23 June 2023

SOURCE: Lorna Tan

As my financial knowledge and experiences grow over time, my beliefs on how to achieve sustainable financial wellness have also evolved.

The main objective is to enjoy my retirement or financial freedom phase without worrying about running out of money before I run out of time. I also want to strike a balance between spending too much to the point that I outlive my nest egg, and under spending at the risk of not enjoying my hard-earned savings fully.

To ensure that I have enough to last my lifetime, I have to work out my “Must-Have Income Floor” (MIF) and stress-test it with different inflation projections.

I've realised that to help me sleep soundly each night, I need to have some lifelong income streams as well as investments that will keep my principal amount or capital intact while I spend on the interest or returns.

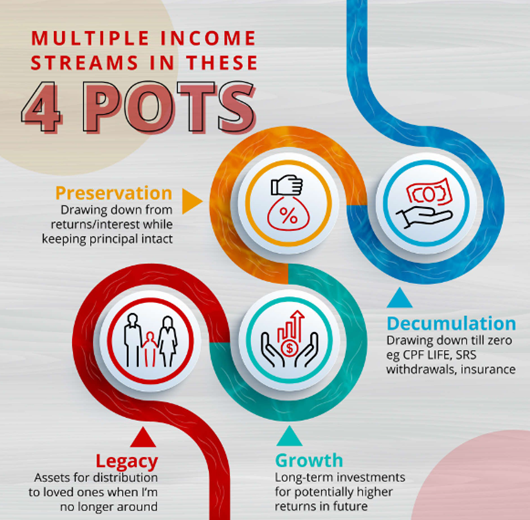

To fund a comfortable retirement that can mitigate inflation, longevity and investing risks, building passive income flows is the way to go. In fact, the multiple income streams that I’ve built sit in these 4 pots:

1. Decumulation - Drawing down till zero for instance, CPF LIFE, Supplementary Retirement Scheme (SRS) withdrawals, insurance

2. Preservation - Drawing down from returns/interest while keeping principal intact

3. Growth - Long-term investments for potentially higher returns in future

4. Legacy - Assets for distribution to loved ones when I’m no longer around

Furthermore, retiring well requires more than just achieving the financial numbers. As a disciplined saver, I’m mindful that the shift from a savings mode to that of spending will be difficult. Boosting mental resilience through engaging in meaningful activities during retirement and staying physically healthy are also important.

Source: dbs.com.sg

So, how do I create a robust retirement plan that ticks all the boxes? Here’s a peek at 10 guiding principles for my retirement.

Retirement planning starts with understanding the lifestyle we desire. When I first started visualising my retirement, I was in my 30s. Being “kiasu” and not knowing what the future holds, I decided to quantify what it means to retire under these three lifestyles: Basic, Moderate and Luxury.

For each lifestyle, I worked out my needs and wants and quantified the expenses. I reviewed this regularly, stress-tested it with inflation assumptions, and adjusted along the way. Sometimes, a “want” makes its way into my “needs” list as my standard of living increased over the years, such as cable TV. Such an exercise offers clarity on which lifestyle is achievable and I have a better idea on when I can reach financial freedom.

This is the minimum monthly income that I have determined as my MIF during retirement.

Since it is a “must-have” amount, it should ideally be funded via more stable and guaranteed income flows, regardless of the state of the economy and market performance.

I realised that the older I get, the more risk averse I become. Although I have the capacity and capability to take more investment risk, the need to do so reduces over the years as more wealth is accumulated. This lower risk profile is reflected in a higher MIF, compared to that in my younger years. It will definitely cover all of my needs and as I’ve become more conservative, this figure will cover some of my wants too.

Do note that to achieve my desired higher MIF, I have to accumulate sufficient financial resources to invest in “safer” products. This is reflected in a higher concentration in fixed income products in my portfolio as I got older.

Do not depend on a “magic retirement” lump sum to draw upon during retirement. It is more sustainable to build multiple income flows to fund our golden years.

For instance, the more guaranteed income flows like CPF LIFE payouts can be used to fund our MIF while the variable income flows from riskier products can fund the amount in excess of MIF or our wants.

Reviewing our retirement plan regularly will help guide the allocation of our savings into different investment products to achieve our objectives.

To fund my MIF in a sustainable manner, some of my multiple income flows will comprise lifelong cash flows such as payouts from CPF LIFE and a private annuity plan.

Other income streams are for the long-term. They include Supplementary Retirement Scheme (SRS) withdrawals that last for up to 10 years and payouts from retirement income insurance for a specified period of say 20 years. These will come in handy during the first phase of your retirement when you’re still physically mobile and are likely to travel more, set up a business or pursue hobbies.

In addition, I invested in a few income instruments that offer decent returns/income to fund my retirement while keeping my principal intact.

They include the annual 4% interest from my CPF Special Account (SA) savings, coupons from the 50-year Green Singapore Government Securities and bond funds (like Singapore Savings Bonds, Astrea bonds and corporate bonds), dividends from REITS and blue-chip stocks, payouts from income funds, and rental income.

Come 2030, one in four Singaporeans will be aged 65 and older. A longer lifespan translates to more years in retirement. Imagine working for 35-40 years to fund potentially 40 years or more in retirement!

This is why we can consider investing during retirement to grow our assets. We can do so via a portfolio - of stocks, index funds, ETFs and/or unit trusts - that offers variable but potentially higher returns for income growth by riding out the market volatility over time.

Statistics showed that one in two healthy Singaporeans aged 65 could become severely disabled in their lifetime. And about 3 in 10 will live a decade or more after becoming severely disabled.

As such, I have to ensure I can continue to afford the premiums of my private hospitalisation Integrated Shield Plan and CareShield Life plan during my lifetime.

The investments that help preserve my principal amounts will offer flexibility and a buffer in the face of potential curveballs, such as a medical crisis, black swan events and persistent high inflationary environment, in retirement.

These investments as well as assets that are unused in my lifetime will form part of my estate when I am no longer around. To have an efficient distribution to intended beneficiaries, I have set up an estate plan through common tools such as a will and a CPF nomination.

I have also done up my Lasting Power of Attorney which can be activated should I become mentally incapacitated.

How do I lead a meaningful life in retirement?

Without proper preparation, some retirees find themselves having to cope with a sense of emptiness and loss of identity, especially during the first few years of their retirement.

This is why we have to be clear on what our life purpose is even before we retire and continue to live meaningfully, supported by our financial resources.

One aspect of retiring is that we will have more control of time. This has to be balanced with discipline and structure. As such, I will continue to keep my weekdays separated from my weekends. And my daily routine will be adjusted to discover new things, volunteer, participate in financial literacy efforts, building memories with loved ones, and exercise.

In summary: take the time to find out what suits you

There is no one single solution that suits everyone because what gives me a better peace of mind will be different for another individual.

If you are constrained by limited savings, all the more you should make the most of government schemes like the CPF and leverage the magic of compounding to grow your nest egg. At the same time, ensure you make the right big decisions like not overpaying for your home.

For those who have surplus cash after setting aside an emergency fund and adequate protection, do invest wisely and build multiple income flows as retirement draws near.

Retiring comfortably is within reach of all of us. But we have to take the first step. And it starts with us taking the responsibility and making retirement planning a key priority.

The choice is yours.

Information in this article is accurate as at the date of publication.

Lorna Tan is the Head of Financial Planning Literacy at DBS Bank and is the author of four bestselling work – Money Smart, Retire Smart, More Talk Money, Talk Money.