28 Jul 2025

SOURCE: CPF Board

Picture this: you’re planning out your finances, and have a list of things you need to figure out. You know you need to settle big purchases like a house, prepare for emergency medical bills, while also planning ahead for retirement. You have the goal in mind: to handle your finances in the best way possible, by making the right financial decisions and finding ways to grow and maximise your savings. Start building your personal financial plan with PLAN with CPF today.

Your financial planning journey begins here

Plan Life Ahead, Now! (PLAN) with CPF is the Board’s one-stop platform for planners and other guidance-related resources. Whether you’re starting your career or approaching your golden years, PLAN with CPF empowers you to make informed financial decisions about your CPF savings. You can access your personalised PLAN with CPF dashboard via Singpass login and enjoy these three key features:

Let’s take a closer look at what PLAN with CPF can offer you:

A personalised dashboard to guide your financial planning journey

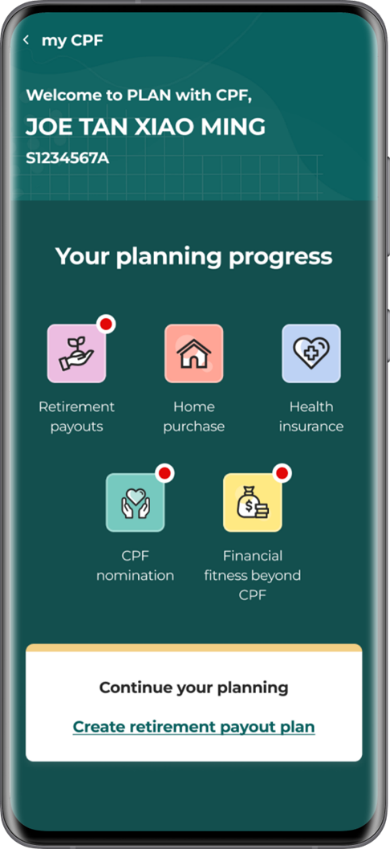

Through your PLAN with CPF dashboard, you can track your planning progress across five financial planning areas.

Each financial planning area has its own share of considerations which the Board’s planners and tools can help you navigate. As your circumstances change, you can always revisit your dashboard to review your plans at any time.

Let’s explore the three key planners that can help with your financial planning journey – the Retirement Payout Planner, Home Purchase Planner and Health Insurance Planner:

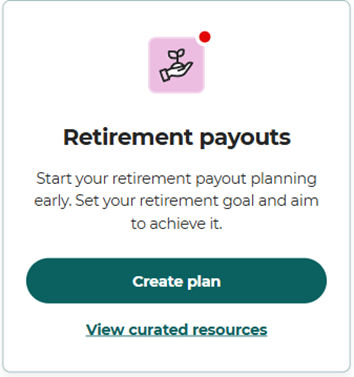

Retirement payouts

Under ‘Retirement payouts’, you can click on “Create plan” to access the Retirement Payout Planner. The planner helps you create a personalised plan to achieve your retirement payout goal via three steps:

1. Setting your retirement payout goal

Start by indicating how much monthly payouts you will need at age 65 to support your desired retirement lifestyle. Would you prefer to have growing monthly payouts to cope with rising prices in the future, or can you lower your lifestyle to buy less over time? The planner will let you know how much savings you need for your retirement payout goal.

Should you fall short of your goal, you can simulate actions like cash top-ups or CPF transfers, and see how they can increase your payouts.

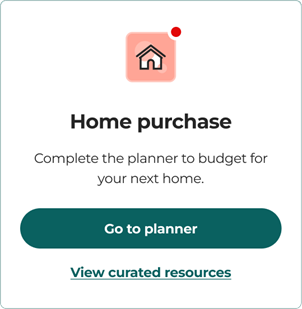

Home purchase

The Home Purchase Planner allows you to estimate your home purchase budget and housing loan amount. It also shows you how the purchase impacts your retirement. This planner applies to members aged 21 to 64, and you can also specify up to one co-owner. Like the Retirement Payout Planner, the Home Purchase Planner comprises three steps:

1. Knowing your financial profile

First, key in your gross monthly income, monthly expenses and cash savings. Together with your CPF savings, this provides an overview of your current financial situation to compute your housing budget.

