31 August 2023

SOURCE: CPF Board

Singaporeans are living longer than they used to. With the average life expectancy at birth increasing from 82.1 years in 2012 to 83 years in 2022, what does this mean for the average Singaporean?

Many may think that living longer is a good thing, but it can also suggest that more people might need extra help and care as they age.

A report by the Ministry of Health tells us that one in two healthy Singaporeans who reach 65 are expected to become severely disabled in their lifetime. Think about someone you know who may need help with assisted living – having long-term care insurance such as CareShield Life or ElderShield can help with providing valuable financial assistance.

Long-term care insurance provides financial support when you need extra help with daily living activities such as dressing, eating, or moving around the house. Think of it as a safety net for financial needs in the event of a disability.

To receive monthly payouts, you must be evaluated by a Ministry of Health (MOH)-accredited assessor who will confirm your inability to perform three out of the six Activities of Daily Living (6 ADLs) listed below:

| Washing | The ability to wash in the bath or shower (including getting into and out of the bath or shower) or wash by other means. |

| Dressing | The ability to put on, take off, secure, and unfasten all garments and, as appropriate, any braces, artificial limbs, or other surgical or medical appliances. |

| Feeding | The ability to feed oneself food after it has been prepared and made available. |

| Toileting | The ability to use the toilet or manage bowel and bladder function through the use of protective undergarments, such as diapers or surgical appliances, if appropriate. |

| Mobility | The ability to move indoors from room to room on level surfaces. |

| Transferring | The ability to move from a bed to an upright chair or wheelchair, and vice versa. |

The payout duration and the amount paid differ between ElderShield and CareShield Life. Continue reading for an overview of both plans.

