28 Oct 2025

SOURCE: BudgetBabe

I got a shock upon receiving my bill for my Integrated Shield plan (IP) last year. Even though I’m still in my 30s, it came up to almost S$2,000.

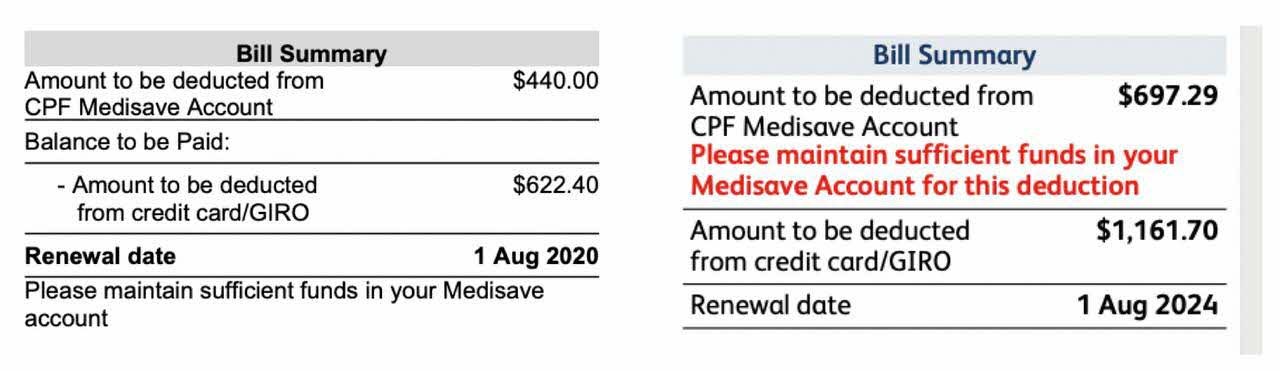

My private IP + rider bill in 2020 vs. 2024.

My IP premiums had been rising faster than I had anticipated. I could not imagine what it’ll be like if I have to continue paying at this increasing rate for the next few decades just to maintain my coverage.

Upon consulting my insurance agent, she advised me to retain my plan as it was since it gave the “highest coverage” and came with a “20% no-claims discount”.

In fact, if it wasn’t for the 20% discount, my bill would have been over S$2,300. So that got me thinking — am I keeping this plan just for the savings, rather than checking if the coverage really suits my needs and budget?

As someone in the sandwiched gen, my husband and I often feel the weight of raising two young kids and supporting our elderly parents. Our budget has to be split for the entire household — with our children and parents too – and this isn’t easy when we’re the ones paying for everyone’s multiple insurance plans. While we had previously bought private coverage for the whole family for an added peace of mind, we also needed to be practical: what is deemed a need vs a want, especially with healthcare costs rising?

We start by looking at what we already have as Singaporeans/PRs:

- MediShield Life: designed to cover 9 in 10 subsidised bills, with deductibles and co-insurance payable by MediSave

- CareShield Life/ElderShield: provide long-term care payouts if we develop severe disability.

If we want additional coverage:

- Integrated Shield Plans (IP) – covers even larger hospital bills, especially if we opt for treatment at private hospitals

- Rider – reduces potential out-of-pocket expenses such as deductibles and co-insurance

I found myself weighing the options. On one hand, public hospitals with Class B2 or C wards already come with Government subsidies, and the bills can be covered by MediShield Life, with premiums payable by MediSave — so maybe paying extra for an IP isn’t essential.

Furthermore, premiums for private coverage could climb dramatically as we age. Given that our private medical insurance premiums could be up to 5 times of our MediShield Life premiums when we hit our 70s or 80s, could we realistically keep up with the costs then, especially if we’re no longer working?

I also worry about passing these expenses on to our children — the last thing we want is to burden them with our high insurance or medical bills.

Back in our early 20s when my husband and I signed up (separately) for maximum coverage, we didn’t think that far ahead about how premiums would rise as we got older. We both assumed the costs would stay roughly the same, and I didn’t realise how my future responsibilities — from raising kids to supporting elderly parents — would add on to my total budget.