2. Selecting your housing situation

Next, indicate whether you have an existing property that you intend to sell, and if you wish to take on a housing loan. If you have an existing property to sell, your sales proceeds will contribute to your housing budget.

3. Calculating impact on your retirement

By indicating your goal for your retirement, the planner is able to show how your home purchase could impact this, to allow you to make a more informed financial decision.

Health insurance

On the healthcare front, the Health Insurance Planner helps project the affordability of health insurance, while also allowing you to evaluate your coverage with other Integrated Shield Plans (IP). The Health Insurance Planner offers you the following:

1. Personalised calculations based on your current plans

By selecting your current plan, age and income, the planner can project your personalised long-term premiums (including rider if any) and MediSave savings. This lets you visualise the cumulative projected premiums that are payable with MediSave, and helps project out-of-pocket costs you may need to cater for.

When the Health Insurance Planner projects your long-term premiums, these projections are up to 30 years or when you reach 90 years of age, whichever comes first, ending at the nearest age decade (such as 50, 60 and so on).

2. Compare key benefits of your current plan with other IPs available in the market

The Health Insurance Planner helps you project the difference in costs between your existing plan and other IP plans you might be considering. You will also be able to compare the key benefits and features across your selected IP plans.

By knowing the costs, you can better balance your additional healthcare coverage needs with what you can afford in the long-term without putting a strain on your finances.

