1 April 2022

SOURCE: Mothership

Demystifying CPF

When I was told to review CPF Board’s new website and write an article about it, I wasn’t terribly excited.

There was even some dread because of my frustrating experiences with the old website.

But after spending some time exploring the CPF Board’s newly revamped website, I was pleasantly surprised by how painless it was for me to navigate the revamped website.

Like many of my peers, my understanding of CPF has always been basic. I accepted CPF as an inescapable facet of living and working in Singapore.

Every month, the government takes a portion of my salary and stashes it away in a safe place so that in old age, I can afford my medical needs and get a monthly payout for my retirement.

Apart from housing, I didn’t know what else CPF could do for me.

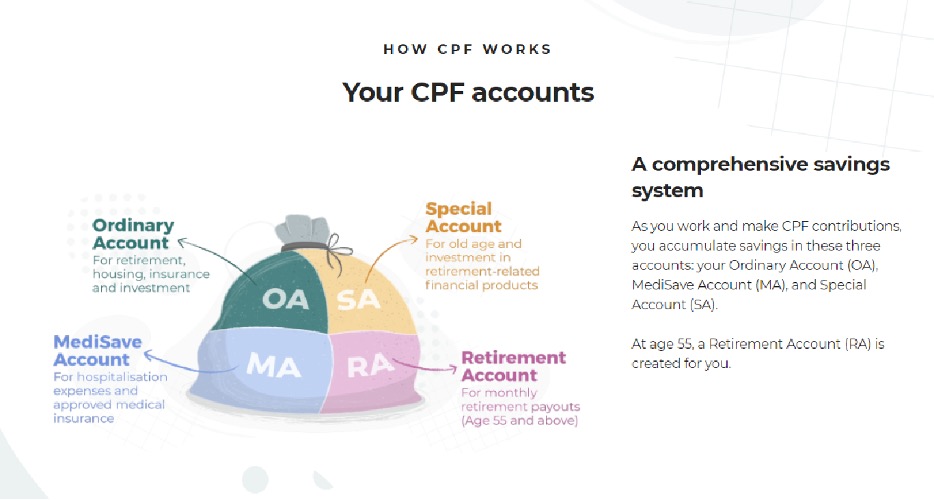

For instance, one aspect I couldn’t quite grasp about CPF was why there are all these different accounts. I finally got my answer after exploring the new website.

Here are some things I discovered while on the new website.

1. Easy to navigate, personalised user interface

After logging in using Singpass, I was directed to a personalised dashboard, which displays my CPF account balances and the latest transactions.

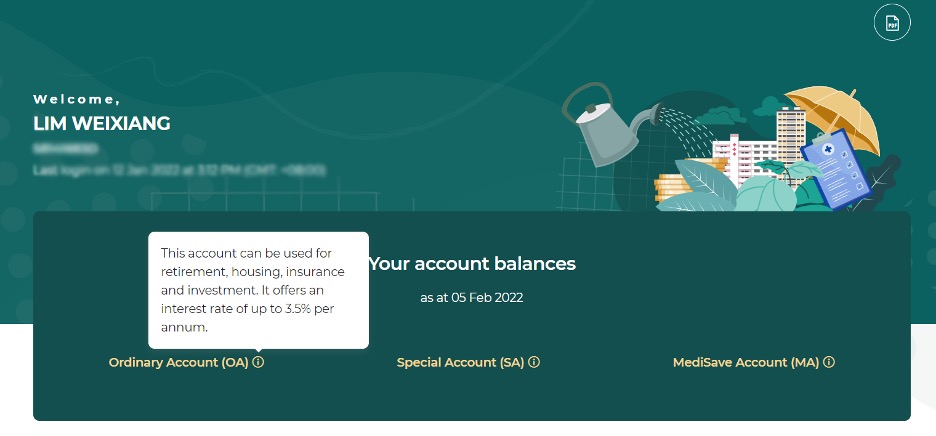

When my mouse hovered over the little “i” icon at the end of each Account, a pop-up box appeared explaining what each Account is for.

Pop-up boxes with explainers. Screenshot from CPF website.

Screenshot from CPF website.

Clicking on the “CPF overview” tab also brought up this neat infographic, which helped me to see the big picture.

Screenshot from CPF website.

