9 September 2022

SOURCE: CPF Board

There’s no denying the importance of one’s health. From running marathons to taking a trip overseas, you can only enjoy the wide range of activities that life has to offer when you take regular care of your health.

In fact, healthcare isn’t just limited to going to the clinic or hospital when you fall ill! It also includes making sure you’re doing well, staying fit and healthy through balanced diet and exercise, and being prepared for unexpected healthcare expenses.

Naturally, managing finances for healthcare isn’t easy, and cutting corners won’t do when it comes to your own health. Fortunately, you don’t have to tackle this issue alone! Your MediSave savings can help support the cost of your own and your loved ones’ healthcare needs.

MediSave is a national medical savings scheme that helps individuals set aside between 8% to 10.5% of their monthly salary to pay for their personal and/or dependants’ healthcare expenses over their lifetime, especially when they retire and no longer have regular income. What can you use your MediSave savings for?

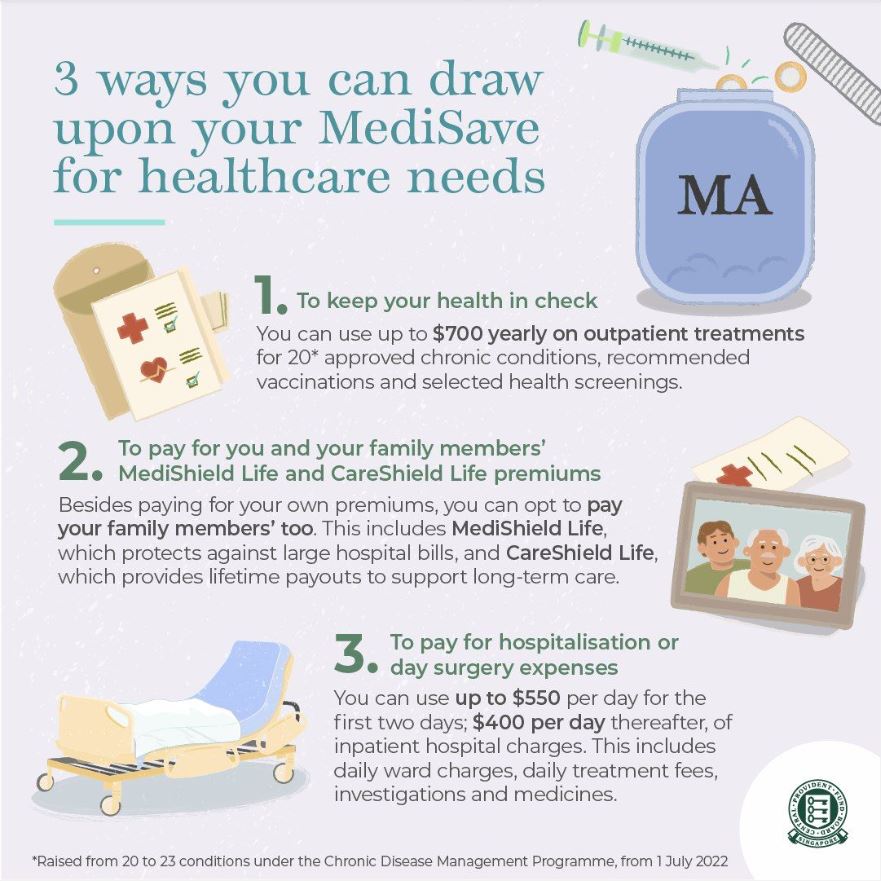

1) Keeping your health in check

First things first: your own well-being. You can use up to $700 of your MediSave savings per year on outpatient treatments for approved chronic conditions, recommended vaccinations and selected health screenings. As of 1 July 2022, the number of approved conditions has been raised from 20 to 23, to include gout, allergic rhinitis, and chronic hepatitis B. You can find the full list of chronic diseases covered here.

You can also use your MediSave for recommended vaccinations, such as Hepatitis B, Varicella, and Measles, Mumps and Rubella (MMR). On top of that, you can also use MediSave to pay for the costs of health screenings for newborns and mammograms for women aged 50 and above. Check in with your physician on what sort of screenings you can go for that can be covered!

2) Paying for your and your family’s healthcare premiums

Part of covering one’s healthcare needs is via healthcare insurance, such as MediShield Life and CareShield Life. MediShield Life is a health insurance scheme that provides Singapore Citizens and Permanent Residents with universal, lifelong protection against large healthcare bills, regardless of age or health condition. CareShield Life, on the other hand, is a long-term care insurance scheme that offers financial support and monthly cash payouts should you become severely disabled.

Both MediShield Life and CareShield Life help shoulder your healthcare costs in their own ways, and best of all, you can use your MediSave savings to pay for the insurance premiums of these plans, allowing you to save more of your monthly income for other expenses.

If your family members are experiencing difficulties paying their own premiums, you can extend a helping hand to shoulder their costs using your MediSave savings too. Be it MediShield Life or CareShield Life, you can pay for both your family members’ and your premiums concurrently with your MediSave savings.

3) Paying for hospitalisation or day surgery expenses

When it comes to planning for the future, there’s always the saying, ‘save for a rainy day’. It’s not a pleasant thing to think about, but this rainy day is nonetheless something we all need to consider. Your MediSave savings can also help shoulder some of the larger healthcare expenditure such as hospitalisation or day surgery, lightening the burden on you, both financially and mentally. For hospitalisation, you can use up to $550 per day for the first two days, and $400 per day thereafter for inpatient hospital charges. These include daily ward charges, daily treatment fees, investigations and medicines. If you need some help with your mental health, you can also use up to $550 per day for the first two days and $150 per day thereafter for inpatient psychiatric treatment, up to a maximum of $5,000 per year.

Do note that the MediSave withdrawal limit remains as $150 per day up to $5,000 per annum for psychiatric treatment at IMH.

For day surgery, you can use up to $300 per day for hospital charges, including daily ward charges, daily treatment fees, investigation and medication. Similar to healthcare insurance premiums, you can pay for your dependants’ hospitalisation and/or day surgery costs with your MediSave savings as well.

When it comes to health, there should be no compromise. Healthcare financial planning is of utmost importance, and MediSave is here to help you approach it with ease of mind. If you’re interested in levelling up your healthcare knowledge, we have a guide that aims to do just that, with useful explanations to help you grasp the various options available to you.

All information provided are accurate as of the date of publication.