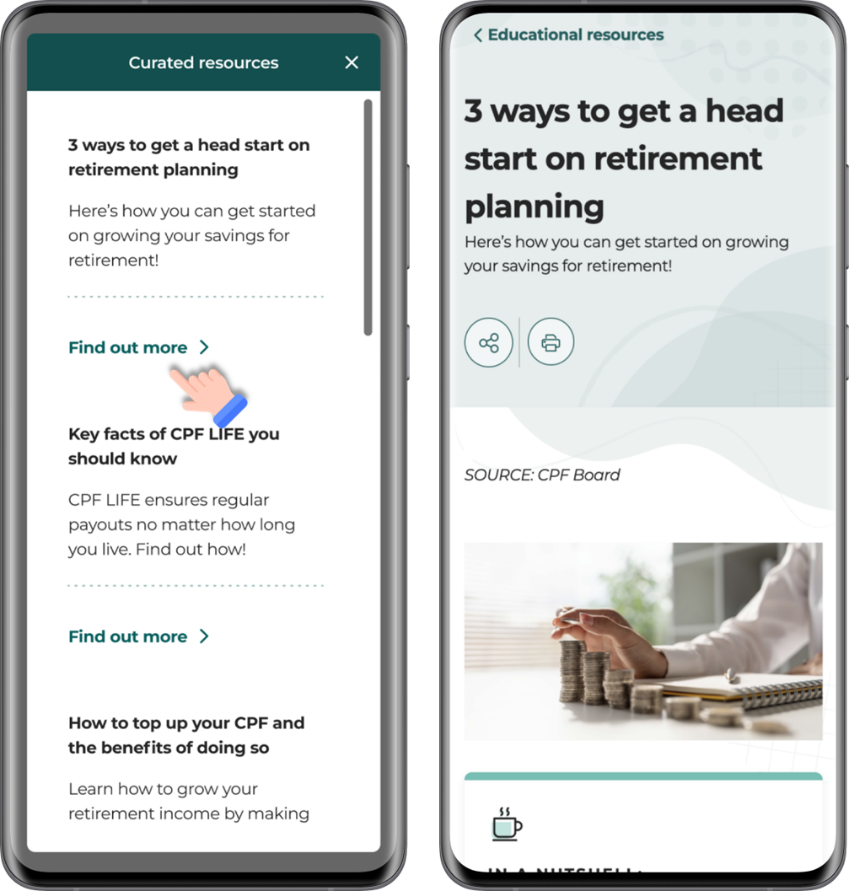

Curated resources for a deeper understanding

In addition to the planners, you can access curated educational resources such as articles and videos within your PLAN with CPF dashboard. These resources help you dive deeper into key financial planning areas – from retirement and housing to healthcare – along with broader financial topics that may be relevant at different life stages. Here’s an example of what you can find:

Get ready to add useful activities to your financial to-do list that you weren’t aware of, while improving your CPF knowledge and financial literacy.

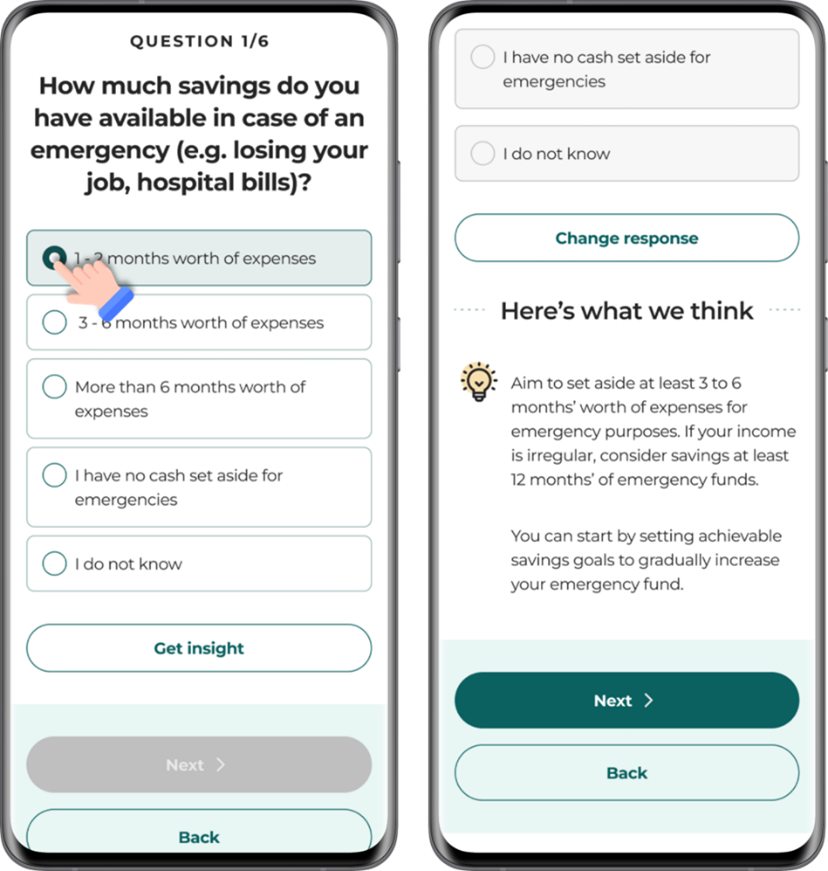

Strengthening your financial fitness beyond CPF

Your PLAN with CPF dashboard also comes with a short questionnaire that helps you quickly assess your financial health beyond CPF. This questionnaire was developed in collaboration with MoneySense, based on the Monetary Authority of Singapore’s (MAS) Basic Financial Planning Guide.

The questionnaire helps you assess your financial health and provides insights on common financial planning rules of thumb, such as emergency funds and insurance protection. This, alongside the curated resources, helps ensure you have the necessary information to make the most of your financial planning for each life stage.

Planning ahead is an important task, but it can feel overwhelming or daunting at times. With the right tools and resources, navigating financial planning can be made easier. Use PLAN with CPF to guide your financial planning journey and Plan Life Ahead, Now!

Information is accurate as of the date of publication.