1 March 2022

SOURCE: Heartland Boy

Since CareShield Life was announced back in 2018, I have been actively monitoring its development to understand how it affects my family’s insurance coverage. I take a keen interest because I am a strong proponent of severe disability insurance coverage. For the past decade, I have witnessed first-hand how my grandparents are unable to perform Activities of Daily Living (‘ADL’). When taking care of a person with severe disabilities, both monetary and non-monetary costs can pile up quickly. I know that I want to manage the financial aspect of it early if this untoward scenario pans out. That is why I have replaced my parents’ ElderShield to CareShield Life for better coverage.

Differences between ElderShield and CareShield Life

Before I explain why I switched my parents’ ElderShield to CareShield Life, I think it is important to explain the key differences between the two policies first. As shown in Diagram 1, I have compared ElderShield 300 against CareShield Life.

Diagram 1: Key differences between ElderShield 300 and CareShield Life

Coverage: Whether it is ElderShield 300 or ElderShield 400, members are free to opt out of the programme. On the contrary, CareShield Life is mandatory for those who are born in year 1980 or later. For existing cohorts born earlier, they have the option of opting in to participate as was the case for my parents.

Pre-existing Severe Disabilities: Those with pre-existing severe disabilities would not be able to participate in ElderShield. Likewise, for those born before 1980, they are unable to join CareShield Life if they have pre-existing severe disabilities. However, those born in 1980 or later and have pre-existing severe disabilities are still eligible to enroll in CareShield Life.

Payout: If insured is unable to perform at least 3 out of the 6 ADLs, ElderShield 300 pays out a fixed amount of $300 per month. On the other hand, CareShield Life pays out from $637/month in 2023 and this increases at 2% p.a. (only until age 67) to catch up with the cost of healthcare. However, once the first payout has been made, the payout amount will be locked in for as long as you are unable to do 3 or more Activities of Daily Living (ADLs). It is pertinent to note that whether it is $300 or $600, this amount is small relative to the cost of hiring a caregiver or helper. That is why ElderShield Supplements and CareShield Life supplements exist to plug this gap. You can also read this interesting narrative of how my mum ended up with 2 ElderShield Supplements.

Duration of Payout: Payouts for ElderShield 300 lasts 60 months (5 years) while payouts for CareShield Life will be lifelong (i.e. until the insured passes away) as long as you are unable to do 3 or more ADLs.

Estimated Premiums: In Diagram 1, I have used an example of an insured who is female and will be 42 years old at the next birthday. Since CareShield Life is more comprehensive and comes with better benefits, it is little wonder that the premiums are more expensive at $285/year compared to $211/year for ElderShield 300.

Premium Duration: Besides being more expensive on an absolute basis, CareShield Life is also required to be paid for a longer duration. Premiums for CareShield Life have to be paid till age 67 (or 10 years for those who join CareShield Life at age 59 or older) whereas premiums for ElderShield 300 are payable until age 65. You can stop paying if you make a successful claim before reaching 67 or the 10-year mark, whichever comes first.

My Thought Process

Before switching to CareShield Life, here are the current coverage that my parents have in terms of severe disability insurance:

- Heartland Boy’s Mum: ElderShield 400 + 1 ElderShield Supplement

- Heartland Boy’s Dad: None as his application for ElderShield + ElderShield Supplement was rejected in early 2021

I explained the differences between CareShield Life and ElderShield to my parents and they understood CareShield Life to be a superior plan that will cost more in premiums. What weighs heavy on my mind was the cost of the premiums given how old my parents are. I take comfort from these facts:

- They are not severely disabled and are hence eligible to enrol into CareShield Life

- The base premiums need to be paid for a period of 10 years. They will enjoy lifetime coverage henceforth

- There are sufficient funds in their respective MediSave accounts to fund the entire premiums.

Premiums previously paid under ElderShield will be taken into consideration as well, as shown in Diagram 2.

Diagram 2: FAQ of ElderShield premiums when switching to CareShield Life (Source: CareShield Life website)

Some of the older folks who are Singapore citizens and belong to the Merdeka or Pioneer generation may also enjoy some subsidies to offset the cost of the premiums. Even though my parents were not eligible for some of these subsidies, I still bite the bullet to enrol them into the programme. The good news is that they recently received their Singapore Citizenship status, and I am checking with MOH if they will be eligible for the subsidies retrospectively.

For those who want an accurate estimate of the premiums payable, kindly log into the Premium Checker e-service found on the CareShield Life website.

CareShield Life Application Process

When I helped my parents to apply for CareShield Life, the application process was relatively straightforward. With their permission, I logged in with their respective Singpass accounts, reviewed their particulars and made some self-declaration. Finally, I put the applicants as the premium payer and received the good news of their enrolment a week later!

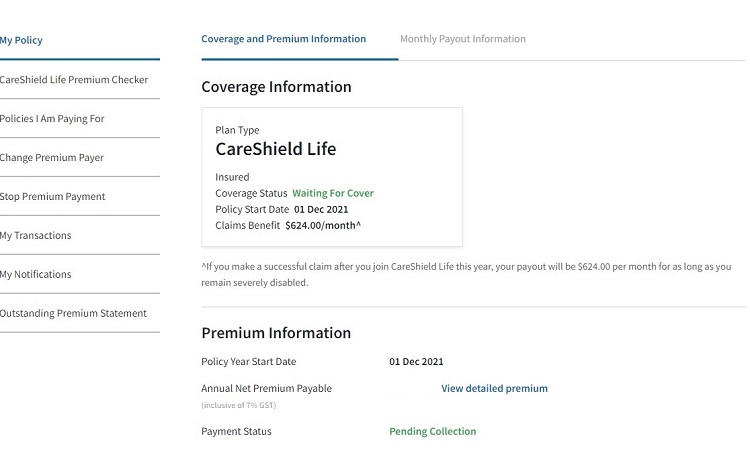

Diagram 3: Screenshot of Heartland Boy's mum CareShield Life premium deduction status

As shown in Diagram 3, you need not worry if you notice that the status of the premium deduction is still pending. I checked in with the officer and she told me that the deduction will be processed in about two months from their CareShield Life’s approved date. She also assured me that the coverage is already effective from the date of approval, notwithstanding that the premium has not been deducted yet.

Conclusion

Despite this change, my mum’s ElderShield Supplement remains intact/in force. This is an important point to reiterate as the ElderShield Supplement can also work alongside CareShield Life cover and do not need to be terminated. There is no need to worry about or worse, cancel your existing ElderShield Supplement just to make the upgrade to CareShield Life.

As for my dad, my financial advisor and I will still be trying to purchase a CareShield Life Supplement after the 1-year time out requested by the insurer lapses. I am determined to give it one more shot as the window to enter is narrowing given his age. As for now, I can rest easy with the knowledge that both my parents have basic coverage against severe disabilities.

This article was first published on heartlandboy.com

Information in this article is accurate as at the date of publication.

.jpg)