5 Aug 2025

SOURCE: CPF Board

The affordability of a home is a top-of-mind concern for many Singaporeans. Inadequate planning, the pressure to upgrade, and the influence of social media can make it easy to make short-term decisions that come with a long-term cost. But it doesn’t have to be this way.

We spoke to Marlina, 38, and Hermi, 44, a Singaporean couple who navigated their home-buying journey with long-term goals in mind. By prioritising financial discipline over impulsive buys, they created a home that not only meets their family’s needs today, but also safeguards their financial goals for tomorrow.

A home that works for you, not against you

"We shifted from wanting something aesthetic to something functional.

Family first." – Marlina

When Marlina and Hermi began searching for a place of their own, they focused on comfort, safety and lifestyle suitability. Rather than stretch their budget for a house that simply looked Pinterest-perfect, they set firm boundaries that reflected what they truly needed.

To them, a home shouldn’t just serve as a milestone; it should also support the life they were building. Proximity to healthcare, schools, and daily amenities were thus key considerations. “We wanted a place where our kids could run downstairs in five minutes to get groceries,” Marlina shared. “That kind of ease made a big difference.”

How they budgeted without losing their sanity (or savings)

The couple took their time to research neighbourhoods, costs, save steadily and adjust expectations. Rather than rushing into purchases, they weighed what was nice to have against what was necessary.

“We love a destination holiday and we love dining out,” said Marlina. “But thinking of our children’s needs and our own long-term needs helped us to stay focused.” Hermi agreed, saying, “We were intentional about prioritising stability. Travel can wait, but a secure home can't.”

It took the couple about 2–3 years to save and plan for their dream home. Eventually, they landed on a 3-room resale HDB in the east that met their needs.

“CPF made home ownership possible for us,” said Marlina. “We found it helpful that the flexibility of CPF meant we could use it for our downpayment and our monthly mortgage. It helped ease our monthly financial burden.”

Reno stories, buffer budgets and lessons learnt

"We were excited. We rushed to secure the first interior designer. Looking back, we should have taken more time." – Marlina

Still, despite all their planning, the couple hit roadblocks. Unexpected renovation costs emerged, like replacing doors in their resale flat as they were not well-taken care of by the previous owner. While they had buffer savings, they had to re-evaluate their budget.

“We had to go back to our spreadsheet and cut back on the ‘wants’ to stay within budget,” they said.

Now, they advise future homeowners to build in a bigger renovation buffer and never rush big decisions.

“When we got our keys, we were excited. We rushed to secure the first interior designer,” said Marlina. “Looking back, we should have taken more time. It reduces stress, and you have time to explore more options.”

Looking ahead

While the couple initially planned for their current home to be their ‘forever home’, as now-parents to four young boys aged two to 10, an upgrade is on the horizon.

“When the boys grow up, they would like to have their own space and their privacy,” shared Marlina. “We’ve been saving again so that we can achieve our next dream space.”

For their next home, the couple is determined to take things slow. “We intend to save for about five years before we move. Five years of savings would give us sufficient buffer for unexpected expenses,” shared Marlina.