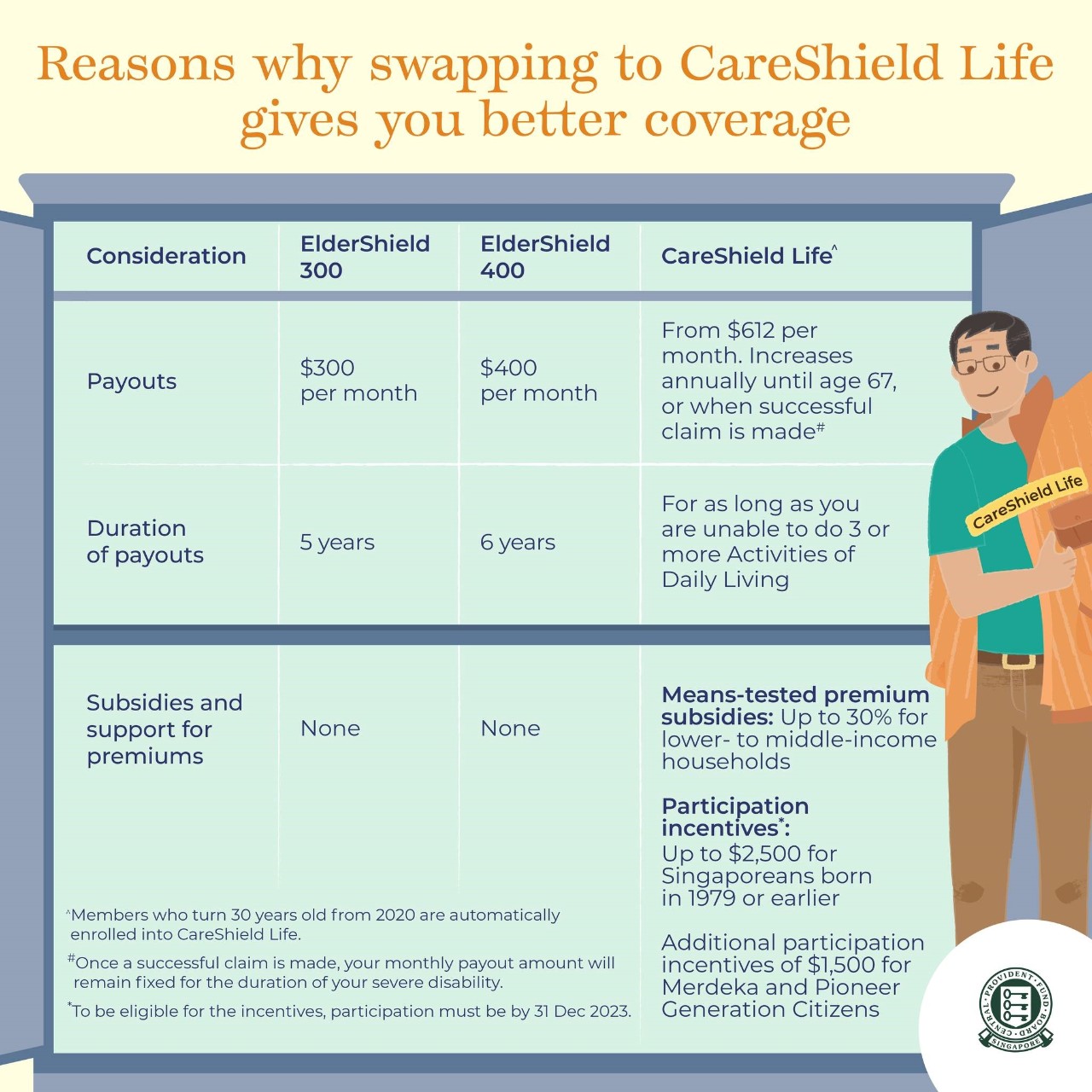

ElderShield was introduced in 2002 as a basic long-term care insurance scheme. Policy holders who are unable to perform three out of the six ADLs will be able to receive a monthly cash payout for up to five or six years, depending on their ElderShield plan.

Since ElderShield was originally offered by private insurers appointed by the Ministry of Health, no subsidies or support are available for the annual premiums.

Between 2002 and 2019, unless they chose to opt out of the scheme, all Singapore Citizens and Permanent Residents with MediSave Accounts were automatically registered in ElderShield at the age of 40.

Auto enrolments for all eligible participants at age 40 were stopped in 2020, with individuals being enrolled into CareShield Life instead.

CareShield Life was launched in October 2020 to replace the ElderShield scheme. This policy is compulsory for all Singapore Citizens or Permanent Residents born in 1980 or later and is also open for eligible Singapore Citizens and Permanent Residents born in 1979 or earlier to join.

Individuals who have enrolled in CareShield Life will receive higher monthly payouts (as compared to ElderShield) in the event they have severe disabilities.

These payouts will be provided for as long as they remain unable to perform three or more -ADLs. Additionally, there are also premium subsidies offered by the government to ensure greater accessibility for all.

Read more about how Sutana tapped on CareShield Life to aid with her rehabilitation process.