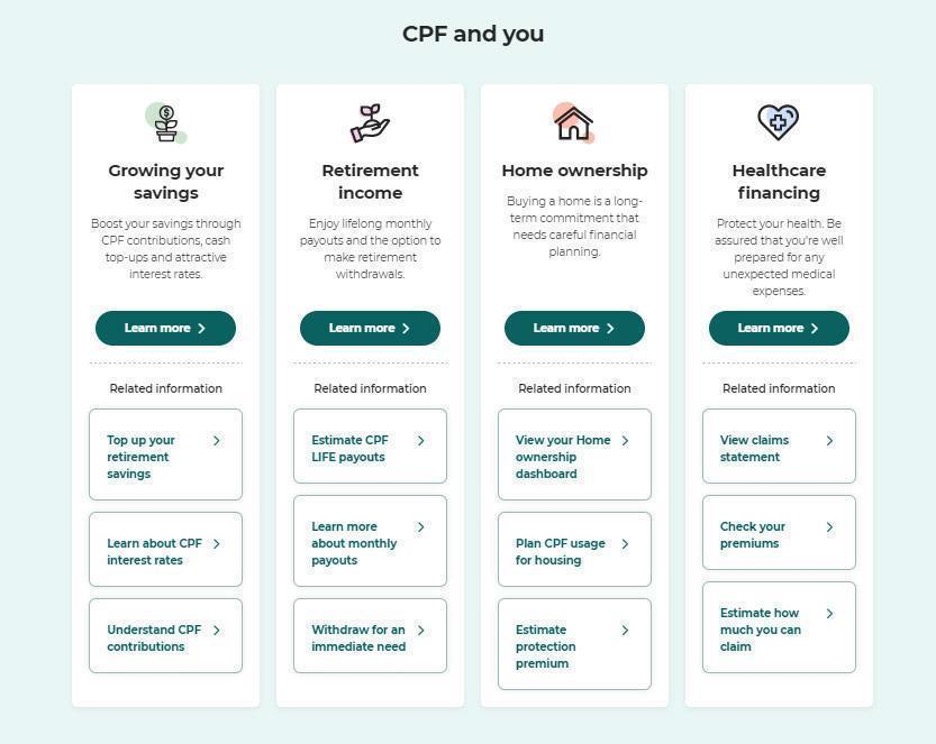

Information is organised in bite-sized nuggets and everything is now neatly categorised according to four broad themes – “Growing your savings”, “Retirement income”, “Home ownership” and Healthcare financing”. I found myself clicking on the different tabs (under the related information panel) to find out more.

Screenshot from CPF website.

All the dashboards and information relevant to me can be accessed using the “my cpf” tab.

Screenshot from CPF website.

2. Make an online nomination

For example, if you click on the “Providing for your loved ones” dashboard, you are directed to a page where you can make your CPF nominations, entirely online. What this means is that you get to decide how your CPF savings are distributed when you pass on. You can also appoint two witnesses, who will witness your intent to make a nomination online as well.

Besides making a nomination, you can also view your nomination details under the same dashboard.

3. View your children’s CPF balances

Being the proud new father of a five-month-old girl, Emma, I was curious about the “Child” dashboard.

Clicking on it allows me to view my daughter’s MediSave balance that can be used for her medical needs, such as recommended childhood vaccinations.

Previously, parents had to put in an application to view their child’s CPF statements. This is more convenient.

I also noticed that the $4,000 in MediSave grant that all Singaporean newborns receive had already been credited into Emma’s account.

4. Make top-ups via PayNow QR codes

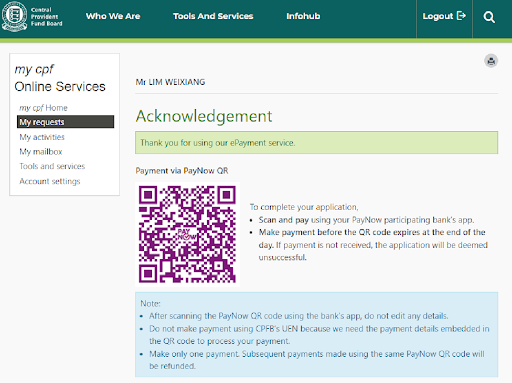

One of the best features about the revamped website is that everything works with QR codes.

You can now make top-ups to your various CPF accounts via the e-cashier, simply by scanning a QR code using a PayNow banking app. I topped up my Special Account via PayNow and it took me less than two minutes to do so.

Screenshot from CPF website.

If you top up your Special Account/Retirement Account, or those of your loved ones, you can enjoy tax relief equivalent to the amount of the cash top-up, up to a cap of S$16,000 per calendar year.

5. Personalised nudges

I also noticed that the website displays relevant notifications at certain intervals.

For example, I recently concluded a 3-week stint as adjunct relief at a secondary school and visited the website after payday. I was pleasantly surprised to see a reminder to check if my employer has paid my CPF contributions.

Screenshot from CPF website.

Effortless transactions, all from your mobile phone

After going through the different tabs, I can’t say that I am an expert on CPF but I’m more informed.

