5 Sep 2025

SOURCE: CPF Board

You may have heard about CPF payouts, but how much do you know about CPF LIFE?

CPF Lifelong Income For the Elderly (CPF LIFE) is a national longevity insurance annuity scheme that provides you with monthly payouts no matter how long you live, starting at any time between ages 65 and 70. It is the main scheme that helps you ‘decumulate’ your CPF savings in retirement, while ensuring lifelong income so you don’t have to worry about outliving your savings, thanks to the risk-pooling element of the scheme.

How well do you really know this national scheme? Read on and test your CPF LIFE knowledge.

There are three CPF LIFE plans to choose from - Escalating Plan, Standard Plan, and Basic Plan. You may know about their names, but how well do you know the details?

Let’s take a look at the three plans’ features, and see if you can match the details to the corresponding plan:

This plan provides level payouts that do not increase over time, and is suitable if you are comfortable with buying less and reducing your spending over time to cope with rising prices. What plan is this?

Please click the option you think is correct.

This is incorrect. The Escalating Plan provides lower initial payouts but increase by 2% annually, for life. The growing payouts generally help you maintain your retirement lifestyle even as prices of items increase.

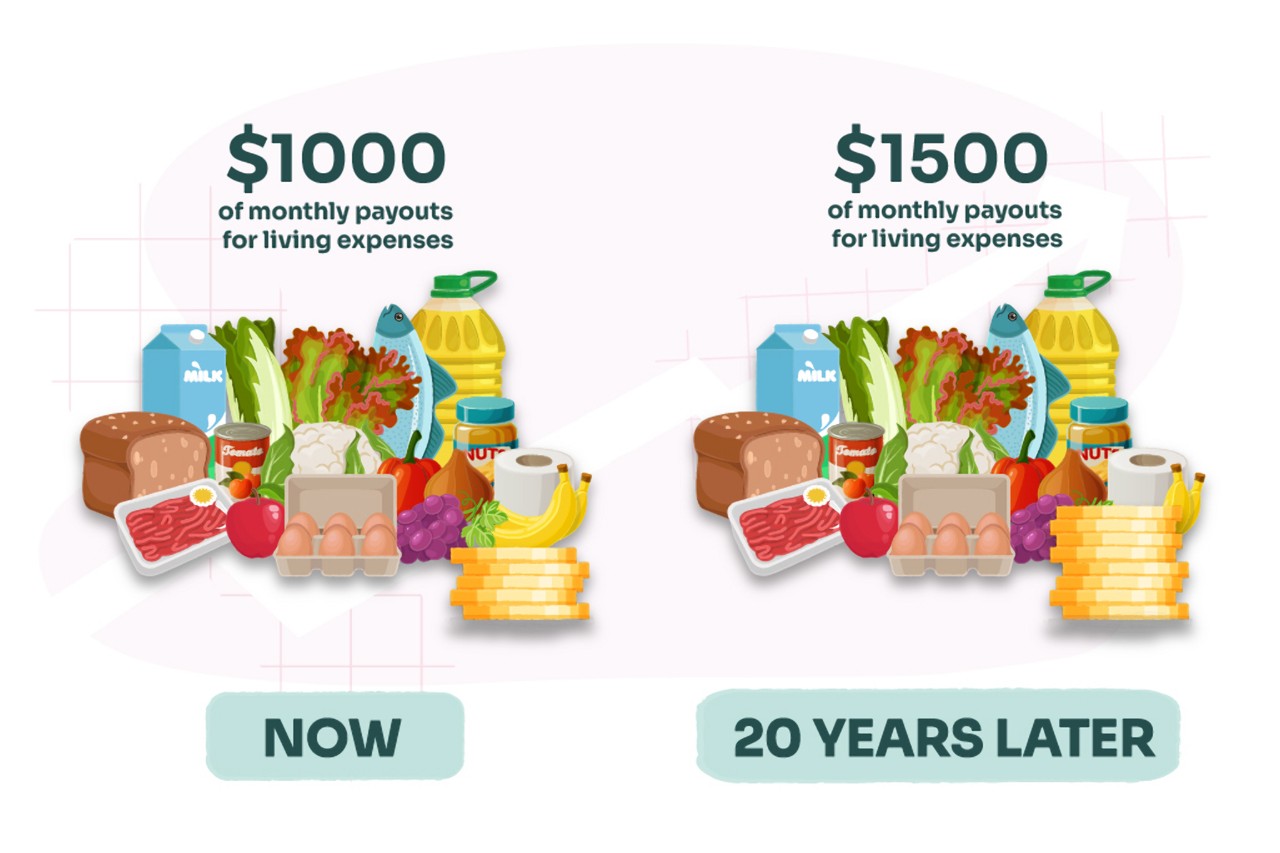

Correct! The Standard Plan provides steady payouts that do not grow, and thus does not protect you against inflation. You may have to reduce your lifestyle and buy less as things become more expensive in the years ahead.

This is incorrect. The Basic Plan provides payouts that start lower and fall when your CPF balances fall below $60,000. You will have to lower your lifestyle to buy even lesser in the future.

The CPF LIFE plan you choose depends on how willing you are to adjust your retirement lifestyle, as things become more expensive.

Under the three CPF LIFE plans, monthly payouts differ based on the plan you choose. But is that all there is to the monthly payouts? For instance…

True or False: CPF LIFE monthly payouts are for life, and these payouts factor in interest earned on your CPF LIFE premium.

Please click the option you think is correct.

Correct! As its name suggests, CPF LIFE offers payouts for life, meaning you can continue to receive monthly payouts for as long as you live, even after your CPF LIFE premium is exhausted.

On top of that, your CPF LIFE premium will continue to earn CPF interest rates, which is factored into your CPF LIFE monthly payouts, allowing you to receive higher payouts from the start.

With life expectancy on the rise, understanding that CPF LIFE will continue to provide payouts for life can give you some much-needed peace of mind.