When I spoke with my friends, I realised that I was not the only one; most of us tend to buy private hospital IPs and riders when we’re young. It is only natural that we want to get the highest coverage possible for ourselves while we are still young and healthy, to be prepared just in case something unexpected happens. And in our 20s, the cash outlay isn’t high so it is no wonder we hardly feel the strain on our budget.

But as we got older, we watched our premiums rise and the out-of-pocket cash portion get bigger. That’s how we went from not feeling it in our 20s, to struggling to pay more now. This is especially when we’re just 2 persons paying for the combined costs of coverage for 7 people in our household i.e. for 2 adults, 3 elderly and 2 young kids.

Seeing our premiums rise sharply over the years made me realise that continuing to pay the same rates (simply because we had already invested in the plan) didn’t make sense. That’s a sunk cost fallacy.

When I saw that the Government had launched the Health Insurance Planner — an online tool designed to (i) help Singaporeans compare health insurance premiums and plans across different providers, and (ii) better understand the long-term MediSave and cash expenses necessary to support their coverage – I thought if only the planner existed when we were reviewing our plans manually! It would have saved us so much time.

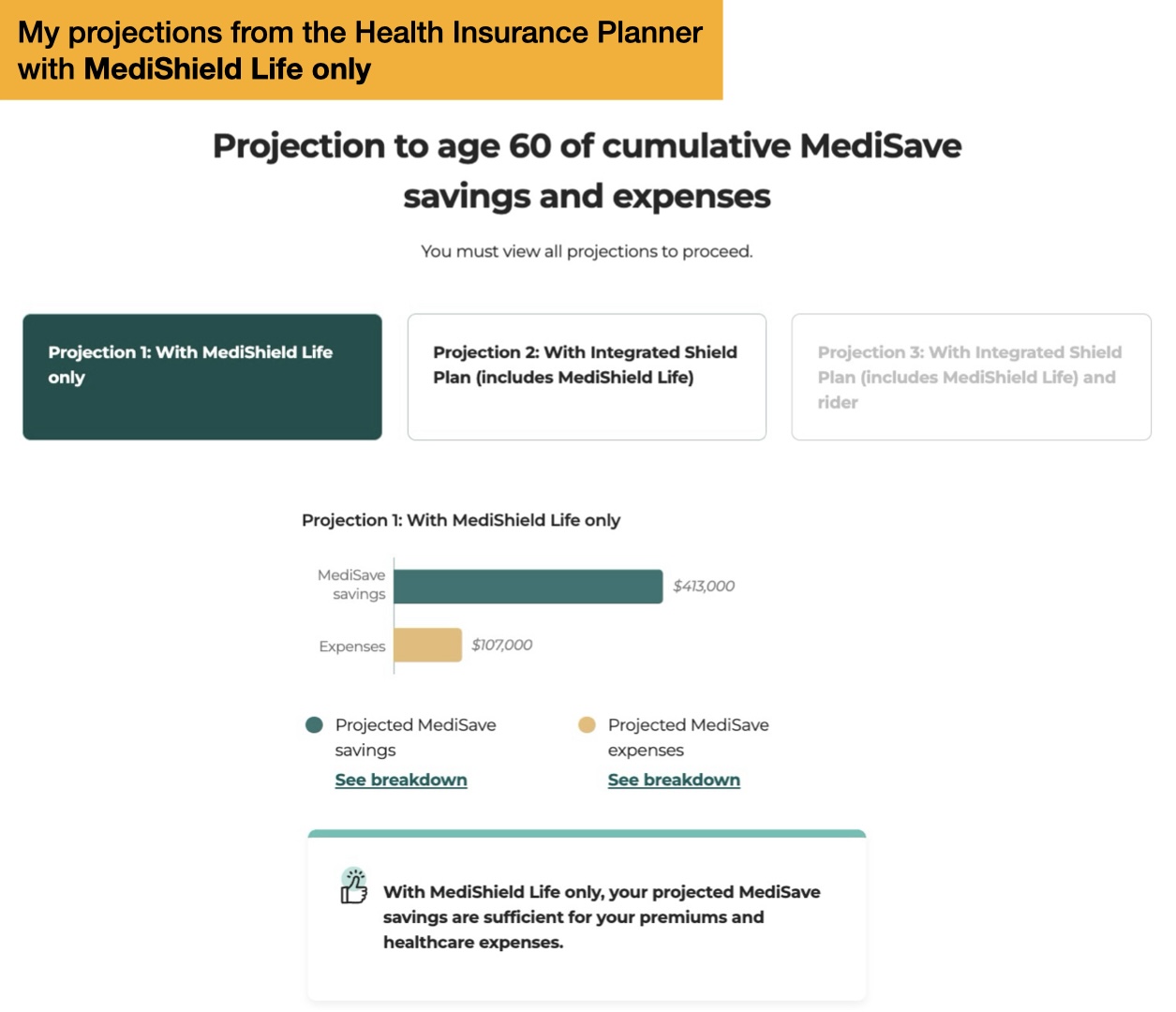

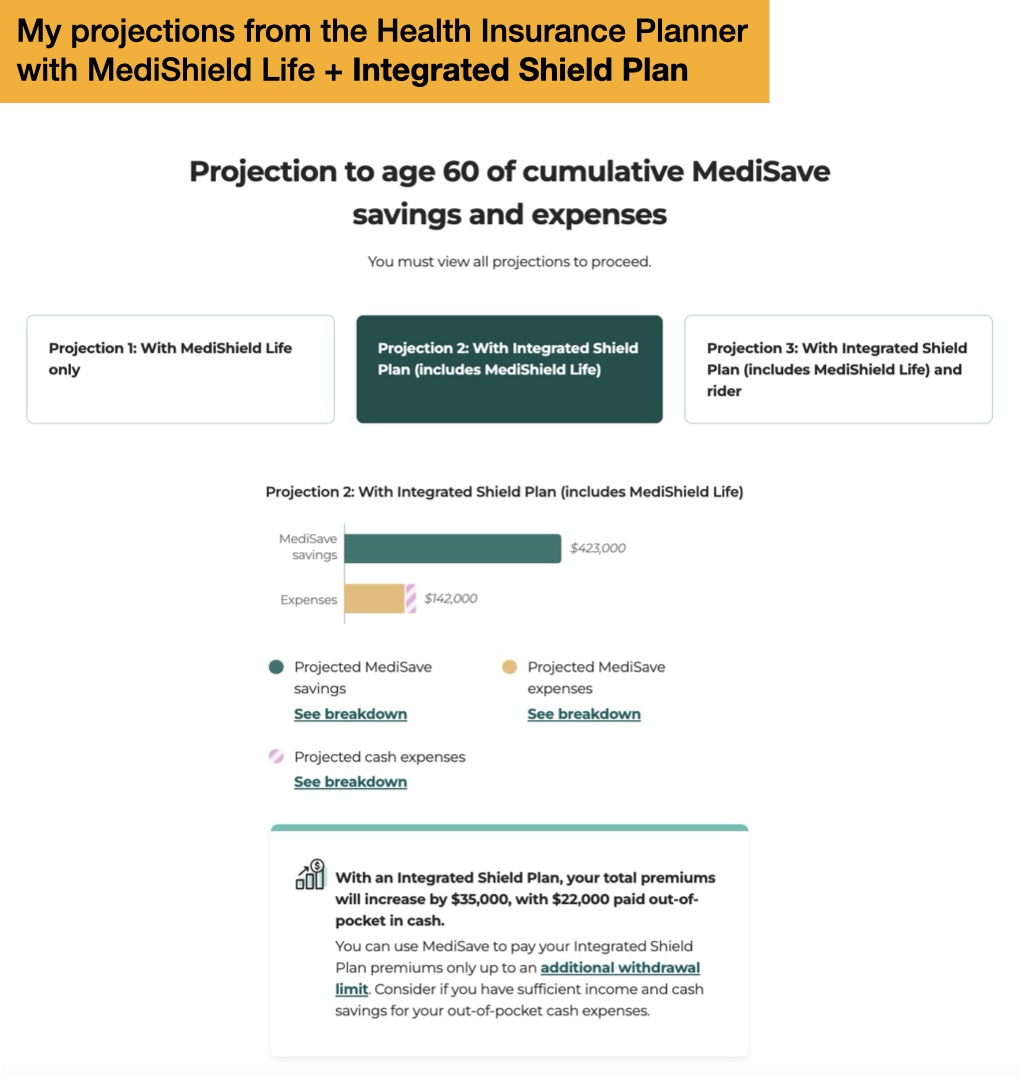

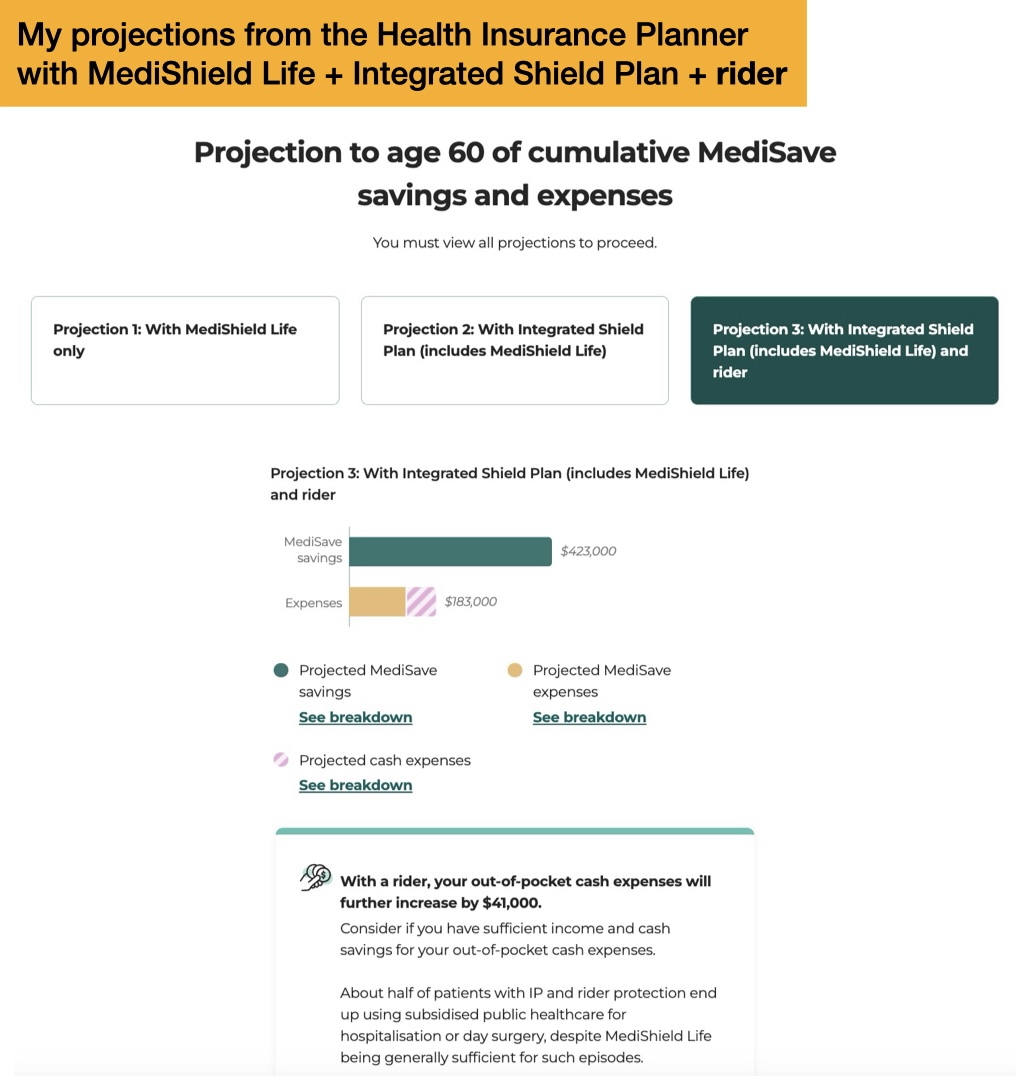

After trying the planner, it confirmed our decision to downgrade our IP was indeed sound. Here’s what it showed me.

