13 Jan 2023

SOURCE: CPF Board

Update 13/3/2023 - find out more about the changes to CPF in 2023 and how they can benefit you.

No matter where you are at in your financial journey, whether it is starting to plan for your future retirement or taking care of your loved ones, it always helps to have some financial support.

Here’s how you can give the start of your 2023 a financial boost:

With the rising cost of living being a concern for many Singaporeans, the Government has been providing Singaporeans with financial support in the past few years.

On top of the Assurance Package (AP) cash benefits ($100-$200) and Cost of Living (COL) Special Payment of up to $500 that was disbursed to eligible Singaporeans in December 2022, keep a look out for more benefits that might be coming your way in Jan and Feb 2023:

- GST U-Save Vouchers - Eligible HDB households will receive double their regular GST Voucher – U-Save rebates (of up to $95) to help offset their utility bills.

- Service and Conservancy Charges (S&CC) rebate – Eligible HDB households will receive a S&CC rebate of up to 0.5 months.

- CDC Vouchers – Every Singaporean household will receive a total of $300 worth of CDC vouchers, which can be used to offset daily expenses at participating heartland merchants, hawkers and supermarkets.

- MOE Financial assistance schemes (FAS) – Subsidy provisions and the income eligibility criteria (revised as of Jan 2023).

- GSTV – Cash (Seniors’ Bonus) – Lower-income senior Singaporeans will receive additional cash benefits between $200-$300.

- Assurance Package MediSave – Eligible Singaporeans aged 20 years and below, or 55 years and above, will receive a S$150 top-up to their MediSave account

What’s more, if you are worried about financially supporting your loved ones who are older, don’t forget that they will also continue to receive benefits from the Pioneer Generation and Merdeka Generation Package, such as MediSave top-ups! In addition, eligible lower income Singaporeans will also receive support from schemes such as Workfare Income Supplement and the Silver Support Scheme.

Check out this page to learn more about how the Government is supporting Singaporeans manage the rising cost of living.

Aside from support for day-to-day expenses, there is also support available to help you build your retirement income for the future, as well as that of your loved ones.

Under the MRSS which was launched in 2021, the Government will match every dollar of cash top-up you make to your Retirement Account (RA) or your loved ones’ RA, up to an annual cap of $600 till 2025. The doubling of cash top-ups to the RA is designed to support seniors in meeting the prevailing Basic Retirement Sum (BRS), thus boosting their future retirement payouts.

To make a top-up to a eligible loved one (or even a member of the community) via MRSS, you can do so conveniently via the CPF website in just a few simple steps:

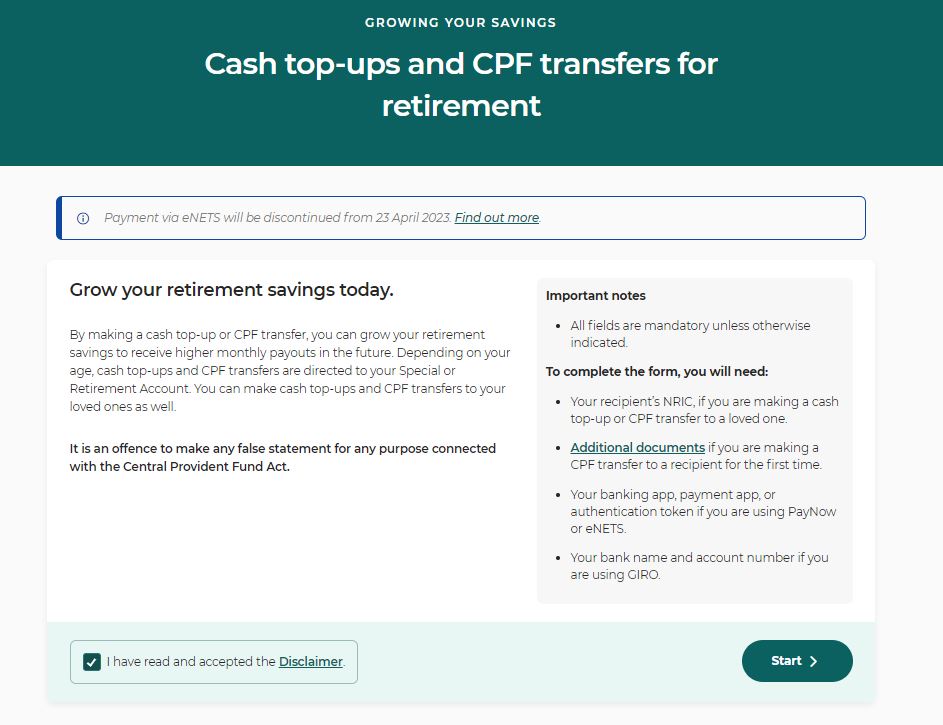

a) Read the disclaimer and click ‘Start’ on the form once you are ready to proceed. You will be prompted to log in with your Singpass.