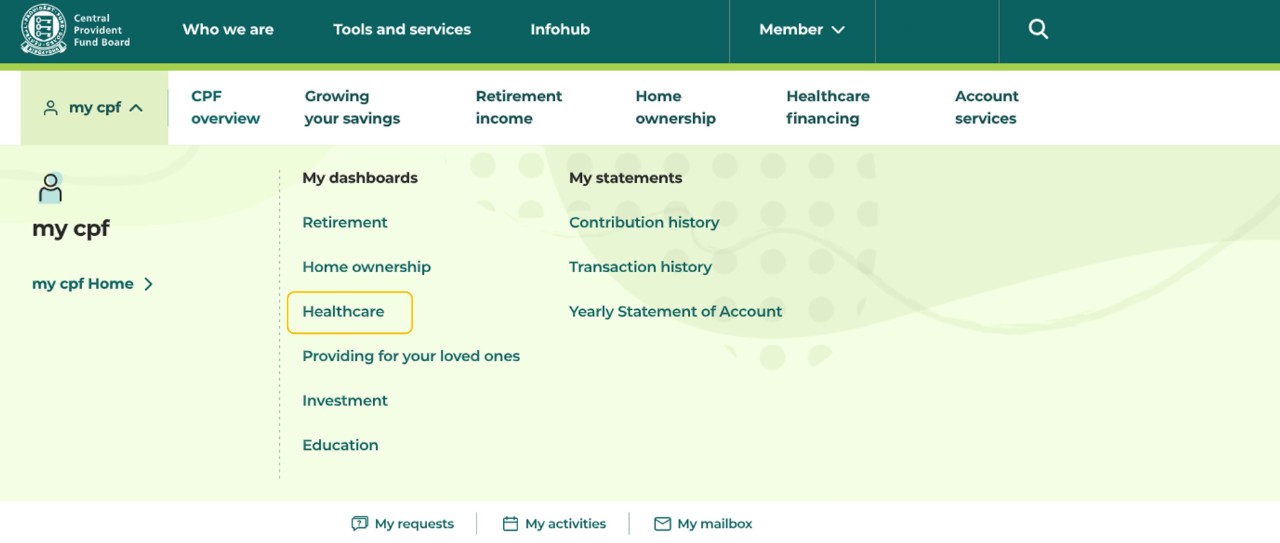

Follow these simple steps to check if you are covered by ElderShield or CareShield Life:

1. Log in to the CPF website using your Singpass.

2. Click on "my cpf" located at the top bar, then click on "Healthcare" under "My dashboards".

3. Click on “Long-term care insurance” or scroll down to the “Long-term care insurance” section to view your insurance coverage.

Disability can occur at any time and at any age, potentially affecting your ability to work and maintain a source of income. In such circumstances, having payouts that will last till you recover can prove to be valuable.

If you are enrolled in ElderShield, the coverage you receive may last up to a maximum of six years. For example, the ElderShield 300 plan provides monthly payouts for a period of five years, while the ElderShield 400 plan offers monthly payouts for six years.

Although receiving payouts for up to six years might seem like a long time, some disabilities require an even longer period for rehabilitation. This could mean that the payouts may not last long enough to support your recovery.

In contrast, CareShield Life offers a monthly payout for as long as you are unable to perform at least three ADLs.

While ElderShield provides basic financial protection of up to $400 a month, this amount may not be enough to cover the comprehensive care required by some disabilities.

In comparison, CareShield Life provides a higher monthly payout that is currently set at $612 in 2023. This amount is adjusted annually and increases by 2% p.a. until you reach the age of 67 or upon the approval of a claim. This arrangement ensures that your monthly payout keeps pace with potential inflations in healthcare costs.

CareShield Life offers enhanced coverage and increased payouts, but comes with higher premiums compared to ElderShield.

To help with the increased premiums, the government offers means-tested subsidies for lower-to-middle-income households that can help reduce the cost by up to 30%. Similar to ElderShield, premiums for CareShield Life can be entirely covered using MediSave.

In addition, Singaporeans born in 1979 or earlier who choose to switch to CareShield Life by 31 December 2023 may qualify for an extra participation incentive of up to $2,500. An extra participation incentive of $1,500 will also be provided to Merdeka and Pioneer Generation citizens who join CareShield Life.

These participation incentives will be evenly spread over 10 years and used to offset the annual premium payable for each year.

If you are interested in making the switch from ElderShield to CareShield Life, take note that there may also be a catch-up component - a flat amount paid over 10 years that is on top of the base premium.

Refer to these steps to convert your ElderShield plan to CareShield Life. The application takes about seven working days to process.

1) Access the CareShield Life website and click on the “Apply to join now” button on the main banner.

2) You will be invited to login via your Singpass.

3) Click on “Application to join CareShield Life” on the side bar.

4) Review your particulars, complete the Activities of Daily Living declaration, and review the premium payable information.

CareShield Life offers several advantages over ElderShield, including higher monthly payouts that continue until your recovery.

If you are currently on an ElderShield plan, consider switching to CareShield life today and enjoy greater peace of mind for your golden years ahead!

The information provided in this article is accurate as of the date of publication.