I was prompted to provide 4 data points:

- Name of my IP and rider

- Number of years left to pay my CareShield Life (or ElderShield) premiums

- My monthly income and additional income (such as bonus) before CPF deduction

- Number of years I plan to continue supporting my dependants with their healthcare policies

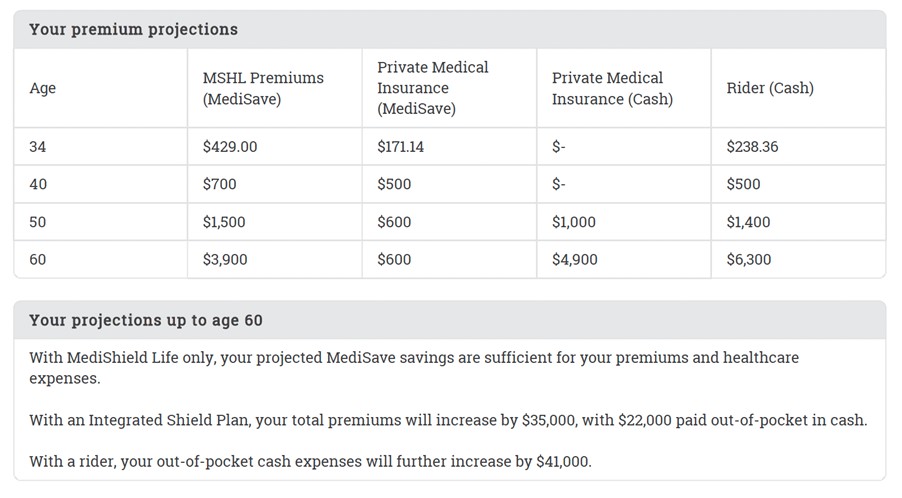

From there, it then showed me the estimated premium projections I’ll be paying over time:

Based on the planner’s current projections, it estimates that by the time I’m 60, I’ll have to pay at least $11,200 in cash every year for healthcare insurance:

Considering that I’m targeting $5,000 in monthly expenses during retirement, that means almost 20% of my budget would go towards insurance alone!

To be honest, that hardly feels sustainable — especially when the Monetary Authority of Singapore’s basic financial guide recommends spending no more than 15% of your income on insurance protection. The planner also highlighted that rider premiums will become increasingly costly as I get older, making it harder to continue financing them comfortably.

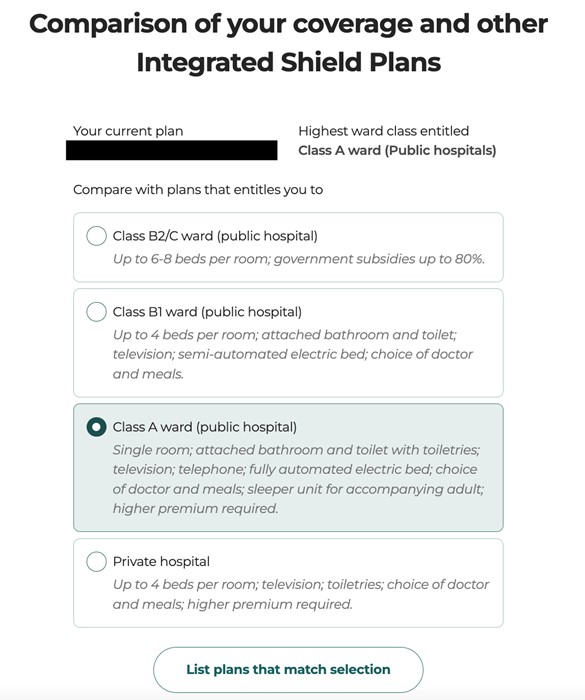

Using the planner, I was also able to compare my coverage with other Integrated Shield Plans (IPs), and even see how the projected premiums of my current and alternative plans stack up. The tool made it easy to see our coverage clearly, and reassured me that switching to a Class A plan would still provide sufficient protection while keeping our costs (today and in the future) more manageable.

