5 Jan 2024

SOURCE: CPF Board

Every month, 20% of your wages are automatically allocated towards your CPF contributions. On top of that, your employer contributes 17% of your wages to this amount*.

These contributions are capped by the CPF monthly salary ceiling, which determines the maximum portion of your monthly wage that is subject to CPF contributions.

Here’s all you need to know about the recent adjustments to the CPF monthly salary ceiling and how it can benefit you!

* For Singapore Citizen/3rd year and onwards Singapore Permanent Residents aged 55 and below. Learn more about the CPF contribution rates for other age groups.

The CPF monthly salary ceiling is the maximum portion of your monthly wage that is eligible for CPF contributions.

Your wages are exempted from CPF contributions for both you and your employer if they are above the CPF monthly salary ceiling.

To keep up with rising wages, it is necessary for the CPF Board to periodically update the CPF monthly salary ceiling so that the CPF system remains relevant in meeting the retirement needs of our members.

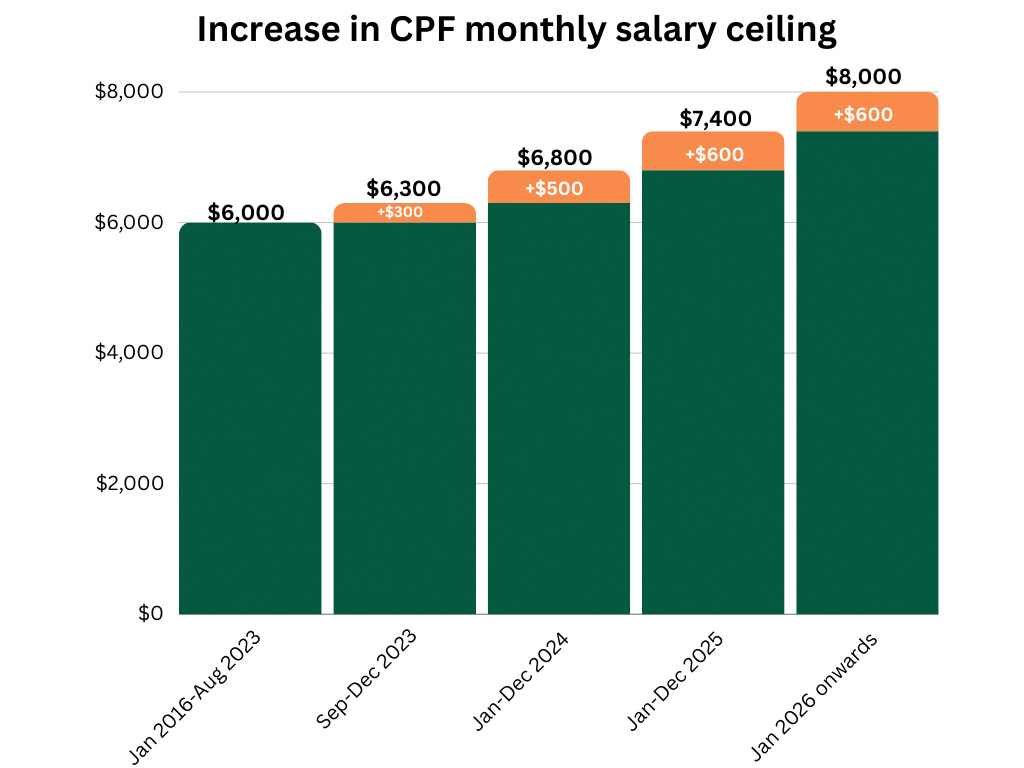

As announced in Budget 2023 on 14 February 2023, the CPF monthly salary ceiling will be gradually raised from $6,000 to $8,000 by 2026. The increase will take place in four steps to allow employers and employees to adjust to the changes.

The monthly salary ceiling saw its first increase of $300 in September 2023, followed by a $500 increase on 1 January 2024. Subsequently, there will be annual increases of $600 in both 2025 and 2026, leading to a monthly salary ceiling of $8,000 starting from January 2026.

