26 Nov 2025

SOURCE: CPF Board

It’s that time of year when everyone’s checking their music stats, so why not your finances too? Here’s how your CPF is helping you (and others) hit the right notes for housing, healthcare, and retirement.

*Total CPF contributions include Government Grants and dividends from Special Discounted Shares scheme and interest paid.

While you concentrate on your career, your CPF grows automatically while you work1, receiving up to 37% in contributions (including your employer’s share) so you can keep building towards what matters.

1 For employees as defined by the CPF Act

In 2026, the CPF contribution rates for employees aged above 55 to 65 will be increased to strengthen their retirement adequacy. The changes will apply to wages earned from 1 January 2026:

The increase (in bold) indicates the rise in CPF contribution rates compared to 2025

Find out more about the CPF contribution changes from 1 January 2026

*Extra interest refers to an extra 1% interest paid on the first $60,000 of a member's combined balances (with up to $20,000 from the Ordinary Account), an additional 1% extra interest on the first $30,000 of their combined balances (with up to $20,000 from the OA) for CPF members aged 55 and above

At the end of the year, you might be planning to go on holiday. While you recharge, your CPF will continue working hard, earning steady, risk-free interest to support your retirement, housing and healthcare needs. CPF interest is computed monthly and credited annually, so your money keeps working even when you’re not.

CPF base interest rate per annum:

|

|

Special, MediSave and Retirement Account |

Interest Rate |

2.5% |

4% |

Interest rate from 1 October 2025 to 31 December 2025

Your CPF Ordinary Account (OA) savings provides strong backing to your housing goals, from paying your downpayment and paying monthly mortgage instalments to even covering stamp duty and legal fees.

Strike the right balance between your OA and cash for your housing expenses, because when they work in harmony, your housing and future dreams stay perfectly on beat.

Total figures may not tally due to rounding

When life takes an unexpected turn, these healthcare schemes have you covered. MediSave supporting medical costs for you and your loved ones, MediShield Life shielding you against large hospitalisation bills, and CareShield Life providing long-term protection in the event of severe disability. They work together to form the foundation of your healthcare security.

Find out how they offer you protection for your healthcare needs.

You can also explore your individual dashboards to manage all your CPF matters — all neatly “wrapped” for you.

