19 April 2023

SOURCE: CPF Board

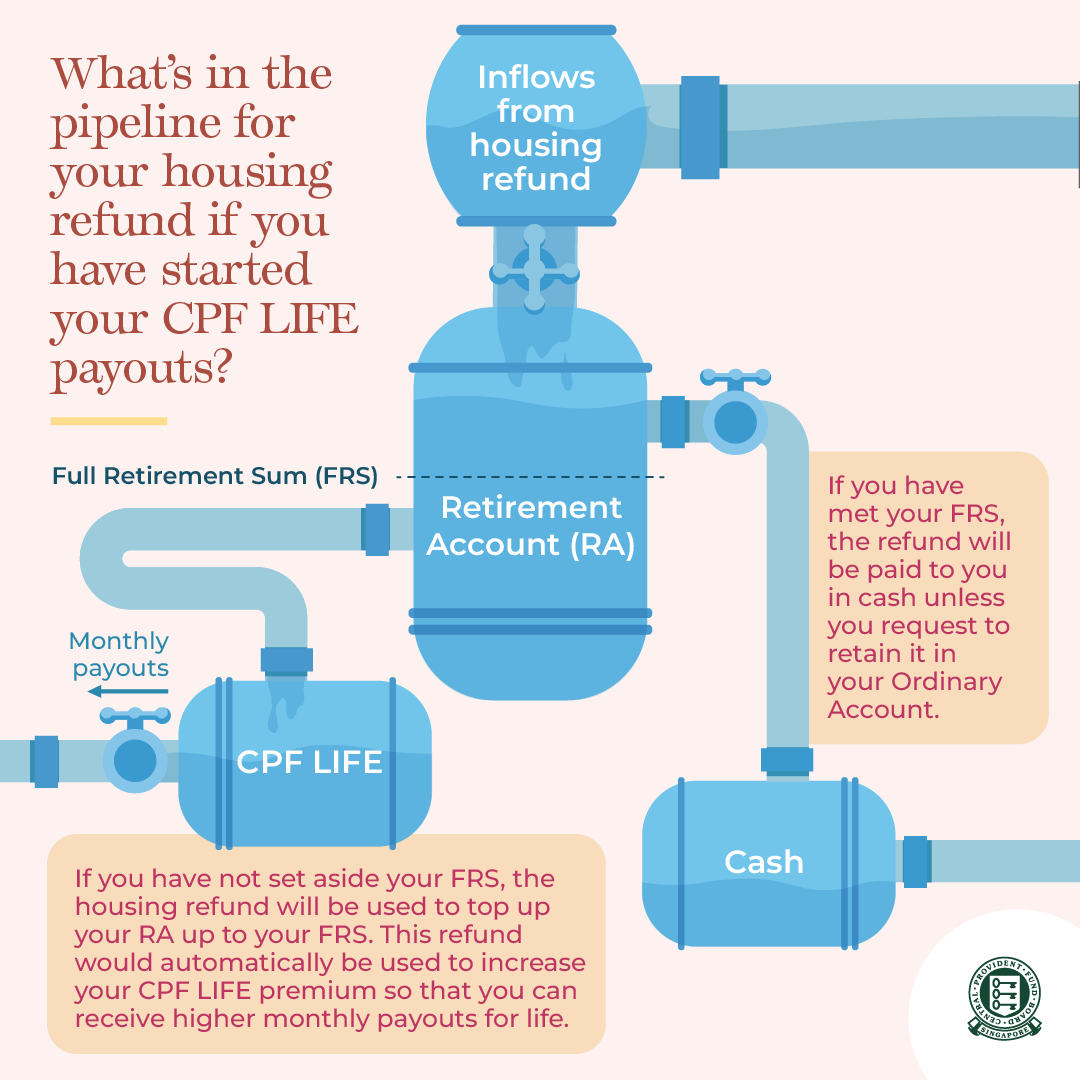

Since July 2022, CPF LIFE members who receive any inflows to their Retirement Account (RA), including their CPF housing refund, will enjoy an automatic increase in their CPF LIFE payouts. To better understand this change, let’s take a look at why it is in place, and how it affects your retirement plans.

For a start, let’s look at the role your RA plays in supporting your retirement. When you turn 55, your Ordinary Account (OA) and Special Account savings will be used to set aside your Full Retirement Sum (FRS) in your RA. This sum is used to provide you with CPF LIFE monthly payouts no matter how long you live, from age 65. The amount of monthly payouts you receive depends on how much you can set aside in your RA.

As CPF is meant for your retirement needs, if you have used your CPF to pay for your property, you’ll need to refund the CPF amount used with the interest accrued when you sell your property, so as to restore your retirement savings. If you’re 55 years old and above, the amount refunded to your CPF savings will be used to top up your RA to your FRS. Thereafter, any balance refund will be paid to you in cash if you did not request to retain it in your OA. However, if you have already met your FRS, the full refund will be paid to you in cash, unless you request to retain it in your OA.

To better illustrate this flow, here are some examples to show the CPF LIFE monthly payout amount that a member can receive before and after the housing refund to their RA.

Example A

John is 65 years old and is receiving $700 for his CPF LIFE monthly payout*.

Subsequently, John sold his flat and $50,000 of his CPF refund was transferred to his RA to meet his FRS. The inflows of $50,000 to John’s RA will be used automatically to increase his CPF Life premium which increases his monthly payout from $700 to $950.

Example B

Mary is 65 years old and is receiving $1,200 for her CPF LIFE monthly payout*.

Subsequently, Mary sold her flat. As she has set aside her FRS of $139,000, the full refund will be paid to her in cash if she did not request to retain the refund in her OA. Since there is no inflow to her RA, her monthly payout will remain at $1,200.

Example C

Hank is 65 years old and has not started his CPF LIFE payout yet. Hank is currently unable to set aside his FRS. If he applies to start his CPF LIFE payout now, he will receive $800 for his monthly payout*.

Subsequently, Hank sold his flat and $50,000 of his CPF refund was transferred to his RA to meet his FRS. The inflows of $50,000 to Hank’s RA will be used automatically to increase his CPF Life premium which increases his monthly payout from $800 to $1,050, if he applies to start his payout now.

*The monthly payout is based on the CPF LIFE Standard Plan computed as of 2023.

If you have started receiving CPF LIFE monthly payouts, you will receive a notification from CPF Board when there’s inflows to your RA, informing you of any revision in your monthly payout.

Information accurate as of date of publication.