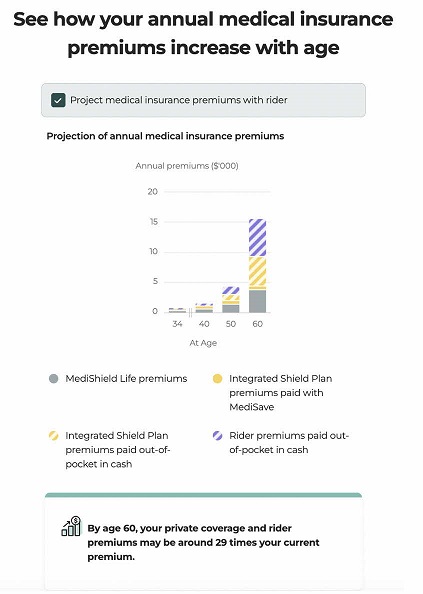

As the tool also generates projections of up to 30 years or age 90 (whichever comes first) – rounded to the nearest age decade — I was able to get a clearer view of how my costs could evolve over time.

Looking at these projections, there’s a good chance I might even consider dropping my rider in the future should it become too difficult for us to maintain the extra coverage.

So if your recent IP premiums have also prompted you to think about your coverage and budget moving forward, then it might be a good time to try out the planner for yourself.

And for those of you who are considering whether to switch insurers, you can now compare your IP options on the planner and see how the projected premiums of your current vs. alternative IPs stack up.

Then, if you need to, you can download a PDF copy of your report – with personalised projections and IP comparisons – and use it to discuss with your insurance agent to help you make a more informed decision.

As a suggestion, you can use the results of your Health Insurance Planner to help you figure out questions such as:

- Are we over-insuring ourselves for situations that MediShield Life already covers?

- At what point do the premiums stop being worth the trade-off against other financial goals?

Having an answer to these might give you the confidence to see and decide how health insurance fits into your overall budget.

Try out the tool out for yourself here to see what it reveals to you about your own situation!

Since I’ve just downgraded my private hospital plan earlier this year, I probably won’t make another change anytime soon.

However, using the Health Insurance Planner helps me to better visualise how rising premiums could impact us over a lifetime, and shows that maintaining our current coverage may not fit my budget once I scale down work.

It also forced me to think through the harder questions: do I mainly intend to use public healthcare, where MediShield Life already covers subsidised bills, or do I really need the extra insurance? Could that money be better used for other family needs or for retirement?

In my case, the planner made the impact of our premiums much easier to visualise, and it helped me have a more constructive discussion with my husband about how much coverage we actually need – rather than just assuming more is always better. In the past, his mindset was, “let’s just keep paying for peace of mind.” But after seeing the planner’s projections, he has now gained clarity on how overspending on insurance could leave us with less cash for other priorities — like our kids’ education, supporting our parents, or even our own retirement needs. As a result, he has become more open to downgrading or even removing our rider in the future if we can no longer afford to continue financing it.

At the end of the day, each of us needs to strike a balance between peace of mind and practicality, and not over-insuring just because it feels ‘safer’.

So if you’re wondering which IP works best for you, it is worth checking out the Health Insurance Planner to understand what the costs could look like for you over time should you opt to maintain your current level of coverage.

Given the recent trends in Singapore’s health insurance scene, it is becoming increasingly crucial that we:

- Plan for long-term affordability, not just maximum coverage.

- Choose a coverage that we can practically commit to till our 70s or 80s.

Try out the Health Insurance Planner today, and discover more helpful tools and resources here.

Important note: Just because I chose to downgrade my hospital plan does not necessarily mean you should follow suit. This article should not be misconstrued as financial advice to downgrade, especially as I know nothing about your health condition, risks, budget or coverage needs. Instead, please read the article, try out the planner, and discuss with a trusted financial advisor as well as your loved ones to decide what is the best move for you.

This article is sponsored by the CPF Board. All opinions and results from the Health Insurance Planner are that of my own.

This article was first published on BudgetBabe. Information in this article is accurate as of date of publication.

.jpg)