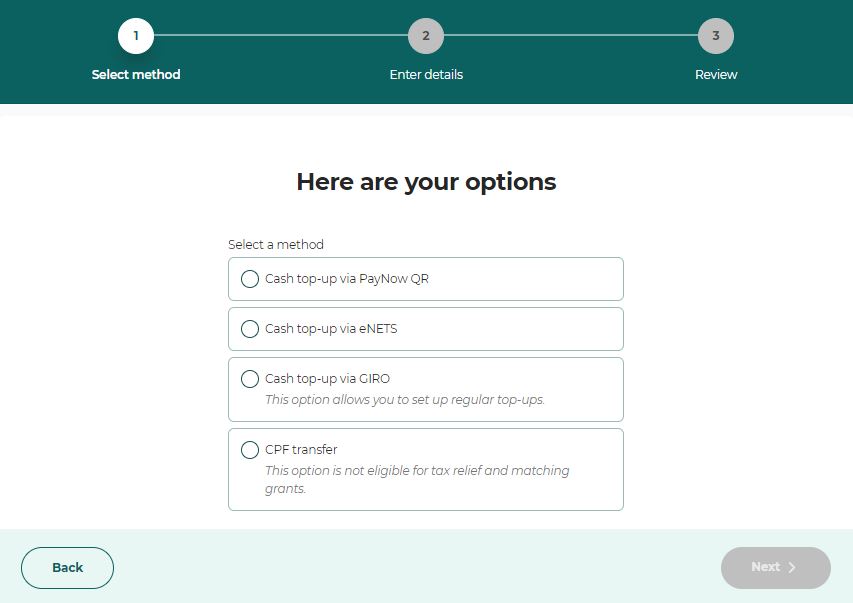

b) Upon successful log-in, you will be redirected to this page. Select a top-up method and click next.

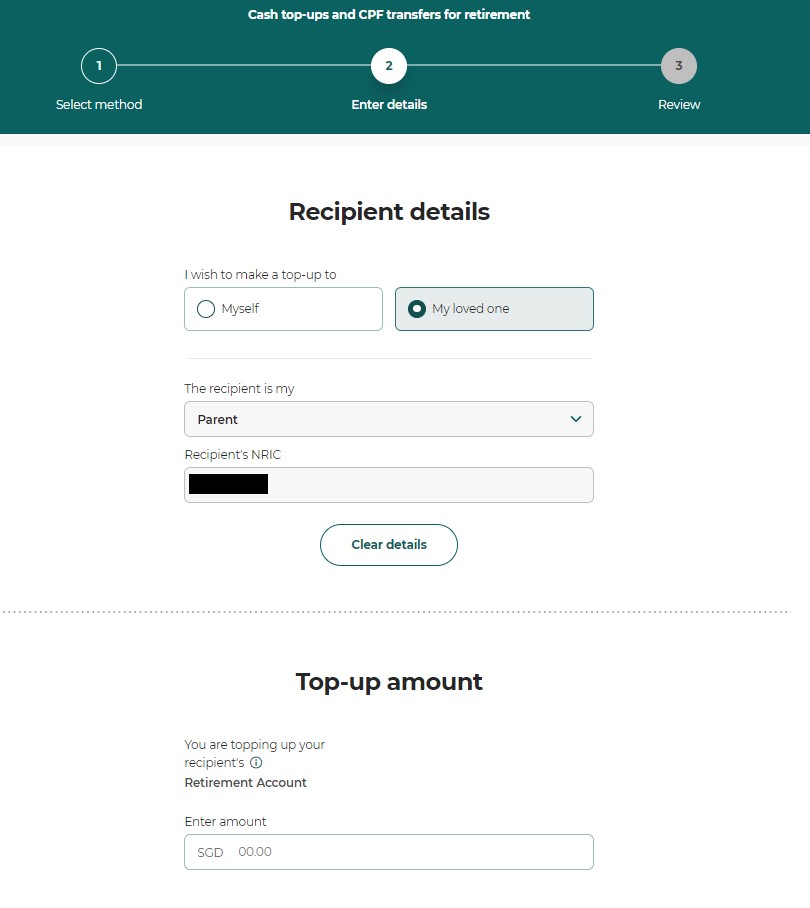

c) Next, you will be prompted to provide the personal details of the person you would like to make a top-up to, along with the amount, before making the payment, so remember to have these details on hand before you start the transaction!

Once payment is successful and completed, you will be redirected to an acknowledgement page. You will also receive an email in your inbox notifying you about this transaction.

Alternatively, you can choose to make a top-up via the CPF mobile app. Learn how to with this step-by-step guide.

As we gear up and plan ahead for the new year, these government schemes can help you navigate any uncertainty ahead!

Information in this article is accurate as at the date of publication.