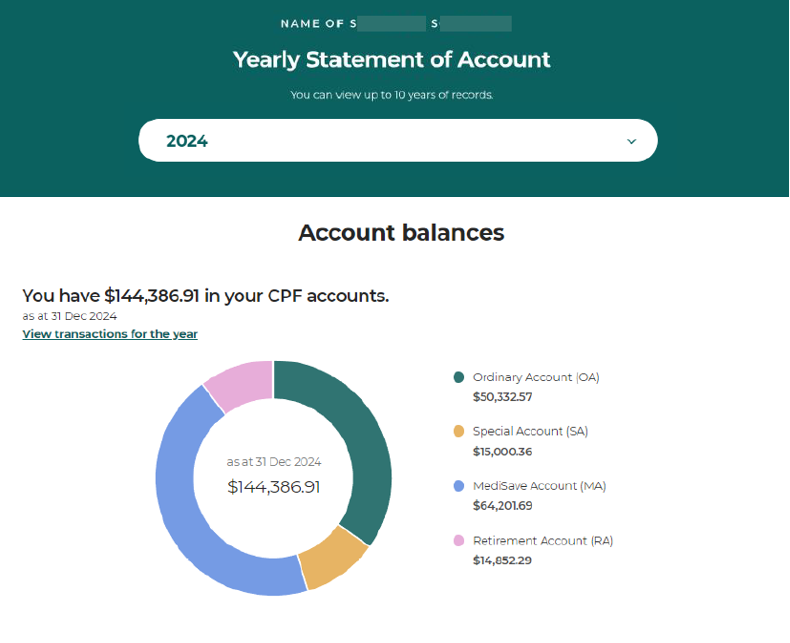

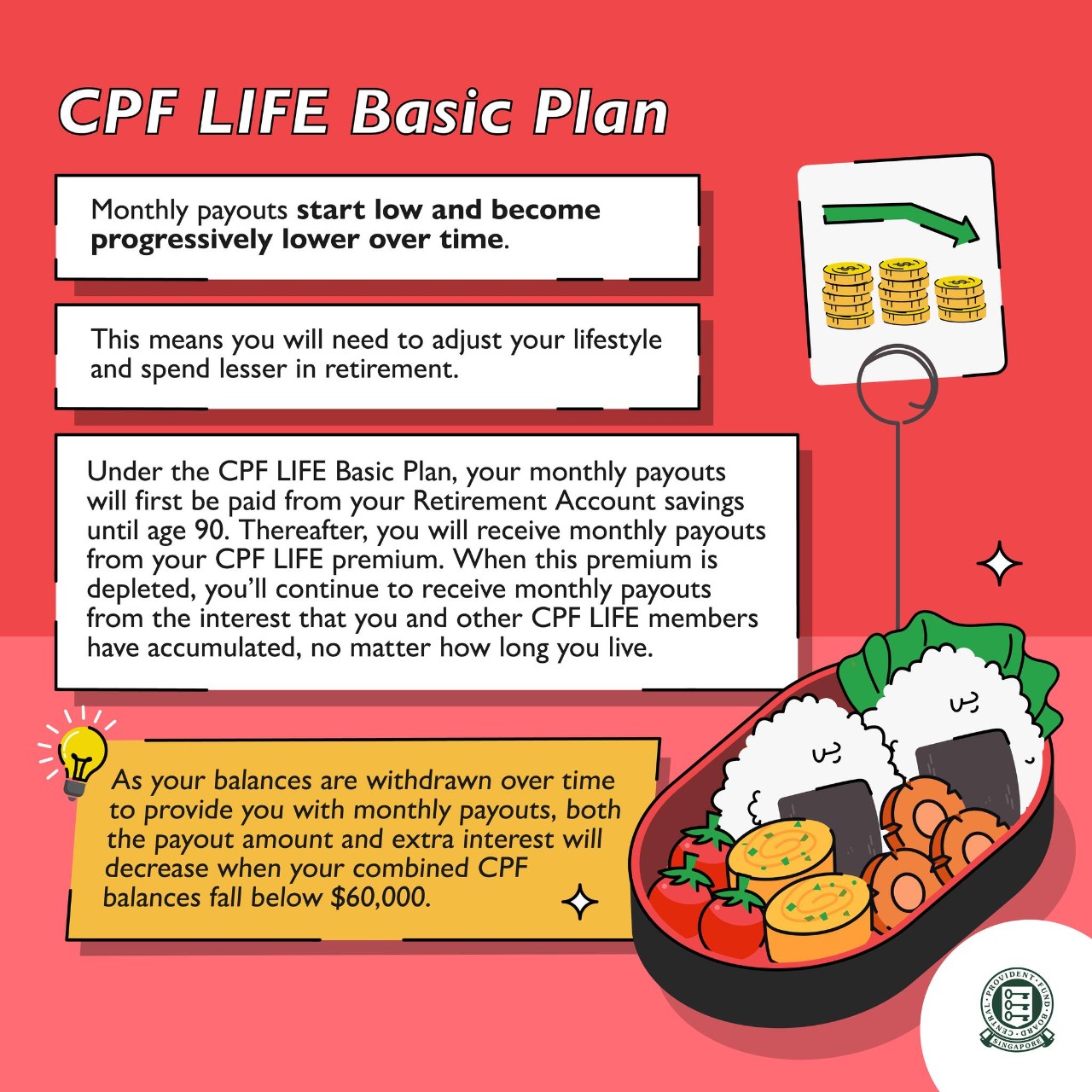

CPF LIFE is a national longevity insurance annuity scheme that provides you with monthly payouts for life, so you can focus on enjoying your golden years. Over the years, your CPF contributions, accumulated interest, and outflows — including housing expenses — all work together to shape your future CPF LIFE payouts. This is why balancing your CPF usage is important for your retirement security.

