4 Mar 2024

SOURCE: CPF Board

Your CPF savings belong to you and are accumulated through years of hard work. Naturally, you might wonder "why can’t I withdraw all my CPF savings at age 55?"

In the second part of our CPF Answers Series, where we answer your most pressing questions, we'll address this very question and share more about the conditions for withdrawing your CPF savings at age 55.

The CPF retirement sum

Before diving into CPF withdrawals, let's first understand the concept of the CPF retirement sum. In short, it is a guide on how much CPF savings you need to meet your desired monthly payouts in retirement.

There are three levels of retirement sums:

· The Basic Retirement Sum (BRS) provides monthly payouts in retirement to cover basic living needs, excluding rental expenses.

· The Full Retirement Sum (FRS) provides higher monthly payouts that cover basic living needs, including rental expenses. It is an ideal point of reference of how much one needs in retirement.

· The Enhanced Retirement Sum (ERS) provides a higher monthly payout, making it suitable for those who want more retirement income.

What happens to my CPF savings at age 55?

Turning age 55 is a significant financial milestone as the distribution of your CPF savings changes in preparation for your retirement. It is a good time to assess your financial situation to ensure that you are on track to meet your retirement goals.

Firstly, a Retirement Account (RA) is opened for you. The main purpose of this account is to provide monthly payouts in retirement. You can start your payouts anytime from your payout eligibility age of 65.

When you turn 55, we will transfer your CPF savings, up to the Full Retirement Sum (FRS), to create your RA. Your Special Account (SA) savings will be transferred first, followed by your Ordinary Account (OA) savings.

If you do not have enough in your OA or SA to reach the FRS but have used your CPF savings to buy a property with remaining lease that can last you until age 95, your CPF savings withdrawn for your property (including accrued interest) will be used to meet your FRS.

The maximum amount you can use for this is equal to your BRS. Your monthly payouts will not increase by using your property as a pledge. When you sell your property, you will have to restore your RA up to your FRS with the sales proceed.

Why can’t I make a full withdrawal of my CPF savings?

So why can't you fully withdraw your CPF savings at age 55 then? This is due to increased life expectancy and the need to ensure you have a retirement income that last you for as long as you live.

CPF was established in 1955 when most people lived to around 60. Members were able to fully withdraw their savings at age 55 and spend on their needs and wants.

However, rising life expectancy over the years has increased the risk of members outliving their CPF savings. Today, half of males aged 65 are expected to live past age 84, while half of females aged 65 are expected to live past age 88*.

We can’t predict which half we’ll be in, but with increasing advances in technology and healthcare, it is likely we will live longer than previous generations. Given the longer lifespans, there is a real risk that your CPF savings could run out if they are fully withdrawn early.

While the thought of receiving all your retirement money at one go at age 55 is appealing, underestimating your lifespan and poor money management can deplete your withdrawn CPF savings and leave you short during retirement.

*SingStat life expectancy for Singapore residents aged 65 in 2023

Assurance of a monthly income for life

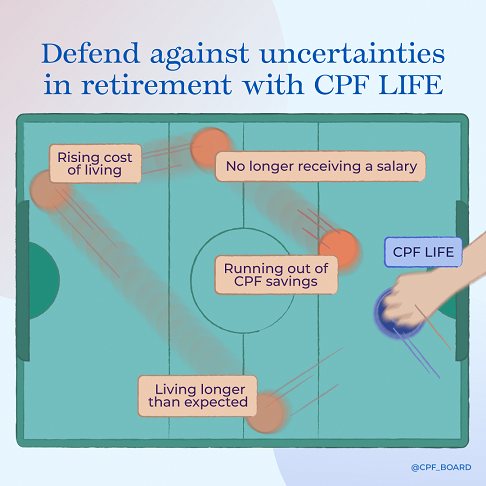

With CPF LIFE, you can have a peace of mind that you will always receive a retirement income no matter what age you live to. Just like how health insurance protects you against unexpected medical costs, CPF LIFE protects you against longevity risks (i.e. running out of your savings in your retirement years). This is especially so when you do not have a source of income in old age.

When you start payouts, anytime from age 65, your RA savings will be used for CPF LIFE. The more RA savings you set aside, the higher your payouts.

Try out the Monthly Payout Estimator to find out how much RA savings you need for your desired monthly payouts.

Withdrawal conditions after age 55

While you are unable to withdraw ALL your CPF savings at age 55, you have the flexibility to withdraw part of it for immediate needs.

From age 55, you can withdraw:

• Unconditional amount of up to $5,000 of your SA and OA savings, even if you are unable to set aside your Full Retirement Sum;

•Your SA and OA savings after setting aside your Full Retirement Sum; and

•Your RA savings above your Basic Retirement Sum if you own a property in Singapore with a lease that lasts you until at least age 95. This reduces your RA savings, and your monthly payouts would thus decrease. Consider if a lower monthly payout can still support your retirement lifestyle before withdrawing from your RA.

If you are age 55 and above, you can check the amount which you can withdraw via the Retirement Dashboard.

The closure of the Special Account for members aged 55 and above from early 2025 will not change the conditions to withdraw your CPF.

What to consider before making withdrawals?

1) Consider your retirement needs and lifestyle

Making withdrawals from your CPF savings means reduced monthly payouts in the future.

If you do not plan to withdraw or use your withdrawable savings, you can transfer them to top up your RA to receive higher monthly payouts in retirement.

As such top-ups is a commitment to grow your RA savings with long term interest for higher payouts, they are not reversible and cannot be withdrawn for other purposes.

You can consider using a partial amount of your withdrawable savings to top-up your RA, so that you can still have the flexibility to withdraw the remaining amount as and when you need to.

2) Take advantage of risk-free CPF interest rates

In 2019, around four in 10 CPF members aged 55 to 70 made no cash withdrawals after turning 55 years old, even though they had the option of doing so.

Those who did so mostly deposited their funds in the banks or used them to pay for near-term expenditure needs or big-ticket items.

Consider keeping your withdrawable savings in your CPF account to enjoy risk-free interest rates and withdraw them only when you need to. With PayNow, you can generally receive your withdrawn monies almost instantaneously.

The information provided in this article is accurate as of the date of publication.

.jpg)