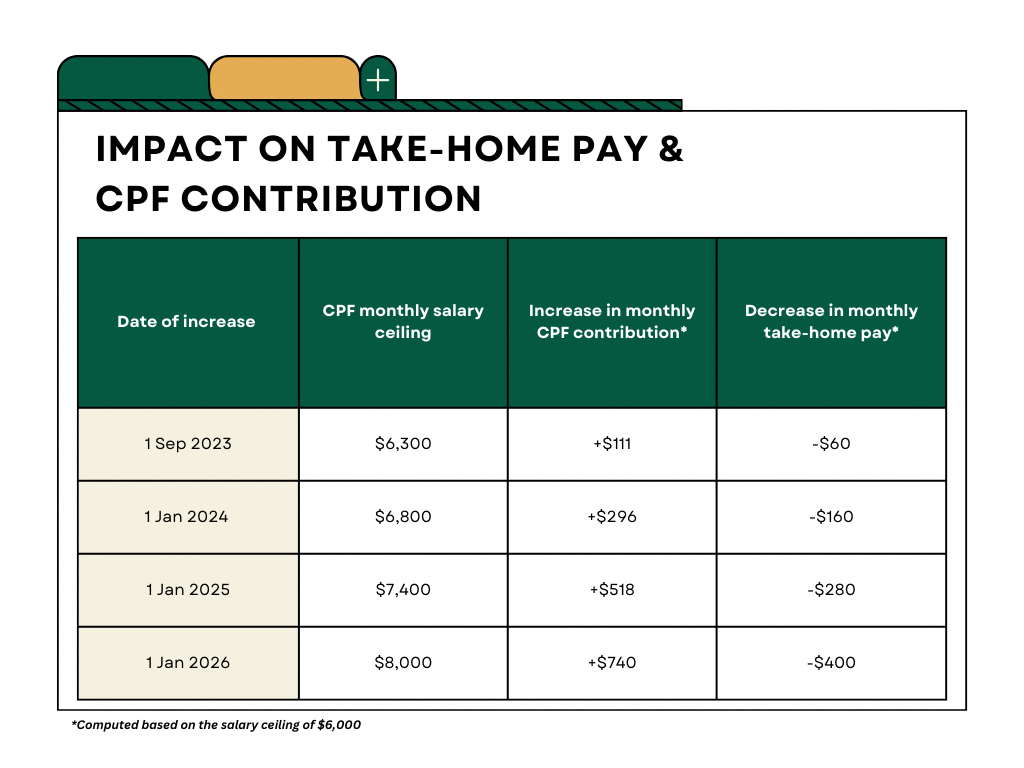

Here’s how the increased CPF monthly salary ceiling can benefit a 45-year-old male employee as at 2023 who earns $8,000 a month and has not reached the annual salary ceiling for CPF contributions:

By 1 Jan 2026, this employee will receive an increase of $740 in monthly CPF contributions. The additional inflows to his CPF can increase his CPF balances by $60,000 when he reaches age 55, and a further $70,000 when he reaches age 65. This will allow him to receive up to $680 more in monthly CPF LIFE payouts^.

In essence, the higher CPF monthly salary ceiling leads to an overall rise in your monthly earnings. This is because your employer contributes more to your CPF.

The increased CPF monthly salary ceiling also boosts your overall CPF savings, paving the way for a more comfortable retirement. In the long run, the increased monthly CPF salary ceiling works to your advantage!

^Based on cumulative increase in CPF contributions from Sep 2023 onwards with a starting balance of $60,000, factoring only inflows to Ordinary Account and Special Account, and assuming no withdrawals, for a 45-year-old male today on starting payouts from 65 years old under CPF LIFE Standard plan.

Consider the following options if you want to increase your CPF savings further:

Give your CPF savings a boost by making a cash top-up to your Special Account or Retirement Account (above age 55). The maximum top-up depends on your age and CPF balances.

You will also enjoy tax relief of up to $16,000 a year if you make cash top-ups in the CPF accounts of yours and your loved ones (up to the current Full Retirement Sum)*.

*Terms and conditions apply

Your Ordinary Account (OA) savings earn a base interest of 2.5%, while savings in your Special Account (SA) or Retirement Account (RA) give you a higher interest rate.

If you are under the age of 55, you have the option of transferring your OA savings to your SA to earn a higher interest rate. For individuals aged 55 and above, transferring your SA or OA savings to your RA allows you to allocate more funds towards your retirement needs.

Note that both cash top-ups and CPF transfers are permanent and cannot be reversed.

The new CPF monthly salary ceiling can help to increase your CPF savings, bolstering your retirement plans in your later years.

If you want to learn more about how you can better prepare for your retirement, check out these 5 tips to giving your retirement a boost and also how you can take on small wins to achieve your financial goals!

The information provided in this article is accurate as of the date of publication.

.jpg)

.jpg)