you have built up some additional cash savings over the years. The earlier you make a refund, the more interest you can accrue for your future/ retirement savings.

In addition, when you sell your house subsequently, you’ll refund a lesser amount to your CPF account.

Another benefit is that you can use the refunded CPF funds** for other CPF approved schemes, for example to finance your next home purchase.

**Only for refunds credited to the OA

Your CPF is there to support the three basic needs in your retirement — retirement income, housing, and healthcare needs. Your CPF savings will form your eventual retirement income, so every dollar you spend on housing could be a dollar less for your retirement needs.

Use your CPF wisely to help purchase your dream home and build up your nest egg at the same time.

Having a warm home and snug retirement, isn’t that the dream?

Information in this article is accurate as of 4 March 2022.