This is incorrect. As its name suggests, CPF LIFE offers payouts for life, no matter what age you live to. In addition, your CPF LIFE premium will continue to earn CPF interest rates, which is factored into your CPF LIFE monthly payouts, allowing you to receive higher payouts from the start.

As CPF LIFE payouts are meant to support you with your desired retirement lifestyle, it’s important to understand your options. Knowing the benefits of CPF LIFE is an important part of retirement planning.

You will be automatically included in CPF LIFE if you are:

- A Singapore Citizen or Permanent Resident;

- Born in 1958 or after; and

- Have at least $60,000 in your retirement savings when you start your monthly payouts.

If you are automatically included, the CPF Board will inform you before you turn 65 to explain the options available to you.

If you are not automatically included, you will receive monthly payouts which will stop when your savings run out. And this is where the next question comes in:

True or False: You cannot opt out of CPF LIFE.

Please click the option you think is correct.

This is incorrect. You can choose to opt out from CPF LIFE, provided you:

- Have a pension or private annuity plan that guarantees monthly payouts that are the same or higher than CPF LIFE;

- Are aged 55 and above; and

- Are both the policy holder and sole insured person of the annuity policy.

However, it can be difficult to find a private annuity plan that matches the security and steady monthly payouts offered by CPF LIFE. If you’re keen to learn more, you can read more about how to use CPF LIFE as the cornerstone of your retirement planning, which includes comparisons with other private annuity plans.

Correct! While inclusion in CPF LIFE is automatic, you can choose to opt out of CPF LIFE if you fulfill the following conditions:

- You have a pension or private annuity plan that guarantees monthly payouts that are the same or higher than CPF LIFE;

- You are aged 55 and above; and

- You are both the policy holder and sole insured person of the annuity policy.

However, with the security and steady payouts offered by CPF LIFE, it can be difficult to find a private annuity plan that matches it. If you’re interested in learning more, you can check out how to use CPF LIFE as the cornerstone of your retirement planning, which also covers comparison with other private annuity plans.

CPF LIFE provides monthly payouts for as long as you live, but the most important aspect is the peace of mind it can give. When you know you are covered for life, it reduces the mental strain that comes with worrying if you will outlive your savings, allowing you to plan for your desired retirement lifestyle with confidence.

The information provided in this article is accurate as of the date of publication.