You’ll be automatically included in CPF LIFE if you:

- Are a Singapore Citizen or Permanent Resident

- Were born in 1958 or later

- Have at least $60,000 in retirement savings when your monthly payouts begin

Wondering what CPF LIFE plan suits your desired retirement lifestyle?

- Cover

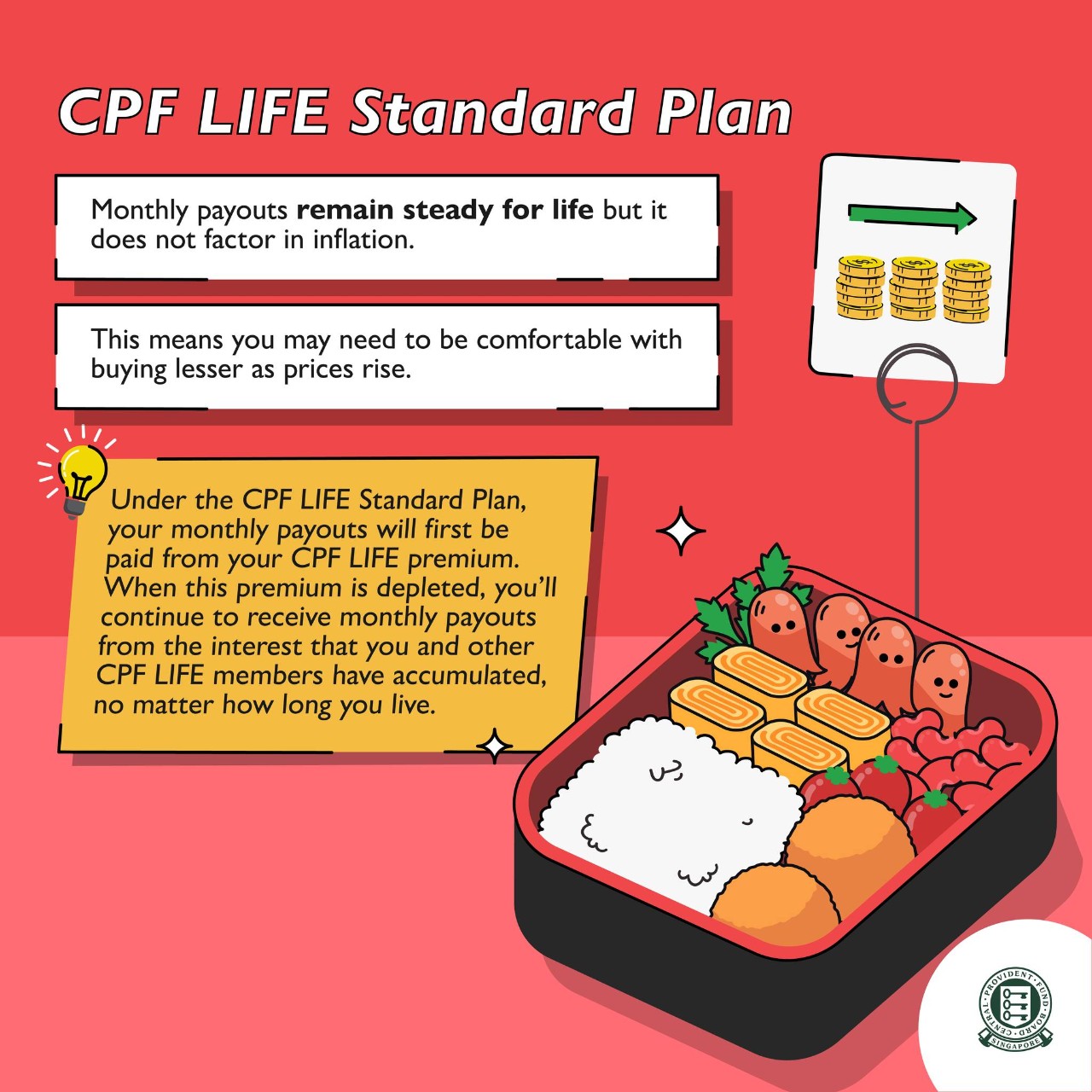

- Standard Plan

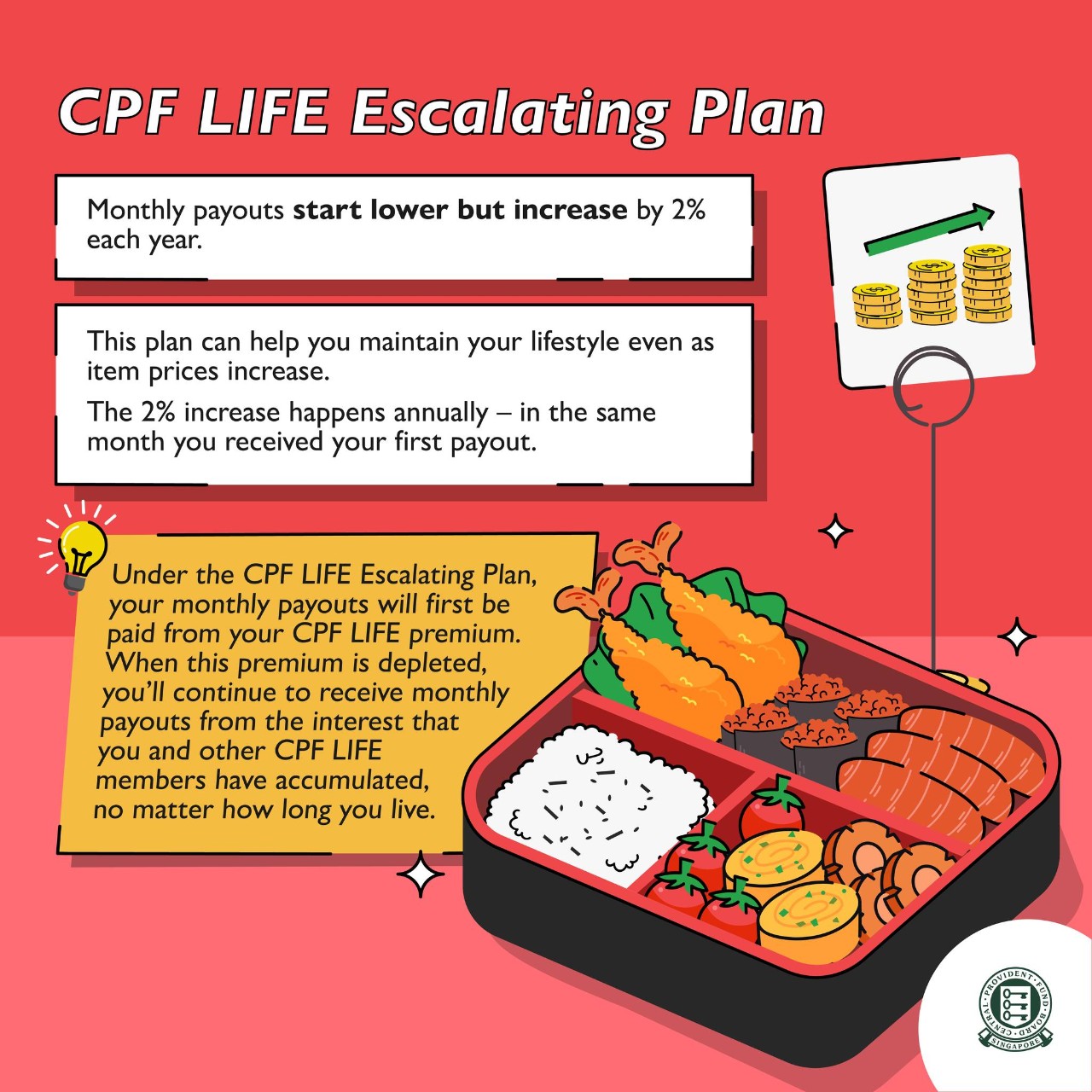

- Escalating Plan

- Basic Plan

PLAN with CPF is your personalised platform to take action with ease, where you can use the featured planners and track your progress along the way. Discover tips to boost your financial fitness beyond just your CPF savings through a short questionnaire. It’s your own financial guidance platform, financial planning made easier for you.

Information in this article is accurate as at the date of publication.

.jpg)

.jpg)