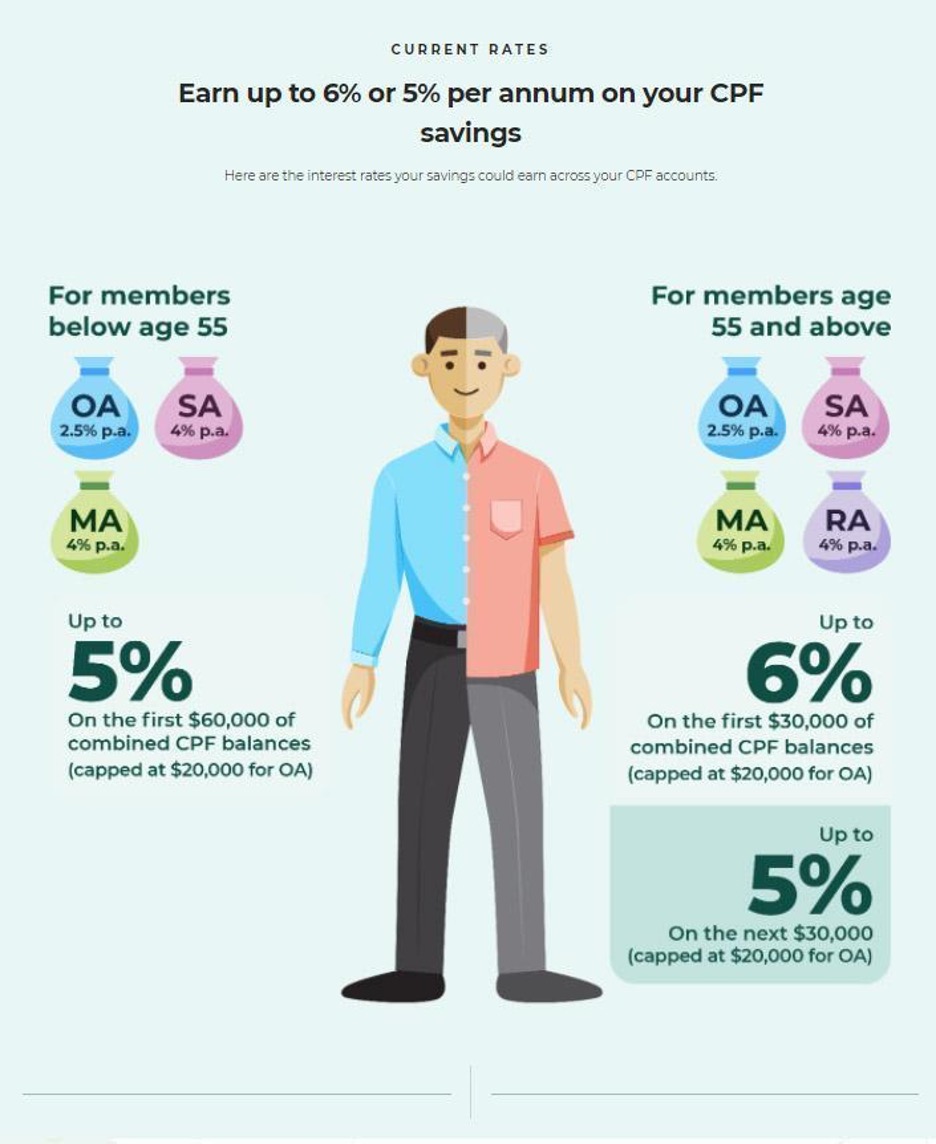

For example, I can now tell you that the interest rate is up to 3.5 per cent for my Ordinary Account, and up to 5 per cent for my Special and MediSave accounts, which has led me to think about whether I should put in more money into my OA to take advantage of the high interest rate.

Infographics make information easily digestible. Screenshot from CPF website.

Most transactions can be done quickly and effortlessly online or via the CPF mobile app.

I helped my mum download the app on her mobile phone and she is so happy that she can now view her CPF account balances without having to make a trip to the CPF Service Centre.

Behind the scenes

Seeing as the revamped website is a huge improvement from what I remember of the old website, I was curious about how all this was achieved.

I was given an opportunity to speak to Thong Bee Chum, Senior Deputy Director at the CPF Board, who managed the website revamp project.

Bee Chum shared that the team behind the website revamp compacted and streamlined what was more than 1,000 pages of content into slightly more than 320 pages. This was a collaborative effort across the various departments within the Board.

She added that CPF Board set out to provide a reimagined and personalised digital experience for Singaporeans all the way since 2019 and involved the entire Board.

To support the revamp, CPF staff had to upskill and adopt agile processes behind the scenes. Many new and interesting job roles were created along the way, such as user experience research and design.

“I was fresh to this project and had to learn about agile and agile implementation from scratch. It was a new way of working for me altogether, where objectives and tasks were completed in 3-week cycles called sprints.”

Bee Chum recalled the team detected some issues with the pages not displaying correctly right before the launch, and they had to camp out overnight in the office to resolve them. Thankfully, they managed to resolve them in time and were able to launch the website without any delays.

This whole experience made her grateful for how positive and committed her team was when the going gets tough.

Bee Chum added that the CPF team is not done just yet. They will continue to develop new products and enhance the website’s user-friendliness for members.

Overall, I think that the staff at the CPF Board should really give themselves a pat on the back for the work they have done revamping the website. I guess the best compliment I can give them is that I am spending a fraction of the time I used to spend on the old website completing more tasks than I did previously.

Don’t believe me? Give it a try yourself!

This article is brought to you by the Central Provident Fund Board.

Top image via Lim WeiXiang.

The information provided in this article is accurate as of 1 April 2022.