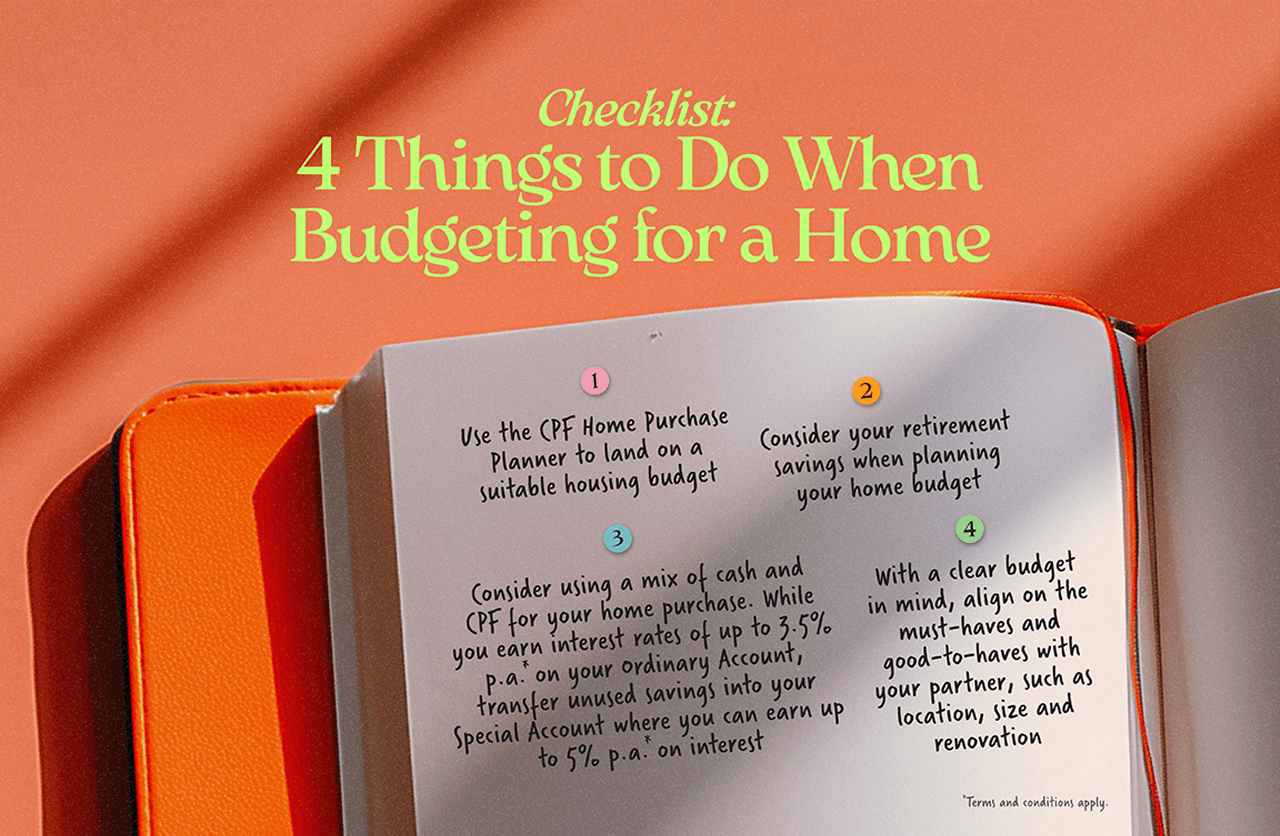

They’ve also explored CPF’s new Home Purchase Planner and found it incredibly useful.

“It scoped how much savings we could use and how much housing loan payments we needed to make monthly. Most importantly, it showed us how our CPF usage today affects our retirement later,” they shared.

Armed with insights from the Home Purchase Planner, understanding the relationship between housing choices and retirement security led to a shift in their planning. “For our next dream home, we plan to retain more of our CPF savings and pay the rest in cash,” they shared.

Living well, now and later

“We still dine out, we still go on holidays. We just plan ahead and put money aside monthly.” – Hermi

Being financially disciplined doesn’t mean one should deprive ourselves. While they are planning a home upgrade, Marlina and Hermi still believe in enjoying the present, just not at the expense of their long-term goals.

“While we were mindful of our spending, we did not want to give up what we truly enjoyed,” said Hermi. That meant setting up a separate budget for enjoyment, and making intentional choices such as opting for short-haul family trips over long-haul ones. By tracking their spending and staying mindful, they’ve created space for both financial stability and family memories.

Like Marlina and Hermi, you can plan wisely, spend thoughtfully, and still enjoy the life you’ve built without compromising your future. With the CPF Home Purchase Planner, you can plan for a mindful home purchase with greater confidence in retirement.

Ready to budget smarter? Use the CPF Home Purchase Planner to budget for your next home with your retirement in mind.

Information in this article is accurate as at the date of publication.